SUMMARY

WhatsApp is on its way to rolling out micro-pension products for the Indian masses

In spite of a robust fintech ecosystem, no startup has attempted to cater to an underserved Indian market

WhatsApp could be facing tough challenges as the low-income population lacks financial awareness and the habit of saving

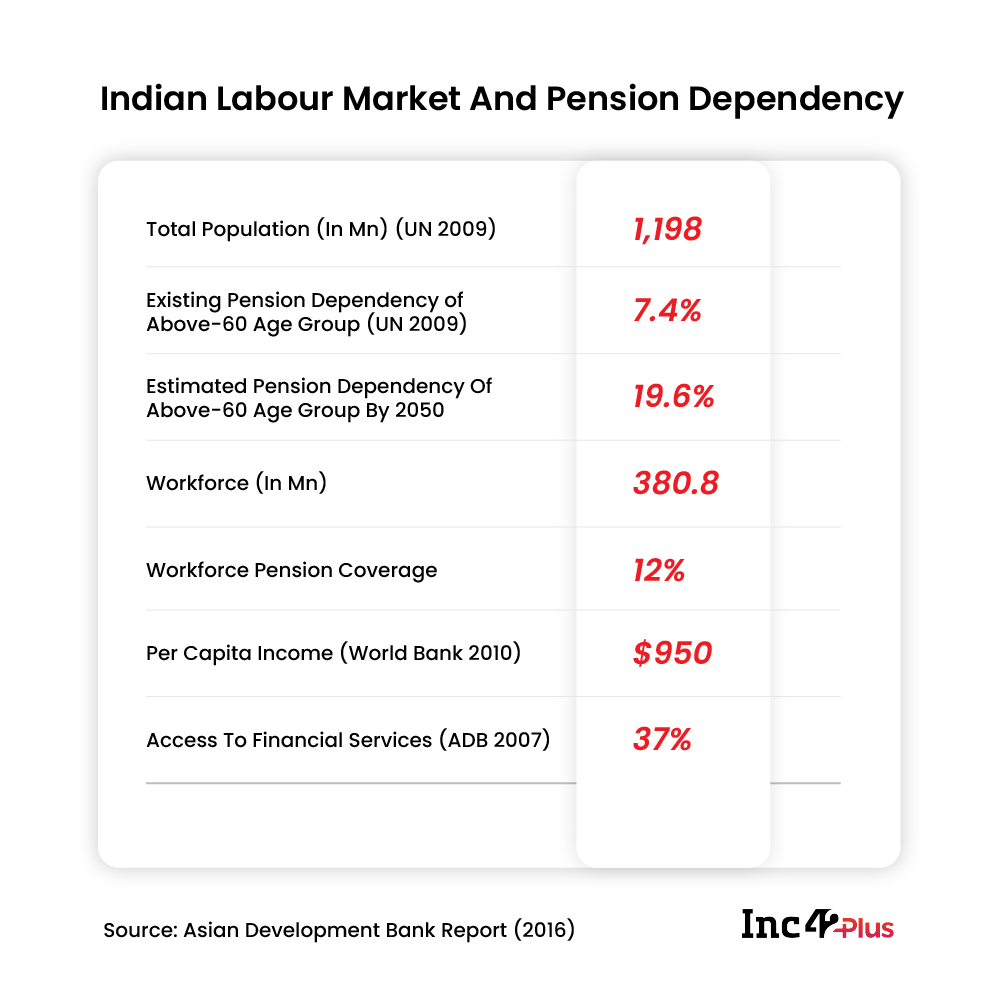

When messaging giant WhatsApp announced its foray into micro-pension products in December 2020, it turned out to be a first-of-its-kind initiative in the Indian fintech space. This is surprising, given the massive depth and reach of the sector. India has 2,000+ fintech startups, and they collectively raised more than $2.1 Bn in 2020, the year of the pandemic, which resulted in an unprecedented slowdown. Moreover, the requirement is already here. From a young demographic in its late 20s in 2019, the Indian population will comprise 20% senior citizens by 2050. Add to that poor financial literacy and a not-so-inclusive annuity market, and the reality looks grim enough. So, what has kept Indian startups away when it comes to exploring the micro-pension space?

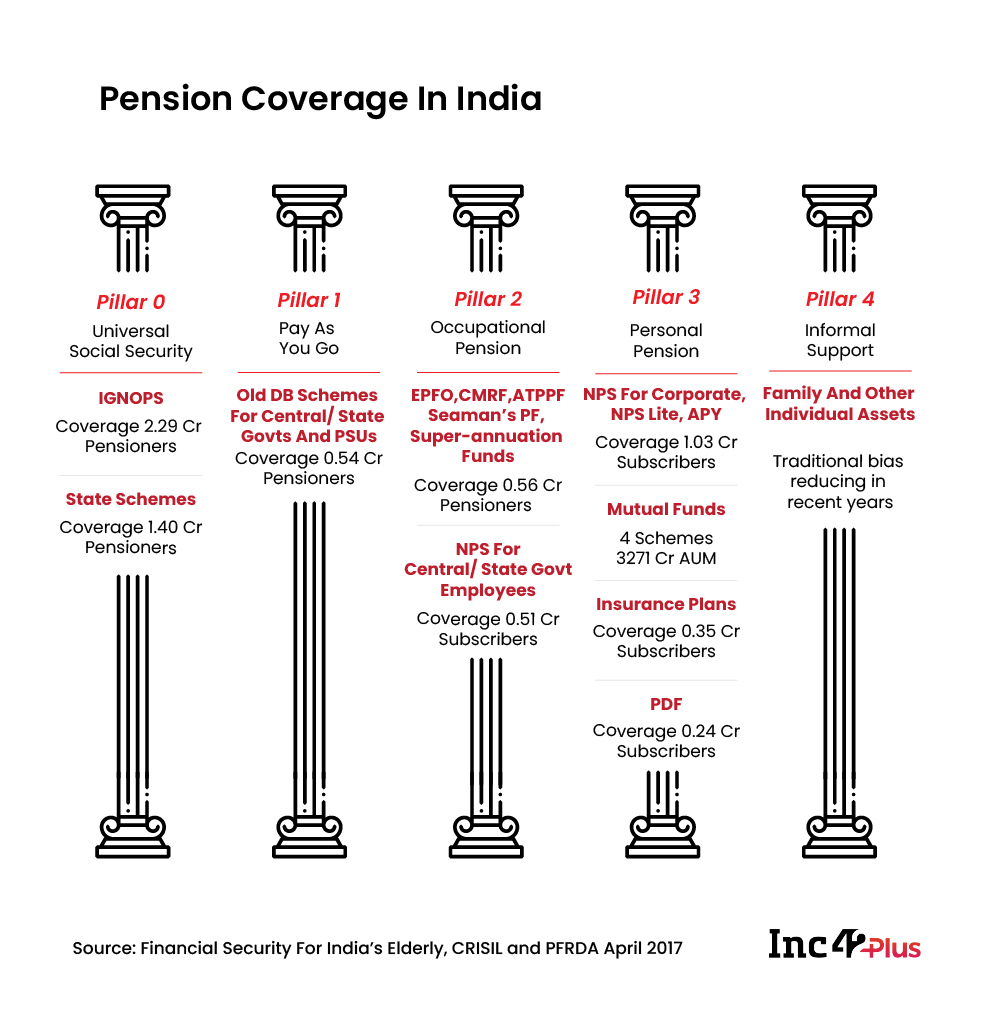

Before we look at WhatsApp’s plans, a quick look at the pension market components will not be out of context here. Pension schemes are financial tools which provide old-age income security, all the more essential now due to long life expectancy and fast-shrinking intergenerational support. They generally offer monthly payments made on the superannuation after a person retires from his/her regular job. Organised pension plans in India are primarily led by the Employees Provident Fund Organisation (EPFO) and Seamen’s Provident Fund Organisation (SPFO), where a portion of an employee’s salary is structurally invested for post-retirement purposes.

In contrast, micro-pension schemes are voluntary, individual plans focussed on the informal sector or low-income workers, and enable voluntary savings to be accumulated over a long period. These could also be hybrid products (a cross between pension and saving schemes), but do not have plan sponsors.

Although informal sector workers do not formally retire like their counterparts in the organised sector, there is still a need for them to prepare for income reduction as old age and declining health often impact their earning capacity.

Whatsapp has already announced an initiative to partner with HDFC Pension for taking the National Pension Scheme (earlier known as the New Pension Scheme) products on its platform. A Singapore-based startup called PinBox will also be a part of this project. Simply put, WhatsApp will be the go-to-market solution in this project; PinBox will manage the user interface and HDFC will design the financial product itself. The initiative is expected to reach 400 Mn self-employed persons in India. But details about the rollout plan is not known yet.

However, Facebook-owned WhatsApp does not enter a new segment randomly without weighing its options. Right from app features and functions to WhatsApp Business (for small businesses) and WhatsApp Pay (for UPI transactions), every single offering was launched by the company only after its rivals tasted some success in those domains. Just as it is difficult to decode Indian fintech firms’ total silence regarding this space, it is equally tough to comprehend WhatsApp’s sudden foray and proactive approach. Where does micro-pension fit into its scheme of things?

The Current Market And Its Challenges

Before we go further, let us look at the fintech solutions offered by the top tech companies in India, especially the likes of Paytm, Gpay, PhonePe and even Amazon Pay. As of now, they offer solutions across investments, lending and payments, but not micro-pension. To be specific, Paytm does offer an NPS product that has been marketed as a wealth-building tool, unlike micro-pensions. Therefore, we have asked the experts why Indian fintech majors have kept away from this space and here is what they say.

According to credit rating firm Crisil, pension penetration in India is estimated to be very low at under 30% of the population above the retirement age compared to over 70% in other Asian countries like Japan, China and South Korea.

A major reason for the low penetration is that the bulk of the population is engaged in the unorganised sector that lacks the money to ensure a decent vesting corpus. Of course, government-led initiatives such as Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM) Yojana and Atal Pension Yojana focus on the unorganised sector, but their reach is limited.

With the median age of the Indian population at 27, it is a young country. But by 2050, nearly 20% of the people will be aged above 60. Crisil estimates that the children support more than three-fourth of the dependent and aged adults in urban and rural areas. The family size of lower-income households is also large as they need more support for each other. In higher-income homes, family support plays a less significant role, and the family size tends to be smaller. But with increasing migration across the country, this pattern is changing fast, creating a critical need for the working population to have pension plans. To complicate matters further, monthly income potential in the unorganised sector can vary substantially, making it difficult for this group to opt for structured savings plans.

“A critical concern for the-low income bracket is meeting immediate expenses. For example, when young people from low-income households use digital payments solutions, they are not planning as far as retirement. For the older generation, those above 45, navigating smartphones might be a problem. The older people also belong to a segment that has traditionally depended on the likes of chit funds to meet urgent cash requirements. Therefore, they tend to be wary of solutions lacking a human touch even when they know the risk of chit funds,” says a fintech consultant who does not wish to be quoted.

Given this scenario, if companies were to offer a simple, intuitive and easy-to-use pension fund to this ageing population to save for their old age, and if it comes packed in a universal smartphone app, will these people use it? It is a tricky space, say experts.

Vivek Belgavi, partner and fintech leader at PwC India, says that the need for this solution has always been there. And now that the blue-collar workers are becoming a part of the larger global policy mandate, the opportunities will grow. “In the fintech space, digital payments have laid down the foundation where investments have been made; user engagement has been created and transaction data has been generated. Now, these businesses will add more layers to monetise the offerings further. So, we will see them diversifying in this (micro-pension) space,” says Belgavi.

According to him, private participation in this space is not high. So, while the need is understood, innovation on the product-market fit is required. A pension solution will work best as an embedded finance tool (as part of other services instead of requiring a separate KYC). It should have a low distribution cost, which can be achieved by using existing distribution channels across fintech or commerce solutions. Also, the backend pension funds (which will support micro-pension products) need to adopt APIs and technology to modernise their offerings, adds Belgavi.

Given the current scenario, WhatsApp can operate as a distribution channel, and there can be multiple providers besides traditional insurance companies. Even telcos now offer sachet-size insurance products along with prepaid recharges and these can be utilised for pension purposes. But the critical part is getting end users to save their money. Irrespective of whether a Paytm or a WhatsApp introduces micro-pension products, the key to reaching their target audience lies in balancing an intuitive user interface with a compelling argument to save, say fintech experts.

What Will The Micro-Pension Solution Offer?

Of course, the solution is critical for WhatsApp, trying to establish a strong fintech presence for some time. After two years of regulatory hurdles, the green light from the National Payments Corporation of India (NPCI) came last November to launch UPI payments on the WhatsApp platform. But the messaging app has not been allowed to go full throttle. In the first phase, WhatsApp Pay can only onboard up to 20 Mn users, just a fraction of its 400 Mn user base in the country. Also, a 30% transaction volume cap has been imposed by the NPCI to protect the UPI ecosystem from a possible monopoly. So, the company is now compelled to look at a wide range of fintech products in insurance and pension space to grow its footprint.

Although details of the rollout are yet to emerge, here is what we know about the stakeholders. HDFC Pension is one of the top-performing pension funds in the country. PinBox, founded by Parul Seth Khanna and Gautam Bharadwaj, has implemented micro-pension, pensiontech and insurance platforms across African nations. They have also helped the World Bank run research programmes on the efficacy of various direct benefits transfer and elderly savings schemes. WhatsApp has just launched its UPI payment services after a two-year-long tug of war with the Indian regulators. Its user base in India is the largest in the world, but the popular app continues to struggle with policy matters, further complicated by parent Facebook’s scandalous record of user data misuse.

Ashutosh Dabral, chief product officer of MoneyTap, an app-based credit solution provider, notes that startups have largely kept out of the pension products space as this segment requires governmental or institutional backing. In fact, pension penetration is so abysmally low in the country that even organised sector employees are not fully covered. The scenario is grim, and individual startups cannot tackle the beast alone. Besides, financial awareness continues to be low despite the strong growth across financial services, thanks to fintech companies.

“Designing a product for this (low-income) segment is not easy. They have had huge capital requirements all their lives and no organised lender is ready to lend to them. Even when companies develop micro-pension plans, how will they design algorithms so that these people can plan their withdrawals without affecting their future needs? That is the most critical question,” says Dabral.

Globally, past initiatives to implement micro-pension plans across Eastern Europe and Latin America did not work out well, he adds. However, the growing digital awareness in the post-pandemic world can benefit fintech solutions providers.

Is India Ready For Digital Micro-Pension Plans?

Ashneer Grover, CEO and cofounder of the fintech company BharatPe, thinks that Indian startups have catered to a younger, digitally active demographic so far. “As this demographic ages, there will be scope to offer them these insurance and pension-based products. But that opportunity lies a few decades ahead,” he says.

But that opportunity is gradually opening up. In the past decade, the Indian government came up with a slew of multidimensional schemes which accelerated financial inclusion throughout the country. Among these are Pradhan Mantri Jan-Dhan Yojana (PMJDY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Pradhan Mantri Kisan Maandhan Yojana (PM-KMY), Pradhan Mantri Shram Yogi Manndhan Yojana (PM-SYM) and Pradhan Mantri Mudra Yojana (PMMY), broadly designed to ensure social security and old-age protection for the underprivileged. In fact, one of the solutions that the PinBox founders proposed in the past included auto-enrolment of pension accounts for the 400 Mn Jan-dhan bank account-holders who do not have pension accounts.

With financial inclusion almost achieved, it is now the right time to think of wealth inclusion, says Srinivas Nidugondi, executive vice-president and chief operating officer, digital financial solutions, at Comviva Technlologies.

“We do see the next step of the financial life cycle where investments are the next logical step, and it is not surprising to see a barrage of communication on mutual funds. Herein lies the opportunity of facilitating those small and incremental savings into low-risk investments,” he adds.

Offering sachet-size investment avenues to the bottom of the pyramid where AI/ML models can be used to help millions get into an investment discipline can be looked at, he suggests. But all this will finally depend on when and how these micro-pension products are rolled out.