SUMMARY

Boasting 250% Year-On-Year Growth Rate, Amagi Media Now Looks To Explore Geo Targeting On OTT Platform

“Selling your company to the media is a necessary part of selling it to everyone else.” This statement made by Peter Thiel in his book Zero to One aptly describes the ongoing fad behind the glamorous advertisement screens of businesses. From print to television, and from digital to personalisation, we have come a long way in luring customers via marketing tactics of varied kinds. While marketers today seem to be having a run towards digital adtech, there is one venture, still capitalising on traditional TV advertising mode, at the same time, harnessing the power of new age techs such as geo targeting, machine learning and deep learning, which isThe Amagi Media Labs.

For millennials, Amagi Media Labs is the pioneer of geo targeting based TV advertising in the country. The Bengaluru-based media technology company has also been touted by media as India’s largest TV ad network.

Let’s have a look at a few stats of the company:

- Working with 23 geo-targeting channels from the stable of Zee Group, Viacom 18, Sun Group, TV 18, Times, NDTV and Discovery.

- A network of 4,000+ small and big brands who have used its geo-targeted solutions till date.

- Enabling large TV networks like AMC Networks, FLIK TV, B4U, VIACOM 18, D-sports, Turner, Scribbs network, Zee, NDTV and around 100+ channels to launch, operate, and monetise channels anywhere in the world.

- Deployments in over 40+ countries.

- $45.2 Mn raised in funding and backed by investors such as Emerald Media, Mayfield Fund, Nadathur Holdings, Ojas Venture Partners, and PremjiInvest.

- A team of 260 employees, R&D centre in Bengaluru and Sales offices in Delhi, Mumbai, Chandigarh, Kolkata, etc., along with global offices in London, New York and Hong Kong.

Since the launch in 2008, the founding trio – Baskar Subramanian, K A Srinivasan and Srividhya Srinivasan, classmates in college and colleagues at Texas Instruments – are known for the numerous awards and accolades for the innovations they have brought to the industry. For the trio, this is their second venture together, the first being a wireless audio technology company, Impulsesoft, acquired by Sify Technologies in 2006.

Post Amagi Media’s launch, there have been a few companies which launched similar products in India. This included Rediff’s Vubites and Star India’s Adsharp. While Vubites has already stopped operations, Amagi Media claims its technology to be way superior from Adsharp, which is powered by Cisco Technologies.

We also came across another venture, Gaian Solutions based out of India, Singapore and the US, offering almost a similar product stack as Amagi Media. However, we found that the company is majorly involved in government projects and has a plethora of other solutions linked to building impactful content experiences in sectors such as banks, hotels, education and more.

However, Amagi Media is one player that is solely leveraging geo targeting technologies in TV advertising to increase a brand’s reach to its target audience. This reflects in the company financials too.

As shared by Baskar, the company is growing at an aggregated growth rate of 250% year on year. “We are already in a bracket of $15.63 Mn (INR 100 Cr) revenues and we further aim to grow about 2x this year.”

A Glimpse Into The Amagi Media Empire: The Vision, Product Stack And More

Baskar believes, that India is very “regional’ in its competition even when it comes to large advertisers. Today, every brand in every market faces competition from local brands. Even leading global brands like Unilever, Glaxos and P&G need to win regional turf wars and not just one big national war. Every product has heterogeneity in terms of market demand.

Also, for a majority of the brands, a significant percentage of revenue comes from the Tier II and Tier III cities. These include cities where internet penetration is quite low and online marketing will not get the desired results. Again, TV is the only medium to reach the masses here.

It is this very need of enabling the brands to closely target their potential consumer base, that Amagi Media’s vision stands on.

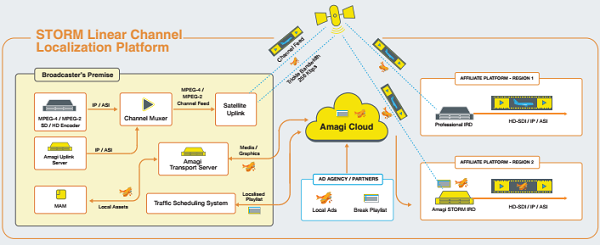

Amagi Media, through its offerings, enables large TV networks and channels to launch, operate, and monetise channels anywhere in the world. This is backed by Amagi’s cloud-broadcast technology, geo targeting system, and patents as well as series of products such as Amagi Mix, STORM, ThunderSTORM and more, thereby working closely with even SME’s and OTT players.

The company also recently partnered with BARC (Broadcast Audience Research Council ) in October 2016, to monitor geo targeting based TV advertising and help advertisers evaluate their national geo targeting based ad-campaigns on BARC India’s software. The team is also working on exploring machine learning and deep learning capabilities, and will soon be announcing some major additions in its product stack in next few months.

Sowing The Seeds Of Amagi Media Labs: Hassles Of Concept Ideation

Richard Branson once said, “Nobody has a monopoly on good ideas, and you can never tell exactly when you will come up with them.” A similar thing happened with the Amagi Media founders.

After wrapping up their first venture, the trio was searching for another idea to experiment and was looking at multitudes of plans in different business models, different markets and growing trends.

As Baskar reminisced, “This was in 2007. One Monday morning, around 11 AM, we were sitting in a park in Bengaluru and were discussing what innovation could we do in television or media. Suddenly, a young boy approached us and asked to show our hands to him and claimed to tell our future. It struck to us that this young boy clearly knows, two people sitting in a park on a Monday morning are jobless, and it’s his chance to earn. So he knows it clearly how to target his customers exactly. And we struck gold then and there only.”

This was the time when TV advertising was considered as the domain only for brands with a big budget for media advertising. For any advertiser to showcase its ad on television, a national tv advertising spot had to be bought. As per data available, in 2007, for a 10 sec national spot, an advertiser needs to pay around INR 3,50,000, which is quite expensive to afford by the small brands or brands with only regional presence. Even today, a 30 seconds national advertising spot on an average cost INR 1 Mn for most Indian shows.

To this Baskar added,

“We realise, that similar to the astrologer boy, TV advertisers also require a targeted advertising. It’s absolutely irrelevant to market your product nationally if you are selling only in New Delhi. From an outsider perspective, we saw media as an exciting opportunity. Clearly, being from a technology background we would wanted to look at how technology can be leveraged to disrupt the media ecosystem, and create more value for the whole ecosystem.”

Dousing The Idea Seeds With Experience: The Tech Twists Added To Traditional TV Advertising

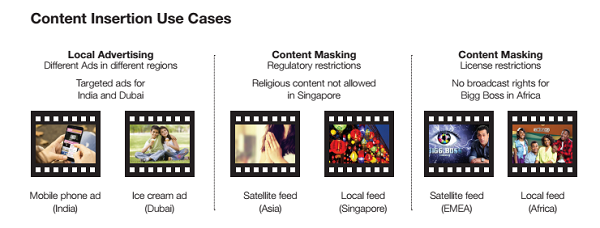

The idea Amagi Media Labs rooted for was simple. It buys commercial time on TV channels such as ZEE, IBN 7, etc., and sells these ad spots to advertisers on the regional/ hyperlocal basis. In this manner, one ad spot, which traditionally gets occupied by one national ad, can then become available for multiple advertisers parallelly, reducing the cost for advertisers and increasing per spot price for the TV channel.

For instance, at present, Amagi Media’s pan-India market is divided into 20 divisions. These markets can be a specific city-like Mumbai, Delhi, Bengaluru, a state like Maharashtra, Madhya Pradesh, Uttar Pradesh or a region like North East, Punjab/Haryana/Chandigarh among others. Hence, a single ad spot can be sold to 20 different advertisers for each channel.

This implies that, during a daily soap advertisement break, a person sitting in Mumbai can might be possibly watching a different commercial, and a person in the same time zone in Delhi, can be watching another commercial.

Also, if a national ad spot costs suppose, INR 100, then using Amagi Media’s technology, the same spot can be sold 20 times for different pricing in different regions. For example, INR 20 in Delhi, INR 30 in Punjab and so on. Thus, on average, a TV channel gets more than what it can get by selling it only to a national spot.

As Baskar added,

“Let’s say there is a 30 second ad spot. Traditionally on it the same ad was going nationally, but now for every region a different ad is broadcasted for the same 30 sec spot. So, this means that both of you are watching same content but during the ad break, you are seeing different adds. Thus, while a TV channel is earning more for the same ad spot, an advertiser is paying only for its targeted users and not the entire nation. This created a win-win situation for both the TV channels as well as advertisers.”

So, What’s The Tech Behind This?

Typically, TV channels go off the satellites and then comes down to different multiple cable tv boxes or DTH servers. At these locations are kept the smart boxes, which has the capability to store data as well as identify the spot where the location specific ad has to replace the national one.

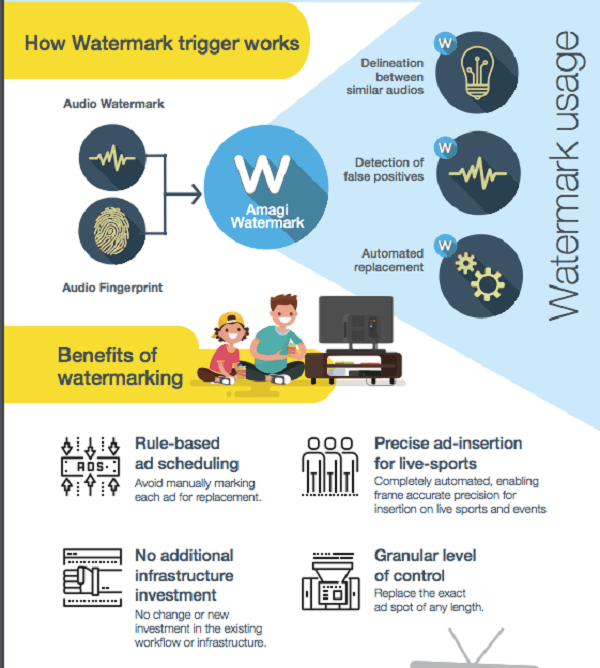

The trigger for the geo targeting based TV advertising comes from a unique watermark inserted on the video/audio signal. The watermark is a kind of invisible and inaudible identifier like a product barcode which, on being scanned by the smartbox, gives the cue to run a local/regional ad and bypass the national ad to where it’s required.

As mentioned on Amagi Media’s web page, “Amagi’s solution can be customised to support the duration and frequency of all ad-replacement needs. Amagi’s solution is based on a patented content trigger (The Amagi Watermark) and STORM, an enhanced satellite receiver that descramblers and decodes the channel in addition to inserting local ad seconds.”

Let’s Consider Some Use Cases.

Amagi Media has worked with a number of brands to date and helped them reach their target audiences. The first use case Baskar shared was of Santoor – whose main TG is South market. Apart from regional channels, to increase their share of voice to the share of market, they use Amagi channels also effectively, like Zee TV or Zee Cinema.

Another example would be Horlicks whose main markets are east and south or Dove, which is an urban Tier I brand. Through Amagi’s geo-targeted solution, they can advertise on mainstream channels at city/state specific levels.

“Furthermore, Amagi Media has been assisting a lot of SMEs with Amagi mix to come on TV as well since it is now possible to advertise on national TVs at a fraction of national cost due to geo-targeting. With Amagi’s new e-portal Amagi Mix, we are making quality media planning, buying and data analytics accessible to SMEs across the nation which was not there earlier,” added Baskar.

Selling The Concept Of Geo targeting In TV Advertising: The Initial Struggle To Establish Amagi Media Brand

Well, as the experienced ones say, building geo targeting technology is one thing, doing business with it is an altogether different experience. Amagi Media founders were no exceptions here. The first few challenges for the co-founders were to prepare a business plan, search for an office space, and then most importantly convince marketers and advertisers of the benefit their geo targeting technology can bring on board.

So, they sat down at coffee shops and in around a month’s time, finally came up with a good business plan. The trio then ended up at Nadathur S Raghavan Centre for Entrepreneurial Learning (NSRCEL) of Indian Institute of Management Bengaluru and started with Amagi Media Labs.

As Baskar said,

“At that time TV and advertising was already a huge INR 15,000 Cr market, that we were trying to disrupt, that too with a technology and a business model that people have not heard of. So, we keep on conjuring answers to questions such as why would people will hear us, why would advertisers will adopt this technology, how should we go and pitch, etc. We were complete outsiders to the industry. So the challenges were high enough for us.”

Thus, in order to make their pitch strong, they spent time with advertisers and various channels both in India and abroad to identify their key issues.

“By 2009, we got an understanding that the existing TV advertising business is a very complex set of the ecosystem, and we were just three people in a room trying to tap out an idea which proves very very far fetched. However, fast forward to today, we are India’s largest geo targeted advertising centre. It was 2010 when we started the business, and in the last 10 years we have created a new market and evolved it,” he added.

Baskar further believes that, globally, the decision-making process is much faster than in India. There has been seen resistance to change in the Indian market, to adopt new technology in the domain of TV advertising.

“This is something more cultural and we are hoping this will change with time. At present, the major challenge is posed by our existing infrastructure and that has to evolve with time. Also, the readiness index to experiment and adapt to new technologies is very low in India, which ultimately makes the entire structure, the biggest challenge to survive in,” he added.

In Conclusion

Since humans started trading, advertisements in different forms have been used to gain attention and establish a clear positioning in the end consumer’s mind. However different the venture is, be it online or offline; startup or an established brand, reaching target audiences is the most tedious task every business is brainstorming for.

While India is leapfrogging to be a digital nation by 2020, it is expected that digital ad spending In India will be on the rise. However, the current stats present an entirely different scenario.

A June 2017 report by Magna projected that even in the next five years, television will still be the largest media in 2021 with a market share of 39%. Leaving behind offline media at 9.7% and digital at 25.5% growth. While living in a digital era, the word ‘still’ naturally drives one to the immense potential this sector has to offer. And, this is the growth that adtech firms like Amagi Media are capitalising on.

The report further adds that, “Television advertising is expected to grow at over 10.3%, with Free to Air (FTA) channels gaining significance, localised content and high-definition (HD) experience boosting regional channels’ viewership.” Another report by Exchange4media suggested that among the various traditional media advertising, spends on television stand at maximum 41% with INR 22,872 cr.

This is another opportunity for the advertising firms engaged in building the primary infrastructure for geo targeting ads to regional audiences. With products like Amagi Mix, Amagi Cloud and Amagi Measure, Amagi Media is currently leading the pack. The analysts further believe that in near future geo targeting can be evolved to an extent that a broadcaster can insert regional daily shows and movies, just like advertisements, during the national playout of the content.

However, one cannot deny the fact that digital advertising is pacing up rapidly with TV advertising and other solutions. Digital adtech has been touted to register a 28% growth rate, and digital ad spends have been predicted to reach the INR 10, 227 Cr mark in the next five years by Magna. Within digital, mobile is driving spends with a growth rate of 65.7%.

Amagi Media has started exploring options such as Thunderstorm, connecting it with OTT platforms. But with each and every market getting crowded with more and more players, the entry barriers are quite low even for companies working with patent technologies. So, how possibly Amagi Media be able to maintain its growth, will unfold with time. For now, Amagi Media is on its way to becoming the mogul of Indian TV advertising industry, harnessing the power of geo targeting.