On a recent trip to Gujarat, I made a checklist of the electronic items to carry. Mobile. Check. Charger. Check. MP3 player. Check. Power bank. Check. Unfortunately, I did not add an Apple USB cable with which to charge the iPod and, as a result, had to shell out INR 350 to a local ‘mobile repair’ outlet for an unbranded version of the same. The cheaper one worked out to INR 150 and was reportedly not compatible with a laptop’s USB port.

This pain point – of reliable, quality accessories for mobile devices – is one that plagues the average Indian on a daily basis. It certainly did Komal Agarwal.

“I was always running out of battery on my phone, it needed charging multiple times a day. And, of course, I had a nasty habit of not carrying the charger everywhere with me,” she begins with a chuckle. “Power banks, inevitably, were the need of the hour.”

This was as far back as 2013 – when smartphone penetration in the country was just catching fire and Flipkart had just been crowned a unicorn. Komal, armed with an MBA degree in Marketing from IIM Calcutta, did not want to enter the established family business of making power inverters. “I wanted to start something of my own. And when I did a little digging around in the arena of power banks and mobile accessories, I discovered that much of the existing Indian market consists of unbranded items – it was mostly ‘use and throw,’ came without any QA checks, was unreliable and had no clear brand as a frontrunner.”

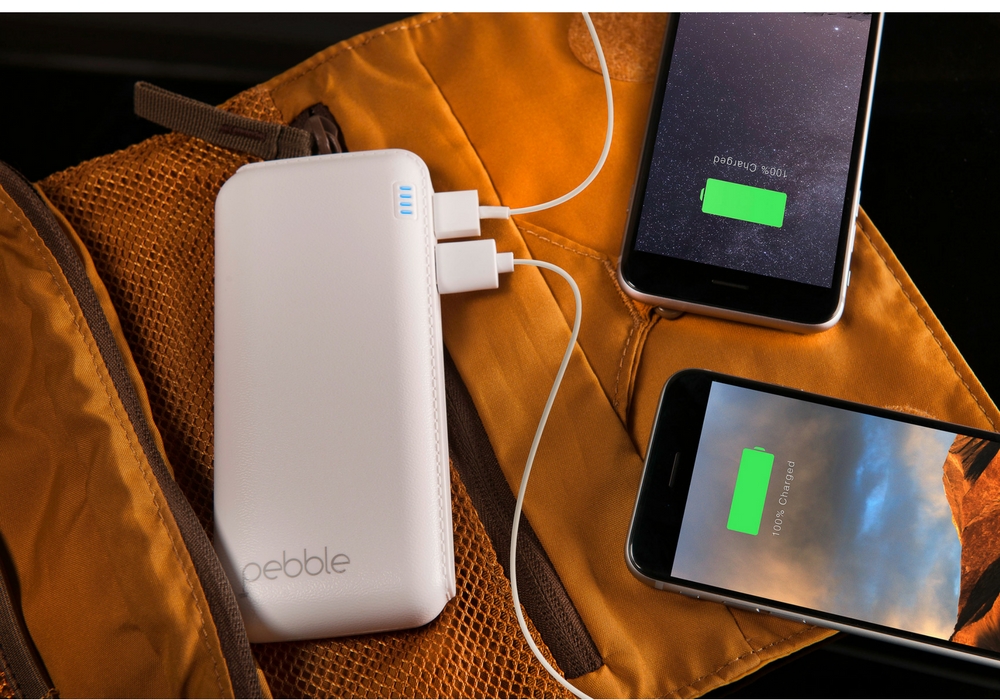

She put her personal pain (and that of countless friends) to good use and approached her father with the idea of launching a new vertical – one that would cater to the needs of the newly minted Indian mobile phone user – Pebble.

“I Wanted A Happy, Friendly Name”

As she puts it, when she came up with the idea and did her due diligence she discovered that there were no Indian brands in the power bank segment. “In fact, when we asked around, no one even knew what the term meant, although Sony had introduced a model, recently back then,” she said.

Her education and marketing background stood her in good stead as she narrowed down on the aspects of the power bank. Existing problems in the product included bulkiness (the more the wattage, the heavier the bank), portability, as well as a pleasing aesthetic. And the most crucial one, “Without quality testing and verifiability, these products were not verifiable – a 10,000 mAH bank would often not have the required capacity.”

“A mobile is something that all of us carry now. After conducting a more formal research into the issues regarding power banks, we narrowed down our focus to these three problems – aesthetics, bulkiness and in-built USB cables,” she says, of the experience.

Komal then leveraged her father’s expertise in the manufacturing domain – the parent company, SRK Powertech Pvt. Ltd had a manufacturing team in China’s Shenzhen and Foshan provinces for UPS converters. All the product development and design were carried out with the help of these experts before the company and its first range of power banks was launched in 2013.

The manufacturing process is explained by Komal as: “Our technical team in China develops and designs the products based on the requirements sent from the marketing team in India. These products are then manufactured in selected contract manufacturing facilities as per specs given by the tech team. Once the products are manufactured, they go through QC by the factory as well as our in-house tech team and necessary certifications are acquired like BIS, CE, etc. The final products are then packaged and sealed and shipped to India.”

Coming from a marketing made her aware of the importance of branding – all-consuming in order to appeal to the average Indian millennial. “We wanted the name of the brand to stand for something happy, friendly, and easily recalled. I was sure I did not want a ‘techy’ name.”

In Komal’s rationale, a pebble stands for small, portable, and something that can weather the elements – qualities that were innately associated with the products that the vertical was looking to launch. “Even back then, I was sure we weren’t just a power bank company.”

And so it was, that Pebble came to market with a range of affordable, portable, aesthetically-pleasing power banks with capacities ranging from as low as 2,600 mAH to 10,000 mAH in the price range of INR 600-INR 4,000 – based out of Noida with a 6-7 member team.

“Old School Partners Had Difficulties Dealing With A Woman”

Any entrepreneur worth their salt knows the challenges of starting up – raising funding, establishing product-market fit, the issues are numerous. Add in the fact, that you’re a woman and the issues start to take on a different dimension.

“I’ll be honest and say that on the product front, we never faced any major challenges while launching. Firstly, the range of products that we launched at the outset and at the price point that we did, allowed us to cater to a wider range of customers,” says Komal. “We were also able to leverage the contacts and connections of the parent brand in order to establish facetime with regional distributors and networks too.”

But there was a flip side to this particular advantage – dealing with the channel partners in North India, which was the first region in which Pebble stepped in. A lot of the regional channel partners were from the old school of thought.

“They were experienced and knew the business inside out, but they had an idea: ‘Oh, she is a young woman with a fancy degree. Can we really talk business with her?’ They were a bit patriarchal and needed to be brought around to seeing me as a businesswoman first, and a woman second,” she adds.

Komal had an advantage when it came to dealing with this thorny issue of diversity and representation in business – having received paid up capital and unsecured loans from her father Ajay Agarwal to the tune of 80%, while the remaining 20% has working capital from banks – she had enough money. “We hired older salespersons who could talk their language and deal with these partners,” she reveals.

Omnichannel Retailing Is The Go-to Model

Pebble operates on a B2B model and is available across channels such as – mom and pop stores, online platforms, and retail chains. The SKUs are sold on a per unit basis, after being rigorously quality tested with an ISO 9001 stamp. The products get manufactured in China via subcontractors and are warehoused in Delhi, from where they are shipped to the various channels.

“We discovered early on that with the advent of smartphones, power banks were a huge market. The only market we wanted for the first two years.” In fact, according to Komal, in 2014 – the product had penetrated into 12 states across India and the sales team had to expand to keep up with increasing demand. As disclosed by Komal, the company generated a turnover of INR 3 Cr in FY 2013-2014.

The B2B model also underwent a bit of an expansion in 2014, with Pebble capturing a fairly new and not-thought-of vertical, which has since turned into their biggest market, in terms of revenue.

“Travellers regularly forget their mobile chargers and power banks when they come to the airport and look for one desperately. It is such a basic need and a constant one, at that. At the heart of it, power banks are essentially a travel-related product,” she says.

It is to this end that the company then decided to tie up with AVA, the shopping arm of Jet Airways India which had outlets in 33 airports. As per Komal, the power banks turned into a bestseller with 10,000 SKUs being sold in a month through the inflight catalogue in 2014, itself.

One of the main ways Pebble sought to distinguish itself from the herd was by making the product authentic. “Existing players were pretty smart – they mentioned 10,000 mAH capacity on the packaging when the battery provided only 4,000 mAH charge – the real capacity was way lesser than was paid for.”

These products allowed Pebble to establish product-market fit by the end of 2014. One of the key reasons Komal attributes to this occurrence is the retailers, wholesalers, and contractors, the B2B sellers had also started to trust the brand and move the SKUs, on a regular basis. An initial challenge that needed to be overcome.

A standardised customer care service with standard replacement guarantees, pickup-and-drop arrangement also contributed to the brand gaining favour with the audience. When asked about the sustainability of carrying out such an extensive exercise for a product that costs less than $25 (INR 2,000) she says, “The reason why this programme is feasible is because our rate of complaint was 1% and, we have tried to maintain the same.”

Diversifying Into Higher End Accessories

Pebble is an Indian power bank – a concept that, after a little bit of digging online, I discovered is strange and unusual, because of the complete lack of known Indian brands in the mobile accessories arena. The company’s decision to only focus on its core strength – power banks – proved a sound one with the four channels providing PMF as well as establishing the brand as trustworthy. In fact, according to her, the Sleek power banks in the 2,600 mAH-10,000 mAH are still one of the bestselling products for the company.

From there, it was an easy leap to expand the product line and diversify into other categories such as Bluetooth speakers, headphones, USB cables, fitness bands, mobile chargers, selfie sticks, OTG (on-the-go) pendrives and chargers (which are mainly for iPhones and reportedly another bestseller) and, last but not least, even affordable VR headsets.

With Google Cardboard, HTC Vive, Samsung Headgear, and the Snap! Glasses already making significant inroads globally on the virtual reality headset front, and Pebble is eager to establish a homegrown brand for the same.

“Pebble Matrix Headsets convert your smartphone into a real 3D theatre with a special inbuilt 43mm long focal length military quality lens that can be adjusted for pupil-distance and sight-distance. Unlike Samsung Head Gear, and are compatible with all mobile phones (Android and iOs) that are in the size range 3.5 inches – 6 inches,” says Komal.

The idea is to simply load a 3D movie or game onto the phone, slip on the headset and experience 360-degree viewing. The headset is also comfortable to use for longer periods with adjustable straps of PU leather and memory foam.

“When we entered into an all-new product play, we never realised another channel of revenue and distribution would open up for us – corporate gifting,” shares Komal. In 2015, once the new lines were launched and accepted enthusiastically by channel partners and consumers alike, Pebble stepped up its game and ventured into corporate gifting – by tying up with close to 500 corporate gifting companies. “In fact, we are the preferred vendors for 200 of these companies. And we have Mahindra, Hindustan Unilever, AVG and major pharma companies on our client roster,” she adds.

Komal attests to the fact that at any given point, a minimum of 2,000 of their SKUs are available for shipping everywhere ensuring bulk quantity availability, a core requirement when it comes to corporate gifting.

Levelling The Playing Field With Global Competitors

In the core product – power banks – companies such as Mi, CNY, Lenovo, Amgrain, Portronics who can be counted as competitors. “But the difference is that these guys were selling online, and only online. And their price points were a bit high on the higher-end power banks. When we maintained lower price points and provided quality products, it was easy to capture more of the online market share.”

When it comes to dissecting the revenue share generated by each of the markets, Komal discloses that 30% of the share comes from general trade and modern trade (including travel retail) and from corporate gifting each.

Online accounts for the remaining 10%.In the other product categories such as speakers and headphones, established players such as Sony, Phillips, SkullCandy, JBL etc. are dominating the online-offline space. “We do not really consider them our direct competition because again, it all comes back to price,” says Komal.

“Our target audience is a user who can afford only up to INR 1,000 for a pair of high-quality headphones, or even less than that, who wants to make an impulsive purchase. The price range we play in is between INR 1000-INR 3000, something the bigger brands cannot afford to do, at the moment.”

Komal reveals that when it comes to percentage of revenue shares: power banks and audio speakers account for 50% and 30% of the share, respectively, while the rest of the product lineup make up the remaining 20%.

When it comes to USB chargers and cables, the issue becomes thornier. “Most of this market is gray, due to unbranded products making their way into the hands of consumers, whether online or offline. 90% of this market is unbranded. And people buy the first thing they see online, as they know nothing comes with quality or safety assurances.” She does confirm that these accessories sell everywhere, in the smallest retail shops in the regions that Pebble is active in.

Perhaps, this is why, the company is now looking to penetrate deeper into niche markets in the accessories lineup – with innovations in OTG, even wireless accessories, sorting out battery issues/storage issues in smartphones. One of its cooler plays in the coming year is providing camera lens for smartphones as an attachment feature. It is also looking beyond India to expand to Southeast Asia as well as the Middle East in FY 2018-19, along with expecting a yearly turnover of $3.62 Mn (INR 24 Cr).

But, with more than 15 states yet to be captured in India and a billion people to serve, the 40-member strong Pebble’s skip across the stream is yet to make it to shore.

Editor’s Note

The current market size of the Indian mobile accessories market is around INR 8,000 Cr. According to an Allied Market study, the global market for mobile phone accessories is expected to garner $107.3 Bn by 2022. But the problem that exists in India is the gray market – where 80% of the accessories come from unbranded vendors, sources. It is this basic problem that Pebble, as a brand, is looking to problem solve for.

While the market might be huge, and Pebble might find success in the new business channels it is entering in, established players exist in each of its product lineups – be it speakers, headphones or VR headsets. These players have cash reserves, global distribution networks, as well as brand loyalty from having existed for decades. How Pebble will be able to attract customers beyond certain strata is the next challenge for the company, as well as achieving scale in the regions it hopes to expand in.