Faering Capital’s cofounder and managing director Sameer Shroff will be joining the company’s board with this round

Smallcase has raised a total capital of over $60 Mn in funding; it claims its transaction volume has grown 2.5x to INR 12,500 Cr

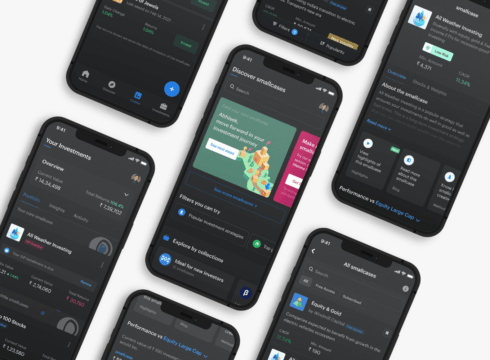

Smallcase is a financial technology company building a platform for direct indexing & model portfolios of stocks & ETFs

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

Investment tech startup smallcase has raised $40 Mn in a Series C round led by Faering Capital with new investors Amazon SMBhav Venture Fund (ASVF) & Premji Invest. Existing investors Sequoia Capital India, Blume Ventures, Beenext, DSP Group, Arkam Ventures, WEH Ventures, HDFC Bank Group, and Rare Enterprise’s CEO Utpal Sheth also participated in this round.

With this round, the cofounder and managing director of Faering Capital, Sameer Shroff, will be joining the company’s board.

The capital raised will be used to continue launching better investment products for the retail investor, and create additional value for smallcase’s partners by growing the ecosystem and enhancing the platform and its capabilities.

Founded in 2015 by Anugrah Shrivastava, Rohan Gupta, and Vasanth Kamath, smallcase is a financial technology company building a platform for direct indexing & model portfolios of stocks & ETFs.

The present funding comes after the startup raised $14 Mn in its Series B round led by DSP Group. To date, smallcase has raised a total capital of over $60 Mn. Post its Series B round, the startup claims to have doubled its user base to over 3 Mn and the transaction volumes have grown 2.5x to INR 12,500 Cr.

Its publisher platform — a business-in-a-box solution for research analysts and advisors — serves over 125 established and emerging investment managers and the gateway API is being leveraged by 50+ digital wealth and distribution platforms, according to the startup.

“In April this year, we launched a $250Mn Amazon SMBhav Venture Fund (ASVF) to invest in early stage tech start-ups. As part of this Fund, we are excited to partner with smallcase in their journey to offer innovative consumer investment products. By increasing product selection and convenience, this will provide an additional channel for consumers to participate in the equity markets”, said a spokesperson for Amazon

As of 26 June 2021, the fintech sector has raised $2.3 Bn in funding and has been the most favoured sector by venture capitalists and investors. The startup primarily competes with other Indian company Groww, which recently acquired Indiabull’s mutual fund business Nextbillion Technology. Other companies that smallcase competes with include Scripbox, Sqrrl, tickertape.in, upstox.com, among others.

Talking about the funding, Shrivastava said, “In 2020, we launched new features and tools to unlock access to smallcases through multiple new channels, and now in 2021, we are working to scale our platform and technology to make smallcases more valuable for both investors and our partners.”

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.