Happy Holi From Inc42! Here’s to a year filled with bold ideas, bright opportunities and breakthrough innovations.

Urban Company’s Bold Q-Commerce Move

As the realm of quick commerce picks up steam, Urban Company

Urban Company

Currently available in Mumbai, users can book house help for as little as INR 49 per hour for services ranging from cleaning of utensils and brooming to mopping and meal preparation.

While there is no clarity on the company’s timeline to expand this service to other cities, the move is definitely one-of-a-kind in the home services space.

Nevertheless, a pan-India rollout will demand much work. The company, infamous for frequent strikes by its workers, will need to guarantee better working conditions, all while chalking out a process to tackle customer inconvenience in case of last-minute cancellations.

As of now, an early rollout could see Urban Company splurge heavily on subsidising the rates for end customers, and this could bite into the company’s top and bottom lines. Notably, the hyperlocal services startup slashed its net loss by more than 70% YoY to INR 93 Cr in FY24.

The new 15-minute maid booking offering comes when Urban Company is preparing for an INR 3,000 Cr public listing. This move (Insta Maids) introduces a fresh quick commerce angle — one that shifts the focus from delivering groceries, clothes, and electronics to now offering house help at lightning speed. Continue reading…

From The Editor’s Desk

super.money Beats CRED In UPI Race: The Flipkart-backed platform emerged as the fifth largest UPI player in February, overtaking Kunal Shah-led fintech unicorn in terms of transactions. super.money clocked 13.9 Cr transactions worth INR 4,812.4 Cr last month.

Purple Style Labs Nets $40 Mn: The Pernia’s Pop-Up Shop’s parent has raised the capital as part of its Series E round, in a mix of primary and secondary share sale, led by SageOne. The startup incubates young designer brands and aids in sales, marketing, and technical support.

Indian VCs Pile Up On SaaS Deals: Homegrown investors are increasingly seeing AI and SaaS investments as the moat for the Indian startup ecosystem in competing against big tech giants globally. So, what’s making GenAI a dominant theme in the VC ecosystem?

Groww Mulls Fisdom Acquisition: The IPO-bound unicorn is in talks to acquire the wealthtech startup as part of its plans to enter the wealth management space and expand its offerings. Fisdom could likely be valued between $140 Mn to $160 Mn as part of the deal.

InCred Finance Nets $30 Mn Debt: The fintech unicorn has secured INR 258 Cr in debt from a clutch of investors in multiple tranches since January. While Neo Group invested INR 50 Cr, InCred’s wealth division and investment banking arm also contributed INR 25 Cr each.

Snap India’s Revenue Crosses INR 100 Cr: The Indian subsidiary of social media giant reported an operating revenue of INR 101.3 Cr in FY24, up 28.5% from INR 78.8 Cr in the previous fiscal. Meanwhile, net profit rose 25.9% YoY to INR 9.7 Cr in FY24.

Astrotalk Ropes In Ex-GlobalBees CBO: The spiritual tech startup has appointed Damandeep Singh Soni as the chief business officer of its ecommerce venture, Astrotalk Store. Soni quit Globalbees in August last year.

ONDC CBO Steps Down: Shireesh Joshi has stepped down as the chief business officer of the state-backed Open Network for Digital Commerce after a three-year-long stint. Before joining ONDC, Joshi held leadership roles at companies like Godrej, Bharti Airtel, PepsiCo and P&G.

Inc42 Startup Spotlight

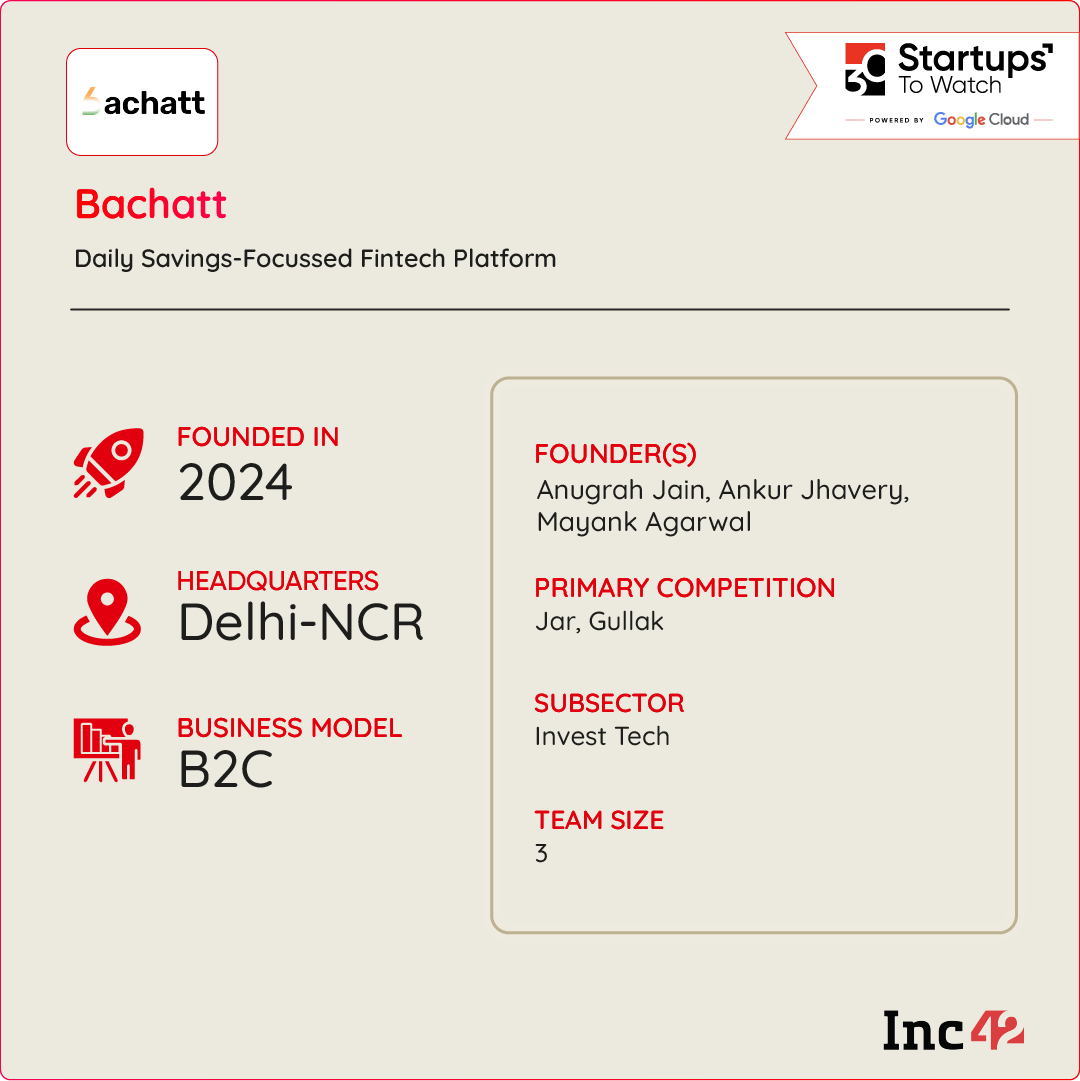

How Bachhat Is Helping Indian Retailers Grow Their Savings

While working with Boston Consulting Group, Anugrah Jain noticed a peculiar problem – grocery store owners, despite earning daily, struggled to save effectively with traditional financial instruments. To solve this problem, he banded together with former colleagues Ankur Jhavery and Mayank Agarwal to launch Bachhat in 2025.

Bachhat is a daily savings-focussed fintech startup, which analyses daily cash flow patterns of individuals and offers a formal solution for savings. The startup claims to grow the income of individuals, earning INR 30K-70K per month, by helping them save INR 100-200 daily.

Going forward, the startup aims to tap into the INR 15 Lakh Cr annual savings potential of India’s self-employed workforce and provide them with easy and reliable financial tools to improve their financial future.

.svg)

Fintech

Fintech Travel Tech

Travel Tech Electric Vehicle

Electric Vehicle Health Tech

Health Tech Edtech

Edtech IT

IT Logistics

Logistics Retail

Retail Ecommerce

Ecommerce Startup Ecosystem

Startup Ecosystem Enterprise Tech

Enterprise Tech Clean Tech

Clean Tech Consumer Internet

Consumer Internet Agritech

Agritech