SUMMARY

India is one of the leading startup hubs globally, with more than 50K startups in various stages of growth

The Indian startup scene was red-hot in 2021, with as many as 42 startups turning unicorn and 11 getting listed. These developments have increased the lure of angel investing for cash-rich investors in India

2021 saw 708 Indian startups got seed funding worth $1.1 Bn, with an average deal size of $2.3 Mn

India is one of the leading startup hubs globally, with more than 50K startups in various stages of growth. The Indian startup scene was red-hot in 2021, with as many as 42 startups turning unicorn and 11 getting listed, giving bumper returns to early-stage investors. These developments have increased the lure of angel investing for cash-rich investors in India

According to Inc42 analysis, 2021 saw 708 Indian startups got seed funding worth $1.1bn, with an average deal size of $2.3 Mn.

What Is Angel Funding?

Angel funding refers to the funding raised in the early stages of a startup. It is usually led by individuals, angel investors or early-stage funds to provide financial backing to an early-stage startup in exchange for equity in the company.

It can be a one-time investment, or it can be in the form of ongoing support, with the smaller amounts being invested in achieving certain milestones. Though angels can invest money at any stage of the business, this often happens at the early stages — seed round and pre-seed funding rounds.

Angel investors take higher risks and expect higher returns than traditional investment options. Many angel investors are actively involved with the business on a day-to-day basis. They may help the business in funding, networking, setting up business processes and providing guidance.

Angel Financing V/s Venture Capital Financing

While on the face of it, angel funding and venture capital funding may look similar, the two are quite different. Both forms of financing require giving away a part of your equity in exchange for capital. Though, the difference comes in at the source of investment. Angel investors use their capital to invest in the business whereas venture capital firms are professionally managed firms.

Generally, angel investing is done at an early stage of the business while venture capital investors may invest in any stage of the business from early-stage to growth-stage companies.

Who Are Angel investors?

The profile of an angel investor is evolving. Angel investors don’t just fall under the bucket of wealthy individuals. Bankers, lawyers, startups employees with cash from ESOPs and even salaried corporate employees are joining the bandwagon. Your angel could be anyone — from family and friends, a serial entrepreneur looking for an investment opportunity to an angel investor via an angel network.

People like Flipkart’s Sachin Bansal, Paytm’s Vijay Shekhar Sharma, and Zomato’s Deepinder Goyal, who have successful startups, are backing other startups as angels and providing finance and expertise. Additionally, top corporate executives like Anand Mahindra, as well as celebrities like M.S. Dhoni, Sachin Tendulkar, Alia Bhatt, Deepika Padukone, and Ayushman Khurana among others are investing in multiple startups.

When To Seek Angel Funding

The timing of the angel funding can have a big impact on the business’ success. As a founder, you should have a firm grip on the business idea in the form of a meticulous business plan, market research, and product development before you approach an investor. Typically, this will be after you have already approached your family and friends, raised a seed round but before you look to raise a Series A funding.

Benefits Of Angel Funding

There are quite a few benefits with going for angel financing:

- You won’t have to worry about returning the money as the angel investors are your partners in profit and loss

- Since most angel investors are sophisticated investors, they are in it for the long term

- One of the additional advantages as a startup founder is that in addition to the financial backing, you get the advantage of their network and expertise. This is quite helpful to make your business grow

It is important to understand that all the benefits mentioned come with a loss of control over your own business. Though, it is a trivial cost for giving your business a chance to grow at a fast pace.

Additionally, you should be careful about the angel that you are raising funds from. You should run an extensive background check on them. Find out if the angel is invested in your startup for the long term or quick money. There have been several cases where angel investors have turned out to be a bad fit for the company. After all, it is better to be safe than sorry.

How To Raise Angel Funding In India?

As a startup founder, once you have done your research and are ready with your business model, now is the time to look for angel funding. Before you seek funding from any sources, you should put some of your own money in the business to show potential investors that you have enough skin in the game. Though it is not a necessity, it would go a long way in showing the prospective investors that you are willing to bet on your business.

Secure Funding From Family and Friends

Your family and friends can prove to be a source of funding in many cases if you can convince them of the viability of your business idea. Once you are ready with the business prototype, you may ask your friends to chip in exchange for equity.

Directly Approach An Angel Investor

Alternatively, you could directly approach an angel investor if you believe your idea is compelling enough. There are numerous platforms to connect to angel investors at your fingertips which makes networking with them easier.

Before reaching out to an angel investor, you should know what an angel investor looks for in a startup. As a founder, you need to put in a lot of time and effort and monetary investment. It would help if you had a fairly good idea on the:

- The industry

- The market

- The product and the service that you are offering (Demand Gap Analysis)

- Market intelligence (Competition)

Once you are clear about all the above, prepare a pitch. A pitch should be a brief, concise, and to-the-point presentation based on the above factors that will help the investor understand that your idea is investment-worthy.

Remember, the pitch is not a business plan, so keep it short and simple. If the pitching process is successful, you will receive your first check, with many more to follow.

Angel Investor Networks

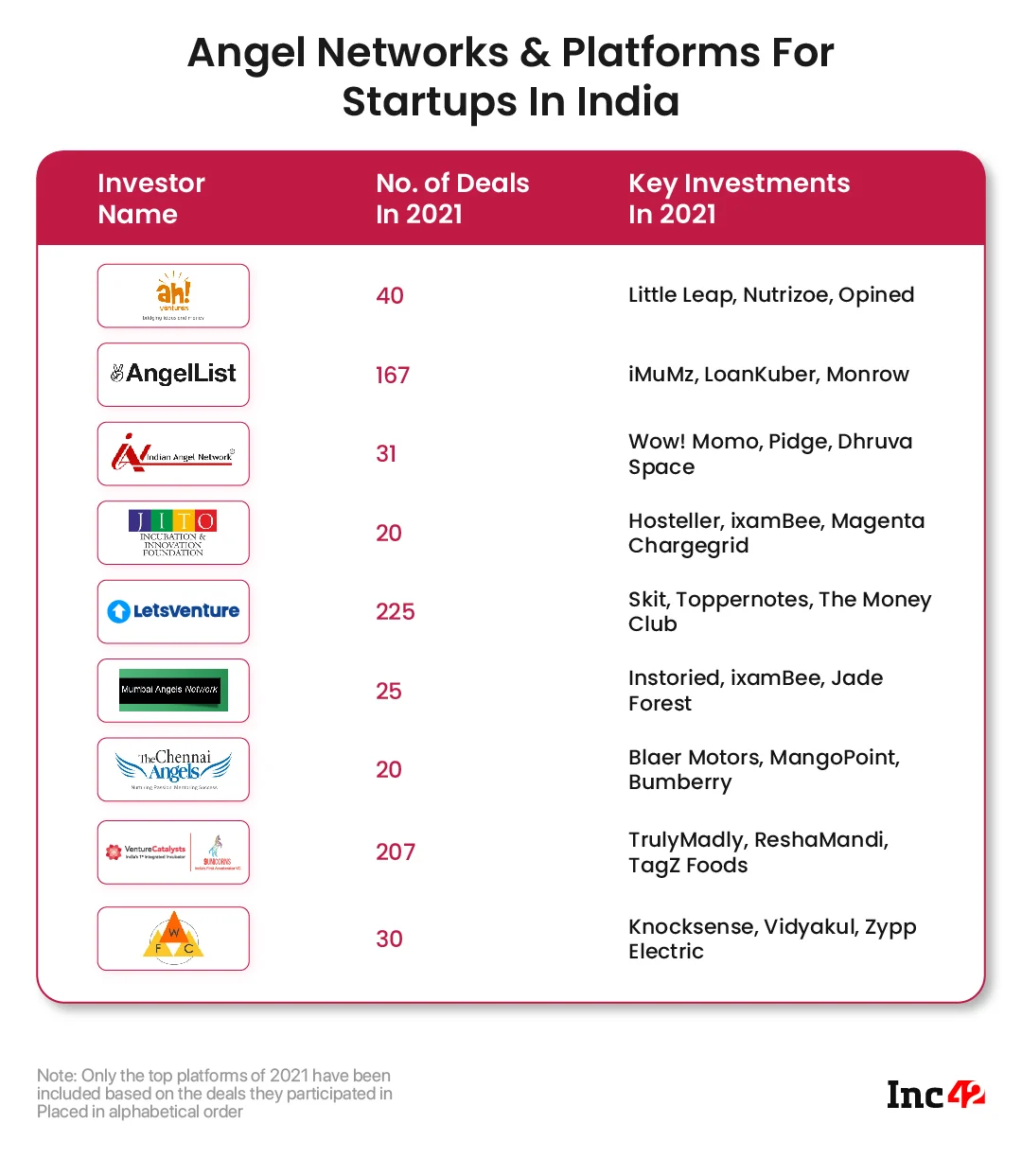

To find angel investors, you may go through the angel investor platforms. Some of the most active angel investor platforms involve names such as LetsVenture, Venture Catalysts, Indian Angel Network (IAN), AngelList India, Mumbai Angels Network, The Chennai Angels, The Bengaluru Angels, CIO Angel Network, Lead Angels Network, and BITS Spark.

For any startup, there is one crucial factor that determines the success of the company — fundraising. Startups are left with no option but to close up their shops if the funds don’t come right on time. That’s when angel networks provide a lifejacket to these startups. The guidance and mentorship provided by angel investors is something that startups desperately seek, especially those in the early stage.