SUMMARY

Kahneman and Tversky's Prospect Theory When Applied To Products Identifies The Link Between Human Nature And Product Failure

One of the many things that used to baffle me was people’s behavior that’s evidently harmful to themselves. Take the case of Pune (a city in India where I live). It has simultaneously the lowest rate of helmet adoption and the highest number of two-wheeler casualties. How do you explain that?

Obviously, my confusion was a cognitive bias that impacts many people. It’s the mind projection fallacy: how I think is how other people must also be thinking. It’s an understandable bias as we know no other mind better than ourselves. We have direct access to our thoughts, but for other, we can only guess why they’re behaving a certain way.

My mistake was that I assumed that if I understand the tradeoff between the cost of wearing a helmet and benefits of avoiding a potential accident (conditioned on how frequently I use a two-wheeler * probability of an accident each time I use it), I’d be foolish not to wear a helmet.

It’s easy to judge people and call them irrational. If it’s done for warm, fuzzy boosts to ego in an idle chat, that’s ok. But it gets frustrating when your personal or professional depends on it.

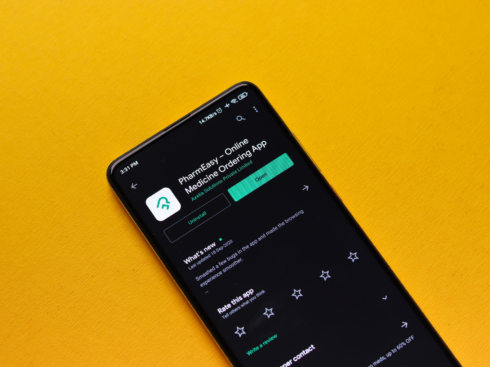

Say, if you are a parent and your children refuse to take obvious precautions. Or take, for example, a common frustration of new entrepreneurs while selling a product. New entrepreneurs during a pitch (either on a sales call or on the product / landing page) usually end up explaining all the benefits that are obviously beneficial to the prospect, and yet when the customer shows hesitation or doesn’t end up buying, the automatic response that leaps to the entrepreneur’s mind is: “why don’t he get it”. I know this first hand as my first product (Wingify platform) was built over 8-9 months during which I added one feature after another to make it into a very comprehensive marketing platform.

Here’s how it looked.

My first SaaS Attempt (2009)

In my head, it had everything that a marketer would need: analytics, testing, and personalization. And yet when it was launched on Hacker News, feedback (below) wasn’t encouraging.

“Unfortunately, it took me 14 page views and 1738 seconds to find the product tour on the page. In general, I found the organization of the different product descriptions to be confusing.”

“I looked at this and completely failed to “get it”.

Then I read the summary here and it sounds like a grab bag of stuff to both analyse and deploy content to sections of your site’s audience.”

Wooah, jargon overload – you’ve managed to put pretty much every technical term on one page and I think that could be a problem to your audience

If you have experience with designing products, the problem with the screenshot will be obvious to you. I’m using this example to highlight a core principle of human behavior that comes up in multiple situations and it explains both why people jump red lights and why good products fail.

Risk Aversion In A Gamble, Risk Seeking On The Road

The difference between what researchers say people’s behavior should be (anybody who jumps a red light is making a wrong choice) and what actual behavior is (if the police isn’t around, people do jump red lights) comes because of the description-experience gap. Many psychological experiments are conducted by giving explicit choices to people with clear probabilities, and they know they’re in an experiment. But in real life, people rarely have access to such probabilities directly. Rather as they continue living, they sample their experiences and estimate probabilities for different situations by themselves. Research studying people’s actual behavior shows that while experiencing situations, we significantly under-estimate (or completely ignore) very small or very large probabilities. We estimate very small probabilities as never-gonna-happen, and very large probabilities that it-is-certain-to-happen.

Research cited in this paper confirms this intuition.

Using Israeli data, Bar-Ilan (2000) calculated that the expected gain from jumping one red traffic is, at most, one minute (the length of a typical light cycle). Given the known probabilities they find that: if a slight injury causes a loss greater or equal to 0.9 days, a risk neutral person will be deterred by that risk alone. However, the corresponding numbers for the additional risks of serious and fatal injuries are 13.9 days and 69.4 days respectively.

From this data, they derive the conclusion: “Thus, red traffic light running is simply caused by some individuals ignoring (or seriously underweighting) the very low probability of an accident.”

The obvious question is why does this happen?

To explain this risk-seeking behavior in red light jumping, it’s helpful to understand when we’re risk-averse.

We’re risk averse in situations that don’t repeat often. In such one-off cases, as we can’t rely on estimating the odds ourselves from our experience, we take a safer approach and become significantly loss averse (as a mistake in a situation that doesn’t repeat could potentially be fatal). That’s how our brain has evolved: when you see a new pattern for the first time in the savannah, it’s safer to assume that is a tiger preying on you.

However, if you go on a path every day to fetch water and one day come across a researcher who tells you that there’s 1% chance that there’s a deadly spider in the grass, you are less likely to believe him because every day you’ve been estimating your own probabilities (and so far you haven’t died).

It isn’t that you are ignoring the possibility of a spider, it’s simply that doing the same thing daily has given you an intuitive feeling for probabilities that informs your tradeoffs. We know ourselves best, so we overindex on our experience (spider bites never happen). This is why people don’t wear helmets. They’re overconfident in their driving abilities and every single ride without a helmet increases their confidence.

However, as I wrote above, when something is new and we don’t have experience with it, we become risk averse.

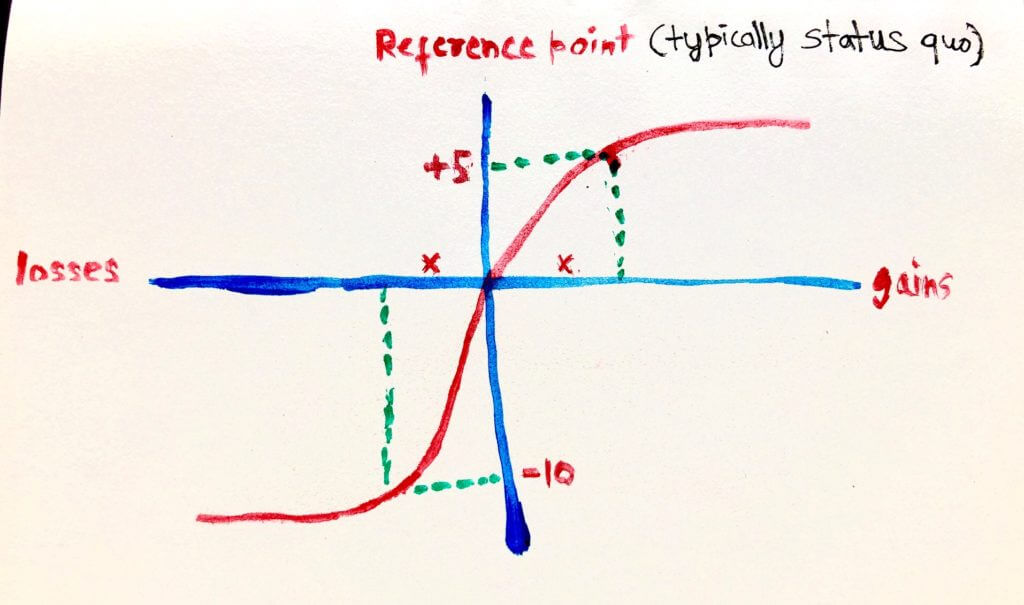

Losses Hurt Us Much More Than Gains Benefit

Risk aversion was one of the major findings of Kahneman and Tversky and they used it to propose Prospect Theory (for which they won The Nobel Prize; it’s the second highest cited paper in economics. If you haven’t read the original, go read it now.). Because we’re risk-averse, when it comes to things that have never happened to us before: like deciding to do a startup, trying a new product, or marrying a person.

In each of the cases, our natural inclination is to be safe (like not quitting the job, not buying that product or not marrying the first person we meet). We take the safer choice unless the benefit * probability of benefit far out-weighs potential loss. Different people have different attitudes towards risk, but Kahneman and Tversky empirically estimated the risk/reward ratio to be 2 (i.e. you value what you have / status quo twice as much as a probable gain).

Prospect Theory Applied To Products

When customers interact with new businesses or products, it’s a new experience for them. Among many others, these three psychological phenomena happen during such interactions: customers mistrusting the promised value by sellers, their impatience towards getting the promised value and during interactions with the product, not getting enough value to counterbalance costs they incur.

The Market of Lemons Problem

There’s typically an information asymmetry between what sellers know about their products and what buyers know. From buyers’ perspective, while engaging in a potential purchase, they never have enough information to know whether what they’re getting is worth the cost (in time, money, effort) that has been asked from them. Even when the seller gives information about the value the buyer will get, buyers suspect because both honest and dishonest sellers say similar things.

So for new products, as buyers can’t tell good products from bad products, they typically end up wanting to pay (in time, money, effort) much less than what the seller demands. In many markets, this drives away good, honest sellers leaving only dishonest sellers (which further aggravates the mistrust). The most famous example of market of lemons is used cars, but some version of this plays in all markets.

Who would you buy lemons from?

In the tech startup world, one of the major reasons newly launched, obviously good products fail is because of mistrust in the market for new tech products. Honest entrepreneurs get penalized in the market for other dishonest entrepreneurs (who overpromise and underdeliver). So, for success, a key objective for an entrepreneur becomes winning the trust of the customer in the market. (This is why brands and social proof matters a lot for new products).

The Description-Experience Gap

Trust is not binary, customers are continuously updating their beliefs what products can do for them. Every time a customer is using a product, she is evaluating the costs (what she’ll lose) against benefits (what she’ll gain). Money is one of the many costs. Others time, effort and reputation.

My mistake with Wingify marketing platform was asking people to invest their time in learning what Wingify platform is capable of, when they’ve juststarted interacting with the product. I was essentially telling them:

“Hey, you don’t know me and have all reasons to suspect that I’m overpromising, but please spend several minutes trying to understand what is going on in the product. Trust me, I know my product will deliver you value many times cost of your time“.

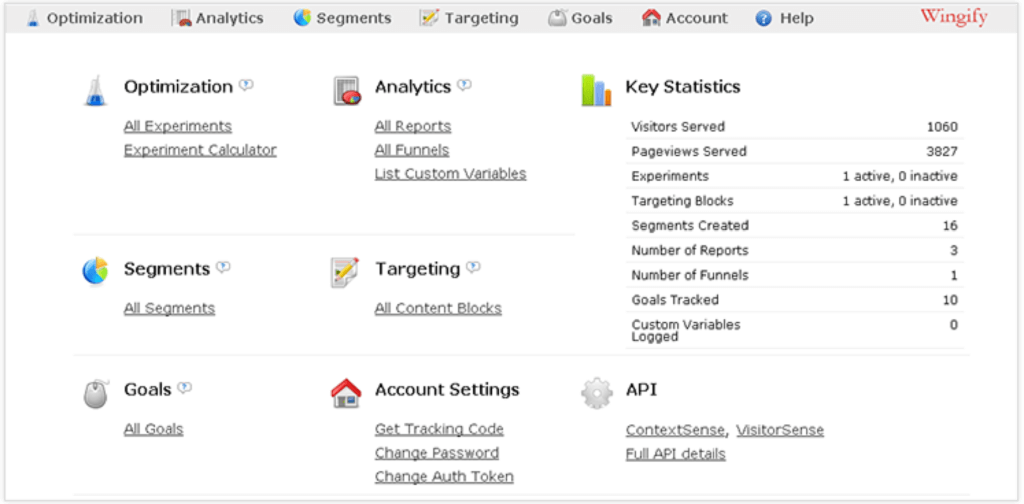

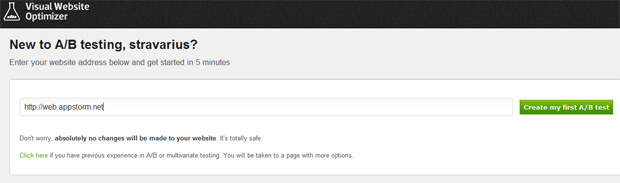

This didn’t fly with people and so for my second product (Visual Website Optimizer), I eliminated everything. In this iteration, all the customer could do was just one thing: enter the URL of her website.

No cognitive investment required from user

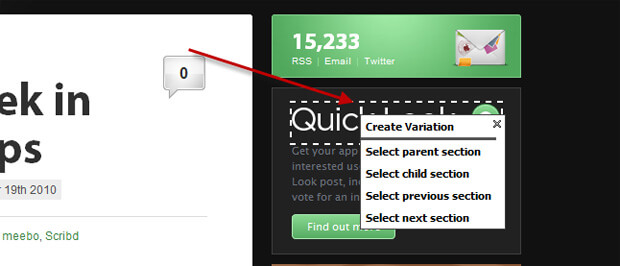

After this step, a visual interface opened up where for the customer the benefits that I had promised (“Visual Website Editor“) became immediately evident.

User made a small investment (enter the URL), product delivered immediate benefit

In the next step, I asked for some more information, then delivered some more value. And so on. For complex B2B products, doing this is hard but it’s worth remembering that:

a) customers are rational in mistrusting upfront as they don’t know about what sellers know;

b) customers consider multiple costs (money, time, effort, cognitive load, reputation) while making the tradeoff of cost vs benefit.

Their expectation of potential benefit continuously changes as they gain more experience with a product or a company (however new products usually fail because customers never got to a point of gaining enough experience to derive full value from those products).

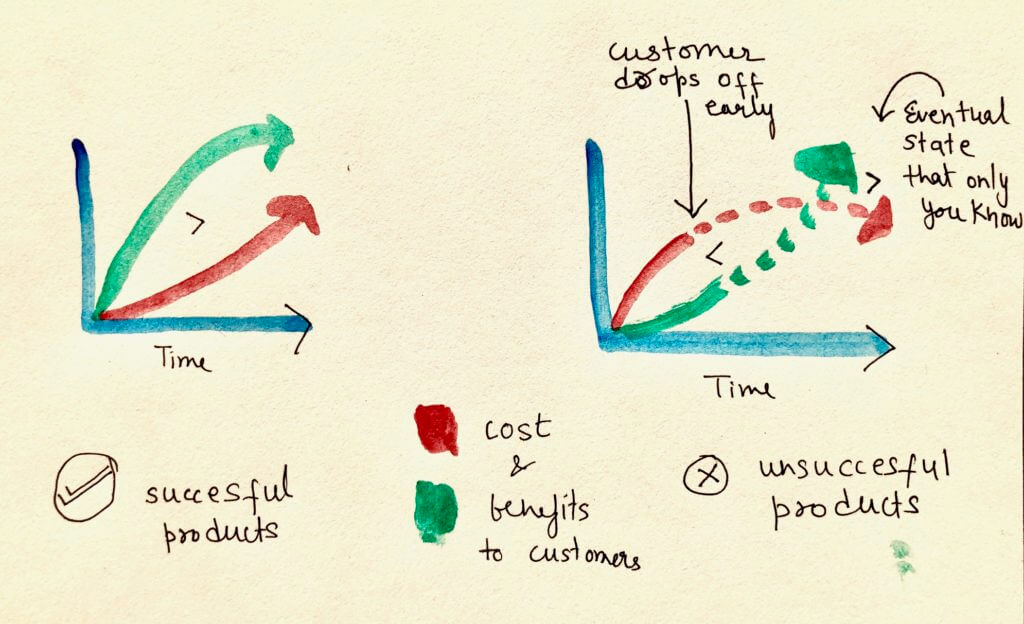

My thesis is that for successful products, the cost vs benefit curve goes something like below.

Good vs bad sales, onboarding, product usage or any other customer experience

Risk Aversion

Because of risk aversion, benefits for customers must be many folds the demanded cost. And using their experience during repeated interactions with the seller, they’re making their own estimates of benefits. At any moment (usually that happens soon enough in journey for new products), when their estimate of costs (that they know for sure – fill a form, talk to sales, $299/mo cost) seems to be higher than the evidence of current and future value, they drop off from the interactions and abandon. (Unless, of course, it’s something they’ve bought and later they discover, it was a lemon. Then they go on social media.)

This is also the reason why startups find their chances with early adopters who are much less risk-averse (and demand less evidence of benefits upfront).

The article was first published on Inverted Passion blog and has been reproduced with permission. Stay tuned for more posts by Paras Chopra.