SUMMARY

Insights into recent rulings of the Income Tax Appellate Tribunal (ITAT) and the potential impact on the dreaded angel tax for Indian Startups

Will you consume the righteous with the wicked?

As the tax filing season in India ends and most heave a collective sigh of relief, the Indian entrepreneur braces for his next challenge: the dreaded “angel tax” notice. This tax has been a cause célèbre for many in the startup ecosystem with its removal being high on the list of everyone’s demands from the Finance Minister before every budget. But the action from the government’s front on this has been to assuage rather than allay the entrepreneur’s fears.

The dreaded section (section 56(2)(viib) of the Income Tax Act, 1961) has been invoked to some success against those flouting the laws and using it to launder money through privately held entities. Indeed, there have been successful prosecutions by the Tax Department in this regard against them. But the rule of law is not to consume the righteous with the wicked. A famous maxim by the noted English jurist William Blackstone attests to this by stating that “It is better that ten guilty persons escape than that one innocent suffer”. While our tax laws borrow this principle, some argue that they’ve inverted the ratio.

The Policy Team at iSPIRT has championed the mitigation of this section (section 56(2)(viib) of the Income Tax Act, 1961) and have made several representations to DIPP, CBDT and the government in this regard. We’ve even spoken about the dreaded Section 68 – which deals with unexplained cash credits and its implications on your fundraise. We’ve had some success in the recent mitigations announced for startups (no angel tax up to INR 10 Cr of funding received, the introduction of an “accredited investor”, etc) but there are still miles to go before entrepreneurs can rest easy.

While the law still remains the same, recent rulings from the Income Tax Appellate Tribunal hearings. We at the Policy Team at iSPIRT have taken it upon ourselves to summarise these proceedings for all the Indian entrepreneurs so that if you’re faced with this dreaded situation, these rulings should be able to come to your aid. For those who enjoy tax proceedings, a helpful link to the judgments is given below each case.

In this article, the term “Assessee” denotes a person who has received a scrutiny notice from the Income Tax Department (CBDT) and Assessing Officer is the relevant tax officer assigned to the case.

Structure of an “Angel Tax” Notice

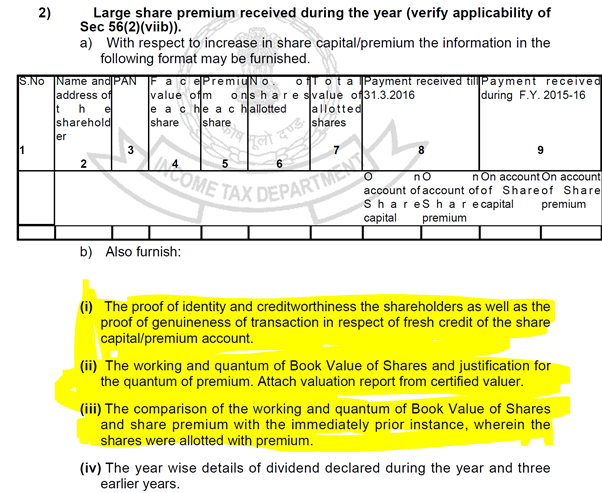

The scrutiny notice under section 142(1) for startups will usually have the following queries in some form or the other. In this regard, the highlighted parts will be dealt with in this article:

Figure 1

Figure 1

The Devil in the Angel Tax: Section 68

Context

The first point above deals with Section 68, a particularly pernicious section. The section deals with any unexplained cash credit in the books of an Assessee being offered to tax if:

- If the Assessee offers no explanation about the source of the credit

Or

- That the explanation offered is not to the satisfaction of the Assessing Officer

This is particularly worrying as the onus of proof depends not on the objective evidence provided but on the ability to satisfy the Assessing Officer as to the veracity of the information.

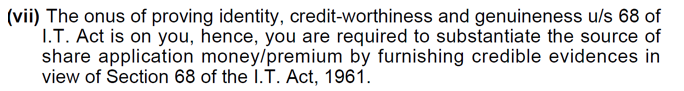

Even the Scrutiny Notices speak about this as shown below:

Figure 2

Figure 2

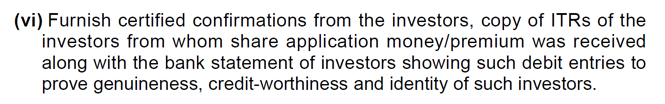

The credible evidence being sought is also illustrated in the notice:

Figure 3

Figure 3

These documents, being sensitive in nature, leads to a point of friction between the investors and startups, especially in early-stage rounds where the amount of capital raised is not high but the sensitivity of the information provided puts many off from angel investing.

A simple query of the PAN numbers of the Investors can be run by the department against their database of returns filed so as to reduce the burden placed upon startups and there would plenty of Indian machine learning and smart analytics startups who would be glad to provide the Income Tax Department with those tools. But until this, succour can be found in the case ruling of “Sunshine Metals & Alloys vs ITO (ITAT Mumbai)”

The Case

In the given case, the Assessee (Sunshine Metals & Alloys India Pvt Ltd) had received INR 35 lakhs from certain entities in regard to the issue of shares by the Assessee. The Assessee had taken this amount through normal banking channels, obtained the PAN of the investors and allotted the share certificates to them as well. Whereas the Assessing Officer had charged the amount so received as income under section 68, in spite of all these documents being produced.

The Summary of the judgement made is as below:

Furnishing of the identity, PAN, share application forms and proof that the shares were allotted to the applicants via normal banking channels with no back-transactions to the investor or their affiliates fulfils the onus of establishing the identity on the assessee’s behalf, with the department having the onus to prove creditworthiness.

Implication

Startups receiving funds from investors through:

- normal banking channels

- under the applicable Company’s Act clauses and

- issuing the share certificates on time

- without any suspect transactions like re-routing the money back to the investors or to their affiliates

Won’t have to suffer from the brunt of section 68 and their burden of proof about the genuineness, capacity and identity of the investors can be discharged as above.

Click here to read the relevant ruling.

Valuation Methods: Assessee’s Choice

Context

Points (ii) and (iii) in Figure 1 above deal with a chronic bane of entrepreneurs when they’ve been dealt with an “angel tax” notice: the justification of the valuation.

The valuation methodologies espoused for section 56(2)(viib) is given under Rule 11UA(2), which gives the Assessee the following 2 methods for valuation as given by a Category I Merchant Banker:

- Net Asset Value (NAV) as stated therein

- Discounted Cash Flow method

However, as always, the devil is in the details. The Act places further conditions on this valuation by making this mathematical process fit the better judgement of the tax officer by placing the burden of conviction upon the Assessee to satisfy the Assessing Officer as to the valuation. It’s hard enough satisfying investors as to a startup’s valuation, but adding tax officers to the mix is a very heady combination for any entrepreneur.

More often than, entrepreneurs have complained about the Assessing Officer dismissing the valuation report by comparing it to their actual financial performance over that time period. Punishing an entrepreneur for failing to meet his numbers by subjecting the delta to tax at 30% is an insuperable burden placed upon any entrepreneur. More details about this process are available here in a previous post.

Choosing the most appropriate valuation method from those given by law, for your startup or business, should be a transaction between two consenting parties alone, without the need to satisfy the tax officer for the same. Yet startups often face this challenge of explaining the same. Thankfully, this issue has been adjudicated upon in the case of “DCIT vs. Ozoneland Agro Pvt. Ltd (ITAT Mumbai)”

The Case

In the given case, the Assessee (Ozoneland Agro Pvt Ltd) had issued shares to an investor for a total premium of Rs 4.99Cr. The Assessing Officer had called into the question the valuation method so chosen on the basis of various factors such as the fact that business had not yet commenced, the assumptions were astronomical, the DCF method adopted was only for a 5 year period, etc.

The Summary of the judgement

Rule 11UA(2) allows the Assessee the right to choose between the two valuation methods provided in the Act and the Assessing Officer does not have the right to insist upon one of the methods being the most appropriate method for the determination of the fair market value of those shares.

Implication

As long as they are applied consistently, the choice of valuation method rests solely with the Assessee and not with the Assessing Officer.

Click here to read the relevant ruling.

Conclusion

The above judgements offer a suitable poultice to any founder beleaguered by an “angel tax” notice. It shows that the courts of appeal offer suitable precedence for any genuine transactions carried out under full compliance with the applicable law shouldn’t fear a notice received and assume the worst. The Government and the Tax Department have adopted positive measures to lessen the burden of compliance with these sections for genuine businesses and these rulings show that the appellate bodies follow the same principle as well.

During our conversations with the Tax Department officials on this, they’ve stated how these laws act as deterrents to those looking for loopholes in their quest to launder money or evade tax. They also stated that the notices are sent out algorithmically, and the high premia charged by most startups due to a low face value usually triggers these algorithms to send out a notice. But those startups who have followed the law don’t have to fear the tax man in these routine queries. While these laws are harsh and the methods of inquiry are common to all, the ambiguity and the timelines place a considerable burden upon first-time entrepreneurs and early-stage startups who have to manage of the herculean task of setting up and growing a business with that of navigating byzantine compliances, all on a shoestring budget.

If anyone has received an angel tax notice this year or one that has not been resolved, please do write it to us at [email protected] so that we at iSPIRT can help in whatever way we can. Do refer to the earlier writings on these matters to that you’re aware of what’s required to navigate these notices.

After all, a tax is not the best form of defence.

NB

- All links provided as from websites whose links have been displayed. iSPIRT, 3one4 Capital or the author are not affiliated to any of these sites

- The matters presented here are a summary of various judgements and are not a formal opinion of iSPIRT, 3one4 Capital or the author. Any scrutiny notice should be discussed with your relevant professionals and the purpose of the article is merely educational