Jio could be headed for a possible public listing in 2025, either via an initial public offering (IPO) or spin-off, believes Jefferies

The brokerage said that it is more likely for RIL to spin off Jio and domestic and foreign investors seem to favour this route

Assuming Jio is spun off from RIL's stable, Jefferies' fair value for RIL would be INR 3,580, but in case of an IPO, RIL's fair value would fall to INR 3,365 in the base case scenario

Reliance Industries’ (RIL) telecom business Reliance Jio Infocomm Ltd could be headed for a possible public listing in 2025, either via an initial public offering (IPO) or spin-off, as the conglomerate major did with Jio Financial Services (JFS), said global brokerage Jefferies.

The brokerage said in a recent research report on RIL that as Jio leads the way in the recent tariff hikes, unlike its past business strategy, while also keeping feature phone tariffs unchanged, it shows the company’s focus on monetisation and subscriber market share gains.

These moves create a case for a possible public listing of the company in 2025, as per Jefferies.

Jio could list at a $112 Bn valuation, adding around 7-15% upside to RIL stock, said the brokerage.

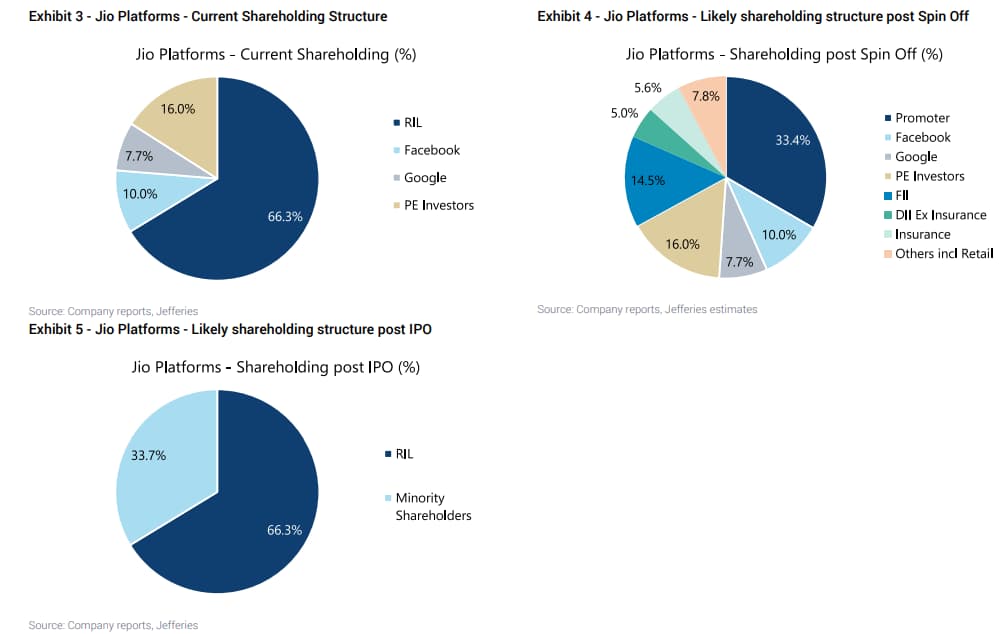

“The decision to spin off or IPO Jio hinges on balancing the upside potential of full value unlocking in the spin-off with the lower controlling stake,” said the Jefferies analysts.

“With 33.7% minority shareholding in Jio, RIL could fulfill IPO (requirements) by listing 10% of Jio. Since Jio is past its peak capex phase, the entire IPO could be an offer for sale by minorities. However, 35% of an IPO is reserved for the retail segment that would require large mobilisation from retail investors. While RIL would retain majority control after the listing, our analysis suggests the Indian stock market imputes a holdco (holding company) discount of 20-50% to a listed subsidiary in arriving at a holdco’s fair value,” the analysts said.

On the other hand, with the vertical spin-off route, there would be no holding company discount but a lower stake for the owner. Jefferies believes that it is more likely for RIL to spin off Jio.

The brokerage also said that both domestic and foreign investors seem to favour the spin-off route for Jio’s potential listing.

With that, the brokerage maintained its ‘buy’ rating on RIL and a price target of INR 3,580, which implies an over 12% upside to the stock’s last close on the BSE.

Jefferies also said that assuming Jio is spun off from RIL’s stable, its fair value for RIL would be INR 3,580. Whereas, if Jio goes the IPO way, RIL’s fair value would fall to INR 3,365 in the base case scenario given the 20% holding company discount.

It is pertinent to note that after a demerger from RIL last year, JFS started trading on the Indian bourses in August 2023. Since then the company has penetrated across verticals in digital payments, insurance, asset management, and other such segments, becoming a key competitor to fintech startups in India.

Meanwhile, Jio has evolved to become a digital giant. It goes without saying that Jio, Reliance Retail and JFS have become key competitors to the major startups and tech companies in the country.

An investor told Inc42 last year how Jio gave Reliance the “pipeline through which it can feed all these services in the future.”

Jio posted a 12% year-on-year (YoY) increase in its consolidated net profit to INR 5,583 Cr in the March quarter of FY24. Its operating revenue increased 13.4% YoY to INR 28,871 Cr in the quarter.

Ad-lite browsing experience

Ad-lite browsing experience