[Note: This article is part of The Junction Series. We will be covering the FinTech sector in detail at The Junction 2017 in Jaipur. Learn more about The Junction here!]

In the mid-2000s, Internet penetration had just begun in the lower sections of society and mobile adoption was increasing. But, when it came to payments or any kind of financial transactions, there was cash and only cash. “In 2005-2006, 97% was cash and only 3% was digital,” begins Naveen Surya, the co-founder of payments platform ItzCash. “This was largely because credit cards were the only option to pay, while debit cards were not in the picture at all,” he adds.

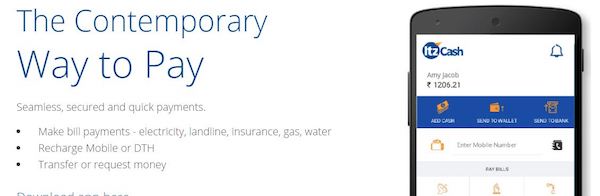

In such a scenario, taking the step towards an entirely cashless form of payment was bold and risky. But that is exactly what the founders of Mumbai-based payments solution firm ItzCash did in 2005. “Ours is a generation of convergence – back in 2004/2005 we started experiencing digital convergence – as commerce was going digital, our money was still in a physical form and hence the drive towards ‘Payments Convergence’ with ItzCash,” says Bhavik Vasa, Chief Growth Officer at ItzCash, who joined the firm in 2011.

And this risk seems to have paid off with the company being backed by marquee investors such as Matrix Partners, Lightspeed Venture Partners and Intel Capital. Essel Group holds the largest share in the firm. To date, all four have poured in around $51 Mn in the company. To show even more faith, Ashok Goel, a serial entrepreneur and Vice Chairman and Managing Director of Essel group company – Essel Propack, is currently the Chairman at ItzCash.

The cleverness of the move is also evident 10 years later, in the ItzCash team of 450+, which is consistently growing at a CAGR of 60% for the last 3 years on all business metrics of volumes, revenues and margins. It also claims to be the largest non-bank PPI (pre-paid payment instrument) in the country to have crossed the $2 Bn mark on a card-base of 110 Mn.

This is their journey – intrepid and interesting.

“We Were Always About Cashless”

ItzCash is an unusual moniker and especially for a digital payments solution. Naveen says, “In a country where Physical Cash is king we have needed a digital alternative as seamless, trusted and convenient – hence India’s Digital Cash, ItzCash.”

He continues,

“It’s only today that everyone talks about being digital and cashless, but back then we were the only ones making this noise. With cash all around and credit card available only to a handful, we realised that it was a clear opportunity to create some sort of tool, or some sort of equipment where a consumer with physical cash can do digital transaction. And we can also give him the same convenience that a credit card holder will get.”

Bhavik elaborates on their journey so far. “If we break up the entire 10-year-journey from 2005 to 2016, then the first five years are really laying the foundation, where we created the infrastructure, and these last five years, we enabled ourselves to accelerate that growth and momentum that we created.”

This growth is seen through the solutions the company provides for the four verticals — consumers, corporate, government, and campus. Along with the oldest ItzCash card launched in 2005, the company provides several pre-paid cards such as temporary payroll card, transport and petro card, salary cards, and corporate disbursements among others. These prepaid cards can be used at any offline or online touch point where third-party payments are accepted. The company also has partnerships with Visa, RuPay, and MasterCard and banks such as HDFC, IDBI and DCB.

The number of retail touch points also known as ItzCash World outlets are reportedly 75,000+. With the average ticket size of transactions ranging between INR 1,200 to INR 1,500; of its 110 Mn base, about 35 Mn are “very active.” But since November 8, 2016, after the demonitisation drive by the Modi government, the number escalated to 45 Mn, as claimed by the company in an official statement.

As Bhavik further explains, fundamentally, the very core part of their DNA lies in creating a “PHYGital network.” This is the internal word that the ItzCash team uses, which means, they only play by a physical reach and digital capability.

“Even today, $2 Tn retail payments is done through physical cash and all electronic transactions account only 10%, so, we have still only started with digital. And we believe, you need a phygital way, so there should be physical reach because I still need a touch point to collect from you the physical cash and then give it to you in the digital form – either as a top up in your card or in your wallet.”

Real Competition Has Always Been Physical Cash

ItzCash was a first mover in many ways – embracing digital and cashless, automating the process and believing in the vision enough to stick to it. Being this first mover gives one added advantages but it comes with its share of challenges too. According to Naveen, fundamentally, there still lies a huge gap between cash and every digital product that exists in the country. As he says,

“Cash was the king and it remains a king. Even today, if you move in a large mall in Delhi and place INR 49,000 on counter to buy an iPhone, nobody will usually ask you anything and you will get the phone. Try doing the same thing with debit/credit card or an e-wallet, they will want a photocopy of your card, your id proof, etc.. So, if you see these are very small small differences but fundamentally we have always been saying that our real competition has always been physical cash.”

Secondly, there was no regulatory framework for this kind of product. “The Payments and Settlements Systems Act came somewhere around 2011, and at that time we were the only entity who are the largest business in this category. We had to actually work very closely with regulators, with the government, to explain to them exactly what we do, what kind of risks exist in the market,” he states.

He further adds, “So, we set up an industry association, the Payment Council of India, where the ecosystem was initially cricket players, merchant aggregators and today, the ecosystem within the association involves players from the online payments industry. We had to create a bridge between the industry and the government and the policy makers, as a secondary challenge.”

The third challenge was awareness. “Since we were the only player, we had to do our bit in pioneering efforts, right from DTH to utility to train ticket to other services including even donations. We were playing our part to make people comfortable with the whole concept,” says Naveen.

According to Naveen, the gap between physical cash and digital still persists and there still lies a long way to create a comfortable state with digit currency experience.

“The landscape has changed. But just the market has grown with more options being available in the form of products such as e-wallets, debit/ credit cards, prepaid cards, net-banking and more. This is good for consumer and industry, however, there are issues such as interoperability which still exist.”

Naveen explains this as – suppose you have an e-wallet now, then you can pay to the merchant via that wallet company only and not via other means. “That’s why we have introduced open loop Visa, MasterCard, and Rupay card so that you, as a customer, are not locked down to a limited number of services. You can use them digitally, physically and, if required, can get access back to your money via ATM withdrawals. So, we are making efforts to respond to the changing ecosystem and to create continue scale in the business while curating the business model with different things at different times.”

Many Digital Payment Options – None That Cater To Middle And Last Sections Of India

The digital payment ecosystem in India has evolved to a stage where we have not one but many options to perform cashless transactions. This include credit/debit cards, e-wallets such as Paytm, MobiKwik, Oxigen, etc., Unified Payment Interface (UPI), IMPS, USSD, RTGS, and NEFT.

When asked how ItzCash plans to strategise its movements in this apparently crowded sector, Bhavik replies, “We think that more and more players are only going to help us make this change happen quickly. The pie is very large for anyone to make that change happen overnight. But, what we see in the digital landscape, is that a lot of the players who are coming in recent times, are only standing on top of the pyramid of India, which is just the top 5%.”

Bhavik further states that this 5% includes people who already have digital means – a bank account, access to cards, etc., and all their money is technically digital only. He further adds,

“If you use your debit card to top up your wallet and then you use that wallet to do online transactions, then that wallet is merely playing the role of a facilitator or a pass-through mechanism. You are not really adding value in the system. But the piece we really want to go after is the middle and last (section) of India. Although, people there have bank accounts, but they don’t use their bank accounts for real transactions. These are traders, shopkeepers, SMEs, who actually earn their money also in physical cash. ItzCash creates a physical reach for those people to pay that physical money and then convert it to digital. That’s where we think we are adding a value to the ecosystem rather than just playing the role of a pass through.”

Naveen further adds here that with ItzCash, it is trying to create a market outside of that 5%, wanting to expand to 10%-20%. “We don’t go to the people like you and me and say that take one more wallet from us, but we actually have large corporate solution schemes. We work closely with corporates such as Amway, Dish TV, Flipkart, BookMyShow, IRCTC (Indian Railways), Satin MicroFinance and more. We know that large corporates need to disburse gifts, need to disburse cash as well – and there we come in with the solution and an instrument to cater to their needs which is either payroll, or gift or incentive. So we reach out to consumers like you and me who have a genuine use case of corporate services and we reach out to the larger mass of India through our retail outlets,” he adds.

“We Will Be The First Company To Be Fully Profitable This Year In Retail Payments”

This financial year ItzCash is eyeing business transactions worth $2.1 Bn (INR 15,000 Cr). With demonetisation in play, the company has also introduced a new range of cards with a wide variety of use cases.

For instance, when tourists coming to India faced trouble in getting their native currency exchanged, the company dispersed prepaid cards through two forex companies at the international airports in Mumbai, Goa and Delhi. It expects to see about $14.6 Mn ( INR 100 Cr) in terms of digital disbursement to these prepaid cards alone, for foreign tourists by the end of December 2016.

ItzCash also recently signed up with small and large-sized companies to offer pre-loaded salary cards for their employees. The company claims to have witnessed a sharp 3x jump in demand for its prepaid cards in the first three weeks of the launch itself, especially from small- and mid-sized employers across the industry. To date, the company claims to have signed up more than 100 large and small size companies to offer pre-loaded salary cards for their employees.

ItzCash also recently signed up with small and large-sized companies to offer pre-loaded salary cards for their employees. The company claims to have witnessed a sharp 3x jump in demand for its prepaid cards in the first three weeks of the launch itself, especially from small- and mid-sized employers across the industry. To date, the company claims to have signed up more than 100 large and small size companies to offer pre-loaded salary cards for their employees.

As Naveen says,

“We are the only player that not only has an omnichannel approach, but a multi-form factor and multi-product portfolio because we believe every customer’s wants are different and different ways are needed to satisfy them. Probably, we would be the first company who will be fully profitable this year in the retail payments business. We were one of the earliest startups in the country. We also went through a Series A and Series B, in 2007, when very few deals used to happen and only selected players get identified. Having gone through that journey, we also believe that we need to be turning the corner and have to be fully profitable, not only to grow as a large player but also to prove that we have cracked the model.”

“Our Core Strength Lies In Collaboration”

The ItzCash team believes that its core strength lies fundamentally in working closely with its partners, be it banks, the NPCI, networks, and even merchants. “We are uncapping this next wave of consumer for digital commerce so we will work and build all of this with different partners. We are accelerating our penetration in India, by which in the next 10 months we will cross about 1 Lakh retail outlets reach in India. We are also working closely with new startups which are coming with more specific use cases, for example, expense management or education in university or campus solution. While they are solving these issues with tech, we have to enable them with the payment platform that we have and that we do better,” says Bhavik.

Next, Naveen believes that the last 10 years were the story of payment convergence, but the next decade will see financial services convergence in India, where consumer will be in the centre.

Investments become the third clear opportunity where with one click on the wallet, a user can invest money into mutual funds for a week. “So what we are seeing is that because we have created this last-mile reach to the consumer, now whether that customer wants to book, travel, stay, invest, or more, now you are slowly seeing that financial services or finserv convergence is evolving, “ says Naveen.

He further adds,

“This is the large opportunity we foresee for the next decade, and that’s next year’s plan for us – to lay the groundwork, so that as the consumer gets ready to consume all of these financial services through one touch point, it will be us.”

Editor’s Note

In 2012, renowned economist and former US Secretary of Labor Robert Reich said, “There will be a time when physical money is just going to cease to exist.” Even before that, in 2007, Guillermo de la Dehesa, a Spanish economist, said ,

“Without cash, we would live in a much safer, less violent world with enhanced social cohesion, since the major incentive fuelling all illegal activity [i.e. cash]… would disappear.”

The recent demonetisation drive by PM Narendra Modi is just an expansion to this concept. As ItzCash revealed more than 28% hike in its active card user base, e-wallets such as Paytm saw over 400% rise in the overall traffic, within a few hours of the announcement. This was also the case with players like MobiKwik, FreeCharge, Oxigen, Ola Money and more.

So, with the digital payment ecosystem finally coming into place, and players like ItzCash, Paytm along with banks and regulatory authorities already playing their part, the status of a ‘Cashless India’ seems to be achievable. The next wave of innovation in payments can be with wearables playing an active part in our daily lives. For instance, as Chris Skinner, author of “The Future of Banking and Digital Bank,” proposed, a payment mechanism built into a watch that person’s bank gave him. As he said,

“The watch includes an RFID or NFC capability, biometric recognition and is supported by existing infrastructures at the merchant front-end and money transmissions process back-end. The retail consumer can therefore go into any store, wave their watch at the contactless terminal, press their finger to the pay point and they have purchased the goods. No card or cash involved.”

Whoa!

A forward-thinking company such as ItzCash can probably envision how this ‘PHYgital’ phenomenon can take place in the near future. And we will be watching right along with it.