Fundraising for an early stage startup can be a serious time consumer.

Like many other things in life, there is an easy way, and a not-so-easy way. We focused on building Whttl for 3 months, achieved some serious traction, and then switched into fundraising mode. Here’s our reflections on raising our seed round for our newest startup. We hope you can pull out some valuable insight.

Organize

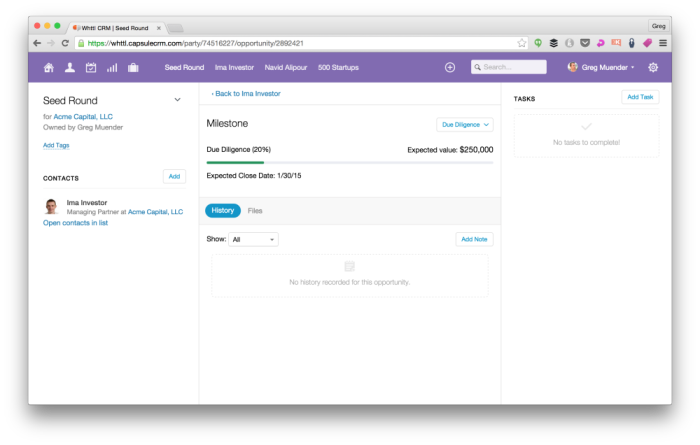

Over the last few years, I’ve curated a list of about five hundred angel investors, venture capitalists, and funds. Nearly every time I saw one mentioned, or heard one in the media, or read about one in a book, I jotted their name and fund down. I put them all in one shared Google Doc, which included standard columns such as contact info, current status, etc. Very quickly though, we realized that this just wasn’t scalable as the dialogues with dozens of investors became more dynamic. So, we moved to a CRM known as Capsule.

It was free for the first two hundred and fifty contacts, which we quickly filled up. Even after that, though, it was only a few bucks per month. (We pay $12 per seat.) We could organize all of our conversations into a pipeline, giving us the tools to analyze a snapshot of our fundraise status, points of friction, and data we could use to improve our conversations. Closing a round should be treated like a sale because you are in fact selling bits of your company in exchange for money. Setting up a solid sales funnel ensures that the velocity of the deals stays up.

All Stars

Some investors move the needle more than others. They are talked about more, come up in conversation more often, and are household names, at least in the startup space. Investors like Jason Calacanis, Kevin Rose, Tim Ferriss, Ashton Kutcher, and Chris Sacca are the types of folks that come to mind. These well known thought leaders seem to be able to get more attention for their investments and leverage their fame for the sake of their portfolio companies. We placed about twenty investors into this category and tagged them as “all stars” in our CRM. All else being equal, before we would commit considerable time pursuing other investors, we would pursue these options first.

Seed Targets

Most investors have investment philosophies. They have specific industries that they invest in, or even those that they don’t. It’s important to know the types of companies any prospective check writer works with, so as to not waste your time, nor theirs. We identified that about fifty of the investors on our list had written checks in a similar space as ours. We had to ask ourselves, “Who is showing interest in our vertical, the on-demand app space?” Those who financially backed startups like Instacart, Munchery, andDogVacay made their way to our targeted cohort. We also looked for investors who were explicitly interested in aggregation and discovery.

Warm Intro

On the Lowercase Capital website, Chris Sacca states the following:

“Turns out we have never ended up backing a company that approached us via the email alias for pitches.”

In other words, cold emails don’t work for him. He notes that his fund doesn’t have a specific policy against this, but they have realized that the likelihood of an investment coming from outside of the network is virtually null. It’s not a knock on good ol’ fashion hustling, but it’s an important indicator that sheer hard work and force alone will not always work.

You’ve got to treat your investment approach not as a blunt instrument, but a surgeon’s scalpel. Understand where your time is valuable; cold pitching a firm that has never invested outside of their network is probably not a wise use of it.

Every investor in our database went through a similar process for us. On a first degree, we’d look them up on LinkedIn, and note the mutual contacts, if any. If that didn’t yield any results, we’d look at the investor’s portfolio of investments, where we’d search for a company where we knew the founders. To get some visibility on an investor’s portfolio, we used a combination of the fund’s website, CrunchBase, and AngelList to get a comprehensive view of investments made.

Batching Requests

We value the time of the people in our network, so we didn’t want to just bombard them with a string of introduction requests. Here’s how we got around that. As we made our way through our list of investors, we would note all of the potential mutual contacts in the CRM. After we had gone through our list, we could search for a particular friend’s name, and see all of the investors that we hoped they could connect us to. Doing this allowed for two things:

1) We would prioritize introduction requests. Generally, we would ask for just one introduction, cherry picked from all possible connections. In some rare events, especially with close friends, we’d give them a small list and ask who they were most comfortable introducing us to. Who where they the closest with?

2) Having this visibility allowed us to balance the requests. We moved them around in such a way to even out the ask amongst our friends. Instead of one friend getting ten requests, ten friends got one request.

The Opt Out

This is kind of more of an etiquette play than anything else, but I must stress the importance of always allowing an easy way out when asking for an introduction. We always give a way to politely deny our request. Perhaps the connection isn’t strong, or perhaps the request wouldn’t be appropriate or warranted. It’s important to avoid placing your friend in an awkward place of having to say “No, I can’t.” Give them that easy out from the beginning, and you’ll both be better off.

Momentum Is Everything

All else being equal, it is much more effective to go all in for a shorter period of time, rather than to stick one foot in the water for a longer period. Everything should be done to create a dense period of investment activity. Traction creates momentum, which continues to fuel the fire. As one friend put it, “You’ve got to present the fact that you’ve captured lightning in a bottle, and the time is now or never to invest.” The rocket ship is leaving, it’s time to get on board.

Check Your Network

As I aforementioned, we were making significant traction in obtaining introductions to the investors on the list. But, the inverse can also work. We went through our closest friends and asked ourselves questions like:

- “Who is a founder of a company?”

- “Of those companies, do any have investors?”

- “Of those investors, is it possible that they might take a look at our project?”

In doing this, we added new, qualified investors to our list.