SUMMARY

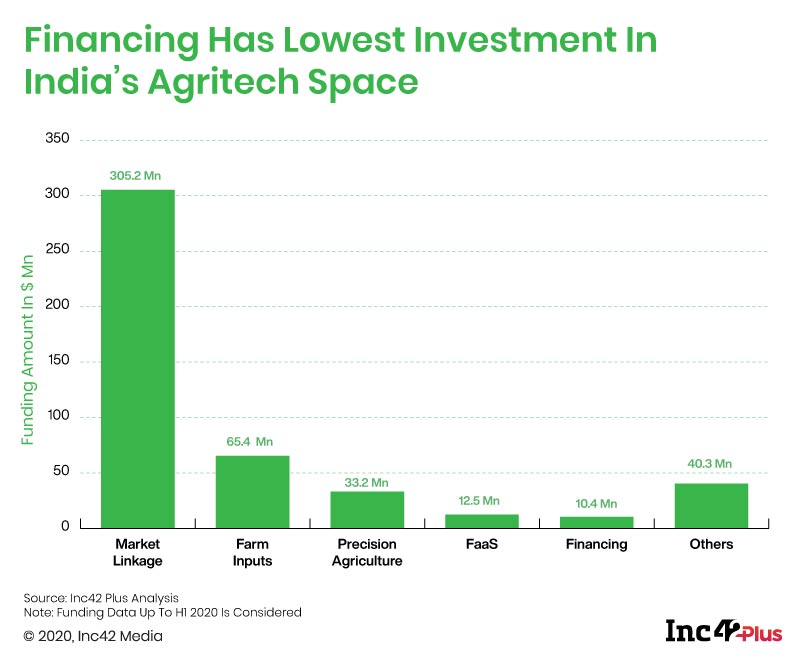

Out of the 1,000-plus agritech startups in India, only a handful are operating in the agri financing space. This segment is the least funded due to multiple challenges involved in achieving scale such as the prevalence of informal credit, repayments in cash and non-availability of customer data

To resolve multiple challenges in the agri fintech space, startups such as Samunnati, Jai Kisan and farMarts are looking at innovative approaches and alternative business models such as working with FPOs and merchants instead of farmers and partnering with market-linkage startups

Will agritech startups’ baby steps towards making fintech accessible to farmers yield results?

Farming 3.0: India’s Mission Agritech

Once least favoured, agritech is today betted as one of the most resilient sectors. The pandemic has further pushed farmers to leverage technology offered by the startups in the space, thereby making the sector a hotspot of investments. Is India’s agritech on the brink of a permanent transformation or the newly-found success a passing cloud? This playbook explores!

What is challenging India’s small and marginal farmers, once considered the economic backbone of the country? As most people already know, the top issue impacting both farmers and agriculture is the lack of timely and adequate finance. Be it drought, flood or pest proliferation, a bad harvest would often force small-scale farmers to seek quick, small loans, but the interest rate could be as high as 10% per week. The reason: Financial inclusion rates have always been low in the farming sector, and farmers are often left out of the formal credit system.

While banks mostly provide collateral loans at 8-12% interest per annum, some non-banking financial companies (NBFCs) may provide non-collateral loans, but the annual interest range could be 13-26% due to the high-risk nature of these loans.

Rural credit comes from two main sources, private and institutional. The former includes private moneylenders, landlords or even relatives who can, at times, exploit the people in need. The second category includes rural co-operatives, commercial banks which provide short-to-medium term credit and the National Bank for Agricultural and RuralDevelopment (NABARD) that takes care of long-term credit requirements. The options are not many when it comes to ‘affordable credit’ from formal sources.

According to experts, the lack of lenders’ presence on the ground, or their outreach, could be a key reason behind the lack of formal credit access.

“Physically checking on every farmer is not only difficult for the banks, but it also makes credit for small and marginal farmers a low-margin business. So, in most cases, banks provide agri loans to only medium and large farmers, who account for just 15% of total landholdings,” says Santosh Kumar Singh, director, agriculture, energy and climate change, at Intellecap, an advisory firm that helps organisations improve business competitiveness.

According to an IndiaSpend report, lending from informal sources is less common among the small farmers in Tamil Nadu at the beginning of an agricultural harvest season. Out of the total borrowings in a single farming season, only 28.39% came from the informal sector in the beginning. But after seeds are planted, the loans raised from the informal sector shot up, accounting for 65% of the total lending. This clearly emphasises how unplanned expenses such as labour or equipment not arriving on time or pest attack compelled farmers to borrow heavily from informal sources. Only quick disbursals of need-based loans can keep farmers out of these growing loan traps.

As the current financial system is unable to cater to such needs of smallholder farmers, the latter’s demand for agri loans remains largely unmet, and quite often, they are not able to save their enterprises. So, most of the agri-fintech startups in India are trying to bridge this gap.

It is not an easy proposition. For starters, agriculture poses unique risks, both abiotic and biotic, which require going beyond the standard lending practices. The current models of data and risk analytics must be tailored accordingly to streamline the process and usher in greater transparency and trust. It is not surprising, therefore, that only a handful of startups such as Samunnati, Jai Kisan, SAgri and Arya have firmly put their roots in the agri-fintech space to resolve one of the fundamental problems – instant finance. A few more like RML Agtech, Stellapps, payAgri, Bijak and DeHaat are also heading towards this direction by adding fintech as one of their core services. Then there are the likes of GramCover which are working on crop insurance distribution in rural India.

Funding in this segment also happens intermittently. In September 2020, Chennai-based agri-fintech startup Samunnati raised $20 Mn in debt from the US International Development Finance Corporation (DFC) to expand its lending activities. Three months ago, Mumbai-based Jai Kisan also announced raising INR 30 Cr ($3.9 Mn) in a Pre-Series A round from Arkam Ventures. NABVENTURES Fund I, backed by NABARD, also took part in that round.

Although several startups such as Ninjacart, AgroStar, Stellapps, CropIn and EM3 Agri entered the agritech space four or five years ago and scaled up fast, they have primarily focussed on making agricultural production and distribution more efficient. According to Inc42 Plus analysis, out of the 1,000-plus agritech startups in India, only 6-12 startups are providing support to farmers and agri-focussed financial institutions.

Why Startups Are Failing To Capitalise On Agri-Finance Opportunities

According to Alekh Sanghera, cofounder and CEO of Gurugram-based agri-fintech startup farMart, the opportunity in this space could be around $60 Bn. It may sound huge, but unlike the fintech companies catering to the urban salaried class in Tier 1 and Tier 2 cities, agri-fintech firms face multiple challenges on the ground and fail to attract investors.

A recent report titled The Role of Tech-Enabled Formal Financing in Agriculture in India and published by Rabo Foundation, in partnership with ThinkAg and MicroSave Consulting, states that out of the 124 Mn small and marginal Indian farmers, who constitute 86.2% of the farming community, only 36 Mn borrow from formal sources (both tech-enabled and traditional). Interestingly, out of the $168 Bn agricultural credit offered by the banks in FY2018-19, more than half the amount was offered to medium and large farmers who already have access to formal capital.

“Fintech for the agri sector is very similar to fintech; you just serve a different clientele in agri. But that makes a lot of difference in the way lending models should be structured. If you are lending to a salaried person, you have the details of that person because of other (financial) data. That becomes the basis of financing. Small and marginal farmers do not have such information,” says Singh of Intellecap.

As lenders must evaluate business fundamentals for loan approvals, they require accurate and up-to-date financial information. However, small farmers have fragmented landholdings and do not have formal ledgers with all their transactions in place for a certain period.

Moreover, farmers have not adopted digital payments or online transactions in a big way. Although smartphone penetration in rural India has risen from 9% in 2015 to 25% in 2018, it is mostly used for watching videos or chatting. Digital transactions are still uncommon, and hence, the data regarding the same that can be relied upon for credit appraisals is missing as well.

Collecting viable customer data is, therefore, not an easy task. “You have to spend a lot of time collecting data to do credit assessment efficiently. It will take many years to collect such data from farmers as most land records are in the names of their fathers and grandfathers. Until that happens, how you keep your business running is the question,” says Singh.

Another stumbling block involves collections as most loan repayments still happen in cash. Although Covid-19 has accelerated smartphone usage, mass adoption of digital payments is still a far cry, especially as most farmers are in the 50-plus age group.

Sanghera of farMart explains how his startup tried to solve this pain point by pivoting to a B2B2C model. “We started our agri-fintech business around 2018 and then developed a model wherein we put a credit-card-like digital ID on the phone. A farmer could walk up to the merchants selling inputs (seed, fertiliser and the likes) or services and buy things on credit after showing his ID on the phone. After such transactions, merchants were paid by the financial institutions concerned. As you can see, it was a cashless loan. Money was never given to the farmers,” he says.

It also gave financial institutions full clarity on where the money was deployed and whether it was spent on non-essential things. But farMart could not continue it for long due to the scalability challenge.

“Most repayments were happening in cash; so, it was difficult to scale. We realised this could only work if someone is doing it in a specific area. You cannot do it pan-India without having representatives all over the country for loan recovery,” points out Sanghera of farMart.

FarMart then started to focus on the merchants instead of directly working with the farmers. “For farmers, the cash flow is always up and down. We understood that behaviour and partnered with financial institutions to roll out an app for the merchants,” he adds. Through this app, merchants can share updates with all farmers about inventory, new products and end-of-season stock-clearing discounts. They can also record, track and follow up on credit payments from farmers. Farmers, too, can discover new input distributors and order seeds, fertilisers and pesticides with instant access to credit.

Starting the loan operations could be another difficulty. It reportedly takes more than a year to get an NBFC (non-banking financial company) licence, and until that happens, startups usually become business correspondents (BCs) of NBFCs. Chennai-based Samunnati also worked as a BC for Edelweiss for more than a year before it got its licence.

According to Rajeev G. Kaimall, cofounder and MD of payAgri, a startup that works with aggregated farmers and provides them with market and financial linkages, operating as a BC provides an opportunity to scale. “From application form filling to underwriting, Samunnati used to take care of everything on the ground. Only the transactions were recorded in the loan books of Edelweiss. We did everything and the margin was high. I think this model can work for many,” he says.

However, this model is not devoid of challenges, says Hemendra Mathur, venture partner at Bharat Innovation Fund and cofounder of ThinkAg. “NBFCs have their own terms and conditions and they will tell you to provide loan guarantees first. Lenders do not want to take any risk. For instance, they would say, give me a 20-40% guarantee. Startups are usually not in a position to give that kind of guarantee,” he adds.

Why Competing With Middlemen Is A Bad Idea

Unlike popular belief, replicating the operations of middlemen or competing with them mostly worked against startups, says Anshul Saxena, a specialist at MicroSave Consulting, a boutique consulting firm that offers strategic and operational advice to governments, banks, third-party service providers and others. “NBFCs which tried to bypass the middlemen were not sustainable either. Automation and digitalisation cannot replace what the traditional lenders have – a thorough understanding of the farmers and their requirements. Over the years, they have also set up a strong network in the villages. Trying to break that is a sure-shot way to failure.”

Another edge that the arthiyas, or the intermediaries, have over startups is that they could provide credit within five days or so while government loans take around 20 days due to the lack of data and other paperwork involved. “If fintech startups have to compete with them, they have to ensure that credit is provided faster. Either you have to be quick so farmers see an advantage in coming to you or you have to give other advantages like pricing,” he adds.

Unlike the arthiyas, most of the startups do not have a physical presence in villages, which is essential for farmers to gain confidence. “Due to their long acquaintance, farmers know they can go to the middlemen with their complaints. With a digital company, they do not even know whom to approach when there is an issue,” says Saxena.

“Outsiders or startups would not know when the need for credit arises for farmers. Middlemen are the local guys who know the farmers well and also their needs. It is a mutual understanding, and very often, that is how the downside and the upside are taken care of,” says Anil Kumar S.G., founder and CEO of Samunnati Financial.

Samunnati is operational in 20 states and around 54 agricultural value chains.

As traditional farming is done by farmers above the age of 50 or so, who find it difficult to adopt new technologies and digital transactions, taking credit from intermediaries also allows them to make all transactions in cash. “Moreover, the middlemen are not always bad people or exploitative. If you can consider them, empower them and give them a digital platform where everyone can have a decent margin, it may work,” adds Saxena of MicroSave.

But this may increase the number of links in the supply chain instead of delayering it. And this is where farmer producer organisations, or FPOs, can help, say startups like Samunnati and SAgri who have started working with them.

Can Farmer Producer Organisations Come To The Rescue?

According to a national paper titled Farmer Producer Organisations (FPOs): Status, Issues & Suggested Policy Reforms, around 6,000 FPOs are now operational in the country. Most of these were set up under various initiatives of the central and the state governments, including the Small Farmers’ Agribusiness Consortium (SFAC), NABARD and other organisations, over the past 8-10 years. Of these, around 3,200 FPOs are registered as producer companies and the rest as co-operatives/societies, the report says. The idea is to create an organised community for farmers hailing from the same geography to rally for minimum subsidies, inputs and other benefits. Now startups are also collaborating with the FPOs to mitigate risks posed by individual farmers.

Samunnati is scaling up well by using this model. It currently operates in 24 states and mostly provides input and output procurement loans. The former is a type of agri loan that helps FPOs aggregate inputs in bulk by connecting farmers to large-scale input suppliers while the latter enables farmers to build market connections. Since its inception, the startup has disbursed more than INR 1,500 Cr in loans and had INR 460 crore-plus assets under management (AUM) as of March 2019.

The startup also provides long-term catalytic infrastructure loans to organisations for warehouse machinery, equipment, processing units and other agri-based infrastructure firms, and has witnessed a remarkable growth trajectory in this space. FPOs can repay the credit through EMIs, partial or bulk payment, based on income generation. Interestingly, credit is provided without asking for mortgage or collateral. Before granting a loan, Samunnati assesses an FPO and verifies its documents, prepares a proposal, issues a sanction letter and gets the necessary documents as required by the sanction letter. The entire process takes around 8-10 working days.

Other startups like Jai Kisan and SAgri, which have not received their NBFC licences yet and partnered with financial institutions to act as BCs, also work with FPOs.

Mumbai-based Jai Kisan has tied up with three blue-chip banks and five NBFCs, including Avanti Finance India, among others. The startup looks after the loan undertakings for Avanti and they share 6-7% of the interest.

“You can have this model running until you get the licence. However, the Covid-19 pandemic has hit lending activities and it may take more time to get a licence. Even then, this is a scalable model. As we are dealing with FPOs, we also face fewer risks,” says Kaimal of payAgri.

Japan-based SAgri also works with FPOs and uses technologies such as satellite imagery, soil sampling and testing to check the productivity of the land and thus ensure that repayment happens.

“We have recently aligned with some FPOs to check who can repay on time. In our pilot projects, we screen people to find out who has defaulted, list those farmers and then assign field executives to collect repayment with the co-operation of FPOs,” says Nagata Satoshi, cofounder of SAgri. It has disbursed loans to 200 farmers across Jaipur, Manipur and Karnataka and has tied up with startups such as FreshoKartz, Freshies Fresh and EasyKrishi, among others.

Despite using technology to check if farmers will have a good yield, timely repayment of loans can still be an issue if personal needs crop up.

“Lending to FPOs reduces that risk. If an FPO fails to pay you back, it misses out on loans for the entire group,” says Rehan Yar Khan, partner at Orios Venture Partners.

Even then, there is a mixed perception regarding the effectiveness of FPOs. In some regions like Madurai, FPOs have been a successful model, but in some areas in Bihar, it lags, says Saxena of MicroSave Consulting. According to a Strategy Paper for Promotion of 10,000 FPOs by SFAC, 50% of the existing FPOs are in the fund mobilisation and business planning phase while 20% of them are struggling to survive.

“They are not uniform in their set-up. And at times, large farmers or the more experienced ones play a key role there. At times, the voice of the small farmer is not heard,” adds Saxena. But with the right practices and resource optimisation in place, many FPOs have become profitable for all their activities across the value chain, he notes.

According to Samunnati’s Kumar, FPOs have huge potential, but there should be an effective engagement to change that potential into a possibility. “They are not businessmen. They have come together for mutual benefits. Some of them may be more enterprising than others. They are an informal set-up; so, they cannot be left to themselves. As a society and community, we have to train them to act like management, which will happen very soon.”

The majority of these FPOs are still in the early stage in terms of operations and have only 100-1,000 members. They require not only technical handholding but also adequate capital and infrastructure facilities, including market linkages, for sustaining their business operations, the NABARD paper states.

Drawbacks Of Limited Data, Financial Institutions’ Resistance

As of now, most startups in the agri-fintech space are providing data support to financial institutions and monitoring crops with the help of new-age technology. However, getting adequate data is a big challenge in India. “Most land records are missing or in one’s grandfather’s name and several grandchildren ask for loans citing the same record,” says Singh of Intellecap.

Consequently, these startups have to invest a lot in time and resources to gather farm-related and farmer-related data to support financial institutions. Besides, it is difficult to access reliable agri-data owned by the government, thus making the potential income assessment a tricky affair.

Additionally, most of them do not have full-stack data (land records, weather information, crop information, among others), which is usually demanded by financial institutions. Most banks are, therefore, sceptical about whether startups could eventually provide all the data required by the organised sector.

Plus, they sometimes have a limited understanding of the solutions and the potential of these technologies. That is why they still rely on their local staff for any information related to farmers and their crops. Banks, too, demand all relevant data for four-five years before conducting a pilot and gathering so much data could be difficult.

“We realised early on that banks need a lot of data and farmers cannot provide that. So, we approached FPOs, but even they did not want to give it. All they want is market linkage,” says payAgri’s Kaimal.

There are some exceptions, though. For instance, YES Bank uses a software programme to geotag farmlands and monitor remotely while RBL Bank uses psychometric data to understand the behaviour of rural customers.

Tailoring Current Models For The Agri Sector

Besides FPOs, partnerships with market-linkage startups seem to help in data gathering as the latter keeps records of transaction history and other data, which makes it easier for financial institutions to disburse credit. In fact, transactions with market-linkage and inputs startups are usually the only records which agri-fintech companies can provide to banks, and their business models have to be tweaked accordingly.

According to Mathur of Bharat Innovation Fund, partnering with market-linkage startups makes loan recovery easy, and closed-loop models are working well lately. “When the product is sold, you approach a market-linkage startup. For instance, you have given a loan of INR 3 Cr to a farmer for 1,000 tonnes of chilli, and you want the startup to settle your loan and pay back the rest to the farmer. It is also an opportunity for startups to control the way money is used,” he says.

For most startups, financing is part of the bundled service, making it easy to collate data. “Startups provide multiple services and, therefore, have detailed data on what the farmers grow and other relevant information. So, they can approach financial institutions with all this data. It is a typical model that will work soon,” says Singh of Intellecap.

On a positive note, Khan of Orios Venture Partners says that with innovative models and technology-enabled solutions, rural fintech will become a major investment theme within agritech as financial inclusion is crucial for this sector. “Finance being a key component, a lot of startups will figure out these issues. And the opportunities will be huge as the sector is huge,” he concludes.

Correction Note | 14.35, January 12, 2021

Use or reference to the trademark logo of Zuari Agro Chemicals Limited in the article was an error and the same has been rectified by removing it.