Data-driven marketing and measurement firm SilverPush has released its TV Advertising Mapping Report on Smartphone and Mobile Operators for the Indian market. Among other things, it highlights that Twitter attracts the least attention and advertising spends from smartphone and mobile operator brands in the digital arena.

The report captures data collected and analysed from June to August 2016. The analysis throws a spotlight on the telecom industry’s two major segments, smartphones and mobile operators, and how they follow different paths across the television and digital world to attract and acquire their customer base.

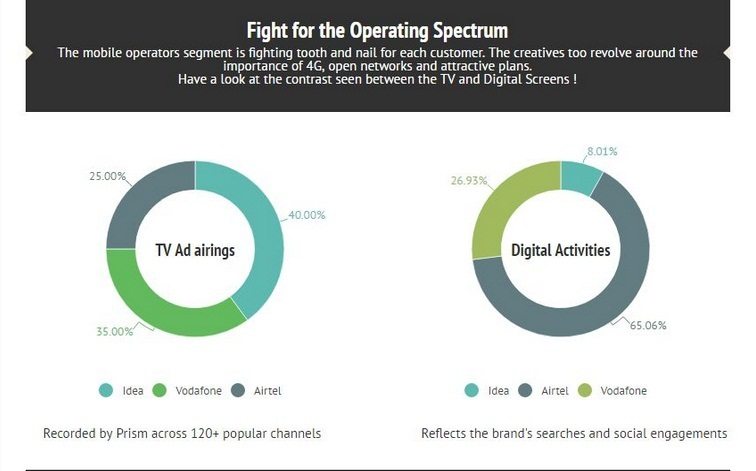

SilverPush employed PRISM, its real-time analytics software, to record the TV and digital data of brands, from over 120 popular channels including general entertainment channels (GEC), movies, news, sports, and regional channels in the country. The mapping revealed that the smartphone and mobile operator categories continue to demonstrate increasingly bullish attitudes on advertising on both TV and the digital medium.

Mobile Operators Are Creating Lot More Noise On TV

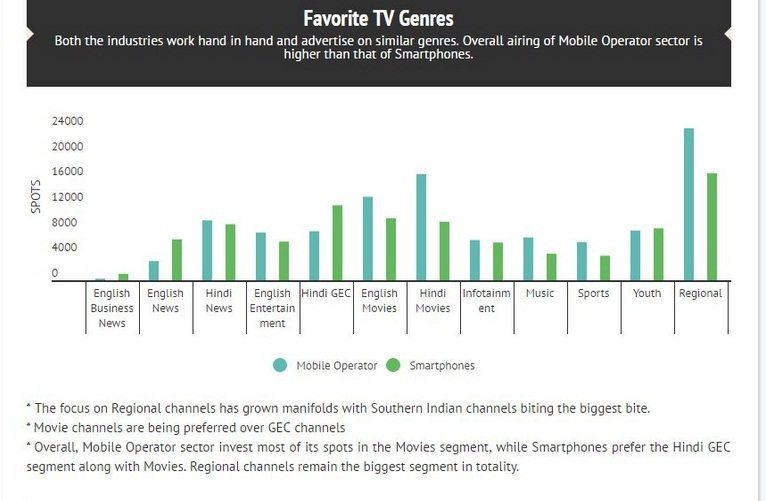

Both smartphone brands and mobile operators are advertising heavily on regional and Hindi movie channels as compared to Hindi general entertainment channels. However, the overall mobile operators are creating lot more noise on TV as compared to smartphone manufacturing players. Smartphone advertisers invest more on Hindi GEC ad spots. On the other hand, mobile operators are more inclined towards English movie channels to run their TV ads.

These are a few key takeaways from the report:

- Both, English and Hindi movie channels are being preferred over GEC channels by almost 49%.

- Also, the focus on regional channels has grown manifold with South Indian channels taking almost 53 % of the overall market share.

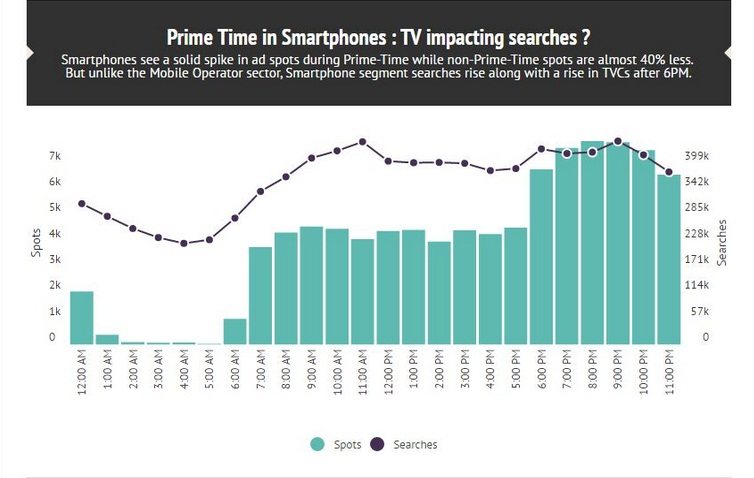

- Smartphones see a solid spike in ad spots during prime time while non-prime time spots are almost 40% less.

- Unlike the mobile operator sector, the smartphone segment searches rises along with a rise in TVCs after 6 pm, with maximum searches taking place around 10 pm.

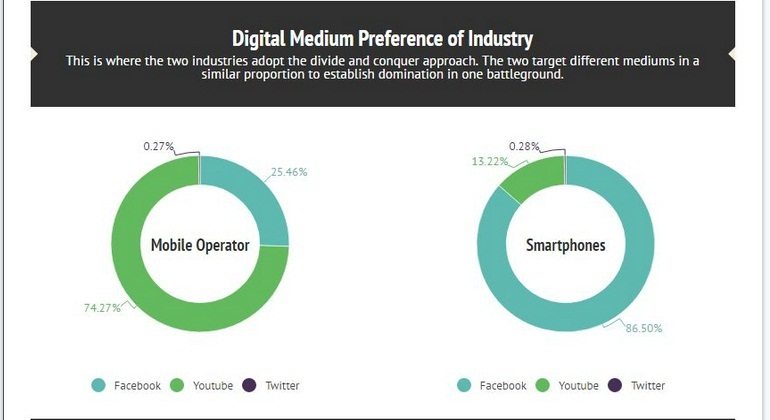

Mobile Operators Spend More On Youtube, Smartphone Manufacturers Prefer Facebook

On the digital media front, smartphones and mobile operators target different mediums in similar proportion to create a dominant standing and brand recall. Youtube attracted the largest share with close to 75% of advertising activity coming from the mobile operator category.

Meanwhile, Facebook witnesses maximum advertising with over 85% of attention attributed to smartphone manufacturing players.

Interestingly, Twitter, as a media platform gets the smallest share of focus from brands in both the smartphone and mobile operator categories.

Across mobile operators, Idea spent the most on TV ads airings (as recorded by Prism across 120+ popular channels), while Airtel spent the most on the digital medium.

The full market infographic can be viewed at http://bit.ly/2cvRy9D.

Welcome to Flash Feed, your essential source for breaking news and innovation from around the web – bite-sized and updated all day.

Welcome to Flash Feed, your essential source for breaking news and innovation from around the web – bite-sized and updated all day.