SUMMARY

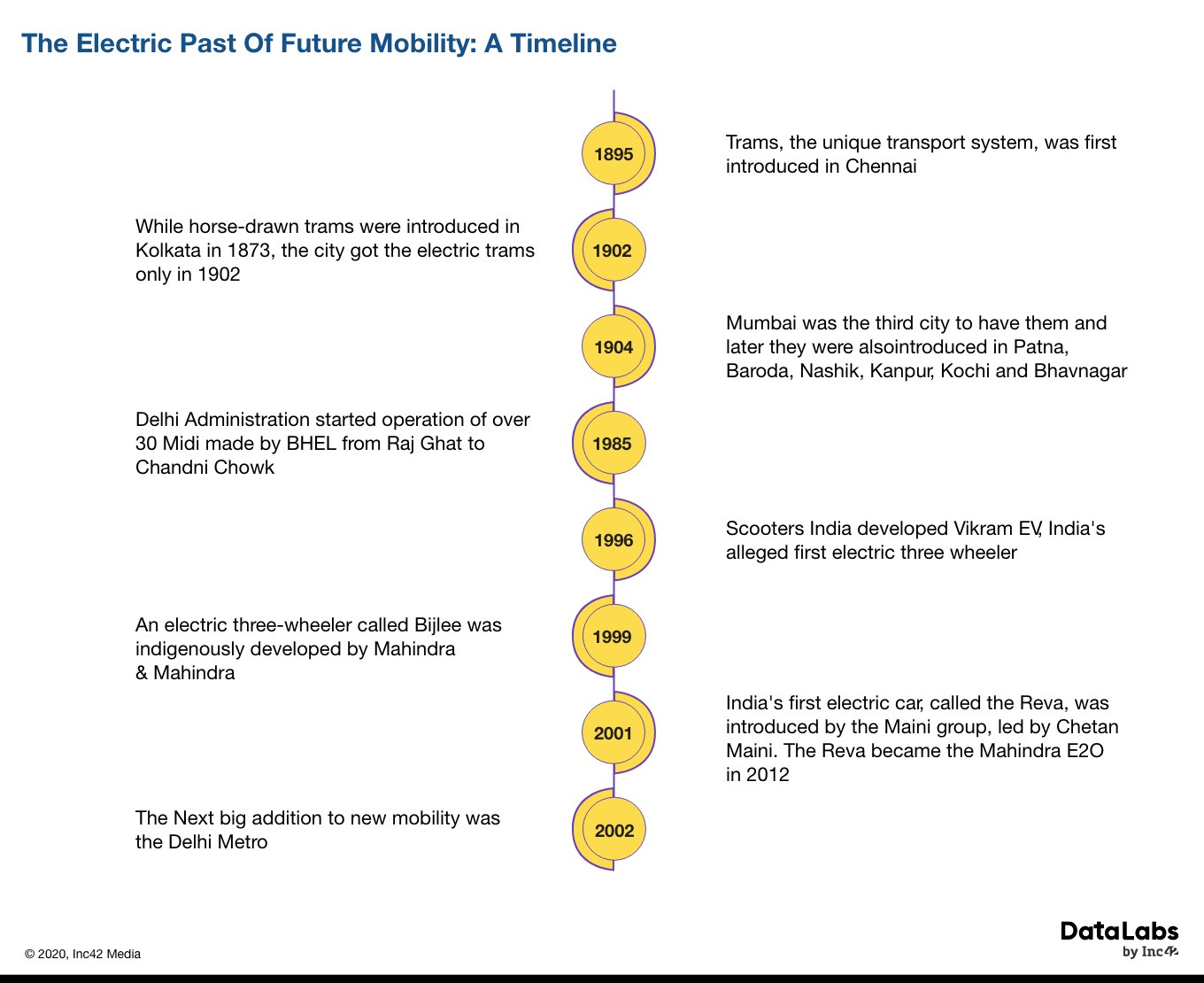

India’s EV journey started in the 19th century with electric trams in Chennai, just a few years after they were first introduced in Russia

While the first electric car was launched in 2001, India has not made market progress in terms of electric mobility

The efforts to make EVs mainstream can reduce alarming levels of CO2 emissions

India's Electric Future

India is electrifying its vehicles, but is it enough to reach 30% penetration by 2030? Deep dive into what really needs to be done to help India become a 'true' EV nation.

[This is a free preview article of our 6-part ‘India’s Electric Future’ Playbook, as part of Inc42+ (our membership programme). In this playbook, we will give you a panoramic view of the world of electric vehicles, which is believed to soon rule the Indian roads. Click here to read the complete ‘India’s Electric Future’ Playbook.]

One of the most ceremonial moments in the history of science was the famous 1903 Kitty Hawk flight by the Wright brothers. However, what culminated in the world’s first successful aeroplane is not only the hard work and determination of Orville and Wilbur Wright but bits and pieces of knowledge passed on by many others through failed flying attempts. Perhaps the most prominent one was Alexander Fyodorovich Mozhayskiy, a Russian Naval officer who came up with a solution to heavier-than-air flight many years before Kitty Hawk took flight.

India’s mobility story also has a similar tale to tell. While the future is undoubtedly electric, generations to come have a lot to learn from the bits and pieces left behind by the past.

While the pioneer is largely considered as the celebrated Reva electric car, the story of electric vehicles on the road actually dates back to when trams ran in Indian cities.

What Sharpened The Focus On EVs

India’s first electric car, Reva, was looked at as a futuristic car. However, it drove too early into the Indian market, which was clueless about green mobility. So what happened in the years since its launch that India is suddenly gung-ho about electric vehicles? It was a culmination of a range of factors that have continued to contribute to the belief that electric vehicles will work in India.

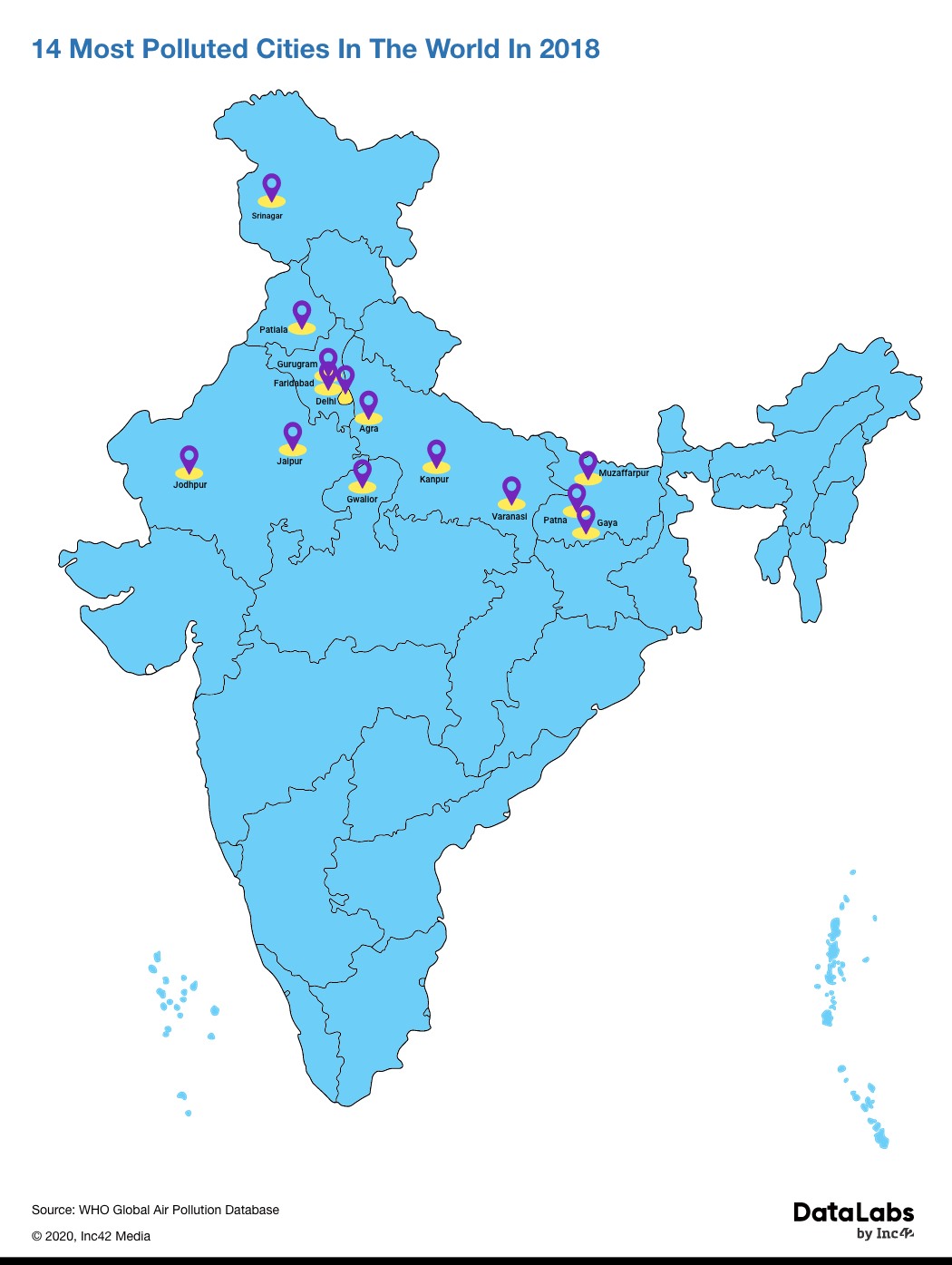

Alarming Levels Of Vehicular Pollution

What really brought EV to the forefront was when Delhiites opened their doors to zero visibility due to smog even at noon in the 1990s. The phenomenon continued every season and as more vehicles hit the roads, it only became worse. According to DataLabs by Inc42, India became the fourth largest auto market in 2017 with sales (excluding two-wheelers) increasing 9.5% to 4.02 Mn units. The domestic automobile sales increased at a CAGR of 6.71%to 26.27 Mn vehicles between FY13 and FY19.

India ranks as the third-largest carbon-emitting country in the world accounting for 6% of the global carbon dioxide emissions from fuel combustion. With the increasing population, public transport wasn’t a viable option for many. The middle class, in particular, opted for cars as the banks started offering easy loans. Thus, the primary reason for the increase in pollution levels was vehicular pollution.

Ineffectiveness Of CNG

Around the turn of the 21st century, the central and state government pushed for CNG as a viable option. In 1998, the Supreme Court (SC) gave April 2001 as the deadline to replace or convert all public buses, three-wheelers and taxis to CNG. And by 2005, around 10K CNG buses, 55K CNG three-wheelers, 5K CNG minibuses along with taxis and cars ran on Delhi’s roads, with similar numbers in many of the other metros in the country.

The CNG transition happened within ten years of the SC ruling and there was a drop in vehicular pollution in Delhi. However, because of an increase in the number of private cars, the solution couldn’t be sustained. Within a few years, the air quality index in New Delhi and other major Indian cities as a result of excessive vehicular pollution indicated the high level of toxicity in the air, which rendered the air unsuitable for breathing.

Despite positive results, CNG couldn’t hold the fort in terms of sustainability, possibly because of technological difficulties.

The popular vote then went to EVs as the best option for green mobility as seen by the government, startups and green warriors despite serious questions raised again about the viability of electric vehicles (EVs) as saviours of the environment. And there were other reasons to back electric mobility.

Dependency On Fossil Fuel Imports

Apart from improving the efficiency and transforming the transport sector, the call for a nationwide EV transition was also to address major concerns such as the rising current account deficit (CAD) on account of rising fossil fuel imports. Additionally, the need to reduce dependency on fossil fuel-based economies that rely on multi-billion dollar worth of oil imports every year also gave way to EVs.

“India became the third-largest consumer of crude oil in the world with its crude oil deficits standing at $52 Bn in 2017 which accounted for almost 50 % of the total trade deficit of $108 Bn,” said Akhil Aryan, cofounder and CEO, ION Energy.

This push for electrification of transport is driven by the imperative to enhance India’s energy security by reducing dependency on imported fossil fuels and conserving forex reserves.

Global Competitiveness

When manufacturing economies such as China turned their focus to EVs, India was also forced to follow suit.

“As China has emerged as the hub for EVs, India wants to position itself as a strategic alternative,” explained Suraj Ghosh, associate director, South Asia Powertrain Forecasts, IHS Markit.

This is mirrored in how India offered itself as an alternative for electronics manufacturing in the past two-three years, which has resulted in a massive boost for Make In India. The attempt is similar with EVs.

Realising that it has the potential to become a global provider of clean mobility solutions and processes that are affordable and scalable, India has double down on EV manufacturing in the past year. “The demand from EVs can greatly improve the utilisation factor of underutilised power plants that display lower plant load factors due to lower capacity utilisation,” Aryan said, adding that the charging pattern of EV users is widely considered to coincide with power demand during the non-peak hours in the country.

The Unprecedented Growth Of Electric Rickshaws

Of course, even with these reasons, market success is a big factor in EV adoption. The failure of Reva is a stark reminder of this. In terms of EVs, the success story came in the form of electric three-wheelers or rickshaws segment which saw tremendous growth in Tier 2/3 towns and rural areas as well as in metros.

The proliferation of electric rickshaws, catering to last-mile transportation at affordable fares and generating profits for driver/owners, without government support or incentives was also an eye-opener for everyone. EVs could work in India, after all.

“These electric rickshaws manufactured/assembled by SME’s, are generating gainful employment to tens of thousands of people at the bottom of the pyramid. It is estimated that around 1.5 Mn electric rickshaws ply on India’s roads, transporting millions of people in an environmentally friendly way, and maybe India’s biggest climate success story,” Christie Fernandez, founder and CEO, Sooorya EV told Inc42.

How The Ball Got Rolling For The New Era Of Mobility

India’s commitment towards reducing CO2 emissions under the Paris Agreement became a big driver too towards electrification of transportation.

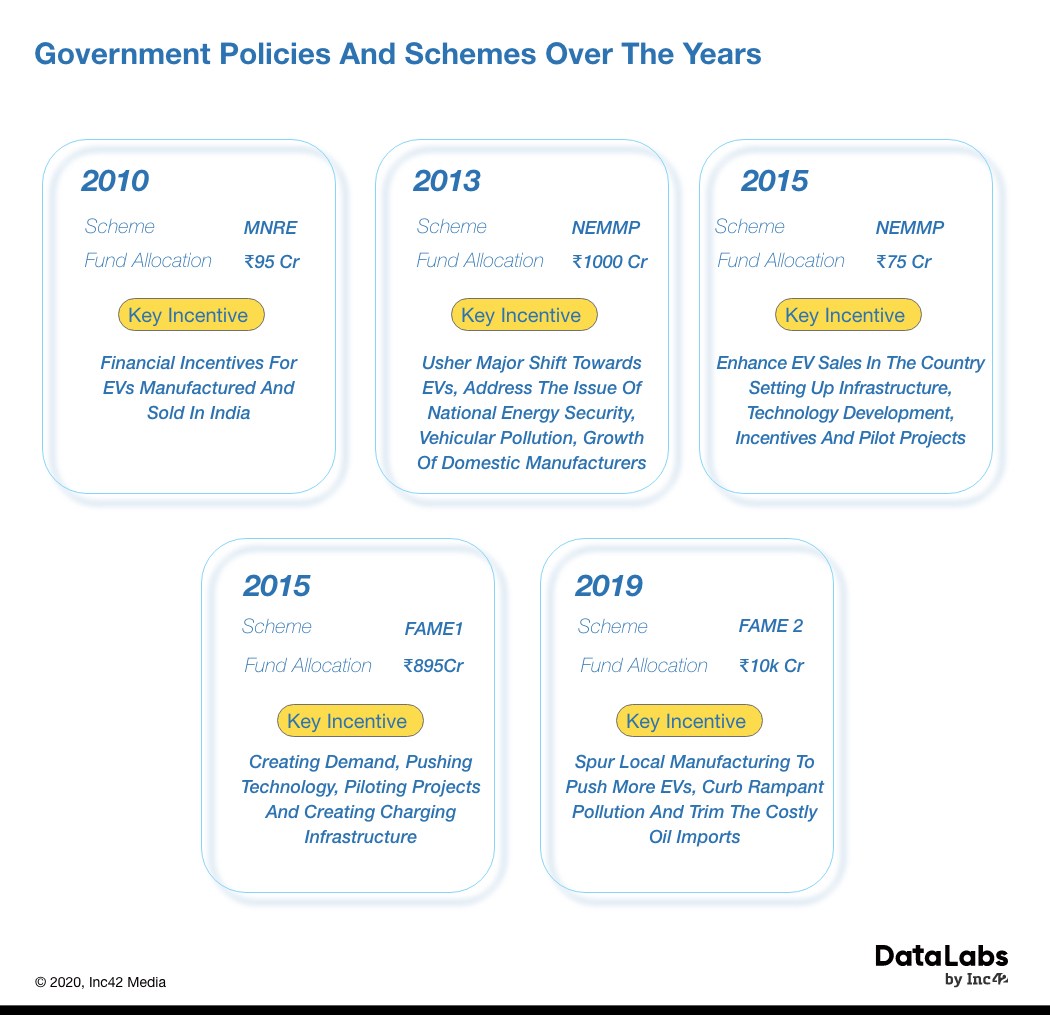

NEMMP (National Electric Mobility Mission Plan) 2013 was considered the first dedicated move by the government to show its intent on moving towards electric mobility and enhance sales. Additionally, both FAME and FAME II have been decently successful.

FAME has put a healthy number of electric two-wheeelers, three-wheelers, buses and some battery-powered and hybrid cars on Indian roads. In FY 2019, over 750K EVs were sold in FY 2019 with a total of 7,59,600 units. This includes electric two-wheelers (1,26,000), electric three-wheelers (6,30,000) and electric passenger vehicles (3,600).

Though FAME Phase 1 didn’t trigger much of an impact on other segments (cars and four-wheelers), it successfully placed electric mobility in the discussion space of ordinary Indians.

“FAME II is a refinement over FAME. It is now trying to bring in quality and spur local manufacturing which is essential for building the EV ecosystem in the country and to make EVs affordable,” said Abhilash Savidhan, automotive professional and clean energy enthusiast.

Environment and electric vehicles are two of the many issues India is facing. With limited resources and budget on one hand and many issues that we are facing as a country, such as agriculture, water, health, education, the available resources for the EV ecosystem and clean energy is limited. “Within the available constraints the government is trying to prioritise and budget the EV ecosystem,” Savidhan added.

Other than the schemes mentioned above, other incentives in India include only 5% GST for EVs as compared to higher rates such as 29%/31%/43% etc for different vehicle categories. Companies are also eligible for incentives based on battery capacity, INR 10K per kWh for two-wheelers and four-wheelers, INR 20K per kWh for buses. Customers availing financing for EV purchase are eligible for an additional INR 1.5 Lakh deduction and manufacturers of essential components are being offered investment-linked income tax exemptions under Section 35 AD of the Income Tax Act, and other indirect tax benefits.

Additionally, the EV supply equipment (EVSE) providers are currently offered between 50-100 % incentives based on the location and type of charging stations.

Startups Bring EVs To Dinner-Table Discussions

So the market is ready for EVs, but who is bringing these new creations to market?

New-age startups in the EV market are coming up with novel business models that would enable consumers to use EVs without burning a hole in their pockets. Prominent players are also tapping into the growing need for last-mile connectivity in the metros, by offering their customers access to their EV fleet on hourly rental rates. Other players in the bike rental business space are currently seeking ways for their electric fleet to run on lower operating costs. Startups are also tapping the battery swapping-based business opportunity, in an attempt to offer cost benefits to consumers and customers.

Over 40 % of the cost of a battery electric vehicle (BEV) in India is for the lithium-ion battery, which makes battery swapping, localising and optimising battery technology the most attractive, viable, and successful business models in the country.

Government subsidies, increasing awareness on pollution and its perils, reducing battery prices, innovative startups with intelligent solutions, along with realisation among OEMs on the importance of becoming a stakeholder in the EV ecosystem, and education of the public has helped the ball rolling.

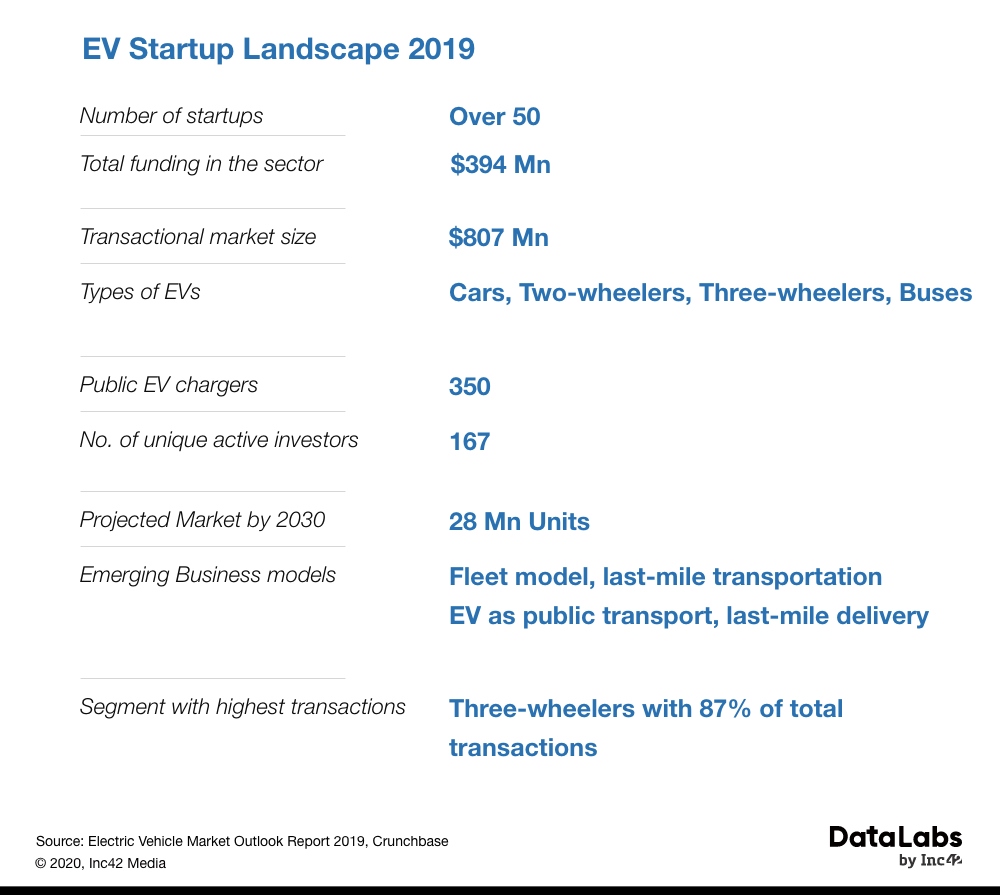

The capital inflow in electric vehicle startups has grown exponentially between 2014 and 2019. “Taking the outlier funding rounds into consideration, the total capital inflow in the electric vehicle sector was at $601 Mn whereas the capital inflow into electric vehicle startups peaked at $394 Mn in 2019. Also, more than $306 Mn worth of investment in Ola Electric Mobility across Series A and B rounds of funding contributed to 77 per cent of the total funding in the sector in 2019,” as per, Electric Vehicle Market Outlook Report, 2020.

Electric Mobility Fleets

Outside consumer sales, the early adopters for electric vehicles have been fleet operators as well as corporate customers. el.

Last year, South Korean automobile giant Hyundai and its affiliate Kia Motors invested $200 Mn in Ola Electric and its parent company ANI Technologies along with committing to develop affordable electric vehicles under the ‘Smart EV’ platform. The automobile maker also announced that it would be introducing a specially-designed EV into Ola’s electric mobility fleet by 2021. The company believes that EVs will gain more traction in commercial use, compared to personal use.

Given the lack of charging infrastructure, monetising EVs in that segment can be challenging. On the other hand, running a fleet allows companies to have their own charging stations and also capitalise on the increasing demand for shared mobility.

Blu Smart is also slowly manoeuvring into the EV business. The Delhi-based company has served over 20K customers since its launch in Delhi NCR and aims to serve 1 Mn customers in the coming months. In June 2019, the EV ride-hailing startup partnered with Mahindra Electric to onboard 70 Mahindra eVerito premium sedans in its cab fleet. It plans to add up to 500 Mahindra eVeritos by April 2020 and also expand to other densely populated cities such as Mumbai and Pune.

Self-drive options like Zoomcar and lease plans also have helped electric mobility gain momentum.

EV Boom In Three-Wheelers

The classic model of automobile design, development, manufacturing and distribution by the OEMs is still relevant to electric vehicles. Battery swapping stations for two and three-wheelers, being set up by Ola Electric, Smart E, BPCL and others will spearhead the adoption of electric vehicles by drastically reducing charging downtime, and eliminating range anxiety.

According to DataLabs, in 2019, the EV market penetration was 1% of total vehicle sales in India (less than 1 Mn units), and of that 83% of sales are electric three-wheelers. While companies like Altigreen offer road-ready electric vehicle solutions for two and three-wheelers as well as small commercial four-wheelers, three-wheelers seem to be ruling the roost.

While trendy products are definitely great from the point of view of attracting buyers, beyond the social media hype, buyers are still not keen on going electric for bikes or cars. However, the higher earning potential for the electric three wheelers has made them easy propositions for customers.

“Electric three-wheeler makers around NCR are selling EVs with just 10K down payment. But both two and three-wheeler business models are equally important. Electric bike and car buyers are looking for the fun factor in EVs, whereas electric three-wheeler buyers looking for earning potential in it,” Mangesh Awasekar, an EV enthusiast who works with Hinduja Tech, told Inc42. (Awasekar’s responses are his personal views and not of the company he represents).

Shared And Public Mobility Potential

The bike-sharing sector is also attracting investments with micromobility startups such as Yulu, Bounce, Vogo and others addressing the last-mile connectivity hurdle. Bajaj Auto recently invested $8Mn in Yulu, which later also partnered with Southern Railways to deploy EVs near train stations.

In December 2018, Uber rival Ola also entered into a strategic partnership to invest $100 Mn (INR 712 Cr) in Bengaluru-based scooter sharing app Vogo. Bengaluru-based dockless bike rental startup Bounce has reportedly raised $150 Mn in Series D from B Capital and Accel Partners, doubling the company’s valuation to $500 Mn.

State transport units (STUs) are also being pitched as the solution for EV transition across geographies. Many states have already come up with EV policies and roadmaps, and STU’s have started running electric fleets, both intracity and intercity (within a distance of 300km).

Additionally, battery swapping for buses, being set up by Sun Mobility for Ashok Leyland electric buses, are expected to help reduce the cost of electric buses and increase range. The recent announcement of Amazon India to add 10K EVs to its delivery fleet by 2025 and IKEA using electric rickshaws in their delivery fleet charged by rooftop solar energy are some of the other successful business models being launched in India.

Build The Ecosystem, And They Will Come

While the future is bright, it’s easy to overlook the foundation on which it is being built. Often, these building blocks are nothing but failed attempts to kickstart the industry.

The first failure, so to say, is the EESL tender and its subsequent fallout. In 2017, Energy Efficiency Services Ltd (EESL), a public enterprise floated a tender to procure 10,000 electric vehicles to be used by government and public officials. This was a bold move to kickstart the industry into action, but the domestic car manufacturers weren’t able to offer an electric car with the right product-market fit. Supporting charging infrastructure wasn’t available either, but 3,000 electric cars were procured through this initiative.

Electric vehicles for personal commutes have also been a failure due to range anxiety. Low-range EVs have been rejected by enthusiasts which in turn has forced automakers to explore high-voltage and long-range solutions, which are expensive to produce. As technology has evolved, EVs with 300km+ range are available in India today, but the price remains a big deterrent.

India’s homegrown automobile players have long complained that the absence of optimum charging infrastructure and high import costs of Li-ion batteries as the major reasons that the top automobile entities in India refrain from investing in the production of EVs.

These shortcomings suffered by the EV community in India are being adeptly overcome by startups even as the government and associated stakeholders look to remove the hurdles.

“While the earlier declaration made by the government of implementing total nationwide adoption of EVs by 2030 was a tad too ambitious to be realized, the new target which calls for at least 30 % of vehicles to be electrified by 2030 seems realistic enough to be successfully implemented,” said Aryan of ION Energy.

Many automotive players have been upping their game to bring EVs on a fast track in India and flesh out the ecosystem. Mahindra Electric has now announced that it will be exporting EV powertrains to the South Korean and European market, starting from 2020.

The Tata Group is planning to make electric cars and batteries, set up charging stations and build a battery recycling plant to solidify an EV ecosystem. Tata Power will set up 650 charging stations in more than 20 major Indian cities over the next year. Tata Chemicals has acquired land to set up a battery manufacturing plant which will be ready in three years.

Hyundai is working on bringing a new mass-market electric vehicle (EV) to the Indian market within the 2-3 years. Hyundai had earlier announced to invest $17 Bn over the next six years on new technologies to speed the switchover to electric and autonomous vehicles.

German luxury carmaker Audi has said that it will be bringing its e-Tron premium electric SUV later this year to India. Audi India is currently ensuring readiness for the components and spare parts for EVs.

Future Speak: Will India Be Electric?

According to the International Energy Agency (IEA) forecasts, there will be 125 Mn electrical vehicles on the world’s roads by 2030. “China, France and the Netherlands lead the charge for the strongest orientation to pure battery electric vehicles, while Japan, Sweden and the United Kingdom have the highest share of plug-in hybrid cars,” said Kailash Chandra Tiwari, a Greenpeace Award winner, who was the head of transport planning at DTC, Delhi from 1987 to 1990 and evaluated the first electric car of Tasmania in Australia.

According to Niti Aayog, if EV aims are realised by 2030, India can save up to 474 Mn of tonnes of oil equivalent (Mtoe) and 846 Mn tonnes of net CO2 emissions over their lifetime. “The Chinese government has long encouraged the purchase of electric vehicles through subsidies and incentives, so it’s hardly surprising that more than 1.3 million new-energy vehicles (electric and hybrid) were sold in 2018. India has good potential. However, challenges of charging infrastructure should be addressed,” he added.

ION’s Aryan believes that India needs to focus on carving a niche in a particular aspect which would allow other parts of the ecosystem to flourish.

“India should use the next ten years to become a leader in next-generation battery technology as it is an honourable way of pursuing the national EV ambition without being critically dependent on any other country. This will further require setting up a high-ambition, well-funded institution headed by a recognised expert. This would be a project worthy of investing the nation’s pride and resources.”