The platform will allow Indian creators to place their digital assets on auction over the blockchain-based marketplace and earn royalty thereafter

For the uninitiated, NFTs are irreplaceable and immutable unique digital items, such as a piece of digital artwork, virtual accessories, or even real-world items such as collector’s cards that have been transferred onto a blockchain network

Unlike cryptocurrencies, which can be exchanged with one another, each NFT is unique and hence cannot be exchanged with another item

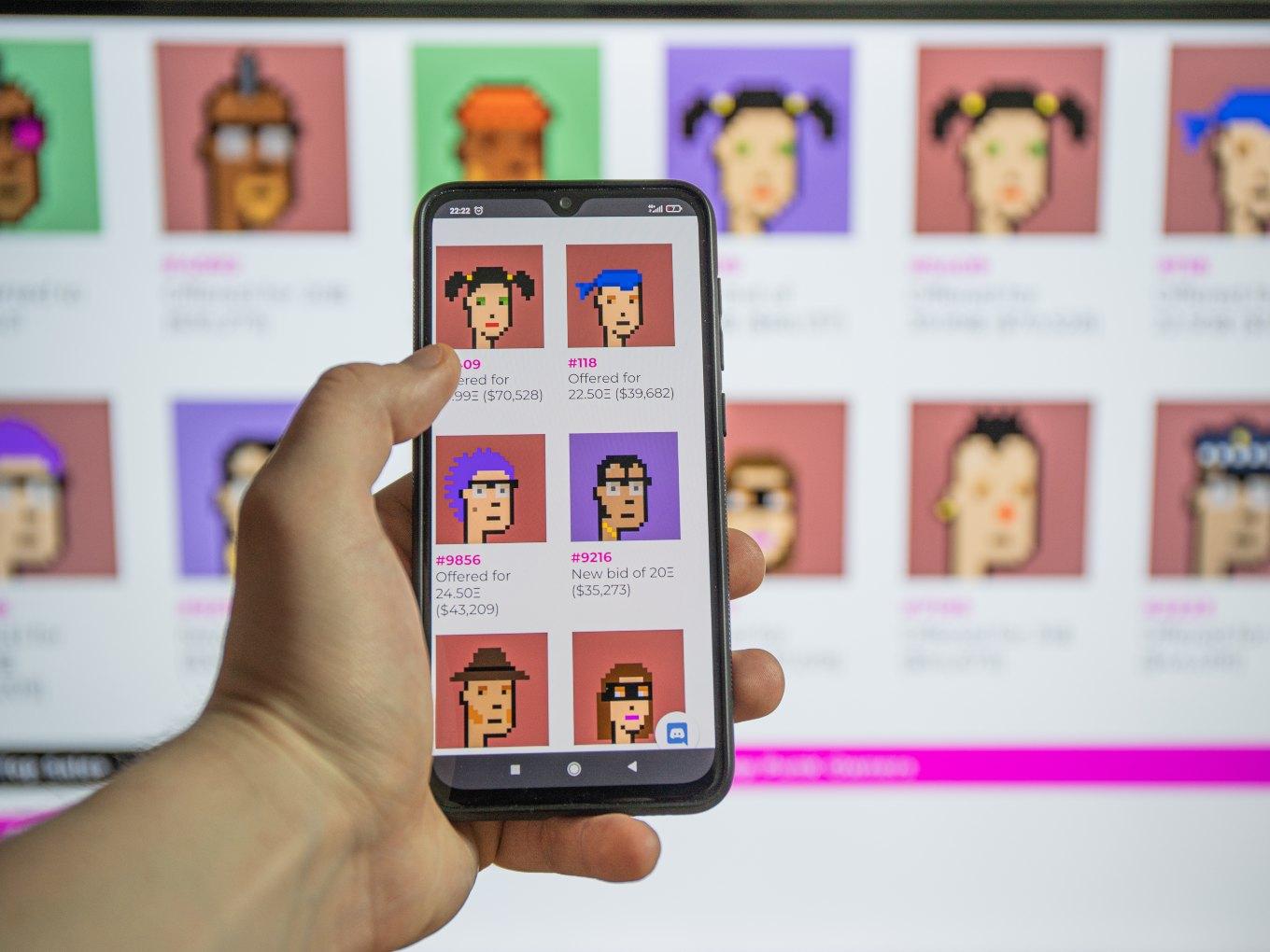

Indian crypto exchange WazirX has joined the non-fungible tokens or NFT-bandwagon, with the launch of an NFT marketplace for Indian artists. The platform would allow the exchange of digital assets and intellectual properties including art pieces, audio files, videos, programs, and even tweets apart from other digital goods and services.

The platform will allow Indian creators to place their digital assets on auction over the blockchain-based marketplace and earn royalty thereafter.

For the uninitiated, NFTs are irreplaceable and immutable unique digital items, such as a piece of digital artwork, virtual accessories to be used in video games, or even real-world items such as collector’s cards that have been transferred onto a blockchain network. Unlike cryptocurrencies, which can be exchanged with one another, each NFT is unique and hence cannot be exchanged with another item. Moreover, while cryptocurrencies such as Bitcoin can be broken down into smaller units such as Satoshi i.e. 100-millionth of a bitcoin, NFTs cannot be broken down in the same way but exist as a whole.

An example of an NFT trade was when Twitter founder Jack Dorsey sold his first tweet for $2.9 Mn in an NFT-based transaction. The advantage of trading digital artwork using NFTs on a blockchain network is that it guards against frauds.

Once a digital asset is converted into an NFT, the blockchain network will lend it unique characteristics, ensuring against nefarious actors creating counterfeit assets. The record of each NFT transaction will be stored on the distributed ledger technology called blockchain, ensuring that the creator’s legal ownership over a digital asset remains intact, and doesn’t undergo devaluation.

The creator can then choose to sell his ownership of the digital asset to other people on an NFT marketplace. He will receive an amount in cryptocurrencies for the sale and could choose to continue receiving royalties on the use of the digital asset.

NFTs also offer interoperability of unique digital assets. So, a property bought on Decentraland, a virtual world and a digital house bought on opensea.io, an NFT marketplace, can be merged together, in such a way that that the digital house can now be put up on your property in Decentraland.

According to a market report, the NFT market grew by 299% in 2020 as it clocked more than $250 Mn as the total value of transactions. This figure includes all sales and transactions including ‘breeding’, ‘minting’, and ‘renting’ of NFTs. With a strong momentum generated, NFTs are expected to grow even more robustly in 2021, especially as it enters the popular lexicon.

“This will truly transform the market in our rapidly digitizing world with a growing interest in NFT across the globe. Both digital creators and collectors stand to benefit from the WazirX NFT marketplace. As of now, we are working around certain nitty-gritty to make NFTs more lucrative for our customers,” said Nischal Shetty, founder and CEO at WazirX

In India, the NFT market is still very nascent. Further, the lack of regulatory clarity around cryptocurrencies could mar their future in the country. This is because NFTs can only be bought or sold using cryptocurrencies, most often Ethereum.

However, the existence of NFTs in itself shouldn’t be a cause of concern for the government from a regulatory standpoint. This is because they use blockchain technology to verify ownership and transactions of assets, a technology that various state governments in India have also proposed to use for securing land and education records. Moreover, considering that NFTs are ‘assets’ and stand no chance to form a counter to fiat currency, as feared with bitcoin or other cryptocurrencies, it is possible that even a law that bans crypto in India could have an exception for NFTs, which are bought and sold using Ethereum wallets, most often on peer-to-peer exchanges.

Ad-lite browsing experience

Ad-lite browsing experience