SUMMARY

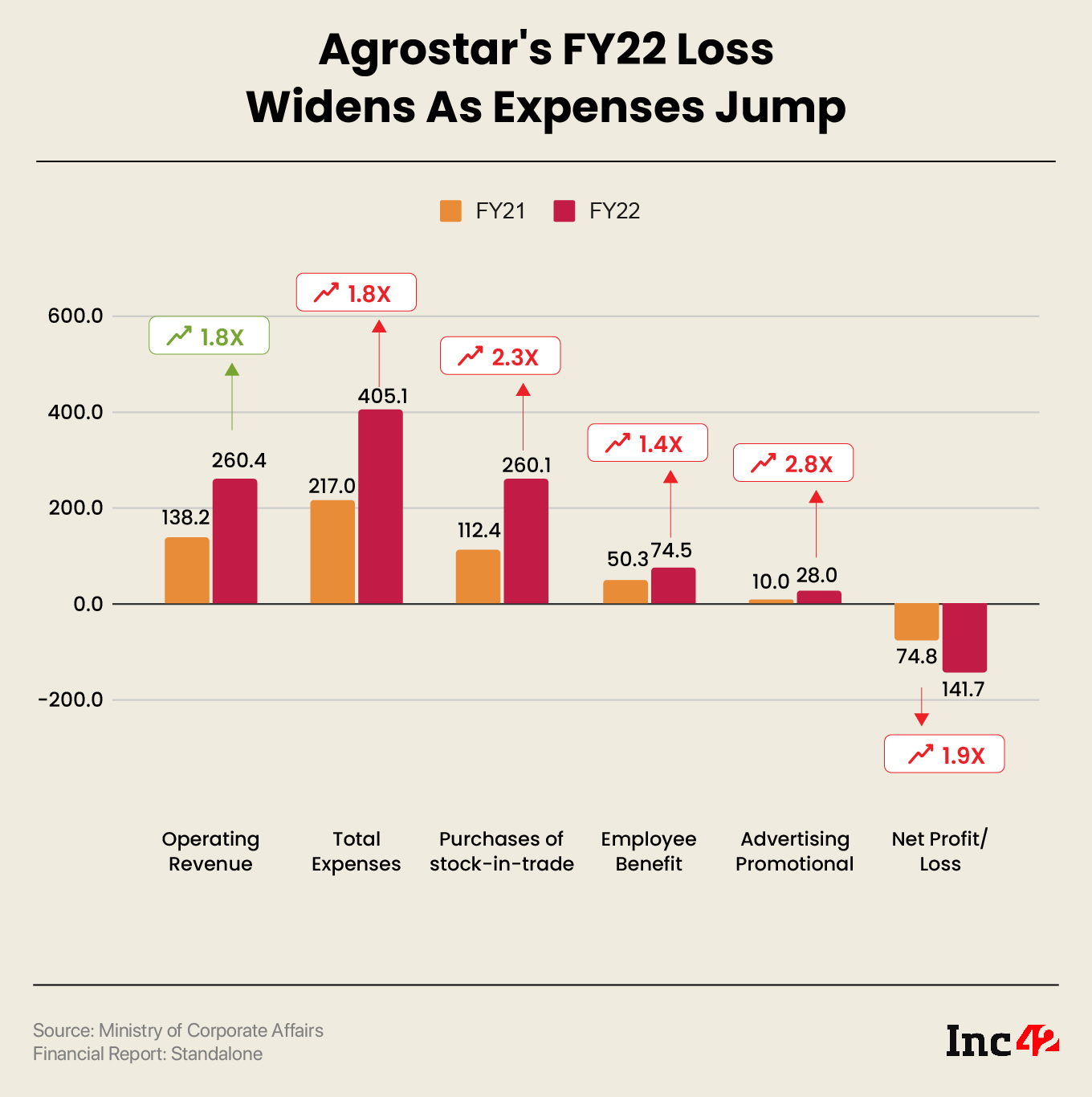

Agrostar’s operating revenue jumped 1.9X to INR 260.4 Cr in FY22 from INR 138.2 Cr in FY21

Total expenditure shot up 87% to INR 405 Cr from INR 217 Cr in FY21

The Pune-based startup last raised $70 Mn in its Series D round, led by Evolvence, in 2021

Pune-based agritech startup agrostar

Its operating revenue jumped 1.9X to INR 260.4 Cr in FY22 from INR 138.2 Cr in the previous fiscal year. The startup, backed by Evolvence Global, provides advisory solutions and agricultural inputs to farmers online as well as offline.

It generated most of its revenue through sale of agricultural inputs. Agrostar earned INR 232.7 Cr through sale of products in FY22, a 96% jump from INR 118.7 Cr in the previous year.

Led by the rise in operating revenue, total revenue increased 1.8X to INR 263.3 Cr in FY22 from INR 142.1 Cr in FY21.

On the expenses front, total expenditure shot up 87% to INR 405 Cr from INR 217 Cr in FY21. The startup spent the highest amount on procurement of products. Purchase of stock in trade expenses jumped 88% to INR 260 Cr from INR 112.4 Cr in FY21, accounting for 64% of its total expenditure.

Meanwhile, employee benefit expenses soared to INR 74.5 Cr during the year under review from INR 50.3 Cr in FY21. Employee benefit expenses included salary, PF contribution, gratuity and other employee welfare benefits.

Agrostar also spent INR 28 Cr on advertising and promotional activities, an increase of 180% from INR 10 Cr in FY21.

The startup’s EBITDA margin improved marginally to -51.2% in FY22 from -51.6% in FY21. Its cash flow from operations stood at (-) INR 138.6 Cr in FY22 as against (-) INR 71.7 Cr in the previous year.

Agrostar’s cash balance stood at INR 266.07 Cr at the end of FY22 as against INR 43.1 Cr a year ago.

Founded in 2013 by Sitanshu Sheth and Shardul Sheth, AgroStar leverages data and technology to solve farmers’ problems of access to good quality agri-inputs by bridging the knowledge gap. The startup claims it has benefited more than 5 Mn farmers so far.

At the peak of the startup funding boom in 2021, Agrostar raised $70 Mn in its Series D round from Evolvence, global asset manager Schroders Capital, Hero Enterprise, and the UK’s development finance institution CDC Group. Earlier in 2019, the startup raised $27 Mn in Series C round led by Bertelsmann India.

Last year, Agrostar acquired Mumbai-based agritech startup INI Farms in a cash and stock deal. Agrostar directly competes against Dehaat. In FY22, Dehaat posted a net loss of INR 1,563.9 Cr while its operating revenue stood at INR 1,273.42 Cr.