SUMMARY

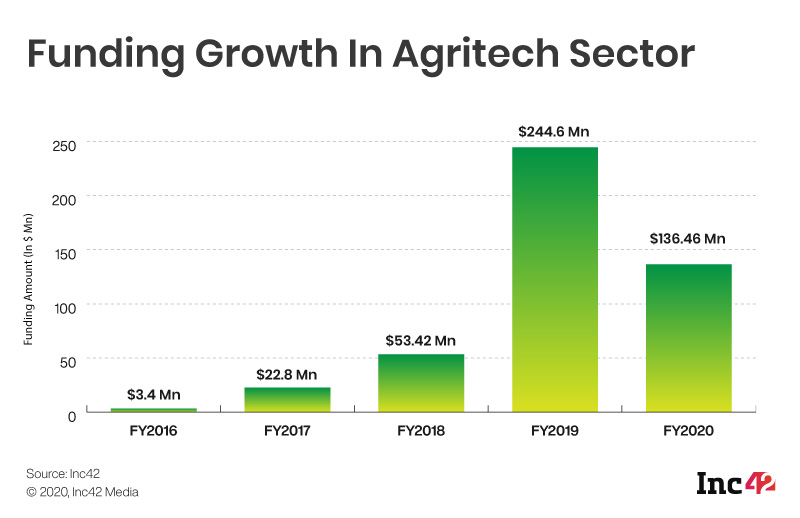

India’s agritech startups received $136.46 Mn in funding last year, compared to $244.6 Mn in 2019

From 2014 to H1 2020, Indian agritech startups have received $467 Mn in funding

Which agritech startup made it to this year’s Agritech Startup Watchlist?

Startup Watchlist 2021

The Inc42’s annual series, Startup Watchlist brings together the list of top growth stage startups to watch out for in 2021 across various industries.

This article is part of the fifth edition of Inc42’s Startup Watchlist series, an annual series in which we list the top growth-stage startups to watch out every year from some of the most trending industries in the Indian startup ecosystem. Explore all the stories from the ‘Startup Watchlist’ 2021 series here.

You can view our early-stage discovery watchlist here.

India’s agriculture sector has for long been loss-making for the majority of farmers. Some of the reasons for this state of affairs is low landholding, lack of modern technology and high-interest rate loans from the informal lending sector. Agritech startups are trying to fix all these issues, with the use of technology and innovative models of underwriting loans. Thanks to the internet and smartphone penetration across the country, alongside the changes at the policy-level and growing investors’ interest, the opportunities for agritech startups are galore.

In the last five years, India’s agritech startups have been mushrooming in the space like never before, building farmer platforms, B2B agri marketplaces, rural fintech enterprises, farm-to-fork brands among others.

Despite all this, so far, the role of agritech startups has been very minuscule and limited, reaching less than 20% of Indian farmers. According to Inc42 Plus analysis, the addressable agritech market potential of India is expected to touch $24.1 Bn by 2025, out of which India’s agritech startups have tapped just $204 Mn in 2020, which is less than 1%.

So far, the market linkage segment has emerged as the most promising sub-sectors, and is expected to reach $12 Bn by 2025. Few of the notable startups in this category include WayCool, Origo Commodities, Ninjakart, Crofarm and Agrostar among others.

Further, in terms of funding, the agritech space has received $467 Mn, from 2014 to H1 2020 combined. Our latest, ‘India’s Agritech Market Landscape Report, 2020’ delves deep into this emerging agritech landscape and finds out what is driving the revenue in this sector. Read the full report here.

In line with the advancements in the sector, Inc42 has curated a list of some of the agritech startups in India that have the potential to outshine their competition in 2021. You can read it here.

Editor’s Note: The startups listed below are in alphabetical order, and do not represent the ranking of the companies in any manner.

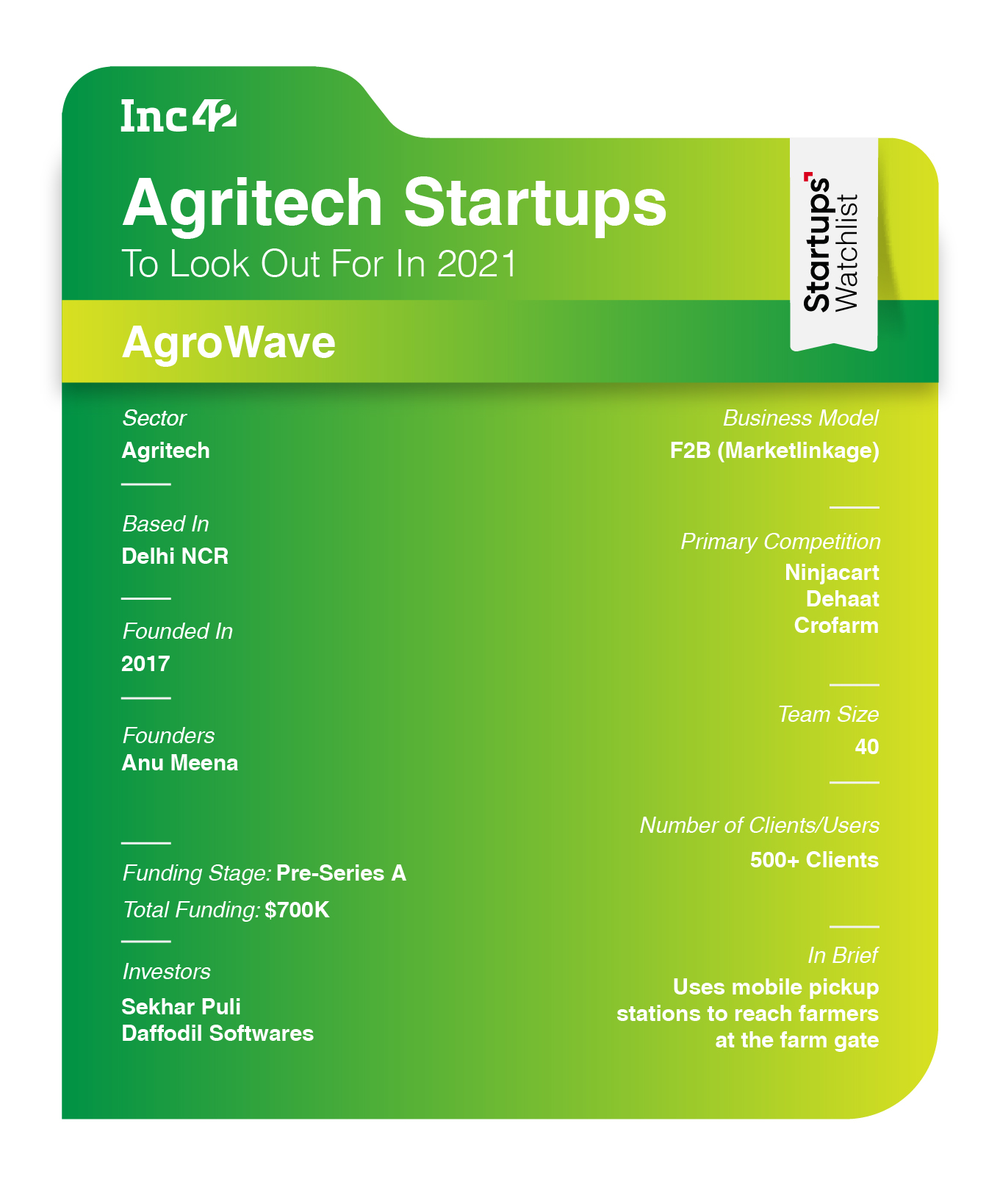

Agrowave: Building Mobile Pickup Stations (MPS) For Sustainable Agri Supply

Innovating at farm gate level is Delhi-NCR based agritech startup Agrowave. The company reaches out to small and marginal farmers in India’s interiors, buys fresh produce and sells them to businesses like cafes, restaurants, hotels, retailers among others. But the question is how are they doing this?

Agrowave’s founder Anu Meena told Inc42 that the company is building a farm-to-market mobility supply chain through an integrated network of smart route mapped mobile pickup stations at farm-gates. “We buy products from farmers and do grading, sorting, packing at our warehouse and sell to businesses where we apply different margins on different products,” she added.

Today, Agrowave procures fresh produce from Palwal, Sonipat, Sawai, Madhopur, Nuh, Alwar Sambhal and Agra, and sells them to businesses. Further, the founder told Inc42 that the company also sells the produce to mandis in Delhi NCR, however, once they have regular supply from its MPS (mobile pickup stations), they will be able to get better margins by selling it to businesses than mandis.

With just 50 MPS at farm-gates, Agrowave has managed to increase its revenue by 32% in December last year. In the last ten months, the company earned close to INR 2.66 Cr MoM. In FY20, its revenue stood at INR 27 Cr, compared to $2.1 Mn in FY19, as revealed by the company.

The company is yet to reach profitability. But, it believes that as it expands its mobile pickup station model to procure more produce from farm-gates, the company will be able to optimise its unit economics.

In the next ten months, the company is looking to build 1000+ MPS at different farm-gates to increase the number of procured products directly from farmers. “We are onboarding large ticket size clients now and helping more and more farmers with higher volumes and better rates,” said Meena.

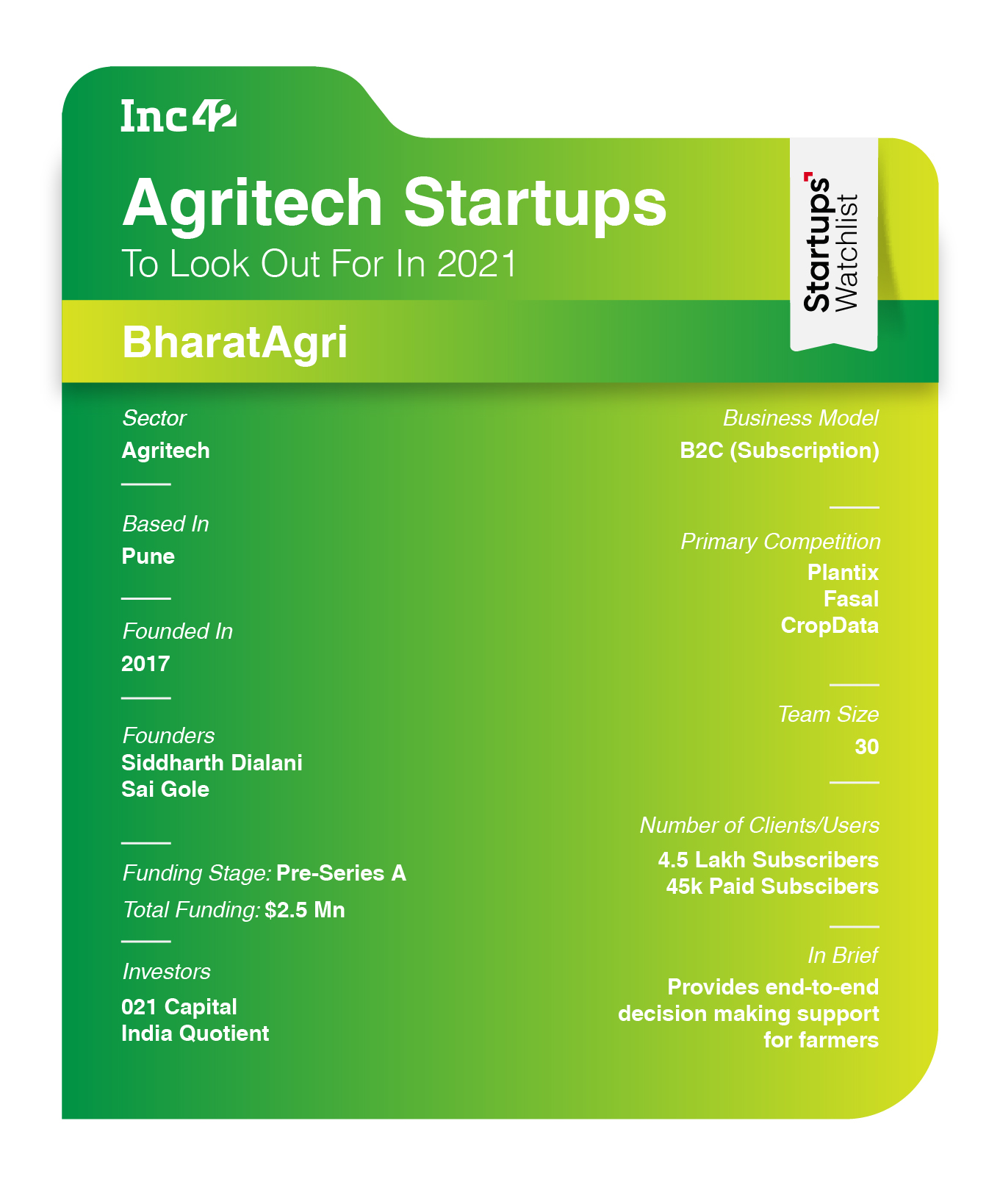

BharatAgri: Leverages Data Science To Provide Personalized Advisory To Farmers

Thanks to the penetration of smartphones in the rural regions across the country, farmers are now slowly adapting to new age apps and technology solutions that can help them in their daily activity. However, access to the internet and smartphones for small and marginal farmers is still a distant reality.

Targeting the medium and large-scale farmers who are typically into growing cash crops like fruits and vegetables is BharatAgri. The agritech firm is targeting to tap 67 Mn medium and large-scale farmers in India with an addressable market size of $6.7 Bn.

The company offers tech-enabled digital services to these farmers, primarily to those who have access to smartphones and internet. Its app-based platform provides personalised advisory to farmers, helping them increase their profits using data science, real-time monitoring, and weather-based advisory. Under the payment model of BharatAgri, farmers pay a subscription fee to be a part of the platform, which is renewed every six months. Further, the company said that over time, the advisory services would evolve into a full-fledged platform, providing support services to farmers through industry partners.

Before the pandemic hit, the company was selling its services offline through a dealer network, and the services were delivered offline. With lockdown restrictions in place, BharatAgri pivoted to a digital model, where its services are discovered, sold and served online. Even the cash collection happens using digital means.

In the last 12 months, its digital subscription sales and revenue has increased 17x. In December 2019, the company was present in four districts of Maharashtra. In a short span of one year, BharatAgri is now present in all districts of Maharashtra and 10+ districts of Madhya Pradesh.

The company said that its business is unit economics positive, but not profitable yet. “We aim to onboard 10K new paid subscribers every month from June 2021 onwards, who will be onboarded online,” said Dialani, stating that in the coming months it will also be introducing support services on the platform for its premium users.

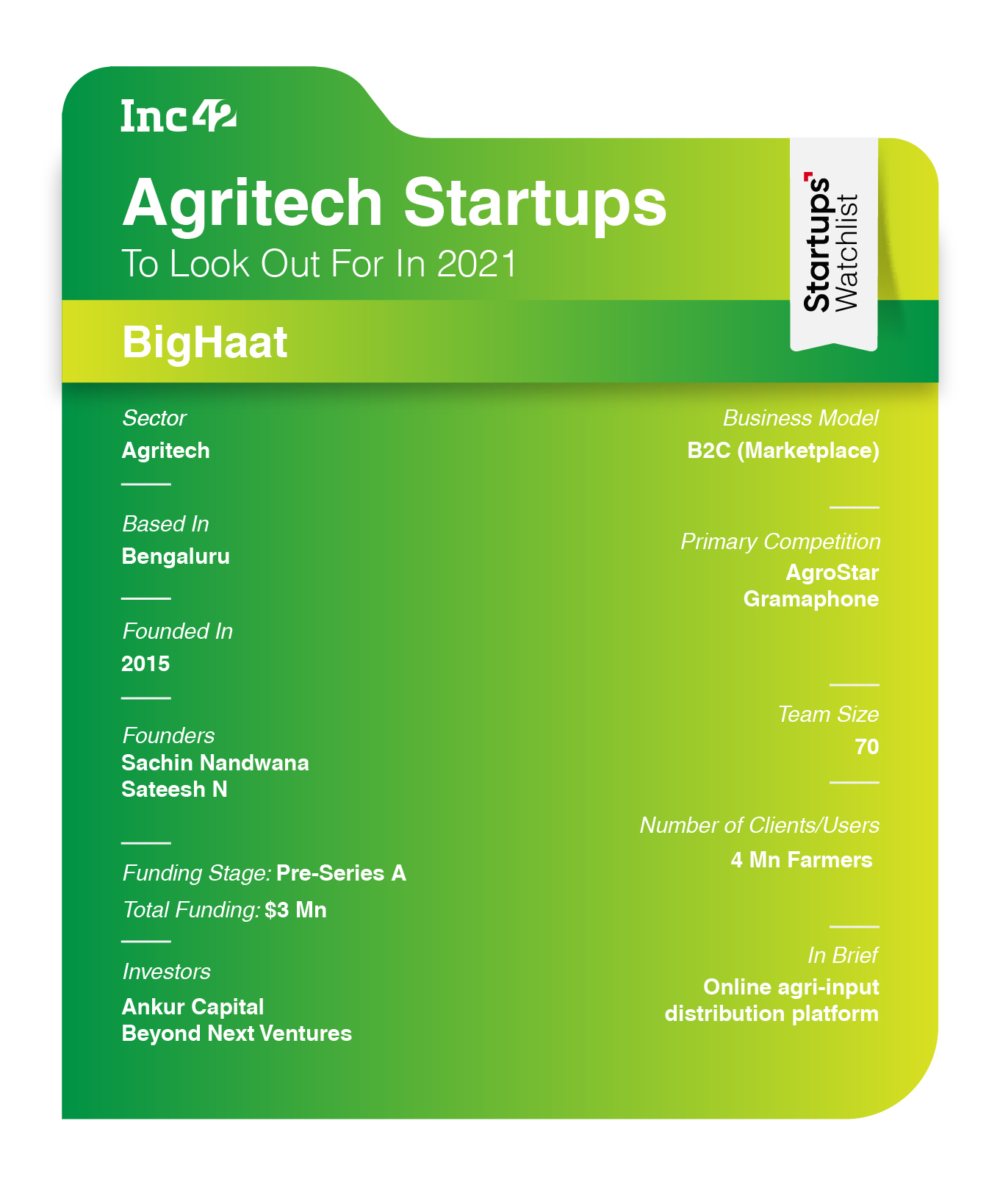

BigHaat: Marketplace For Agri Inputs

Helping Indian farmers in their pre-harvest journey is Bengaluru-based BigHaat, a next-gen agritech startup that provides crop advisory and accessibility to a wide range of high-quality farm inputs leveraging the power of data, science and technology. The startup is eyeing the agri-inputs market, where close to 145 Mn farmers across India spend about $52 Bn annually, particularly on the farm inputs to grow crops. This segment is growing at a CAGR of 10%.

Similar to BharatAgri, BigHaat also told us that it has embraced the digital channel to acquire and engage farmers, leveraging on the opportunity being presented by the exponential growth of smartphones and internet usage in rural India. In addition to this, the company also claimed to be supporting farmers, including small and marginal farmers, who do not have access to smartphones by providing a missed call number, where they can engage with an agri-expert in their local language.

But, how does BigHaat earn its revenues? It told Inc42 that the company earns from the suppliers who are listed on its marketplace model. However, it is offering farming advisory as a service for free. On the flip side, BigHaat has also become a de facto launchpad platform for various manufacturers to reach pan-India farmer base with a way lower cost of marketing and distribution. It has partnered with large MNCs like Bayer, Corteva, UPL, along with 200+ brands offering 4000+ SKUs.

In the last 12 months, BigHaat has grown exponentially, where it has witnessed 3x growth in revenue, 5x in terms of user base (1.5 Mn monthly page views and 250K monthly active users (MAU)) and 2x in terms of team size, across 50% of pin code locations in India. The company said that they are almost profitable at the unit level and are planning aggressive growth in the coming years.

Recently, BigHaat also collaborated with Microsoft towards building next-generation solutions for farmers to impact their lives and building a sustainable agriculture ecosystem. “We will continue our growth momentum of last year, and will continue to build 5x growth supported by strong tailwinds, and our recent fundraise,” said Nandwana, envisioning to become one of the largest agritech players in India by 2025.

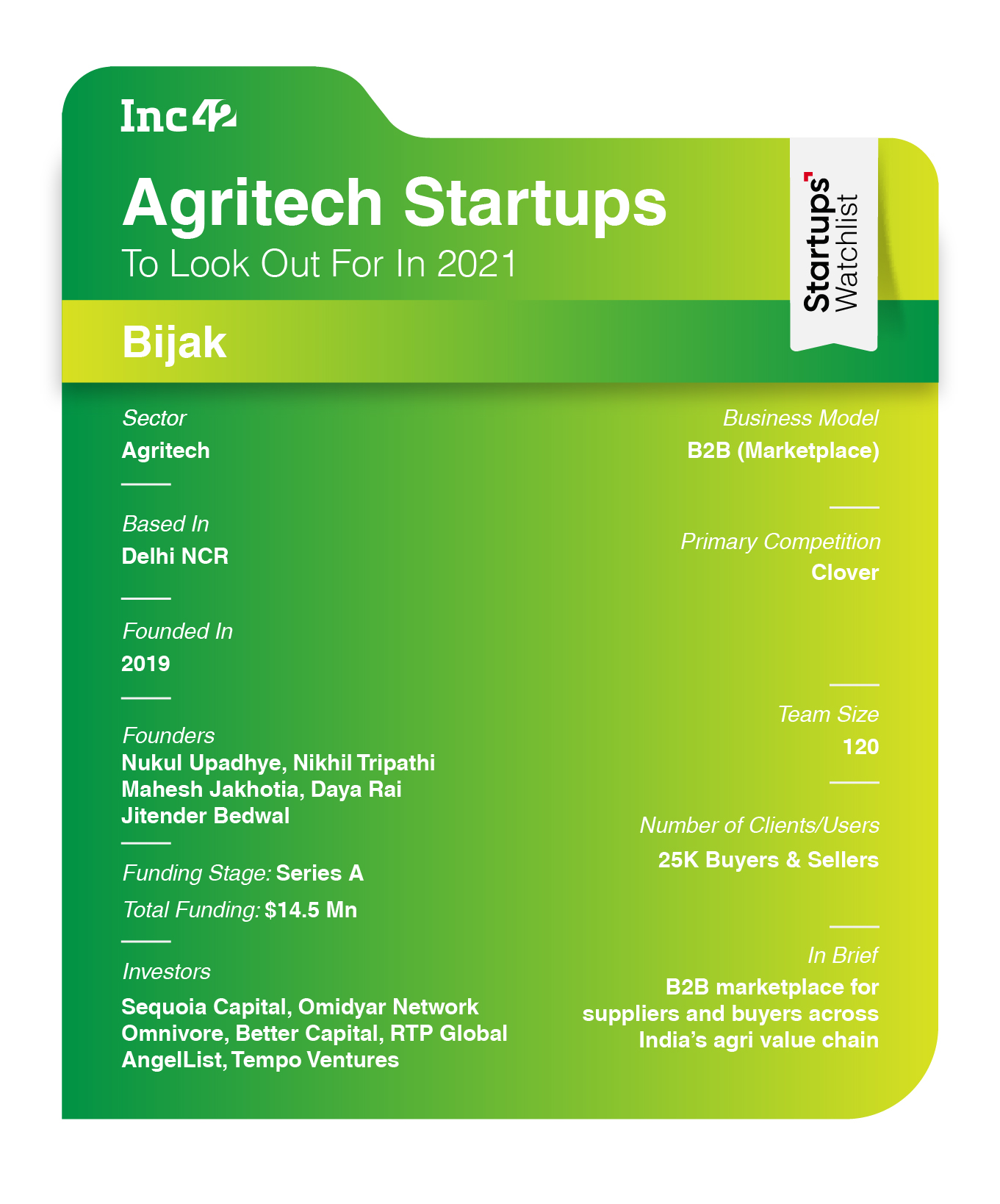

Bijak: A B2B Marketplace For Farmers, Middlemen And Food Producers

Digitising the physical mandis, artiyas (commission agents), dalaals (brokers), loaders, mills, and middlemen by providing them with a user-friendly online mobile application is Bijak. Its app is currently being used by buyers or sellers of Agri commodities, including traders, processors, aggregators, and other agritech startups. With this, Bijak is eyeing a $200 Bn market opportunity of digitising offline agricultural marketplace.

Currently, Bijak earns from lead generation commission from farm financiers (including rural banks, NBGCs, fintechs, etc), who get access to Bijak’s data pool of farmers and agri-transactions. The platform charges commission on every loan disbursed by farm lenders.

In fact, in the span of 19 months, the company said that it has scaled to over 600 regions across 25 states, and facilitated trade in over 100 agri-commodities.

Also, the company claimed to have recorded a gross merchandise value (GMV) of INR 1,200 Cr, compared to INR 50 Lakh in October 2019. Since March, the company said that it has grown 278% in terms of the transaction value. Its team size has also grown from 30 to 120 people in the last two years. “Our plan for 2021 is to create more liquidity across all commodities to ensure users get the best price and counterparties. We also plan to roll out additional features such as financial services and logistics,” said Nukul Upadhye, the cofounder of Bijak, stating the roadmap ahead of the company.

Clover Ventures: Offers Full-Stack Agronomy Solutions To Urban & Peri-Urban Farmers

Bengaluru-based Clover provides full-stack agronomy solutions to the greenhouse farmers in the network, improving yields and standardising output quality. Currently, present in two cities, Bengaluru and Hyderabad, the company manages a farm network of greenhouses that are based in peri-urban and rural areas surrounding urban consumption zones, thereby ensuring freshness and reducing spoilage.

“With our greenhouse focussed cultivation, we are trying to largely make cultivation weather/climate-neutral and thereby ensuring there’s no volatility in production or quality. And with our full-stack agronomy intervention for the farmer, we have standardised cultivation pedagogy (the seeds/inputs to be used and the entire set of activities to be done during the crop-cycle), ensuring optimal yield across cultivation,” said Avinash BR, the cofounder of Clover, emphasising on market knowledge, yield and productivity, and market access.

In October 2020, looking at the change in consumer behaviour towards healthy and fresh produce, Clover pivoted to D2C model with more than 100 kirana stores across Bengaluru and Hyderabad with its range of packed produce. “Now, we are doubling our footprint across kirana stores every two weeks and serving individual households and apartments with fresh range of produce in both cities,” explained Clover cofounder Arvind Murali, stating that Covid has only strengthened its vision to democratise access to high quality, safe, healthy and delicious fresh-produce.

At present, Clover caters to about 150+ farmers across Bengaluru and 70+ farmers in Hyderabad. From April to December 2020, the company has been growing at a 43% CAGR. “We also introduced 40 new SKUs in 2020 and expanded to Hyderabad in 2020,” avered Murali. Revenue-wise, the company has grown 4x over the last six months, stating that the total addressable market size is about $100 Bn.

“Our plan for 2021 is to increase our foot-print/customer base in Bengaluru and Hyderabad while planning for other city launches. In parallel, we want to establish and demonstrate branded fruits and vegetables (F&V) as a sustainable category,” concluded BR.

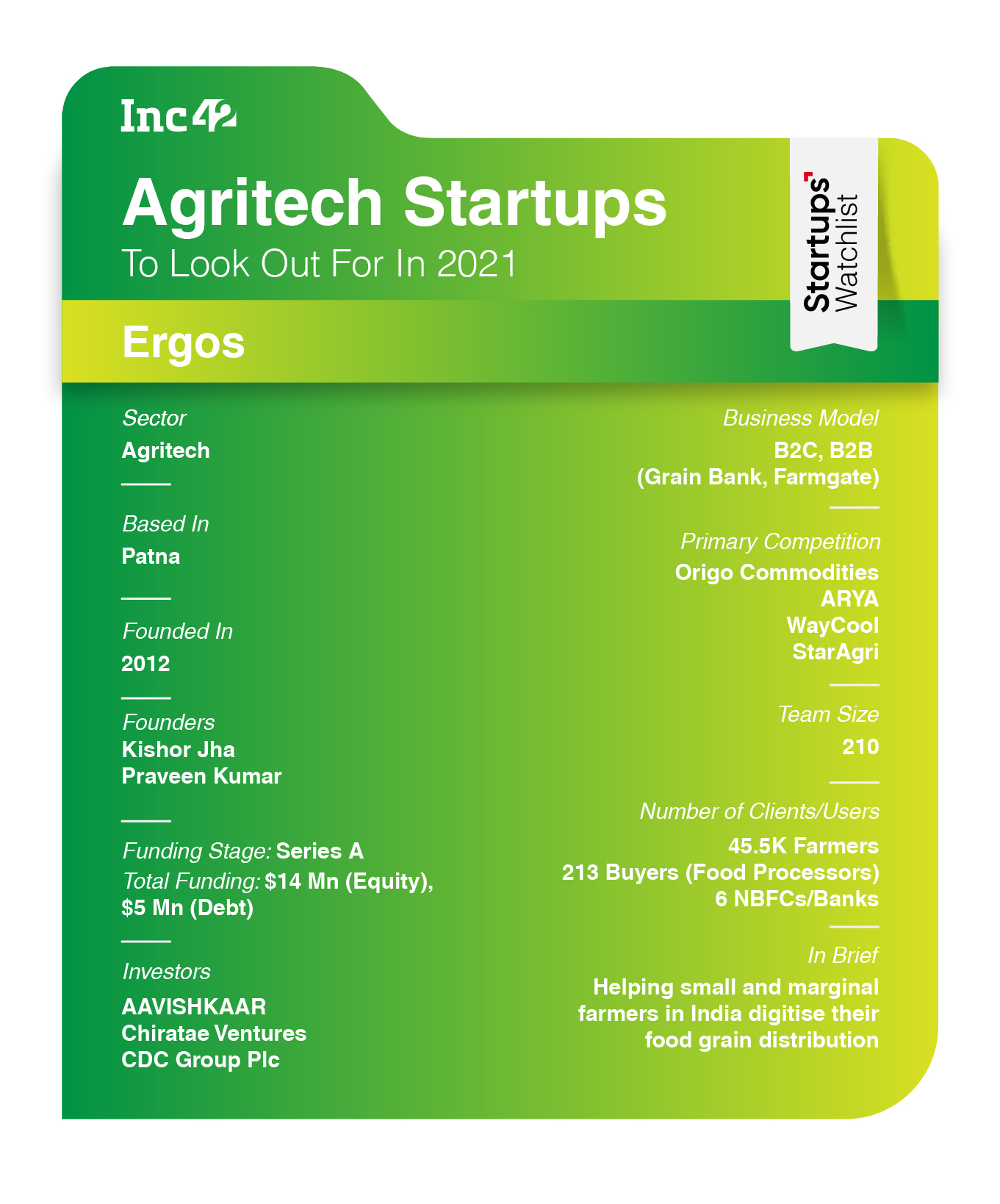

Ergos: Enabling Farmers To Convert Food Grains Into Tradable Digital Assets

Patna-based Ergos has one of the most unique models in the agritech landscape. Competing with the likes of Origo Commodities, ARYA, WayCool and StarAgri, the company is building a ‘Grainbank,’ which provides doorstep access to end-to-end post harvest supply chain solutions to small and marginal farmers. In other words, it looks to enable farmers to convert their grains into tradable digital assets, avail credit against those assets through partner NBFCs and banks, and get better prices for their produce.

Dynamic in its approach, Ergos earns revenue by charging farmers for storing grains on a monthly rental basis (depends on the quantity), and also it charges end buyers and food processors who buy on its platform and charges loan processing and sourcing fee to NBFCs while lending to farmers on the basis of produce stored in its warehouses.

Ergos told Inc42 that during the pandemic, it aggressively increased its warehouse footprints and set up close to 157 grainbank/warehouses across 14 districts of Bihar, compared to 32 grainbank in three districts before Covid, as demand from farmers increased drastically, where it witnessed close to 10K new farmers joining the platform in the last ten months.

The company did not comment on the profitability or revenue of its business. However, its corporate filings under the name ‘Ergos Business Solutions’ revealed that in FY19 the company earned revenue of INR 19 Cr, compared to INR 17.41 Cr in FY18. Also, it recorded a loss of 5.4 Cr in FY19, compared to INR 4.3 Cr in FY18.

In 2021, the company is planning to set up 250 grainbank across Bihar and few districts of eastern UP, serving close to 100K farmers. “This will give us an opportunity to manage close to 350 Cr worth of farmers’ produce on our platform, potentially increasing the income of participants by not less than INR 60-65 Cr,” shared Kishor Jha, cofounder of Ergos, eyeing at an addressable market size of $265 Bn.

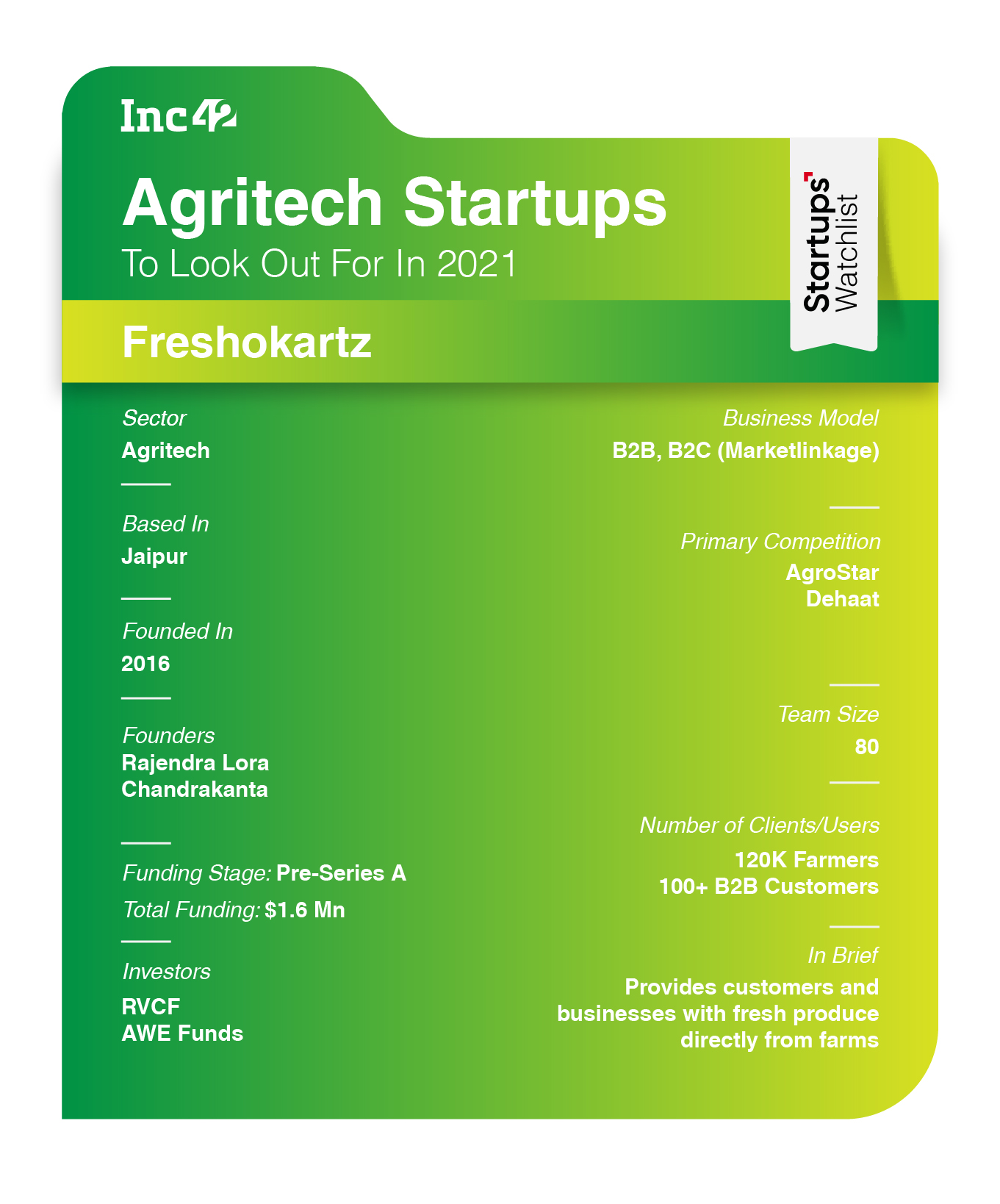

Freshokartz: Offers Soil Data-Based Crop & Fertilizers Recommendations To Farmers

Delivering quality seeds, pesticides and fertilisers to farmers’ doorstep led us to Jaipur-based Freshokartz. The company offers soil data-based crop and fertiliser recommendations to over 120K farmers through a network of 40+ physical centers and mobile app. Besides this, it also helps farmers in market linkages, financial support and advisory among other services.

At present, the company claims to have partnered with about 100+ B2B clients in the market linkages aspects, including Reliance Retail, Udaan, Bijak, Metro and others, alongside 50+ agri input companies such as UPL, Sulphur Mills and others.

During the pandemic times, since a large majority of farmers were unable to go to the market, Freshokartz ceased the opportunity by delivering agri inputs to farmers’ doorsteps. “We saw 20% growth in the last six months,” shared Rajendra Lora, cofounder and CEO of Freshokartz.

Further, the company said that it is gross profitable, ensuring the business is sustainable with limited cash burn. In FY20, the company claimed to have earned a revenue of INR 5.16 Cr, and looks to touch INR 15-50 Cr with a network of 10 Lakh farmers in the next two years. “In the coming months, we will be adding more services like machinery products and other services,” said Lora.

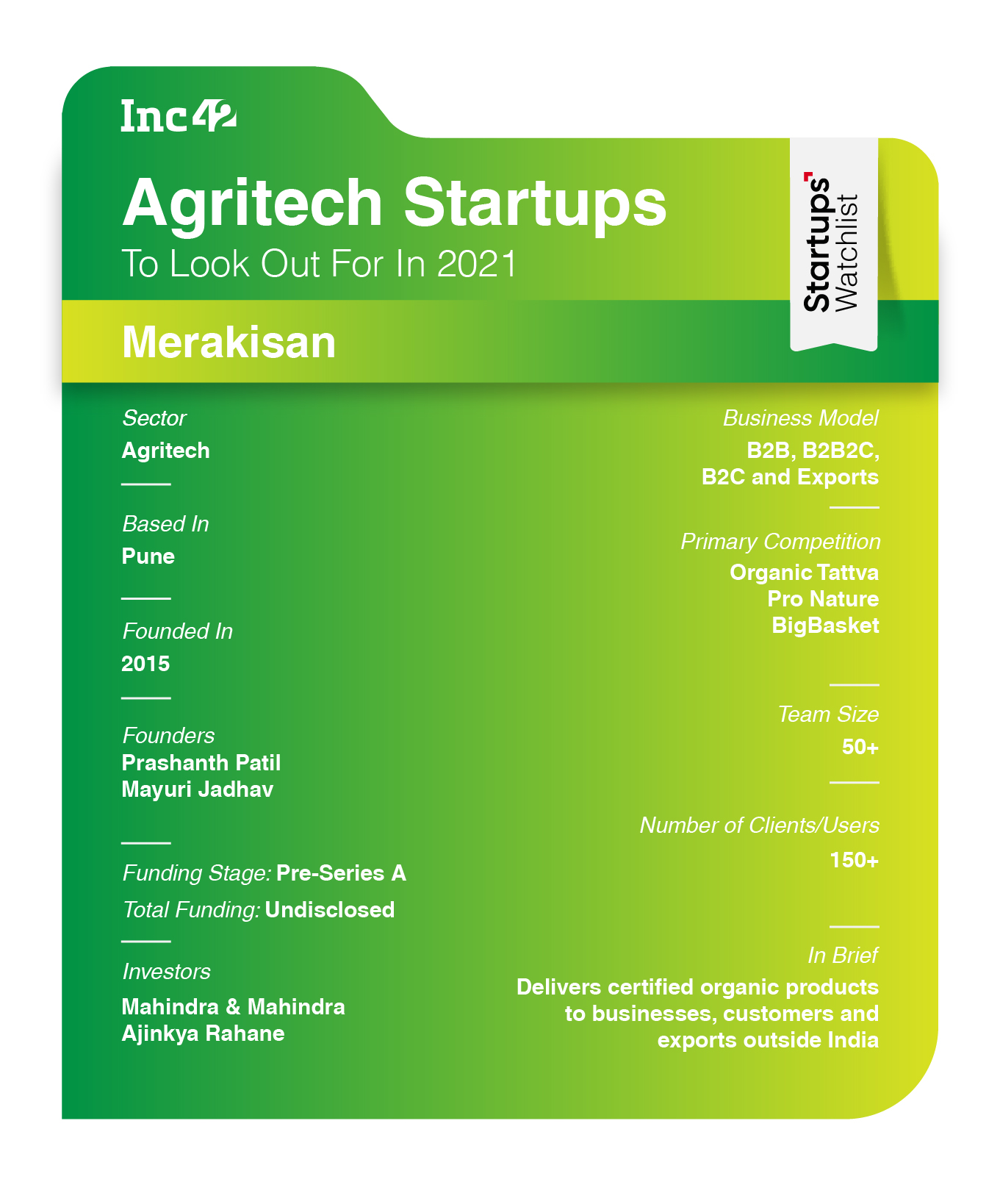

MeraKisan: Delivers Certified Organic Products To Customers In India & Abroad

From addressing the market linkage problems of delivering fresh fruits and vegetables since its inception in 2014, to pivoting to organic agri segment in 2019, MeraKisan has established itself as one of the credible players in the agritech space. Its product portfolio includes non-perishable products like pulses, cereals, sweeteners, dry fruits, spices and millets in bulk and retail.

Currently operating in B2B, B2B2C, B2C and export markets, Mahindra-backed MeraKisan is now focussing on a tech application called Organic Pandit, an organic produce marketplace that leverages blockchain technology for traceability and authenticity of organic products.

“We cater to bulk buyers and exporters with our presence in more than 10+ countries globally and also directly to our end customers through our retail chains present in more than 700+stores and distribution chains in India and also through our very own ecommerce platform MeraKisan Daily,” shared Prashath Patil, founder of MeraKisan, stating that they procure produce directly from certified organic farmers, and have impacted lives of more than 15K farmers across India.

MeraKisan’s ecommerce platform and mobile app, which was launched in February 2019 in Pune, catering directly to customers, has got about 22K app downloads and its online website has witnessed about 9K active users. In terms of revenue, in the last fiscal year, the sales have grown 5x and this year, witnessing a revenue of more than INR 30 Cr in FY20, and in the coming months the company is looking to cross over 10x.

“Monthly, we ship about 5K+ orders via ecommerce marketplace, including Amazon, BigBasket, and other organic ecommerce portals including our website,” shared Patil, and said that in the next three to four months, it plans to take the order numbers up to 10K per month, alongside expanding its product portfolio and service through its tech platforms. “Over the next two to three years we plan to grow to over 20+ countries worldwide in revenue and presence and impacting the lives of more than 25K+ farmers,” he added.

Editor’s Note: The startups were selected on the basis of editorial discretion, keeping in mind various factors such as revenue growth, profitability, funding stage, pivot and growth of the companies in the preceding year among other factors, and have been weighted thoroughly on the basis of the performance of the companies, and some of the information was also gathered from public and private sources.