While Swiggy's revenue base has grown considerably over the past year, the real question is whether profitability is within reach ahead of the IPO

Three years after Indian startups lined up for public listings in 2021, we are back on the IPO trail in 2024. And it’s swiggy

The Bengaluru-based food delivery and quick commerce giant has reportedly taken the confidential filing route for an INR 10,414.1 Cr ($1.2 Bn) IPO. And it has the company of Indian unicorns such as Ola Electric, MobiKwik, Digit Insurance and FirstCry on the IPO road this year.

Interestingly, Swiggy’s IPO plans come despite the company‘s inability to clear the profitability hurdle in FY24 by most accounts. And as we have seen over the past year, this is a critical factor for success in the public markets.

And at the same time, Swiggy’s quick commerce business Instamart seems to be slipping against the competition. So this Sunday, we wanted to examine whether these challenges will derail Swiggy’s potential IPO in 2024?

But first, here’s a look at the other top stories from our newsroom this week:

- Online Fashion Boom: The Indian ecommerce opportunity is projected to cross the $400 Bn+ mark by 2030, with online fashion platforms accounting for more than 25% of this surge, according to the latest report by Inc42

- Koo’s Woes Continue: After seeing a massive decline in users, Tiger Global-backed Koo has halted salary payments for April 2024 as talks with strategic partners are yet to fructify, the company confirmed in our exclusive report

- Healthify’s Cutbacks: Another Inc42 exclusive — the healthtech giant has laid off 150 employees in a restructuring exercise as it looks to make its India business EBITDA profitable and expand its offerings in the US market

Swiggy Joins IPO Buzz

Before we dive into the past year for Swiggy, let’s take a look at the IPO details. Swiggy’s potential IPO offer will include fresh issue of shares worth INR 3,750.1 Cr (about $449 Mn) and an offer-for-sale component worth INR 6,664 Cr (around $799 Mn), as per regulatory filings.

Founded in 2014 by Sriharsha Majety, Nandan Reddy, Phani Kishan Addepalli and Rahul Jaimini (who exited in 2020), Swiggy is backed by VC and PE giants such as Prosus, Accel, SoftBank and Invesco among others.

While the company was valued at $10.7 Bn after its funding round in early 2022, in recent weeks, many of the company’s investors, including Invesco and Baron Capital, have marked up the value of their investments in Swiggy, which would bring the company’s valuation to over $12 Bn.

At the moment, little is known about which shareholders will be offloading their shares in the IPO but reports suggest Prosus is likely to shed a bulk of its stake in Swiggy.

The global investment giant could well be tagged as Swiggy’s promoter in the IPO given its large shareholding. Currently, Prosus owns 33% of Swiggy, which would automatically make it a promoter in any public offering.

But the investment arm of South African conglomerate Naspers is said to be in talks to sell a portion of its stake before the IPO to bring its holding under 26%, which would release it from SEBI’s restrictions on the shares it could sell after the public listing.

Profitability Remains A Question Mark

Given the valuation markups by key investors in recent months, there’s optimism about Swiggy significantly cutting its losses over FY24.

As Inc42 reported in early 2024, Swiggy is expected to report revenue of over INR 10,000 Cr in FY24, 20% higher than the INR 8,260 Cr it reported in FY23. This is largely due to a big surge in Instamart orders, platform fees related to food delivery and growing traction for its dining out business, according to sources within the company.

Other sources who have seen Swiggy’s disclosures for H1 FY24 told us the company touched INR 4,735 Cr in revenue only from food delivery and its quick commerce vertical Instamart. This is over half of the total revenue from these two verticals in FY23.

So while the revenue base has definitely grown, the real question is whether profitability is within reach. As early as May 2023, Swiggy claimed that its food delivery business was more or less profitable, but things have changed since then, particularly given the competition in the quick commerce space (more on this later).

While we don’t know the loss for FY24, as per reports, Swiggy trimmed its net loss to around $207 Mn (INR 1,730 Cr) in the first nine months of the fiscal year, compared to the INR 4,179.3 Cr net loss in the entire FY23.

But some analysts we spoke to believe that this may not be enough given Zomato’s swing towards profits in FY24. If Zomato is able to show profits for the full fiscal year, which we will find out in the next month or so, then Swiggy will have to do a lot more than just shave some of its losses.

“Quick commerce is the key for long term profitability. Blinkit has already outpaced Zomato’s food delivery business. A Goldman Sachs report this week said that Blinkit’s contribution to Zomato’s market value has surpassed the core food delivery business. So Instamart will be extremely critical for Swiggy,” according to Rahul Jain, vice president of brokerage firm Dolat Capital.

The Goldman Sachs report estimated that Blinkit has an implied value of INR 119 per share, compared to INR 98 per share for the food delivery vertical. As a result, Blinkit is contributing close to $13 Bn to Zomato’s market cap, out of a total market cap of nearly $20 Bn.

Importantly, Blinkit has been contribution positive in the last two consecutive quarters. In February, Blinkit’s contribution margin, as a percentage of GOV, in the overall business improved to 2.4% in Q3 FY24 from 1.3% in Q2 FY24.

Losing Ground On Quick Commerce

Blinkit’s massive surge is despite the fact that Zomato’s food delivery business has looked to push the accelerator on platform fees and delivery fees in recent months. Given this shift in dynamics between food delivery and quick commerce, it will be interesting to see how well Instamart holds up for Swiggy in the long run.

It’s no secret that Swiggy started as a food delivery startup, and while it was one of the first movers in the quick commerce vertical with Swiggy Instamart, its two major rivals Blinkit and Zepto have made the most of the quick commerce opportunity.

On the food delivery side, Swiggy has gradually ramped up the platform fees and has also added collection fees from restaurants in the past year. The company charges between INR 3 to INR 4 per order from customers, which directly contributes to Swiggy’s bottom line.

Platform fees have become an industry-wide trend, so this may not necessarily be a big moat for profitability for Swiggy. Besides this, it’s been a year of restructuring exercise at Swiggy, which included mass layoffs, reduction in spending, and streamlining of operations to reduce cash burn.

Whether it is the partnership with IRCTC to deliver pre-ordered meals to train passengers or merger of its premium grocery vertical InsanelyGood with Instamart, the startup has taken a number of steps to boost revenue and curb its losses.

In a bid to push up the average order value for quick commerce, the company recently integrated Swiggy Mall, which sold a wide range of non-grocery items like footwear and electronics items, within the quick commerce offering.

This will be critical as Zepto claims to be on pace to achieve $1.2 Bn in annual sales in FY24, which will undoubtedly be helped by the recent introduction of Zepto Pass loyalty programme and a per-order platform fee.

Even though it remains the second largest quick commerce player in India after Blinklit, Swiggy has seemingly lost its first mover advantage in this category.

In a recent report created in collaboration with HSBC Global Research, Zepto claimed that it has a market share of 28% in January 2024, compared to Zomato-owned Blinkit’s 40%. Instamart, which was the market leader in March 2022 with 52% share, has seen its share of the pie drop to 32% in January 2024, the report claimed.

While it may not be the most accurate representation of the market given Zepto’s collaboration with HSBC, this is not the first report to indicate that Swiggy is losing ground on the quick commerce front. And what complicates this further is the big push for quick commerce from the likes of Tata-owned BigBasket and Flipkart in recent months.

So even as Swiggy gets ready for its IPO, it has to contend with multiple challengers in the highly lucrative quick commerce vertical, while also ensuring that this doesn’t take its focus away from food delivery or the dining out business.

And this also means Swiggy’s potential public listing will be the first public test for quick commerce as a category in India. Which way will the market sentiment fall when Swiggy eventually comes up for its IPO?

Sunday Roundup: Tech Stocks, Startup Funding & More

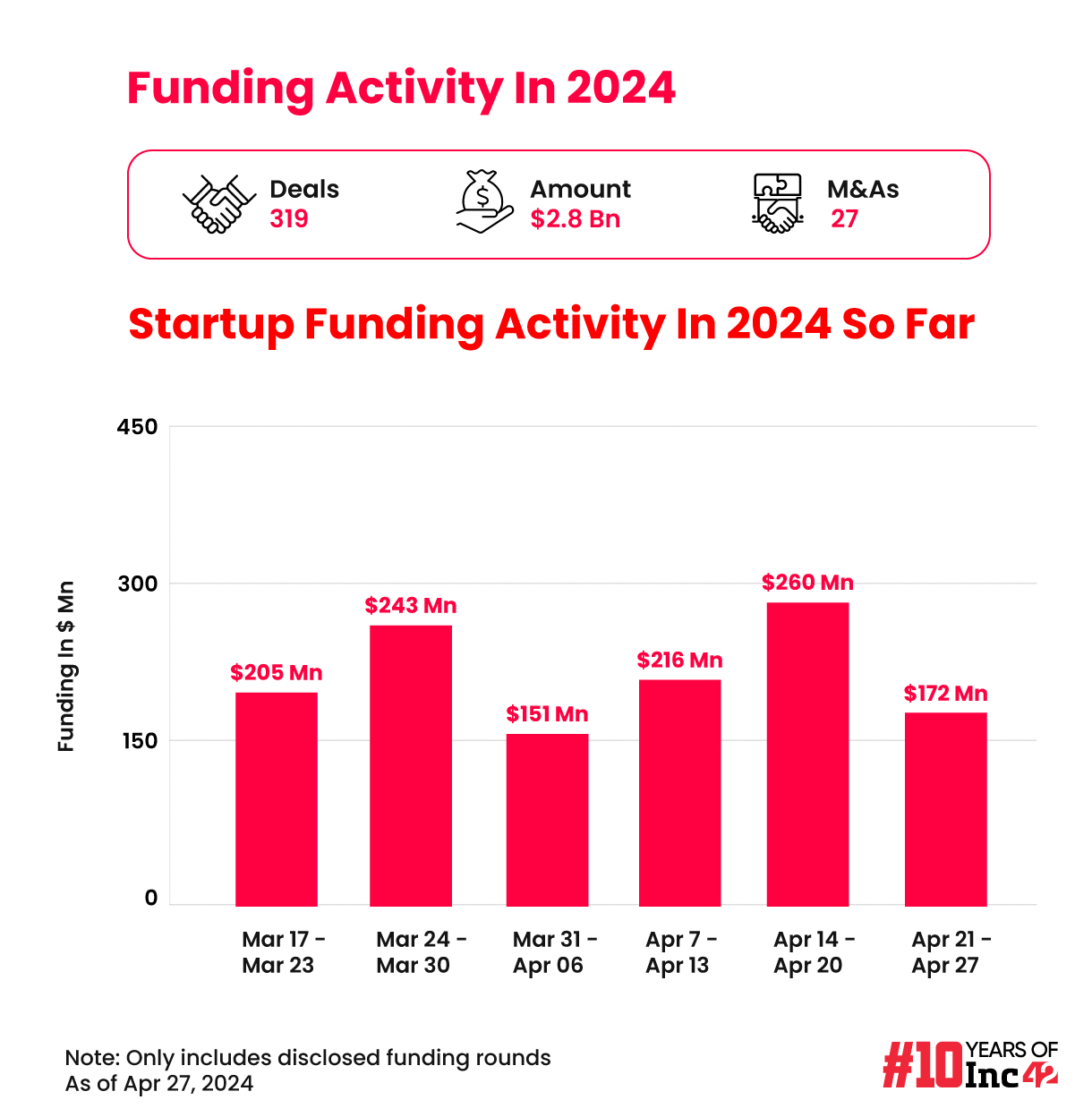

Funding Dip: After two weeks of steady funding inflow, there was a decline in startup funding this past week, with a total of $172 Mn raised across 21 deals, down 33% week-on-week

WhatsApp’s Ultimatum: Continuing its legal tussle with the Indian government, WhatsApp told the Delhi High Court that it would be forced to pull out of India if it is forced to revoke end-to-end encryption in its app

Jio’s FY24 Numbers: Despite muted sequential growth in Q4, Jio Platforms’ operating revenue for FY24 grew 10.4% YoY to INR 1.09 Lakh Cr, while its annual net profit rose 12% to INR 21,423 Cr

FirstCry Pulls DRHP: Kids-focussed omnichannel retailer Firstcry has reportedly withdrawn its DRHP filed with SEBI and is likely to file new IPO papers with more up-to-date financial disclosures

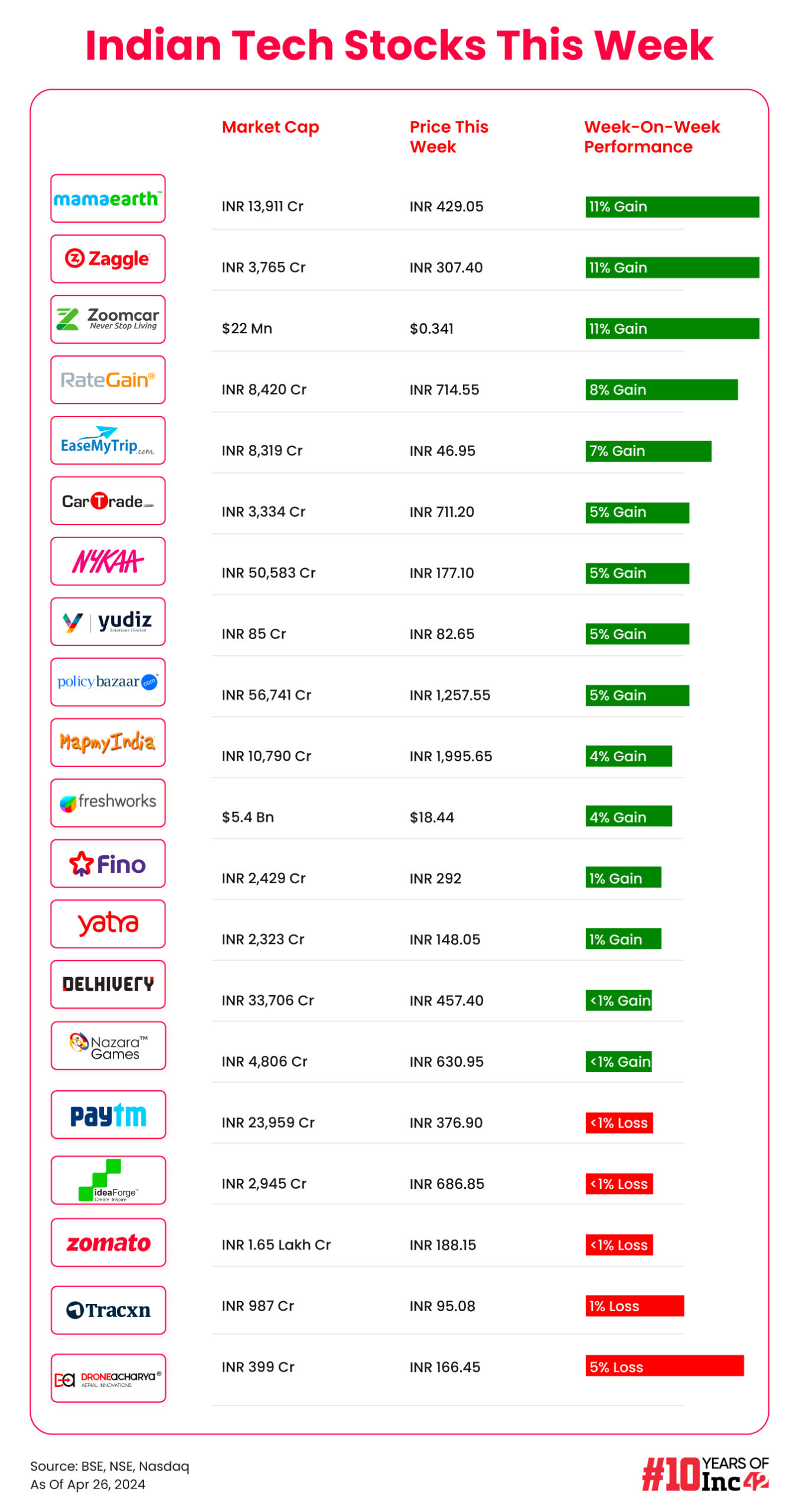

Mixed Signals For Paytm: Indian mutual funds increased their shareholding in Paytm during the March quarter despite selloffs by foreign institutional investors. Does this signal an imminent rally for the fintech giant?

Ad-lite browsing experience

Ad-lite browsing experience