While calculating tax on income from crypto mining, its infrastructure cost will not be treated as the cost of acquisition

Loss from one crypto asset will not be set off against the income from other crypto assets, says the finance ministry

Such a clarification will keep the KYC-compliant users away and crypto users may once again go underground, fear crypto companies

On February 1,2022, finance minister Nirmala Sitharaman had proposed 30% tax on income from crypto and 1% TDS on crypto assets’ transactions.

This immediately evoked mixed feelings in the crypto community. On one end, most of the crypto founders welcomed the move, on the other end, they have also been demanding to reduce the crypto tax from 30% to 18% and TDS to 0.1-0.5%.

The situation was however about to worsen.

On Monday, Mar 21, 2022, bringing more clarity to the Finance Bill, 2022, the Indian government announced:

- While calculating 30% crypto Loss from one crypto asset will not be counted against the income from other crypto assets

- The cost incurred to the setting up of infrastructure will not be counted as the cost of acquisition while taxing income from crypto mining

Besides, the GST Council in its upcoming 47th meeting is also expected to classify crypto as goods or services and may bring it under the ambit of GST, according to a PTI report.

This has sparked a fresh cause of concerns among the Indian crypto community. Ashish Singhal, cofounder & CEO, CoinSwitch commented,

“This is detrimental for India’s crypto industry and the millions who have invested in this emerging asset class. We fear the lack of provision to offset losses will drive away users from KYC-compliant exchanges and platforms to the underground peer-to-peer grey market, which would defeat the purpose of the tax.”

The Budget recognised virtual digital assets (VDAs) as an emerging asset class. Therefore a natural course of action would have been to progressively bring the regulations at par with other asset classes. “Instead, today, with this clarification, we have taken a step backwards. If a regressive provision such as this would have been applicable in equities, it would have discouraged retail investors from participating,” Singhal added.

Crypto: What Happened In The Parliament

On March 21, 2022, Congress Lok Sabha MP Karti P Chidambaram asked:

- What is the legal status of crypto in India

- Whether infrastructure costs incurred in mining crypto are to be treated as cost of acquisition

- Whether the losses incurred due to the sale of one cryptocurrency can be set off against the gains arising from the other cryptocurrencies

To which, the minister of state, finance Pankaj Chaudhary stated that the Finance Bill has proposed to insert Section 115BBH to the Income Tax Act, 1961 which seeks to define virtual digital assets and include crypto assets. As per the proposed provisions of section 115BBH, infrastructure costs incurred in the mining of VDA (eg. crypto assets) will not be treated as cost of acquisition as the same will be in the nature of capital expenditure which is not allowable as deduction as per the provisions of the Act.

Chaudhary further clarified that the loss from the transfer of VDA will not be allowed to be set off against the income arising from the transfer of another VDA.

What Does It Mean

We had earlier explained the impact of the Finance Bill 2022 in detail for the crypto industry. With the latest clarifications, there are certain changes in terms of tax calculation.

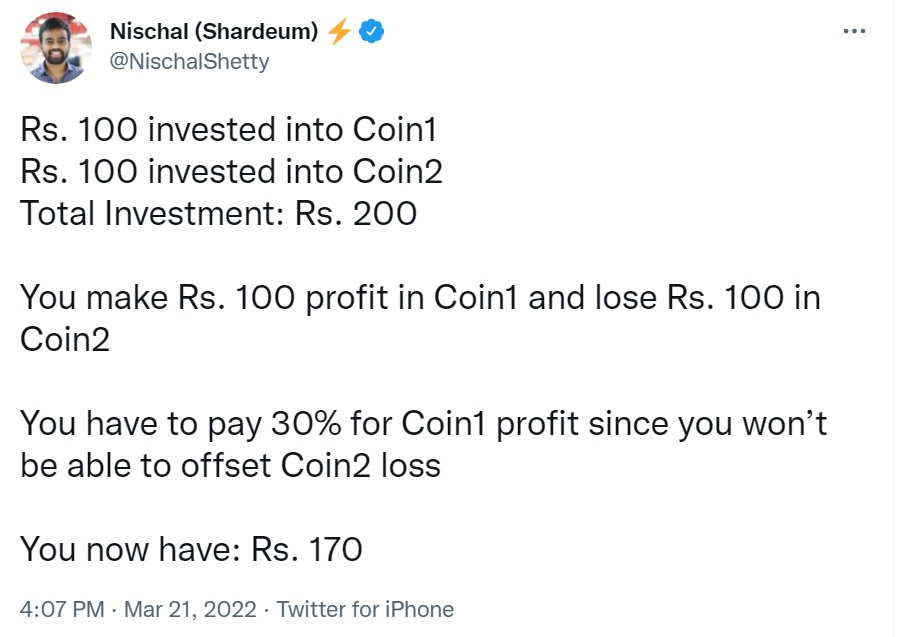

Explaining this, Binance-owned WazirX founder Nischal tweeted,

Further, if someone has invested in 5 crypto assets for instance in Bitcoin, Ethereum, Ripple, Dogecoin and Polkadot. The person who makes INR 100 from Bitcoin investments and makes a total INR 300 loss in other investments, will still have to pay INR 30 tax.

One of the crypto founders told Inc42 that they are once again forced to pursue legal courses as this is worse than banning crypto in India.

Similarly, regardless of investments towards setting up crypto mining infrastructure, the cost will not be counted as the cost of acquisition while determining the tax on mined cryptocurrencies.

It’s a regressive development, feared by most of the crypto startup founders and enthusiasts.

The crypto tax in its present form will come into effect from April 1, 2022 onwards.

Ad-lite browsing experience

Ad-lite browsing experience