SUMMARY

India's urban farming startups are tapping the hyperlocal demand for fresh high-quality produce in cities with vertical farms, hydroponic growing and greenhouses

While VC interest in urban farming has been on the rise, startups need to tackle challenges such as high cost of operations and lack of product variety before expanding to newer markets

Despite questions of scalability, factors such as farming land crunch, food security and health issues are encouraging for the future of urban farming

Farming 3.0: India’s Mission Agritech

Once least favoured, agritech is today betted as one of the most resilient sectors. The pandemic has further pushed farmers to leverage technology offered by the startups in the space, thereby making the sector a hotspot of investments. Is India’s agritech on the brink of a permanent transformation or the newly-found success a passing cloud? This playbook explores!

Shivendra Singh, currently the founder and CEO of Barton Breeze, was working on a hydroponics pilot project in Dubai in 2014. At the time, he was just a fresh graduate from IIM-Ahmedabad. Even then, he did not fail to realise the potential impact of the technology on a country like India that needs support to face the vagaries of climate change. The young professional had a new mission. He wanted to provide chemical-free food to consumers all year round and make sure that the agricultural produce would not be affected by the change of seasons.

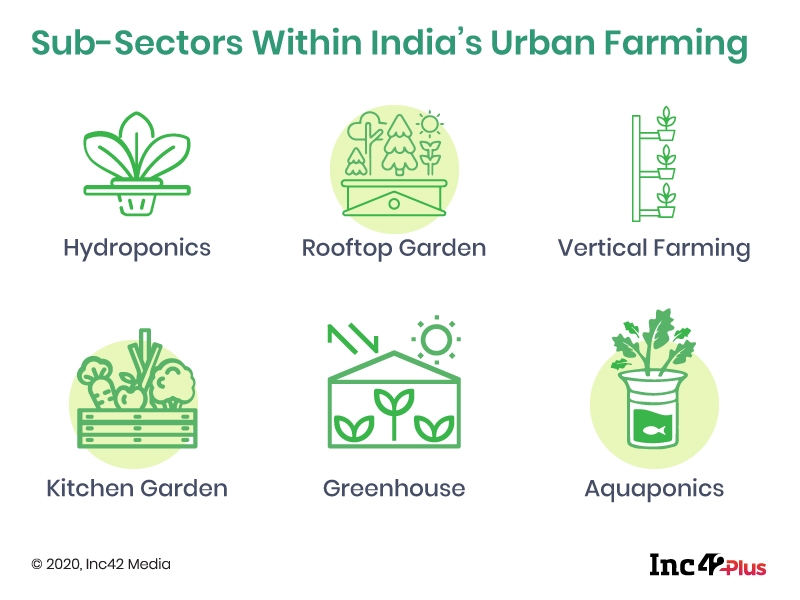

Singh came back to India soon after that and set up an artificial intelligence-driven hydroponic farm in 2015. Five years later, the startup has evolved into a 3,50,000 sq. ft hydroponic and aeroponic farm that grows more than 11,50,000 kg food annually. Both hydroponics and aeroponics enable plants to grow without soil, allowing higher and healthier yields with fewer resources.

Today, Barton Breeze is not a solo venture in this space. A host of urban farming startups such as Clover Ventures, Homecrop and Growing Greens are also working on the rising levels of pesticides in farm produce by growing crops in a controlled microclimate in farms or sourcing directly from personally-vetted farming estates.

According to an analysis by Pesticide Action Network India, a total of 275 pesticides were registered for use in India in 2016, of which about 255 are chemical poisons and more than 115 pesticides out of the 275 are highly hazardous. But the harmful nature of the pesticides did not create enough commotion to enact change. As a country which has been too concerned about feeding its humongous population since Independence, the quality of food remains a matter of discussion only in newsrooms and certain elite circles.

It is no longer so. The ‘mission clean food’ startups mentioned above leverage terrace gardens, hydroponic systems, integrated farming and other new-age methods that use nearly 90% less water than field farms, 40% less fertiliser than traditional agriculture and zero pesticides. Crops which usually grow in 30-45 days, now take as few as 12 days due to urban farming methods like hydroponics, claim these companies.

Before we dive deeper, let us look at the basics of urban farming, also known as urban agriculture or controlled-environment farming. The term generally refers to horticulture cultivation using the controlled-environment agriculture (CEA) technology where the light comes from LEDs, and temperature/humidity is likewise programmed. There are certain theoretical advantages here. For instance, food can be grown close to where the demand is as traditional farmland is no longer required. As a result, fresh produce can reach city dwellers within a few hours without the need for resource-intensive transportation, refrigeration and storage.

With the urban population in India at 377 Mn – it is estimated to touch 404 Mn by 2050 with 50% people expected to live in cities – startups, too, are keen to cater to the growing demand and looking at the segment for sustainable business models.

Investors Sow The Seeds Of Next-gen Farming

Given the rising opportunities across the agri value chain, especially in a pandemic-hit world where farming is not as severely affected as other key sectors, agritech is thoroughly explored as a sustainable investment option. Urban farming is undoubtedly riding this wave.

Of late, both angel investors and venture capital firms have shown a growing interest in the startups operating in this space. Barton Breeze told Inc42 how calls from investors have gone up by 150% and customer queries by 200% since March. The startup builds smart farms, operates them and sells the produce directly to customers.

According to Avinash BR, the cofounder of Clover Ventures, the demand side in India has recovered faster than the supply side. Therefore, upstream areas involving core supply, supply chain and services catering to farms and farmers are evincing a lot of interest.

“Besides fintech and edtech, agritech is also seeing a huge interest from investors. There are tremendous opportunities around the whole gamut of the sustainable food business or the macro theme of food security. It starts from how you plan for sustainable food production for a growing population to how you grow with optimal natural resource utilisation and how you make farming more sustainable and resilient with the focus on yields. These are different areas where a lot of activities are happening,” he says.

Clover is a Bengaluru-based agritech platform that works with smallholder farmers and manages a network of more than 70 acres of peri-urban farms. It has also developed a well-organised supply chain and sells its greenhouse-grown fresh produce to B2B clientele, including cloud kitchens, fine-dining outlets, food processors and modern retail facilities located in Bengaluru and Hyderabad.

Globally, investors are looking at companies which provide sustainable solutions to everyday issues. For instance, Berlin-based InFarm, which has built a network of urban vertical farms with the help of the Internet of Things (IoT) and machine learning, raised $170 Mn last month.

“Investor sentiment for urban farming is showing a positive trend across the globe, and we could see the same in India. Urban farming efficiently utilises private and public spaces in cities.

As more people migrate to urban areas, it will make those communities self-reliant in terms of food supply, thus reducing hunger and poverty. This is why startups providing high-quality produce by using sustainable farming methods are raising funds from angel investors,” says Ankur Bansal, cofounder and director of Mumbai-based BlackSoil. His company is yet to invest in this space, but it is closely monitoring the upcoming opportunities.

“Climate uncertainties and changing weather conditions have affected many farmers so badly that the next generation does not want to farm. But there are visionary investors like the Y Combinator, Pioneer Fund and actress Samantha Akkineni who believes in the future of sustainability and think that is the future of farming,” says Vihari Kanukollu, the founder of UrbanKisaan. The startup uses farm-control software to manage hydroponic farming and also sells kits to help customers grow vertical hydroponic gardens at home.

The Covid-19 pandemic and the consequent slowdown have further compelled investors to revisit their portfolios and shift focus to the ‘essentials’ category.

“Several investment portfolios which do not cover consumer essentials may not recover anytime soon. So, ‘essential sectors’ like agriculture and clean and nutritious foods are bound to absorb this attitudinal shift. We are now seeing never-before positive sentiment from consumers, investors, partners, franchises and even international players who are keen to partner with us,” says Krishna Reddy, founder of Hyderabad-based Homecrop.

The bootstrapped startup sells terrace, rooftop and balcony garden kits to pan-India consumers through its online store and other online marketplaces. The startup offers a monthly or bi-monthly service option and also conducts online and offline workshops and tutorials.

All these have resonated well with urban customers who want to stay away from pesticides and other inorganic methods of farming. For instance, Delhi-based Kaze Living has seen a 50% month-on-month growth since it started in 2018 and a 70% monthly retention. Last month, the hydroponic startup’s average order value stood at INR 1,537.

“The advantage of hydroponic farming is that the product is completely free of pesticides and chemicals. We grow them in RO-purified water, with zero pesticides and chemicals, and we make farm-to-doorstep deliveries within three hours of the harvest,” says Anisha Goel, cofounder of Kaze Living.

Asked about the rising investor interest, Goel says, “Through our long-term relationship with India’s National Horticulture Board, we are in touch with 15 potential investors who are keen to partner with us and invest INR 30-50 lakh in Kaze Living farms.”

Sustainable Farming Vs Business Sustainability

Cleary, urban farming is now closely watched by the investment community and consumers, too, are more invested in the concept. But the bigger question is: Will there be commercial-scale adoption to ensure long-term success? Currently, urban farming is still in its early stages, mostly pursued by hobbyists and enthusiasts, and a few attempts happening at commercial cultivation. “However, people are still looking at several factors such as economies of scale, consistent supply and sustainable models,” says Avinash of Clover.

Interestingly, traditional agriculture is both a cause and a victim of water scarcity, according to FAO, and this requires a serious adoption of sustainable farming techniques. More than 1.3 Bn people in India are on the verge of a severe water crisis while farming accounts for nearly 90% of the country’s consumptive water use. By 2030, India would require twice the amount of water available to feed the growing population, and this scarcity has already rendered a lot of valuable farmland completely useless.

Although entrepreneurs in this space vouch for urban farming as the next most crucial agricultural upgrade in India, making things commercially viable would not be easy. “

Urban farming is a step towards sustainable agriculture, but it is only a part of the entire road map to sustainability. This model will only work if it is executed in a commercially viable way. One should consider setting up plant factories around the cities to ensure a hyperlocal approach as not everyone has space, time or money to grow these on their own,” says Kanukollu of UrbanKisaan.

If factory production, and not individual farming, will bring in the scale as Kanukollu believes, another critical factor that can drive commercial-scale adoption is expanding the range of agricultural produce. However, it will require more innovation, tech usage and experiments in food science.

“This farming model is typically leveraged only for a select range of leafy vegetables and certain other herbs. Unless the model can help grow a wide range of veggies and fruits, its adoption will always remain marginal,” says Rajeev Ranka, Principal at Incubate Fund.

Incubate has already invested in Bengaluru-based Gourmet Garden, a full-range brand offering zero-contamination veggies and fruits. The reason: The model allows the startup to build an end-to-end business that can scale sustainably and offer quality produce to consumers at a relatable price premium.

Currently, the demand is seen among conscious consumers who trust urban farming produce due to negligible chemical traces, lower water utilisation and production proximity (hence, fresh produce reaches homes fast). But it is still a niche segment. “As of now, urban farming has not addressed the production of staples such as rice, wheat or maise. But the ability of decentralising production will make it a good support system to the existing agricultural ecosystem,” says Siddharth Bharadwaj of Social Alpha. His firm has invested in 19 agritech startups in India, including Farmveda, Kamal Kisan, Upsoil and the likes.

Need Of The Hour: Cost Efficiency

The biggest barrier to adoption is the cost of urban farming models, especially the prohibitive upfront costs. “The model of controlled-environment farming has a large spectrum based on whether it is single-level or multilevel, uses artificial lights or natural, requires temperature control or not, the automation level and so on. Only those models which control all essential variables at an efficient capex level will be able to scale. New funding options could also accelerate this adoption,” says Ranka of Incubate Fund.

Primarily, it is the need to bring sources of food closer to points of consumption that has given rise to urban farming. As the niche segment starts expanding to serve more customers, most businesses will see a spike in demand. But for that to happen, the prices of products need to compete with those freely available in the market.

“Innovations in the segment will make this transition and adoption simpler and cheaper from a production point of view. And that will directly impact the pricing of the final product. When urban farms start producing larger quantities of food, retail prices will come down and adoption will increase,” explains Bharadwaj of Social Alpha.

Moreover, this kind of farming can only be adopted if technology enablers can make it affordable for farmers. That is what some startups like UrbanKissan are working upon. “We are on the road map to make it accessible to all marginal farmers and foresee the switchover happening in the next 24-28 months, says Kanukollu.

As of now, customers are not likely to pay a disproportionate premium for the quality of the produce. On average, the expected premiums are likely to be in the range of 20-30%. However, the existing models require 15-30 times higher capex than regular farming and productivity has to rise significantly to make up for additional costs. “Given the level of innovation and cost, most players may only focus on an extremely narrow range of produce (read vegetables) for which economics work. With innovation in model design, an efficient cost structure and more awareness regarding the benefits of this gold standard of farming, the range could become broader and the model more relevant,” says Incubate Fund’s Ranka.

“Lowering the production cost in hydroponic farming makes commercially viable production of strawberries or exotic salad greens in the city centre possible. You can recover the capex invested within two years and a half and produce lettuce at INR 35 a kg,” says Goel of Kaze Living.

“We believe scale will come naturally as consumers get easy access to high-quality, chemical-free produce. Our approach is based on extensive market research in the habits of consumer kitchens, eating habits of people and expenditures on food and health categories. Our efforts to produce clean food will eventually reduce health costs of families and we are certain that consumers will choose quality,” says Anubhav Das, founder and managing director of Red Otter Farms.

Launched in 2016, the startup initially focussed on producing salad greens and now specialises in aquaponic farming, which combines growing of fish and other aquatic animals using aquaculture and growing plants without soil using hydroponics systems. Plants are fed with the waste from aquatic animals and the vegetables in turn clean the water that goes back to the fish.

Explaining how the company is trying to reach scale in a cost-effective manner, Das says, “We ensure predictive farming through a strong data-driven work model where every seed germination is tracked. We also use land and water resources efficiently as is done in aquaponics and design our systems for scale to reduce initial investments, thereby controlling our prices.”

Understandably, the cost factor will continue to determine demand within the sub-segments of urban farming. For instance, the demand for terrace gardens has picked up due to lower setup costs. Similarly, integrated farming systems are gaining traction as early-stage innovations make them affordable. Hydroponics, which is the most expensive system right now, is also pursuing innovations to bring down the cost.

“Some promising startups are addressing this issue, but they are still at the product development stage,” says Bharadwaj of Social Alpha. Nevertheless, startups across all sub-segments have been able to cut costs in terms of storage, refrigeration and food transportation by reducing food miles, which negates the cost of farming.

Which Sub-segments Can Address India’s Agrarian Crisis

When the issues of cost and product range are resolved, urban farming is expected to address the major pain points of traditional agriculture. And many of its sub-segments will play a vital role in that transformation.

Although land-scarce countries like Singapore have mainly adopted urban farming, the agricultural land volume is not a major problem in India. The country’s arable land area is the second-largest in the world, after the US, and its gross irrigated crop area is the largest in the world. “It is not that land is scarce in India. It is all about how the land is utilised, how tightly farmers can be integrated into the supply chain and how agriculture can be made more remunerative for them,” says Goel of Kaze Living.

Moreover, India will soon face the challenge of feeding its growing urban population. This is no mean task as food production, processing, transportation and agricultural waste are putting enormous pressure on environmental resources. Historically, an increase in food production has always happened at the expense of water usage. As of now, 70% of the world’s fresh water is used for agriculture and 70% of water pollution is also caused by it.

Adopting modern techniques could be essential to overcome such a situation and make India food-secure. “We believe that urban India has been disconnected from farms, farmers and their agrarian roots, and people have now realised this. Food growth and sustainability cannot be achieved unless cities take control of their food systems,” says Shivendra Singh, founder and CEO of Barton Breeze.

But with so many new technologies and systems around, which of the current sub-segments will see more adoption?

“Smart urban farms will have vertically stacked growing beds, up to five-six levels high, using less than 1% of the space required by conventional growing. The land is a precious commodity in densely populated urban areas like the National Capital Region and other metros. The hydroponic technology helps save valuable water, land and labour resources,” says Singh.

However, agritech-focussed VC firm Omnivore bets on greenhouse farming over hydroponics and vertical indoor gardens. Hence, its investment into Clover.

“The need for urban farming is born out of an absence of land and light, but India lacks neither. In general, there is certainly a play for protected, climate-resilient agriculture in the country. So, hydroponics is useful but only minimally. You do not need hydroponics for most of the things Indians grow and eat,” says Mark Kahn, managing partner of Omnivore.

According to him, vertical indoor farms may eventually cater to a slice of India’s urban elite. But they are certainly not the answer to the increasing demand for superior fresh produce. “Today, India has a rapidly growing tribe of conscious consumers who demand traceable, sustainable and high-quality produce. Greenhouse farming meets all these requirements and it has been part of Indian agriculture for more than two decades now.”

Can Startups Address Challenges Of Scale?

Although some models within the urban farming framework may work better than others, the key lies in achieving scale, bagging more funding and climbing out of the ‘niche’ to cater to mainstream consumers.

“Given the pandemic scare and the growing number of consumers looking for healthier and fresher alternatives, this space is likely to boom in the coming years. Many restaurants, cafés and home chefs will look to source premium produce from networks of urban farms. It will be a more sustainable and healthier alternative to traditional private labels,” says Bansal of BlackSoil.

However, a robust deal flow will require more than technology and innovation, he notes. The models need to showcase economies of scale and monetisation potential. Such models, VCs feel, will have a bigger impact and several backers.

Overall, urban farming could become a strong contender that can meet the food requirements of a growing population, turn profitable and see more funding opportunities, provided there are innovation and use of technology. “If we do not bring technology to agriculture, we are not going to get there. The good thing is technology will allow us to raise performance and lower cost at the same time. When the cost of vertical farming starts going down, it will match the cost of traditional agriculture at one point,” says Singh of Barton Breeze.

According to Bharadwaj of Social Alpha, experts do not consider it a fad and closely watch the space. “We have seen urban farming move from a micro trend to a macro trend in the last decade. We expect it to grow into a megatrend in the next five-eight years. Early-stage entrepreneurs will increasingly bring about the changes needed for operationalising the segment. It is exciting, given the potential urban farming holds.”