Of the 14 startup stocks under Inc42’s coverage, nine declined in a range of 0.2% to over 4%, with Zomato being the biggest loser, down 4.3% on the BSE this week

RateGain, Delhivery, PB Fintech, Nazara and Tracxn rose in the range of 0.7% to over 10% as RateGain emerged as the biggest winner

In the broader equity market, benchmark indices Sensex and Nifty50 rose about 1.6% and 1.4% to 62,027.9 and 18,314.8, respectively

Despite overall positive Q4 FY23 results by the new-age tech stocks, the investor sentiment was largely bearish this week as the border market continued to remain volatile.

Of the 14 startup stocks under Inc42’s coverage, nine declined in a range of 0.2% to over 4%, with Zomato being the biggest loser, down 4.3% on the BSE this week.

Besides, Nykaa fell 4.2%, CarTrade Technologies was down 3.6%, EaseMyTrip declined 2.5%, and last week’s biggest gainer DroneAcharya slipped over 2% this week.

Meanwhile, RateGain emerged as the biggest winner, as its shares soared 10.4% on the BSE. It also saw a sudden spurt in volume at the exchanges this week. However, the traveltech SaaS platform informed the exchanges that there is no undisclosed/price-sensitive information or any impending announcement/corporate action to be released in this regard.

RateGain is expected to report its Q4 FY23 results next week.

Besides RateGain, Delhivery, PB Fintech, Nazara and Tracxn were also up in the range of 0.7% to 2% this week.

In the broader equity market, benchmark indices Sensex and Nifty50 rose about 1.6% and 1.4% to 62,027.9 and 18,314.8, respectively, this week.

The market has now been consolidating and is awaiting fresh triggers for the next leg of the rally as the structure of the market remains positive, observed Siddhartha Khemka, head of retail research, Motilal Oswal.

“Markets on Monday will react to India’s inflation data and the Karnataka election outcome. Investors would continue to keep an eye on economic data to be released next week,” Khemka said.

This week, the government published an inflation data report. The country’s retail inflation moderated to an 18-month low of 4.7% in April, in line with expectations.

Now, let’s dig deeper into analysing the performance of some of the new-age tech stocks this week.

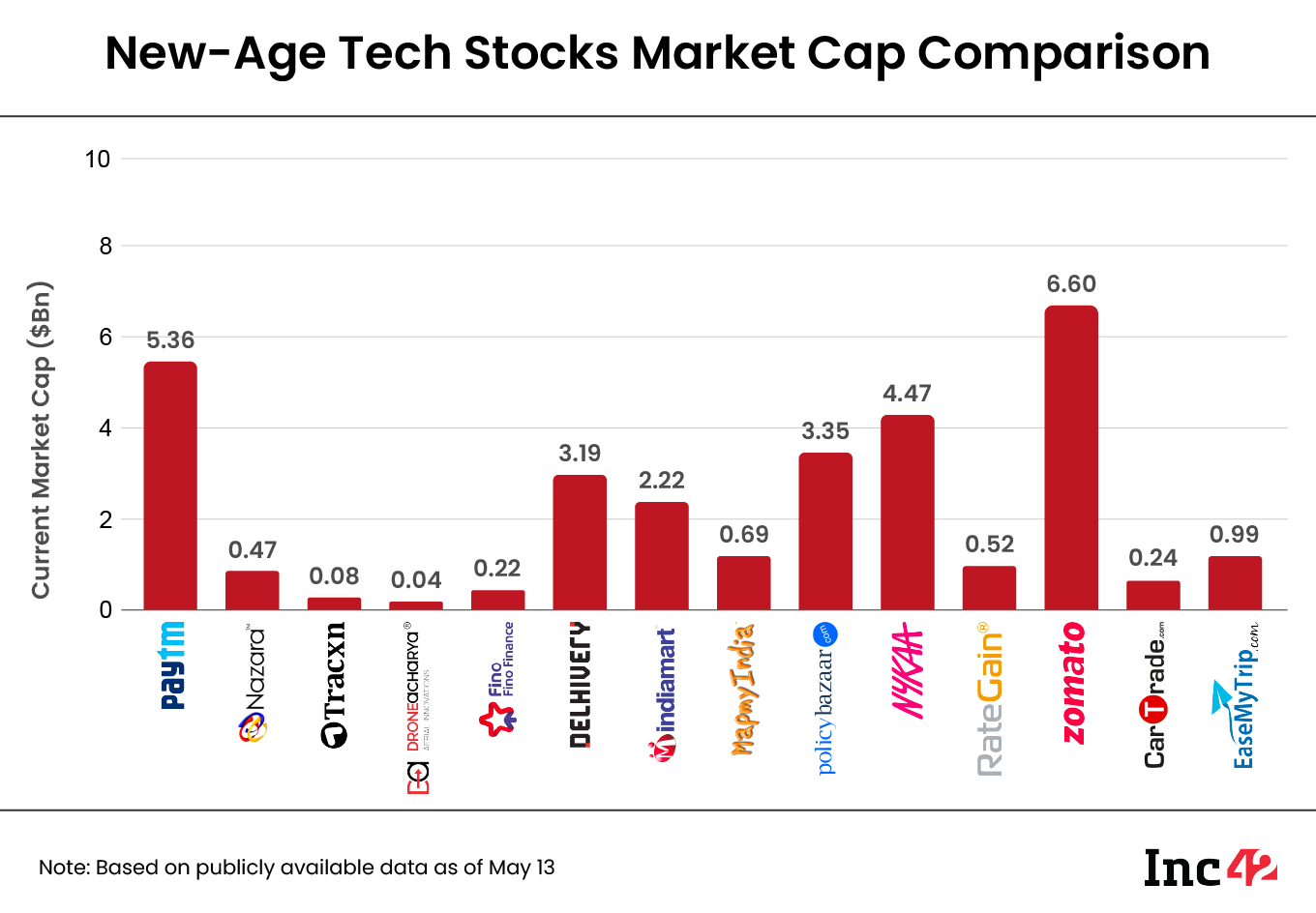

The 14 new-age tech stocks under Inc42’s coverage ended the week with a total market capitalisation of $28.49 Bn as against $26.58 Bn a week ago.

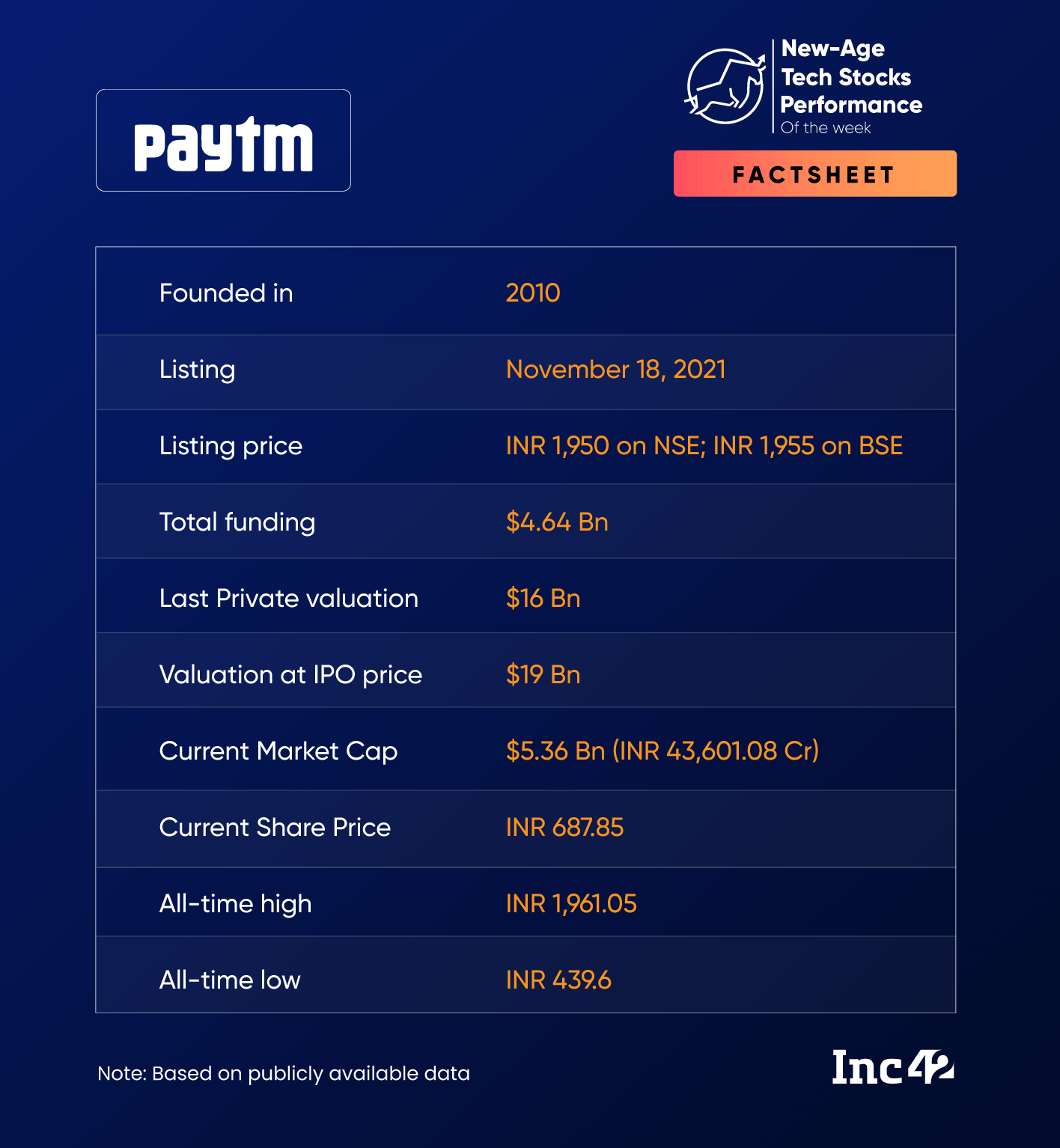

SoftBank Sells More Stakes In Paytm

Helped by the positive quarterly and FY23 financial report, shares of Paytm were on an upward spiral, however, were offset later this week as SoftBank sold more stakes in the company.

Paytm’s stock ended the week down marginally after it lost over 5% in two straight sessions starting Thursday (May 11) after SoftBank’s report. On Friday, alone, Paytm was down 1.5% compared to Thursday’s close, ending the week at INR 687.85 on the BSE.

In The News For:

- SoftBank said that it offloaded over a 2% stake in the company, which was an aggregate of 1.3 Cr shares, in a series of disposals undertaken between February 10 and May 8.

- The stake sale came despite Paytm adding to the books of SoftBank. As per the Japanese VC major’s financial report published this week, its Visions Fund 1 gained $111 Mn from Paytm in the January-March quarter of 2023.

- Paytm also revealed its plans for launching the ‘UPI International’ service on its app soon.

- The fintech major’s net loss declined 78% year-on-year (YoY) to INR 167.5 Cr in Q4 FY23, and it also reported its second consecutive operationally profitable quarter.

A majority of brokerages seemed bullish about Paytm following its results. Goldman Sachs said that the Q4 results are expected to bring a pause to the debates that persist around Paytm’s business model and profitability.

Many brokerages expect the startup to achieve overall profitability by FY25 or FY26.

Paytm has made a double top formation near the INR 740 level. “We need to wait until the INR 650 level to buy the stocks,” said Jigar S Patel, senior manager and technical research analyst, at Anand Rathi. He expects Paytm to see a bounce in the range of INR 720 to INR 730 next week.

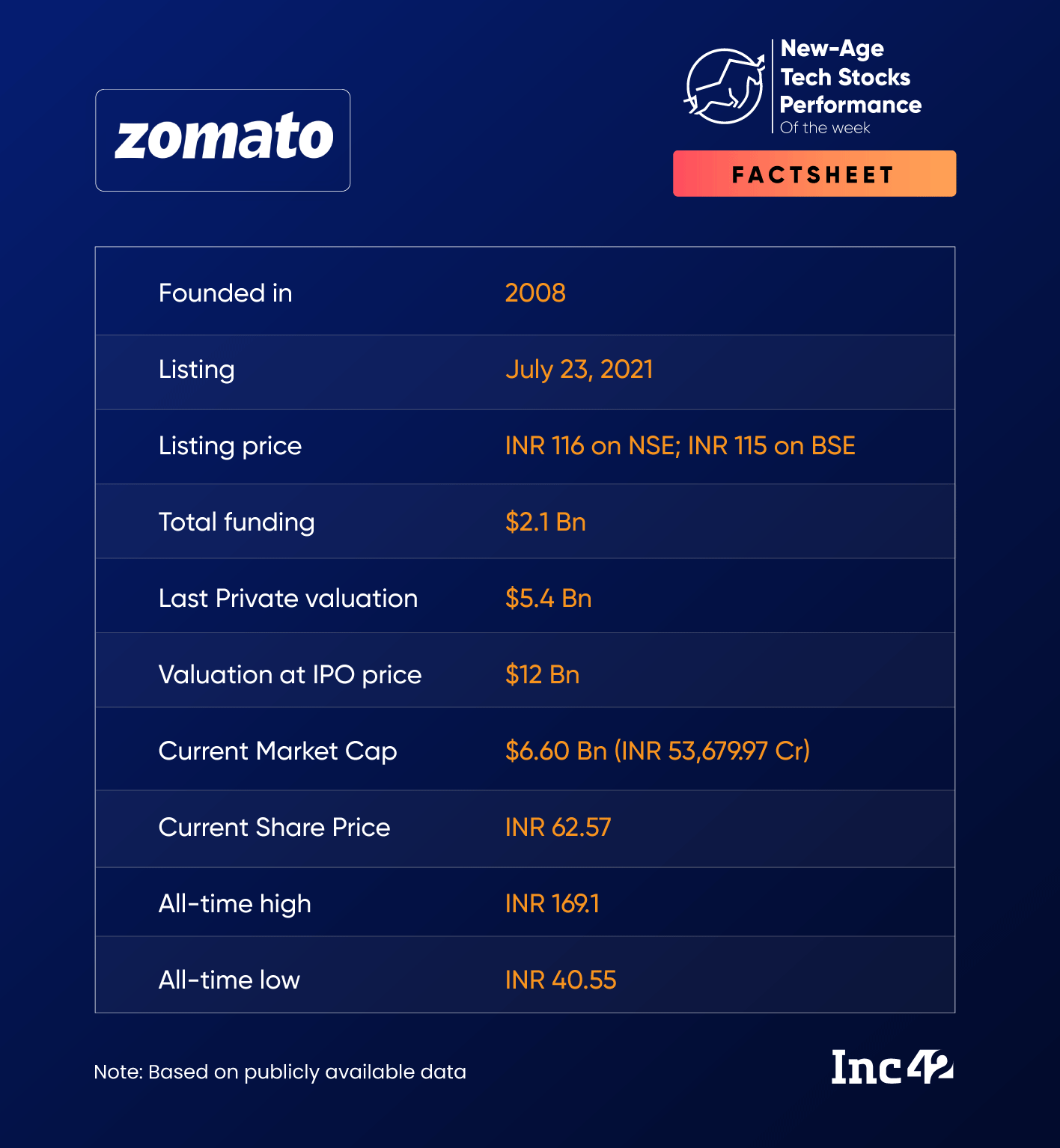

Zomato To Face Increased Competition

Reversing the bull run of two weeks, shares of food delivery major Zomato fell 4.3% this week, amid fears of a rise in its competition from the government’s Open Network for Digital Commerce (ONDC) platform. The Zomato stock ended Friday’s session at INR 62.57 on the BSE.

In The News For:

- Inc42 reported last week that ONDC’s effort to provide food delivery at a significantly lower price compared to Zomato and Swiggy can pose a major challenge to these two main players in the food delivery segment.

- While its existing business verticals are already facing weak fundamentals, Zomato has reportedly started piloting B2B logistics services.

- Zomato’s quick commerce business Blinkit is still facing service disruptions in Delhi-NCR after last month’s strike by its delivery executives.

Competition Watch:

- While many restaurant owners and industry players believe ONDC can be a threat to Zomato, brokerages like Jefferies and Motilal Oswal have a different stance.

- Another new competitor has emerged for Zomato, named WAAYU. Backed by Bollywood actor and investor Suniel Shetty, WAAYU is a no-commission food delivery platform, which is in sharp contrast to the 18%-24% commission that Zomato and Swiggy charge from its restaurant partners.

- Invesco has further cut the valuation of Swiggy to $5.5 Bn, which stood at $10.7 Bn in January last year.

While it is becoming more evident that the era of a duopolistic food delivery market in India is slowly ending and the emergence of ONDC can make it even more difficult for Zomato and Swiggy to scale, Motilal Oswal said that the open platform for ecommerce poses no immediate threat to Zomato.

“… we see ONDC as a potential threat to Zomato only if it meaningfully scales up across categories, allowing it to achieve greater efficiency compared to the walled gardens,” the brokerage said.

Meanwhile, Jefferies noted that the current discounts on ONDC, which is a major reason behind the buzz about the platform becoming a threat to Zomato, the discounts are only for a limited period.

“Pricing comparisons suggest that ONDC offers value, but this is led by ‘limited period’ subsidies. Hence, despite some concerns, we do not see the risk to the duopoly, even while ONDC is a key monitorable,” the brokerage said.

For the next week, the crucial level for Zomato shares will be in the INR 57-INR 68 range, said Anand Rathi’s Patel.

“Zomato’s support for the next week is INR 60, followed by INR 57, where we can buy the stock. The target will be around INR 63-INR 64,” said Patel, adding that the stock will first fall and then bounce back.

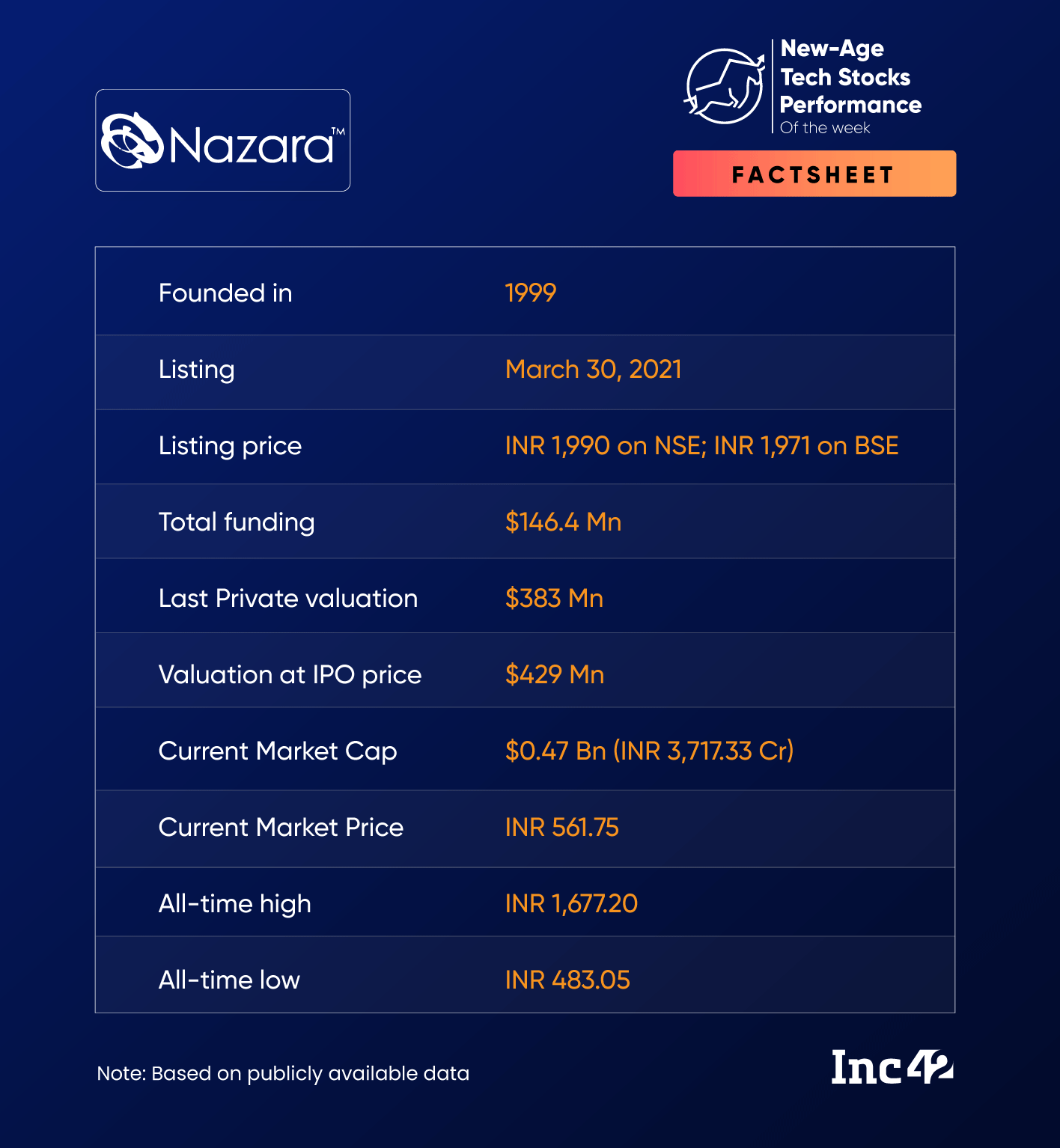

Nazara Fails To Impress Investors With Q4 Results

Shares of gaming company Nazara rose early this week, following its Q4 FY23 results but slipped after that. Its shares were up 0.7% this week, ending Friday’s session at INR 561.75 on the BSE.

Nazara reported a net profit of INR 9.4 Cr in the quarter, which was up from INR 4.9 Cr in Q4 FY22. But sequentially, its profit declined from INR 20.1 Cr in Q3 FY23.

In FY23, its net profit was up 21% YoY at INR 61.4 Cr.

Following the results, Jefferies cut its price target (PT) on Nazara to INR 700 from INR 800 earlier, which implies an upside of 24.6% to the stock’s last close.

“Lower-than-expected growth and higher churn in Kiddopia, lower-than-expected margin in Nodwin and slower growth in Adtech were the key disappointments,” said the brokerage.

However, Jefferies has maintained a ‘buy’ rating on the stock.

Meanwhile, ICICI Securities, too, has maintained a ‘buy’ rating on Nazara with a price target of INR 700. While the brokerage believes that the company could benefit from inexpensive acquisition opportunities, given its significant cash balance and a bull case valuation of INR 800 apiece, it also sees a bear case valuation of INR 400 on the stock if growth slows and margin improvements do not play out.

In fact, Nazara continues with its acquisition spree. It recently purchased an additional 19.5% stake in its subsidiary Next Wave Multimedia in an all-cash deal of INR 15.5 Cr.

Anand Rathi’s Patel sees the stock’s support at around INR 550. He expects it to bounce from there in the price range of INR 620 to INR 622 in the next week.

Ad-lite browsing experience

Ad-lite browsing experience