SUMMARY

OnePlus India Was Begun In 2014, With Vikas Agarwal Taking On The Mantle Of General Manager

Technology is the new rock ‘n roll hall of fame. Nowhere was this more apparent than at the recent OnePlus India launch of OnePlus 5 – the new flagship smartphone – from a Chinese smartphone maker that began operations just four years back. Since 2013, OnePlus has managed to release six premium smartphones – OnePlus One, OnePlus Two, OnePlus X, OnePlus Three, OnePlus 3T and OnePlus 5 – at non-premium prices.

As one of six co-founders Carl Pei, said in an interview in June 2017, “In the $400-plus space, we are already No. 2. Last year, we were also profitable.”

After capturing 19 countries mostly in established markets such as US, China and Europe, the OnePlus India journey began a year later in December 2014. OnePlus India has had a meteoric and challenging journey, as compared to its European and East Asian counterparts. Yet, the company has managed to ink its name in the annals of history, joining such premium smartphone makers such as Apple and Samsung whose phones retail for almost twice the amount of what you pay for a OnePlus handset.

In fact, according to a Trak.in report, by 2015 OnePlus One had become extremely popular in East Asia, Europe, and North America with the total shipments amounting to 39%, 32%, and 22% respectively of the total sales.

But, let’s retrace our steps a little. Go back to the beginning, where it all started.

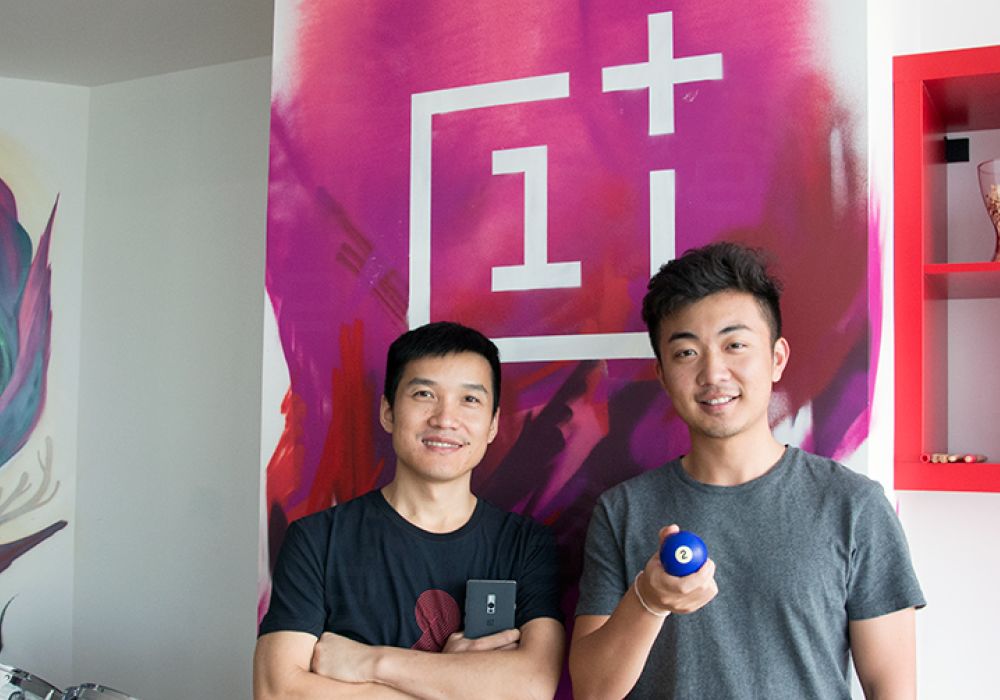

In 2013, the global smartphone market was first beginning to see signs of an explosion – with emerging economies such as India, Indonesia, Malaysia and Thailand aggressively adopting a mobile-first strategy. Two people sitting in a car in traffic – Carl Pei (ex-CEO of smartphone maker OPPO) and Pete Lau – and working on their iPhones were struck by an idea of building a premium smartphone like the iPhone but available at affordable prices.

To this end, the founders first launched a tech-focussed OnePlus forum, to understand what users in their community wanted from a premium phone. In fact, to this day, the user community plays a big part in how OnePlus releases updates. Thus, began the journey of Chinese smartphone brand – OnePlus which was formally launched in December 2013 in Shenzen, China. The company is headquartered in Guangdong and operates in about 35 countries globally including Europe, US, China and India.

“Our value proposition has always been to make OnePlus products future-ready. Our philosophy revolves around giving our users more than what they are looking for. And to do so in a cost-efficient manner, which was why OnePlus will always be an online brand first and foremost,” begins Vikas Agarwal, General Manager at OnePlus India, headquartered in Bengaluru.

“Our value proposition has always been to make OnePlus products future-ready. Our philosophy revolves around giving our users more than what they are looking for. And to do so in a cost-efficient manner, which was why OnePlus will always be an online brand first and foremost,” begins Vikas Agarwal, General Manager at OnePlus India, headquartered in Bengaluru.

One of the core differentiators of OnePlus was the way they launched the first smartphone OnePlus One back in 2013. An an invite-only launch with the phone available exclusively on the OnePlus website, reminiscent of the early days of Facebook and Gmail, for ardent users who had followed the brand. The markets they targeted were Europe, East Asia and the US.

The idea paid off handsomely and OnePlus became an instant viral, global phenomenon. And with premium specs (3GB RAM, 32 GB and 64 GB storage, 13 MP front-facing cameras and 5.5” Corning Glass screens in Sandstone Black and Grey), the company was able to expand sales to 19 countries by April 2014.

The success of the startup stemmed from the fact that it was enthusiastically accepted in Europe – a mature, tech-savvy and operator-driven market. The way Vikas explains it, “These markets which already have established names such as Apple, Samsung dominating with the audience are hard to break in. But the OnePlus team consisted of 19 different nationalities who understood what these markets needed and focussed on core tech users. That helped in us reaching 19 European and US markets combined by April 2014.”

Also, OnePlus had a marketing rule that it had followed in each of these 19 markets. To present a mid-range costing phone ($350 and above) with the specs of a premium handset exclusively on their own website. The idea, as Vikas states, was to have a seamless online to offline experience for their customers. Everything, from marketing, to sales, to after sales was end-to-end handled by OnePlus in each country.

But, all this changed, when it came to India.

Turning Its Gaze Towards India: The Second-most Viable Market After China

Vikas joined the company as OnePlus’ first employee in India in December 2014. He had passed through the IIT+IIM rigmarole and even worked in the PE/investment sector for a while. Entrepreneurship soon took over and he started a hyperlocal startup which folded up in 2013. After a brief stint with the Ibibo Group managing their ecommerce entity, Vikas tried for the OnePlus position that had opened when the company first thought of entering India. This was back in August 2014.

“OnePlus launched formal operations in December 2014 and I have been part of the journey since day one,” he shares with a fond smile.

Data played a crucial role in how OnePlus takes steps forward in terms of geographical expansion, as most of the user information available on social media and the OnePlus community forum is analysed and taken into account. So, one of the analyses showed that a large part of the OnePlus’ website traffic was coming from India by April 2014. “OnePlus had no presence whatsoever in India back then. No promotions were taking place too. Yet, India was ranking in the top seven countries in terms of website traffic.”

Vikas describes the Indian buyer behavior as users using a US-based address, ordering the phone through the invite and jailbreaking it to be used in India. “When we analysed this kind of user behaviour, we refined our core focus to include India.”

Exceptions Made For India: Partnering With Amazon

Trust is a big factor in India, especially when it comes to ecommerce which has only recently seen country-wide acceptance. And it does have to be noted that fellow Chinese smartphone maker Xiaomi, which also entered India at roughly the same time went with homegrown ecommerce website Flipkart as part of its launch strategy.

In 2014, OnePlus as a brand name was unknown to the general population. But the market had been analysed enough that it warranted looking at a differential approach to brand-building. The marketing team at OnePlus remained unconvinced that the website-only selling model would work in a country as diverse as India. Enter Amazon India, which had also started out a year before in June 2013.

“Amazon had global clout and presence, something the homegrown ecommerce sites lacked. Plus, they were starting out in India like us. We looked at the smartphone market in India and all the brands were advertising across platforms – Flipkart, Snapdeal etc. The sites did not appeal on the exclusivity, premium smartphone-front, something OnePlus insists on.”

Due to this combination of a global presence, trust, and reliability factor OnePlus became the first mobile brand to exclusively launch on Amazon India at the time.

Of course, the invite-only strategy was incorporated into the Amazon fold, the first phone was launched on December 2, 2014 and were sold out on Day 1. While Vikas declined to give actual figures, this Trak.in report managed to eke out the sales breakdown. The company sold 850K-950K units all across the world declaring revenues of $300 Mn in 2015.

For India, the company claimed to have shipped 7% of its total phones for 2015. Thus, it can be concluded that about 65,000 OnePlus One handsets were sold in total.

The launch was also successful enough for Indian operations to warrant their own office. So, the global OnePlus team set up an office in Bengaluru considering it as the most important market for them.

Issues Plaguing OnePlus India: Then And Now

At the outset, OnePlus faced a legal controversy when it first entered India. The complainant was Micromax, which claimed that the company was violating exclusivity clauses with Cyanogen Mod OS (the mobile software which OnePlus One runs on). The court order locked sales as well as locked capital, giving the company pause in the initial months of launch.

Eventually, the matter was resolved when the Delhi HC ruled in favour of a non-exclusivity clause and Micromax ended up withdrawing the case in July 2015.

After sales service and customer care was another sore area of operations for OnePlus India. Their global customer care service has been outsourced to a global partner. The idea behind this move was that the smartphone issues do not vary from region to region, in the mature markets. India, however, was another ballgame altogether.

“When we entered India, our original desire was to open a customer care centre in every town in India. But two things stopped us – the quality of these centres could not match global standards. Being a small company, spare parts inventory became a problem,” Vikas is candid enough to admit. The core issue for poor after sales could be traced back to a few factors.

The phone was priced affordably but the customers expected the kind of exclusive service that would be given for a premium smartphone – like say at an Apple retailer outlet. The staff was untrained and the centres were placed in remote locations as part of multi-brand outlets in strip malls. During the OnePlus 5 launch, Vice President Kyle Kiang spoke of CEO Peter Lau’s experience trying to find a OnePlus customer care centre in Delhi and unable to do so. “He had to drive around for hours and ended up in a remote corner of Delhi, somewhere. This was bad for business.”

This forced the company to once again come up with an India-specific solution for customer care. Which included placing company-managed exclusive centres in premium locations in Bengaluru, Delhi, and Mumbai. The other thing they did was tying up with a German and UK-based servicing company that has satellite reach all over India. “We have also internally set a TAT (Turnaround Time) of less than one hour. 90% of customer complaints get resolved within the TAT.”

Switching From Cyanogen to Oxygen OS

Cyanogen was an open source platform that could be customised by Android-facing OEMs. It offered more than stock Android options in terms of design interface and the overall UI/UX experience. According to Vikas, OnePlus was the first OEM to sign a partnership with CyanogenMod founder Steve Kondik. But, after the company faced copyright infringement and breach of contract issues in India, they started building their own OS viz. Oxygen Mod – which was rolled out in community beta in February 2015.

Incidentally, Cyanogen formally shut down operations in December 2016, after co-founder Steve Kondik released a blogpost chronicling the problems facing the open source platform.

With the launch of OnePlus 2 in 2015, Oxygen OS too was rolled out on all phones. As Vikas says, “We focus on solving one core customer problem with all our phones. If OnePlus One was focussed on providing a premium hardware experience, Two was all about the software. Oxygen was stable, robust and feature-ready.”

Competing With A Plethora Of Smartphone Brands, Taking OnePlus India Offline

Let’s face it. The smartphone market in India and the world over is saturated. In fact, it would not be hyperbolic to say that the average smartphone user is spoilt for choice when it comes to buying the perfect handset, both due to the presence of an infinite number of smartphones appealing to different price pockets, but also due to the fact that online websites offer a dearth of choices. There are non-premium brands such as Micromax, Intex, Lava, Spice being manufactured in the country itself, international competition for OnePlus ranges from brands such as Apple, Samsung, Xiaomi, OPPO, Lenovo, Motorola, Gionee to name just a few.

Globally in Q1 2017, Apple and Samsung combined held about 32% of total market share followed by Chinese smartphone brands – Huawei, OPPO, Vivo which claimed 9%, 8.7%, and 6.8% of the market, respectively.

With the notable exception of Apple, which has stuck to its end-to-end premium phone experience at premium prices, the rest of the brands offer a mix of models and features for discerning users. In such an overflowing market, price points is a key differentiator, since, OnePlus offers premium features for a mid-range price. For instance, the OnePlus 3T (INR 27,999), a bestseller on Amazon India came equipped with a unique Dash Charging feature that allows for the fastest, full battery charging in the shortest span of time.

The other specs (6GB RAM, 850 Snapdragon Processor, 16 MP front-facing camera) that OnePlus 3T comes with are being provided by such premium models as the iPhone 6 and iPhone 6s and Samsung Galaxy S7 – both of which retail at upwards of INR 52,000 at the minimum.

Carl Pei defended the OnePlus selling philosophy with, “I think we are so small, that we are not going to be disruptive. It’s only our own mistakes that will lead to our downfall. It’s not what other people are going to do.”

Peter Lau too talked about how the company plans on focussing on exactly one product. And each feature of this one product – camera, smoothness and system and battery has to be the best offered at non-premium prices.

“Other brands make 10 different models a year. But if you create 10 different models, how can you be focussed on creating the best possible product every year? When I go to sleep, I only think of my one next product. It’s difficult for others to compete with that.”

Making The Jump To An Omnichannel Retailing Experience

But, like every other online brand OnePlus has now entered the offline vertical too – trying to offer an omnichannel experience and capture a larger chunk of the 500 Mn smartphone user market that India has become. OnePlus’ retail strategy is like every other online ecommerce brand. Gain critical mass by increasing user stickiness, brand loyalty and then parlay that into building a considerably different offline retail experience.

The site of its first offline or ‘in-store experience’ is Bengaluru – where the company launched a store in centrally-located Brigade Road. “It took us more than a year to lock the space, the concept of the flagship store down. Bengaluru was our chosen ground because it is our biggest market. It’s the undisputed tech capital market and has our biggest community in terms of sales.”

The flagship store opened in August 2016 and claims to be more than a store that displays the OnePlus phones and accessories. It aims to offer an experience to the user, bring additional value add to the tech community. For instance, the entire first floor has a 50-60 seating capacity and is a potential venue for TedX Talks.

As all retail stores are all about the sales, what numbers does the OnePlus store declare? While Vikas is reluctant to reveal any actual numbers, he does disclose that, from a Bengaluru perspective they ‘have been able to recover costs on a monthly basis. And that the sales volume is easily 5x-10x compared to an average smaller mobile store.’

Which brings us to the stiffer competition that OnePlus faces. Yes, the brand has a considerable presence on Amazon India but in the offline world, OnePlus jostles for user attention and floor space with multi-brands, more established chains such as Mobile World, The Mobile Store as well as any number of smaller, non-branded smartphone retailers. How does it plan on staying ahead of the curve and entice the Indian consumer here? To which Vikas says categorically,

“The OnePlus store was not conceptualised from a sales perspective. We are looking to increase our coverage and brand awareness. Complement the online-first strategy, which consolidates all regions under the Amazon India umbrella.”

Perhaps, it is for this reason that they have also opened a mini ‘experience zone’ at DLF Mall in Saket, Delhi. “We want to answer questions such as what questions are our visitors are asking. How many people are visiting and what reason do they have to do so?”

2017, The OnePlus 5 Launch, And Making India The Core Focus

OnePlus 5 was recently launched on June 22, 2017 in Mumbai with much fanfare. The company has even picked Amitabh Bachchan to be the brand ambassador in order to emphasise the trust/authenticity and storytelling factors.

While the new phone retails at INR 32,000 for the 64GB handset and again boasts of features that can apparently best the Apple iPhone 7, the model has come under considerable flak from acknowledged tech geeks, namely for the zero innovation in terms of camera, the overinflated use of RAM space 6 and 8 GB RAM for the 64GB and 128GB handsets respectively.

I was curious enough to ask about why the company launched the OnePlus 5 instead of the OnePlus 4, the obvious numbering choice and Vikas chuckles. “We, as a company, are a superstitious lot. So no, 4. We had the 3T and went onto 5.”

In a recent interaction with Business Today, Peter Lau the new CEO of Business Today said that when he spoke internally to the OnePlus global team, they said that 5 is the number they liked and they will use that, the same as with OnePlus 3T. “Also, a lot of Chinese coustomers don’t like ‘4’ because it has the same pronunciation in Chinese as death.”

While the phone has its share of detractors, it does enjoy unprecedented popularity. As demonstrated by Arun Shrinivasan, Head Of Category Management at Amazon India at the time of launch. He stated that the website had logged 1 Mn Notify Me emails as of 2 pm, on the day of the launch, in anticipation of when the phone would go on sale. For the uninitiated, Notify Me emails on Amazon are ways for people to keep abreast of unavailable or coming soon products. The OnePlus 5 currently holds the #1 rank in Amazon India’s Electronics category and #2 in Electronics, Mobiles and Tablets, Smartphones sub-categories.

2017 Is India-Focussed

That OnePlus is serious about India is believed by the fact that the latest flagship model has been launched in India along with the other global markets – namely China and Europe. “2017 is India-focussed,” Vikas emphasises. “Finally, the discomfort of shopping online has been replaced with buyer-readiness. People are trusting in us, so we’re doubling down on our efforts here.”

A key stat that Vikas shares is that in terms of adoption, 90% of European markets can afford the device (retailing at around $492 for the 64GB OnePlus 5). In India, this number is 19%. And yet, the sales match with each other – given that Apple does not enjoy as much popularity in India and Samsung has been dethroned by Xiaomi, OnePlus and similar brands.

So, how do they plan on taking OnePlus to the discerning Indian smartphone user?

“We are an urban brand, selling online. So we are first going to focus on the big cities until saturation is achieved.” He mentions Delhi, (largest city in India and the capital), Bengaluru, Mumbai as the markets that the company plans on capturing in 2017 through online pushes as well as providing an after service experience that matches sales performance. For offline, the mini experience zones is the strategy the company aims to employ.

The OnePlus Core Vision: Breaking Down ‘Never Settle’

The company boasts of a total of 1500 employees based out of China and India. But, in comparison to other mobile manufacturing behemoths such as Apple, Samsung, Xiaomi, OPPO, Google’s Motorola the company is small. Both in terms of employees as well as the practices the OnePlus team has adopted. The lean and agile startup mindset still prevails in the company majorly when it comes to major decisions.

“In the hardware business, inventory is the most major challenge for us. It takes up a chunk of the capex (capital expenditure). It’s always balancing between too much and too little – demand and supply. We adopted a new seller strategy, that of exclusivity, to rationalise demand.”

Vikas decodes this cryptic statement: for one, the invite-only programme was email-based.

Plus, there was a two-day expiration date on the email invite so they could not be hoarded for months together. And lastly, the company relied extensively on the OnePlus community and word-of-mouth to generate awareness. They still follow the practice of publishing a weekly update on Saturday in the OnePlus community forum in order to maintain proximity with the users, while keeping a pulse on what the users wanted.

All the above factors, that of having limited invites which would expire in a limited time while being proactive with interested users, basically led to analysing user behaviour (number of invites equal to handsets produced). Manufacturing supply could begin to keep up with demand, because of the limited-time factor. Demand started getting subsidised while supply could catch up with demand.

In fact, as Peter Lau claims, they still take about four weeks to ship to Europe even in 2017.

A basic lean startup strategy continues to be employed at this startup. And, while Vikas claims that the invite-only strategy was more from a manufacturing standpoint, there was no denying the coolness bar was raised a notch higher when the programme was first launched. Of course, as brand awareness reached peak levels in 2015 and the launch of OnePlus 3, this invite-only programme has been permanently discontinued.

But, considering that OnePlus plans on taking on Apple and Samsung at the premium smartphone game, both of whom still hold strong in 2017 garnering 13.7% and 20.7% globally, it does seem like they have their work cut out for them – in terms of increasing adoption in India through providing better after-sales service, widening the ‘OnePlus India Never Settle’ experience to include offline retail and continuing to understand what their community wants. For two friends who sat down and decided to make a cheaper iPhone, the world certainly seems to be theirs for the taking – one smartphone at a time.