2015 was a banner year for startup funding with over $2.3 Bn invested across 1000 deals.

Things are much slower in startup land and startups are complaining about how they’re finding it difficult to raise Series A. We lay out below, our analysis on what’s happening and why.

Our first finding is that the Series A crunch is real. According to VC Edge, Angel deals have increased more than 5x from just ~130 in 2011 to over 700 in 2015, following a steady upward trajectory. Whereas, the Series A deals have remained fairly range bound and the peak was probably in 2012/2014 where ~86 companies got funded. Series A is a much more deliberate round and can definitely be considered as a very important milestone for a startup. The seed to Series A conversion for a mature market like the US is 35% (average for the 2009–12 vintage source: Mattermark).

In India, driven by the meteoric rise of seed deals (50% CAGR, 2011–15), the Series A conversion has dropped steadily from 34% in 2011 to 22% in 2014 to just under 10% in 2015. Data suggests that ~ 85% of the Series A rounds are raised within two years of seed funding. This is in line with the general thought process of Seed funding as well, wherein seed investments are expected to give a startup a runway of 12–18 months and a bridge round might help extend it by a few more months (hence, we might not see the conversion for 2015 to be very different from what it is, currently).

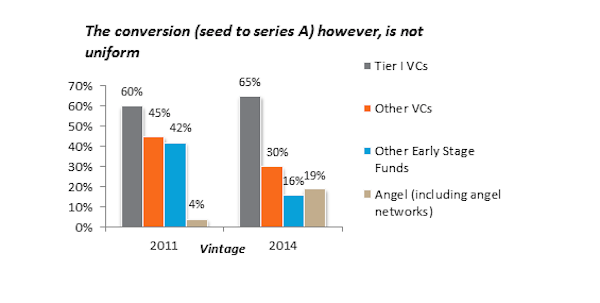

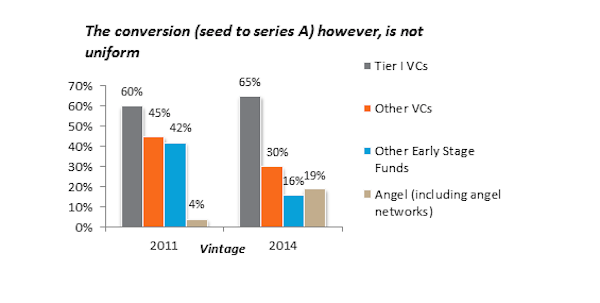

Going a step further, we decided to analyse the portfolio, by the type of seed investment that the startup received. This is where the seed to Series A conversion metrics gets really interesting. Across the years, around 60% of the companies seeded by a top tier VC seem to convert to a Series A. While other fairly large VCs reveal a conversion of 30% to 45%.

(One caveat here is that some of the seed deals by VCs might not be reported publicly and hence the conversion rate could be overstated; it still nevertheless, should be higher than the average).

On the other hand, smaller, early-stage funds witnessed a sharp decline in conversion, from over 40% in 2011 to just over 15% in 2014. One of the primary reasons for this was 2014 & 2015 unprecedented increase in the launch of new early stage funds (over 40).

The funds raised had to be deployed soon enough and, accordingly, institutional seed deals increased from ~80 in 2013 to 120 in 2014 and 180 in 2015. The other reason could be attributed to the general behaviour of Tier I VCs during upturn and downturn.

Seed Investments: Tier I VCs led just 13 deals in 2013 and this went up by 3x to 41 deals in 2015. When investor confidence is high, VCs tend to get in at an earlier stage to enjoy possibly over sized returns.

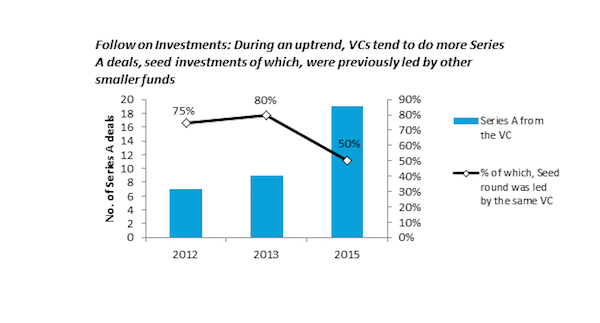

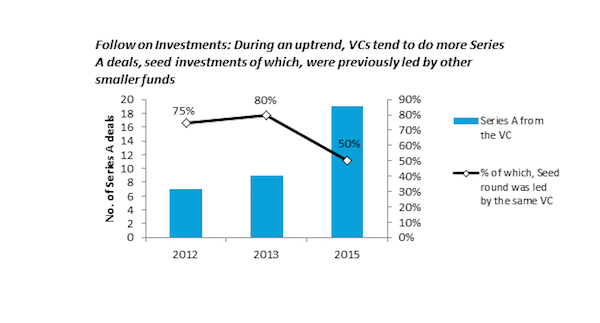

Follow-on Investments: We also looked at the Series A investments across multiple years, for one of the Tier I VC, and went back to see how many of these companies had previously raised seed funding from the same VC.

In a slow year, the VC tends to prefer leading the next round for its own seed deals and in a good year, it tends to lead a lot of deals led by other smaller, early-stage funds as well.

2014 to Q3–2015 saw new early-stage funds, ramping up seed investments, along with Tier I VCs, who had increased their own seed activity. The euphoria subdued and 2016 has been a ‘slow’ year. VCs naturally have led follow-on funding for their own seed deals as compared to that of other early stage funds.

For startups in general, and especially those who have raised funding during a ‘boom’ period, importance of bridge rounds and ensuring amicable relationship with angel investors, cannot be overstated; read more on the number of rounds it takes to Series A here.

On a positive note, Indian startups are now getting early and growth funding from a number of VCs situated out of Japan, US and Singapore – Maverick Capital, Beenext, Gray Matters Capital, Velos Partners, RB Investments, Thrive Capital and Mistletoe are few such players. Most of them do not invest in seed rounds and also, usually look for companies with an existing institutional seed investor based out of India. Increased participation of such players, can lead to an overall better and a more ‘even’ series A conversion…

(Data for the analysis had been taken from VCCircle and Venture Intelligence).

About The Author

[This post by Rohit Krishna, investor at WEH Ventures first appeared on Medium and has been reproduced with permission.]