With the budget session around the corner, the government has come out with a uniform definition of the word startup, so that only innovative companies could benefit from the Start Up India, Stand Up India initiative.

Under the definition, a budding entrepreneur with a turnover of less than $3.6 Mn (INR 25 Cr) can avail tax breaks and other benefits for a five-year period.

Department of Industrial Policy and Promotion (DIPP) said, “It would bring about uniformity and ensure that only genuine startups get the benefits. Also, entities formed by splitting or reconstruction of existing businesses will not be considered as startups.”

As the startup has been defined, now only deserving companies will be able to gain from the ‘Startup India Action Plan‘ and create conducive environment for startups in India.

A government notification read

- The process of recognition as a ‘startup’ would be through mobile app/portal of the DIPP

- In order to obtain tax benefits, a startup will be required to obtain a certificate of an eligible business from the Inter-Ministerial Board of Certification.

- Startups will be required to submit an application with certain documents, including a letter of funding (of not less than 20% in equity) by any incubation fund/angel fund/private equity fund, duly registered with SEBI, that endorses the innovative nature of the business.

The Inter-Ministerial Board would consist of Joint Secretary of DIPP, representatives of Department of Science and Technology, and Department of Biotechnology.

The government also wants a boost in innovation, therefore, start-ups should be engaged in development, deployment, or commercialisation of new products, processes or services, that driven by technology or intellectual property.

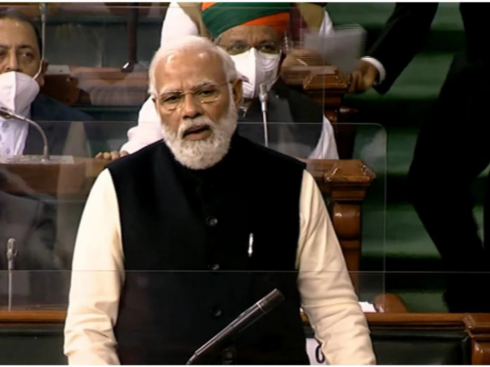

Earlier in January, Prime Minister Narendra Modi unveiled a slew of incentives to boost startup businesses; offering them a tax holiday and inspector raj-free regime for three years, capital gains tax exemption and INR 10,000 Cr corpus for funding.

Welcome to Flash Feed, your essential source for breaking news and innovation from around the web – bite-sized and updated all day.

Welcome to Flash Feed, your essential source for breaking news and innovation from around the web – bite-sized and updated all day.