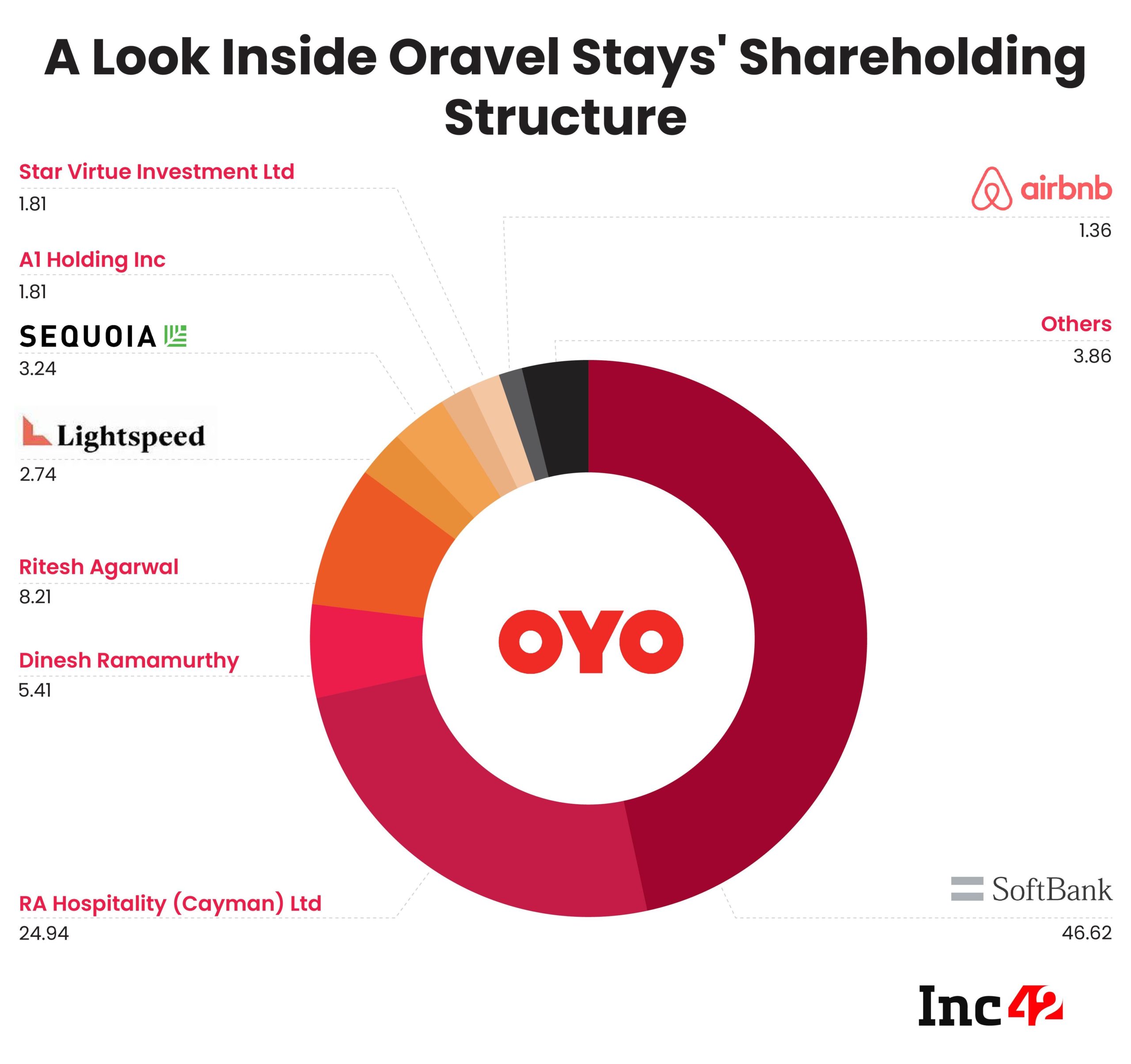

According to the DRHP filed with the market regulator, founder Ritesh Agarwal holds 8.21% stake and RA Hospitality owned by him holds 24.94% shares

Masayoshi’s SoftBank holds the highest number shares at 46.62%

Current shareholders will be offloading these shares amounting to INR 1,430 Cr via OFS

Gurugram-based hospitality unicorn Oravel Stays, which runs OYO has filed for an INR 8,430 Cr ($1.2 Bn) IPO. The offer will include a primary component which will include an issue of fresh shares worth INR 7,000 Cr and an offer-for-sale, and several existing investors will offload their shares, amounting to INR 1,430 Cr.

Founded in 2013 by Ritesh Agarwal, OYO so far has raised close to $4.1 Bn from 26 investors.

Agarwal, the CEO and Founder, who individually holds an 8.21% stake in the hospitality startup, won’t be selling his stake in the proposed IPO. RA Hospitality Holdings (Cayman), which is owned by Agarwal, holds a 24.94% stake.

SoftBank’s SVF India Holdings (Cayman) Ltd holds 46.62% shareholding in Oravel Stays. According to the DRHP filed with the market, regulator shows that SVF India Holdings will offload shares of up to INR 1,328.5 Cr through the offer for sale.

A1 Holdings Inc, which holds a 1.81% stake aims to sell a stake worth INR 51.6 Cr. While China Lodging Holdings (HK) Ltd will offload stake worth INR 23.13 Cr Equity Shares. It currently holds a 0.81% stake in the hospitality unicorn.

The INR 1,430 Cr offer for sale (OFS) will also include — stake sale of up to INR 26.71 Cr by Global Ivy Ventures LLP, which currently has 0.94% stake in the company.

The other shareholders having more than 1 per cent stake in the company are Dinesh Ramamurthi (Trustee of Oravel Employee Welfare Trust), Sequoia Capital India Investments IV, Lightspeed Venture Partners IX, Mauritius, Star Virtue Investment Limited and NASDAQ-listed AirBnB Inc, holding 5.41%, 3.24%, 2.74%, 1.81% and 1.36% respectively.

The remaining shareholders in the company own less than 1% stake and their cumulative holdings stand at 3.86%.

In September, Inc42 had exclusively reported that OYO would give 4,333 bonus equity shares to 12 equity shareholders at a face value of INR 10.

According to regulatory filings accessed by Inc42, OYO would have allotted:

- 1,833 and 2,273 equity bonus shares to its founder Ritesh Agarwal and OYO’s holding entity RA Hospitality Holdings respectively.

- The hospitality giant’s investor SoftBank has received 79 bonus equity shares, whereas Lightspeed Venture Partners has been allotted 49 bonus equity shares.

- Others who have been allotted bonus equity shares include OYO’s chief human resource officer Dinesh Ramamurthi, Sequoia Capital, Ivy Ventures, Do Moonstone Advisors, DIG Investments, Vinod Sood, Anuj Tejpal, and Misha Kohli.

The Delhi-NCR based unicorn plans to utilise 29% of its net proceeds from the IPO to repay part of the borrowing availed by its subsidiaries.

The repayment or prepayment of debt would amount to INR 2,441 Cr, as per the DRHP. The net debt of Oravel Stays at the end of the financial year 2020-21 stood at INR 2,848.79 Cr, showed the filings made with the regulator.

It plans to mobilise another INR 2,900 Cr towards organic and inorganic growth initiatives and the rest will be put into general corporate purposes.

Ad-lite browsing experience

Ad-lite browsing experience