Reliance Retail has raised INR 37,710 Cr from global investors including Silver Lake, KKR, General Atlantic, Mubadala, GIC, TPG and ADIA in less than four weeks

Last week, Abu Dhabi-based sovereign wealth fund Mubadala picked up 1.4% stake in Reliance Retail for INR 6,247.5 Cr

ADIA invests in technology assets, both publicly listed and private

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

United Arab Emirates-based sovereign wealth fund Abu Dhabi Investment Authority (ADIA) has committed to invest INR 5,512.50 Cr in Reliance Industries’ retail unit Reliance Retail in exchange for 1.20% equity stake on a fully diluted basis. Reliance Retail has been valued at a pre-money equity value of INR 4.285 Lakh Cr.

With this investment, Reliance Retail has raised INR 37,710 Cr from global investors including Silver Lake, KKR, General Atlantic, Mubadala, GIC, TPG and ADIA in less than four weeks.

This deal comes three days after Singapore’s sovereign wealth fund GIC on October 3 said it will invest Rs 5,512.5 Cr to buy 1.22% share in Reliance Retail. On October 1, Abu Dhabi-based sovereign wealth fund Mubadala Investment Co said it would invest Rs 6,247.5 Cr to buy a 1.4% stake in its retail arm.

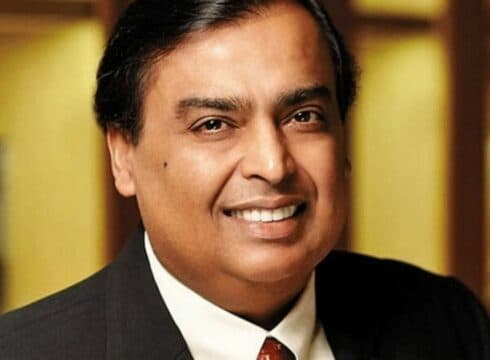

Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said, “We are delighted with ADIA’s current investment and continued support and hope to benefit from its strong track record of over four decades of value creation globally. The investment by ADIA is a further endorsement of Reliance Retail’s performance and potential and the inclusive and transformational new commerce business model that it is rolling out.”

On September 30, General Atlantic announced to invest INR 3,675 Cr in Reliance Retail in exchange for 0.84% equity stake on a fully diluted basis. Reliance Retail has been valued at a pre-money equity value of INR 4.285 Lakh Cr.

Besides ADIA, three reliance investors General Atlantic, Silver Lake and KKR have also invested in Reliance Retail. Silver Lake has invested INR 7,500 Cr in Reliance Retail for a 1.75% stake at a pre-money equity value of INR 4.21 lakh Cr. Meanwhile, KKR invested INR 5,550 Cr in the company for 1.38% equity stake.

ADIA invests in technology assets, both publicly listed and private. The sovereign fund has bought shares in publicly listed companies like LIC Housing, Jindal Stainless, Inox Leisure, Escorts LT, Infosys and ICICI Bank till March 2020. Technology is one of the five target areas for the investment firm.

Hamad Shahwan Aldhaheri, executive director of the Private Equities Department at ADIA, said, “Reliance Retail has rapidly established itself as one of the leading retail businesses in India and, by leveraging both its physical and digital supply chains, is strongly positioned for further growth. This investment is consistent with our strategy of investing in market-leading businesses in Asia linked to the region’s consumption-driven growth and rapid technological advancement.”

{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.