Of the 19 new-age tech stocks under Inc42’s coverage, 11 declined this week in a range of 0.1% to almost 19% on the BSE

Eight tech stocks gained in a range of 0.5% to 5% with RateGain emerging as the biggest gainer

In the broader market, Sensex rallied 1.16% and Nifty50, both reaching close to their all-time highs

The Indian new-age tech stocks continued to witness mixed investor response, even as the broader domestic equity market recovered amid improving global cues.

Of the 19 new-age tech stocks under Inc42’s coverage, 11 declined this week in a range of 0.1% to almost 19% on the BSE, with Paytm once again being the biggest loser.

Other losers this week were ideaForge (down 5.1%), DroneAcharya (down 4.7%), Yatra (fell 2.7%), Nazara (down 1.4%), and PB Fintech (down 0.2%).

Meanwhile, eight tech stocks gained during the week in a range of 0.5% to 5% with RateGain emerging as the biggest gainer. The travel tech SaaS startup rallied sharply this week after it announced that hospitality platform HotelKey chose RateGain’s platform to enhance its distribution capabilities.

Besides, Zomato rallied almost 5% and ended the week at a 52-week high of INR 160 on the BSE. Logistics unicorn Delhivery was also up 3.2%.

On the other hand, Mamaearth and IndiaMart gained almost 3% while Tracxn Technologies was up 1.8% during the week. Nykaa and CarTrade Technologies gained more than 0.5%.

In the broader market, Sensex rallied 1.16% and Nifty50 1.2%, both reaching very close to their all-time highs.

Vinod Nair, head of research at Geojit Financial Services said that the Indian market continued its broad-based recovery aided by positive global and domestic cues.

“Narrowing India’s trade deficit, led by softening commodity prices and a manufacturing push by the government, attracted investors to capital goods, metals, and industrial stocks,” Nair said. “On the global front, an expectation of a pickup in consumption demand in China after the New Year holidays supported the global market sentiment,” he added.

Meanwhile, Siddhartha Khemka, head of retail research at Motilal Oswal expects the market sentiment to strengthen further as the prospect of a pre-election rally is quite strong.

“Two important pre-poll surveys by India Today and Times Now predict a more than comfortable majority (272+ seats) for the incumbent BJP-led NDA. Nifty is hovering near all-time zones and is all set to make new highs next week,” Khemka added.

Now, let’s take an in-depth look at the performance of some of the new-age tech stocks this week.

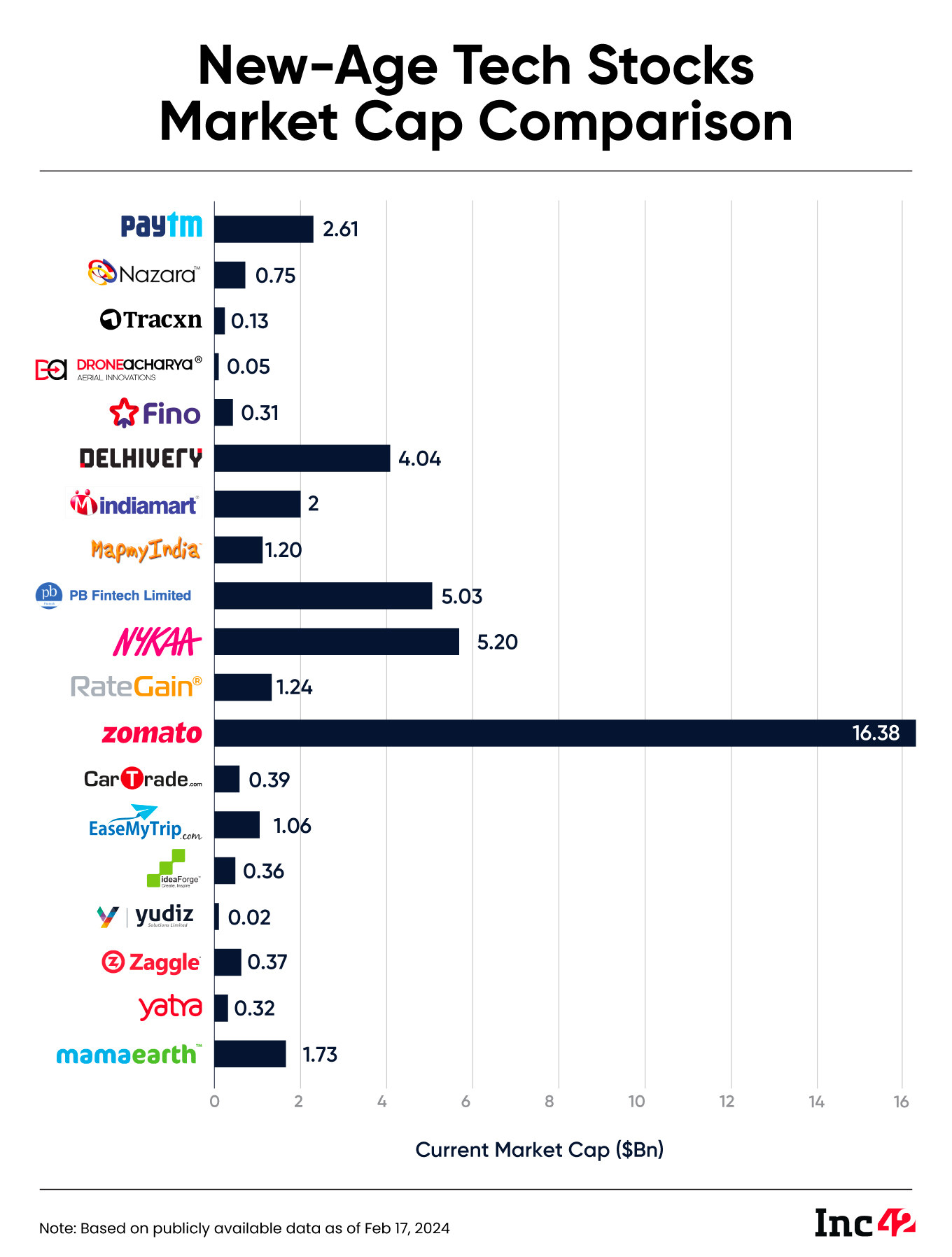

The total market capitalisation of the 19 new-age tech stocks under Inc42’s coverage stood at $43.19 Bn at the end of this week as against $42.74 Bn a week ago.

Paytm’s Market Cap Down 56% In A Month

As the crisis in Paytm Payments Bank continued, shares of Paytm parent One97 Communications ended at new record lows in three consecutive trading sessions this week. The stock touched a low of INR 318.35 during Friday’s intraday trade (February 17).

However, the stock ended Friday’s trading 5% at INR 341.5 on the BSE, higher than Thursday’s close, helped by some positive developments.

Overall, Paytm shares tanked 18.7% this week.

Here’s a quick look at the Paytm crisis:

- RBI governor Shaktikanta Das said there was “hardly any room” to review the stance on Paytm Payments Bank.

- After ED registered a case of forex violations against Paytm Payments Bank, Paytm issued a statement saying its banking unit does not undertake outward foreign remittances.

- In some relief to Paytm Payments Bank, RBI extended its deadline for stopping other banking services, including UPI facility and fund transfers, to March 15 from February 29 earlier.

- RBI clarified that Paytm QR codes, soundboxes, and card machines would continue to be operational even after March 15, given the merchants migrate to other banks.

- Paytm said that it shifted the nodal account of Paytm Payments Bank to Axis Bank.

On the technical charts, Paytm’s movement remains unpredictable as its shares are impacted by new news developments.

It is pertinent to note that brokerage Macquarie has downgraded Paytm stock to ‘underperform’ from an earlier ‘neutral’ rating and lowered its price target to INR 275 from INR 650. The brokerage sees Paytm at the risk of losing a large number of customers.

Amid the crisis, Paytm’s market cap declined 56% in one month and is currently at an all-time low – $2.61 Bn.

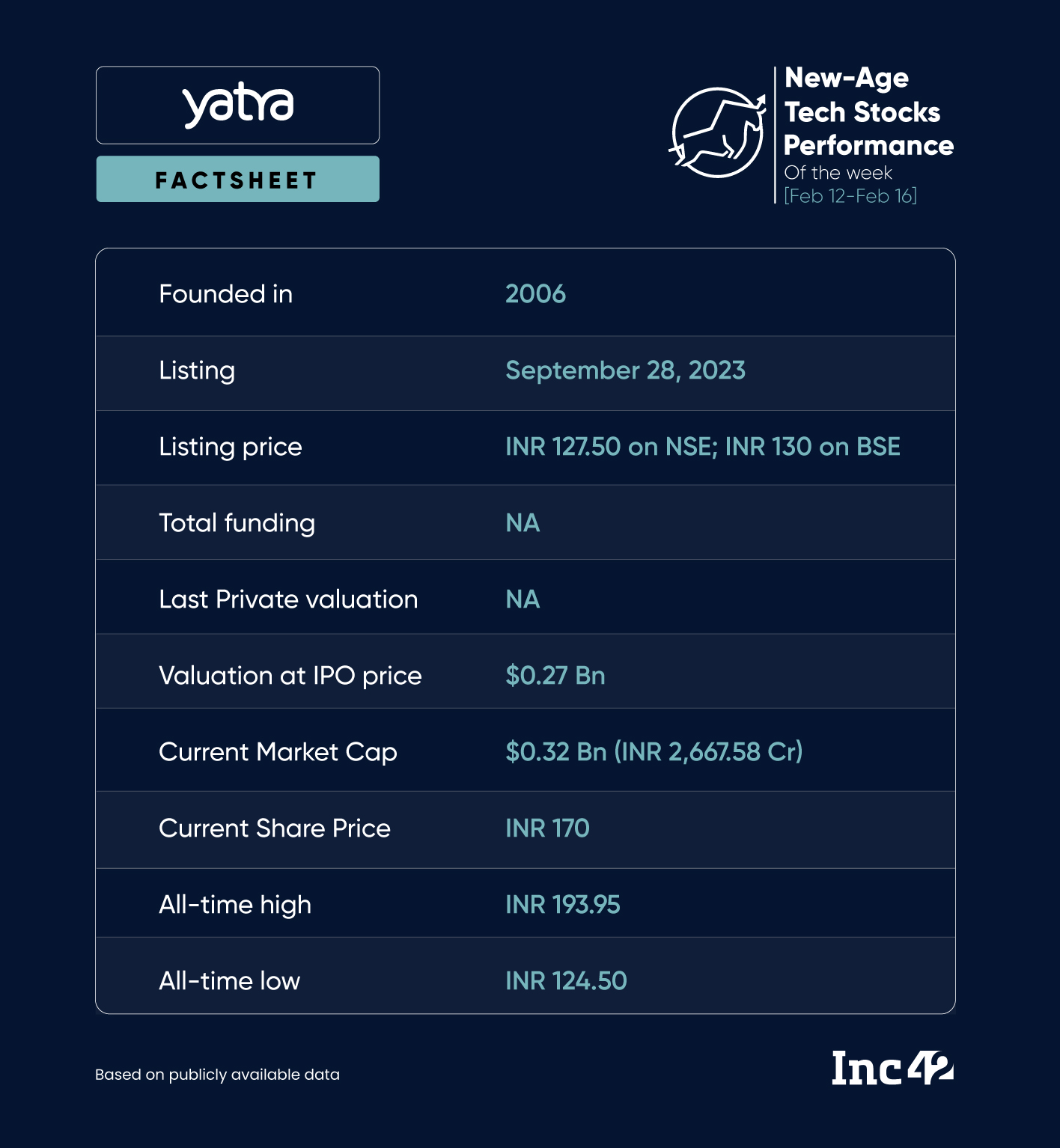

Yatra Back In The Black

Online travel aggregator Yatra Online reported a consolidated net profit of INR 1.1 Cr in Q3 FY24 as against a loss of INR 5.6 Cr in the year-ago period and a net loss of INR 17.1 Cr in the preceding Q2 FY24.

Its operating revenue also jumped almost 23% year-on-year (YoY) and 17.2% sequentially to INR 110.3 Cr in Q3 FY24.

Though Yatra once again reported a profitable quarter after a loss-making quarter, its profit was far below the INR 6 Cr profit it reported in Q1 FY24.

Shares of Yatra declined 3% a day after its Q3 earnings announcement but ended the week marginally higher at INR 170 on the BSE.

Overall, Yatra shares were down 2.7% during the week but its movement largely remained sideways.

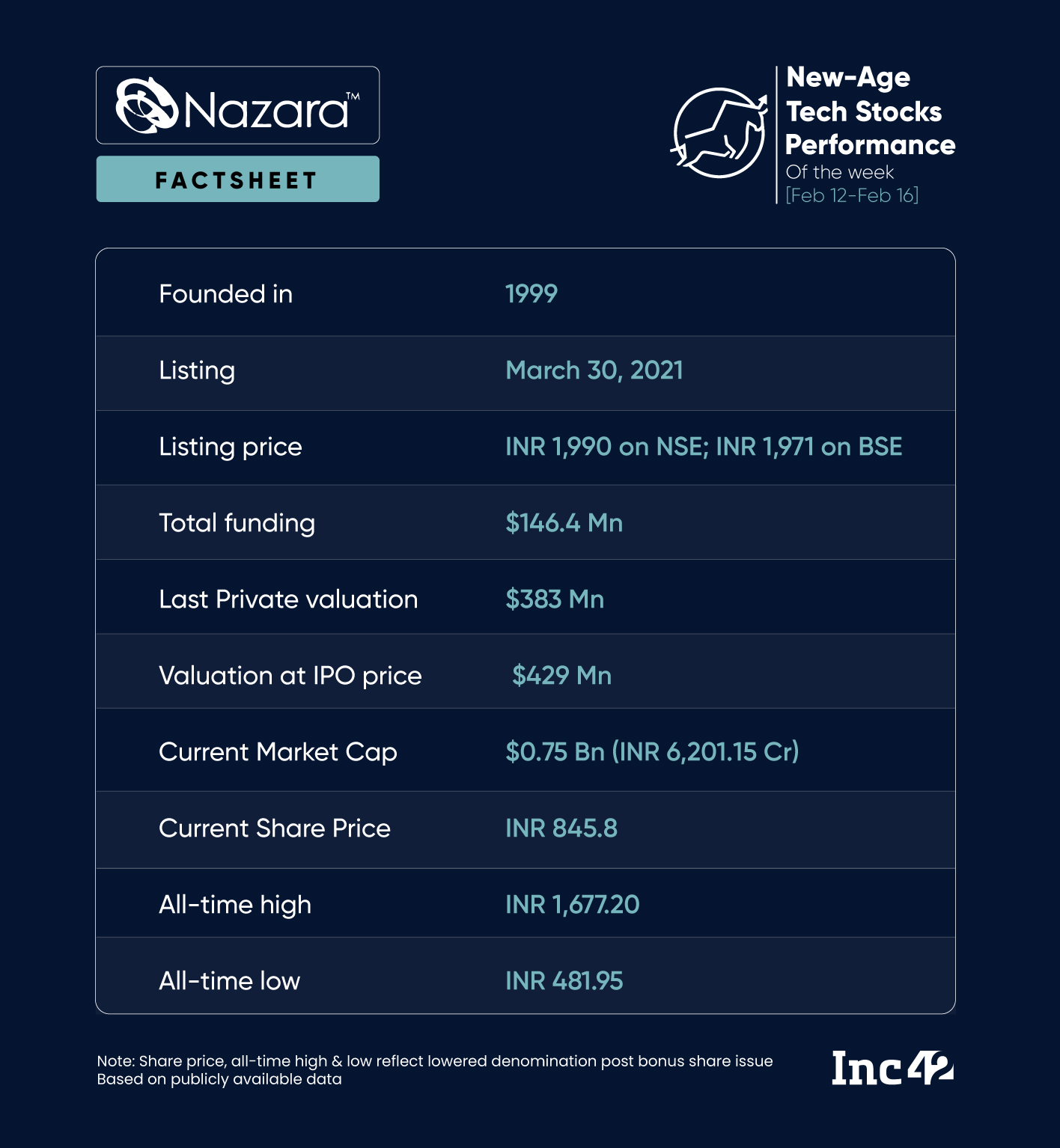

Nazara’s Acquisition Spree Continues

In an all-new deal announcement, gaming major Nazara’s esports subsidiary NODWIN Gaming said it would acquire 100% ownership of Ninja Global FZCO (Ninja), expanding its solutions offering to publishers and brands in the Middle East and Turkey.

The development comes within a month of NODWIN Gaming’s acquisition of Comic Con India for INR 55 Cr and an investment of about INR 71.8 Cr in a German marketing services company for gaming and esports, Freaks 4U Gaming.

Over the last few years, Nazara bolstered its offerings by making multiple acquisitions, including NODWIN and SportsKeeda, and post the recent fundraise from Zerodha’s Kamath brothers and others, the gaming company has doubled down on its acquisition spree.

However, the shares declined marginally after its latest deal announcement on Wednesday (February 14). Overall, its shares fell 1.4% during the week, ending the last trading session at INR 845.8 on the BSE.

Earlier this month, Jefferies raised the price target on the stock to INR 810 from INR 770, implying a downside of 4.2% to Nazara’s last close. The brokerage also reiterated its ‘hold’ rating due to a weakness in Kiddopia, Datawrkz, and real money gaming segments.

With NODWIN’s media rights revenues also falling in the nine months of FY24, the brokerage cut its esports revenue estimates. In fact, after its Q3 results earlier this month, the shares haven’t witnessed any major momentum so far.

Ad-lite browsing experience

Ad-lite browsing experience