The idea of the report is to look at the demand and supply distribution across sectors and analyse what is hot and what is not and vice versa.

Let us start with analysing the demand side.

With LetsVenture being a managed marketplace, it curates the startups that are made visible to investors on the platform. Hence, to move to the fundraising section on the platform, the founder needs to apply and get approved for Investor Connect. These are the startups we consider as actively fundraising startups on the platform.

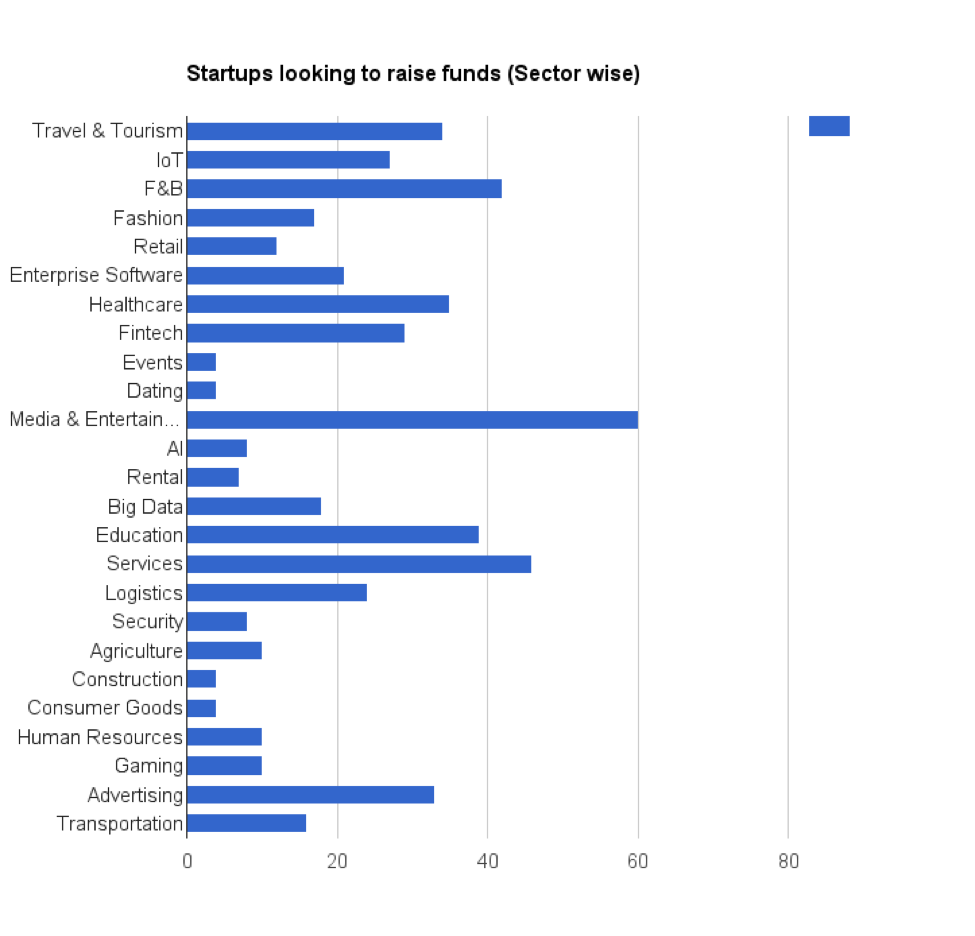

Please note that the sectors considered are those which have seen at least one funding happening in Q2 of this financial year. Also, we have included ecommerce or marketplace as well as a sector but we will not be using them while making conclusions on sectoral trends. These are basically horizontals or a way of doing business. This is how the distribution across looks like:

Sector-wise Distribution

This graph basically depicts the sectoral distribution of 600 ventures who applied for Investor Connect on the LetsVenture platform (looking to raise funds). Media & entertainment sits at the top.

Most of the startups we are seeing here are across discovery (content, experiences, nightlife etc.), digital media, social media, and entertainment. Fintech, healthcare, education, services etc., being evergreen sectors stay at the centre of the pyramid.

We are still seeing a good number of startups in F&B and travel and tourism which is pretty encouraging. F&B has mainly seen packaged F&B and food R&D startups while a lot is happening around travel discovery, travel planning, and hospitality. It is good to see IoT, enterprise software, big data, agriculture, and AI picking up in the country. Limited conclusions can be made just at looking the demand side, let us move to see how the market is performing.

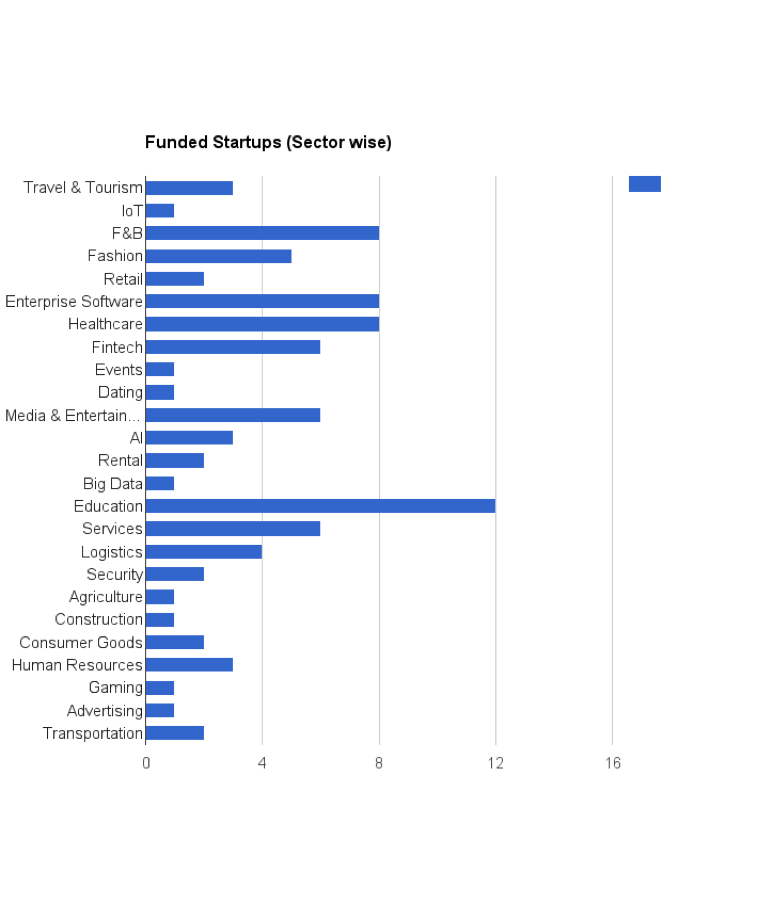

Hence, we next looked at the fundings that have happened over the course of three months. The data in consideration here is the publicly available data of funding that was published in the same quarter.

Market-wise Angel Funding

Interestingly, education is the hottest sector in terms number of deals done in a particular sector. Then come healthcare, enterprise software and F&B followed by media and entertainment, services, fashion, and fintech.

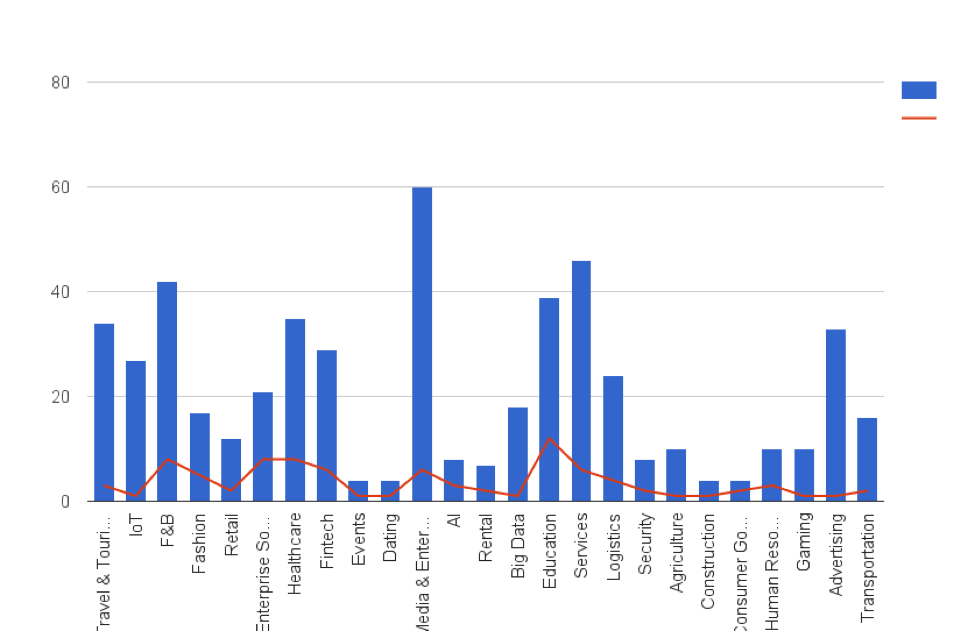

Let us move to the last but the most interesting bit of putting it all together. As mentioned before, we will not be looking at ecommerce and marketplace for any comparisons. Here we go:

So we have looked at around 600 companies who were willing to raise an angel round and around 100 who have raised funds across sectors. Assuming that around 60% of the companies who raise funds are on LetsVenture and 30% of the companies raise funds in stealth mode (unpublished), it is safe to assume that only 17% of the companies willing to raise funds, actually raise funds in the angel market.

Observations

- Media and entertainment being the hottest sector in the companies, raising an angel round is not an indication of performing, when it comes to fundraising. Hence, the space is crowded and operating/venturing in it into can expect tough competition.

- The percentage of funded companies across Internet of Things, big data, gaming, and agriculture is not very high. But these are a few sectors which were hardly seen in the funding news a few years back. These are definitely amongst the emerging ones!

- The highest percentage of companies that got funded for a particular sector stands at 38.1%. Certainly, enterprise software is one of the hottest sectors in the country at present.

- The likes of fashion, education, and human resources are a few sectors that are positioned above the average. They continue to be amongst the hot sectors.

- A few sectors which are not doing well are Internet of Things, travel and tourism, big data, and advertising. Internet of Things and big data being the emerging ones, this is definitely not a good time to be in advertising and travel & tourism.

Percentage Breakdown

F&B – 19%, retail – 16%, services – 14%, and logistics – 17%. What is common here? Each and every percentage is pretty close to the average. A lot has been said lately that this is not a good time to startup in the country, market sentiment is bad around fundraising etc.

Well, we have data to prove it all wrong. All these sectors with average performances are a proof of the same.

LetsVenture has also announced the dates of its much-coveted angel summit, LetsIgnite 2017. It will act as a platform for startups to connect with angel ecosystem and raise funds.

This year, the platform is opening up the event to both growth-stage startups and early-stage startups looking to raise funds.

Track 1: Angel Funding

Early-stage startups looking to raise angel funding between $50K to $1.5 Mn to apply. Last year, eight startups successfully raised funds three months after the event and in 2015, 35% of finalists closed their rounds post-LetsIgnite. Once submitted, the application will go through four rounds of curation.

Track 2: Growth-stage Startups

Successfully funded or late-stage startups are connected to the right VCs (VC Connect), B2B customers (Customer Connect) and relevant corporate development teams for founders looking at merger and acquisition opportunities (M&A Connect). Startups need to complete only one application (for Track 2) to apply for VC connect or customer connect or mergers and acquisitions or all three. For more information, you can check out link1 and link2

Startup applications are open! Click here to apply! The event will be conducted in Bengaluru from March 16-17, 2017.

This report was built using LetsVenture proprietary data and publicly available information. Source: LetsVenture Intelligence. It has been published by Team Inc42 in collaboration with LetsVenture.