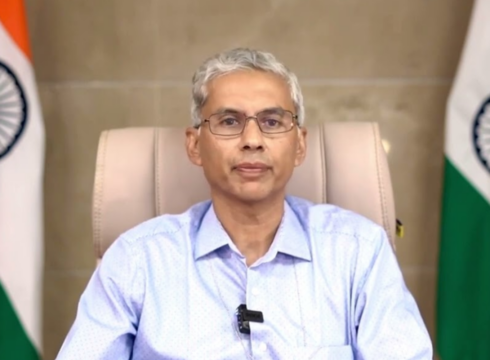

The tax will help level the playing field that is tilted in favour of foreign investors: DPIIT Secy Anurag Jain

Jain noted that the DPIIT-recognised startups would not attract Angel Tax

The Angel Tax is being levied on startups at 30.9% on net investments above the fair market value

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

While India’s startup ecosystem debates over the reintroduced Angel Tax, according to Anurag Jain, the secretary of the Department for Promotion of Industry and Internal Trade (DPIIT), Angel Tax would not apply to startups in India.

The tax will help level the playing field for domestic investors that is tilted in favour of foreign investors, said the government official.

“There is no Angel Tax on startups. Let me be clear. (Section) 56.2 (VII B) used to have two provisions. One was the preferential treatment of foreign players. Preferential treatment has been done away with. But for startups, there is no change,” Anurag Jain, secretary of DPIIT, said at a press conference on Thursday (February 2).

Jain noted that only the DPIIT-recognised startups would not attract Angel Tax.

The DPIIT secretary also said there were sufficient provisions in place to ensure Angel Tax does not apply to startups. “We all understand that people invest in startups for their potential. Today, it may not be valued. But they know it will be valued like this after a while, so they invest. There is a proviso that this is not attracted for startups,” said Jain.

What Is Angel Tax?

The government reintroduced the Angel Tax in the Finance Bill 2023, tabled right after Finance Minister Nirmala Sitharaman presented the Union Budget 2023-24. The government first introduced the tax in 2012 to prevent money laundering and roundtripping via investments.

The move has raised fears in the investor and startup communities that it would worsen the ongoing funding crunch, especially given that investments in Indian startups fell to $25 Bn in 2022 from $44 Bn in 2021.

The tax covers investment in any private business entity, but it was applied to startups in 2016. The Angel Tax is being levied on startups at 30.9% on net investments above the fair market value. Even though the tax was applied for only a year, many startups were retrospectively assessed for Angel Tax.

The move raised a lot of concerns in the ecosystem since most did not have the cash at hand to pay this tax bill and therefore risked being prosecuted. Regardless of who pays the tax, in the end, it would end up eating into the startup’s funds.

The Angel Tax, if adopted as is, would also result in investors stringing their purses tighter and asking startups to redomicile to invest easily since a majority of Indian startup funding comes from offshore investors.

The government’s move to accelerate reverse flipping would be rendered meaningless in the face of increased taxation and disclosure pressures coming from the Angel Tax.

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.