SUMMARY

An employee with ESOPs becomes a potential shareholder and can buy vested stock options

ESOPs can be partially or completely monetized on liquidity events such as buybacks, secondary sales, or an IPO

This monetization of ESOPs (if the startup has a considerable valuation) will far exceed the employee’s standard remuneration

Want to understand how Employee Stock Ownership Plans (ESOPs) work? In this article, we will deep dive into knowing some of the nuances with an example that might help you chart out a perfect ESOP plan.

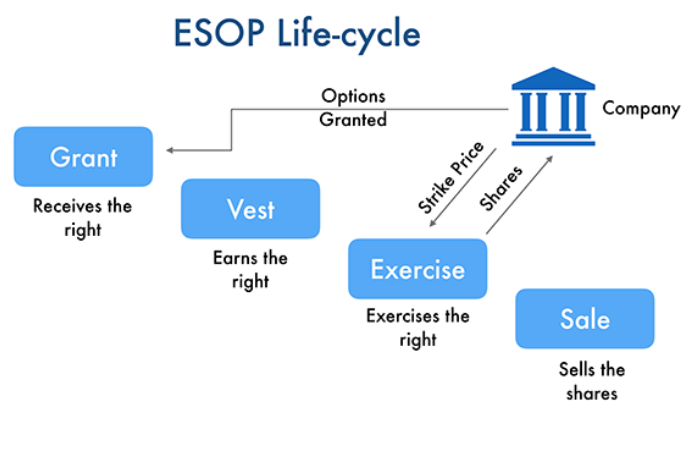

Before we explore the lifecycle of ESOPs, it is important for you to be familiar with a few terminologies:

- Grant Letter: The letter through which ESOPs are issued to employees

- Vesting: The process through which employees can apply for shares of the company against their equity grants

- Exercise: The practice which allows employees to have ownership of ESOPs that were granted to them

- Exercise Price: The price at which the employee purchases ESOPs

Here’s an ESOP Dictionary that you can use to understand the basic nuances of ESOPs

ESOP Lifecycle

Let’s take a real example to understand how ESOPs work.

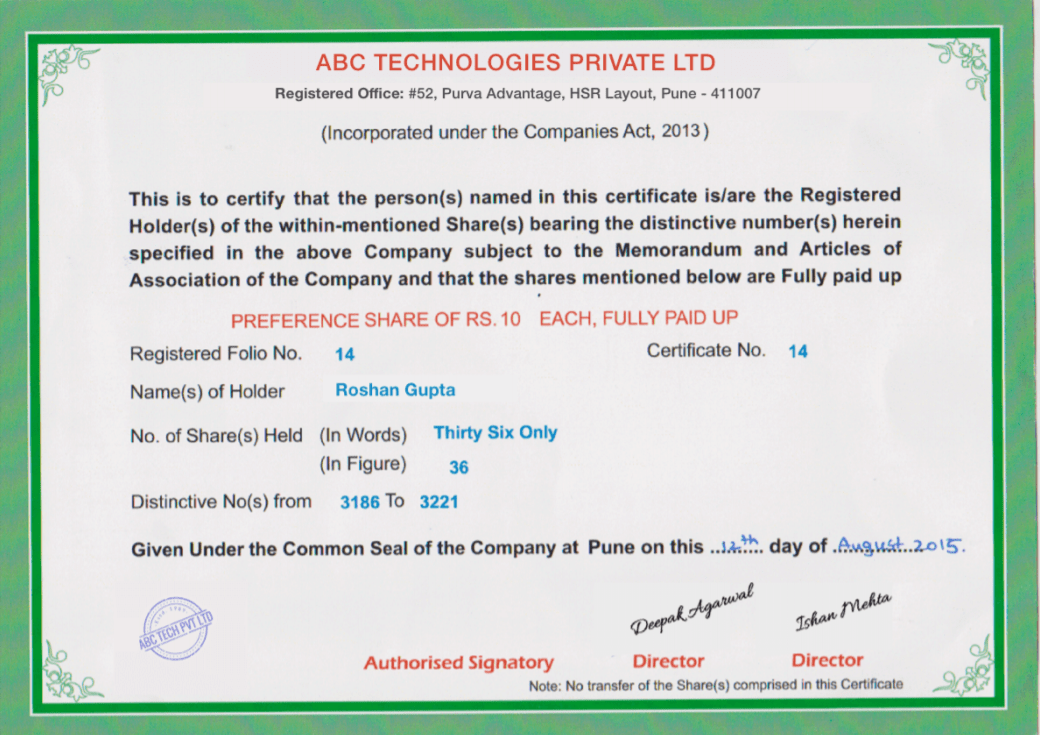

Roshan has been granted 1500 ESOPs via a grant letter on Feb 14, 2018 (grant date). Here’s the Grant Letter.

The exercise price is INR 500 per option. Click here to view the Exercise Letter.

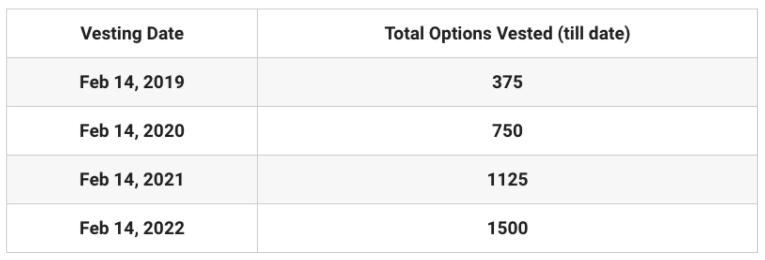

As per the grant letter, all the 1500 stock options have a compulsory 12-month cliff period, following which they will vest uniformly over a 4 year period. The complete vesting table and dates are as follows:

After the cliff period, Roshan can exercise his vested options first on Feb 14, 2019, and then on the same date in subsequent years. If he chooses to exercise on the same date (see the attached exercise letter), he will pay 375 X 500 = INR 1,87,500 as the exercise price

Roshan will also have to pay exercise tax

Let’s assume that the FMV of the shares is INR 8,500 per share. So, he will pay a tax on his notional income. The notional income can be calculated as

375 X (8500-500) = INR 30 lakh

On this notional income of INR 30 lakh, Roshan has to pay tax as per his tax slab. If the tax rate for his slab is 33%, he needs to pay about INR 10 lakh as income tax in that year.

Now, let’s assume that Roshan decides not to exercise his vested options annually. He leaves the company on Feb 28, 2021, after his third vesting schedule. As of now, he has 1125 vested options. His unvested options (1500-1125 = 375) lapsed the moment he resigned.

But, the company has a policy of allowing employees to exercise within six years of leaving the company. If he doesn’t exercise in this time frame, all of his 1,125 vested ESOPs will lapse. If he chooses to exercise, he has to pay a lot of exercise tax (apart from his exercise price), Roshan is thinking hard about what to do.

After a few years, as part of the Series C round, the company is providing ESOP liquidity to select employees including Roshan for 20% of his vested ESOP.

Roshan decides to take part and he exercises his vested options, he submits the exercise letter to HR and pays the company 1125*500*20% = INR 1,12,500. He also has to pay the income tax amount to the company.

The company will allot 1125*20% = 225 Equity shares to Roshan and he will receive the duly signed share certificates.

Then these shares will be transferred to the investor and Roshan will in-turn receive the sale amount.

Why Opt For ESOPs?

While companies are leveraging ESOPs as a retention tool and growth multiplier, employees also benefit in the overall process. To summarise, ESOPs can help you:

- Boost personal wealth (through equity ownership)

- Grow professionally (as primary contributors)

- Improve job security and satisfaction

- Actively participate in decision making

However, cashing out ESOPs can be a cumbersome process. Here’s a blog on the liquidity events that pave the way for monetizing your stock option grants.

MyStartupEquity is a full-stack free product (up to 100 users with grants) to manage your cap table, create and roll out your ESOPs and facilitate ESOP liquidity for your team. You can book a free demo with their team here:https://bit.ly/3jAVPZT