SUMMARY

India’s news publishers reported big tech’s content deals but kept mum on how they could benefit from such arrangement

Dear Reader,

Imagine your favourite cafe starting to charge you for referring it to your friends. Unfair, huh?

This is the argument that Melanie Silva, the managing director of Google Australia and New Zealand, has put forth when asked about the tech giant’s standoff with the Australian government regarding news publishers’ payment when it features snippets from their content. Both Google and Facebook are at war with the country, threatening to pull out if they are forced to pay.

The Australian government also wants to make sure that big tech companies inform the country’s news publications about the changes implemented in their news search algorithms. There will be a strict non-compliance penalty, for the search giant, if these terms are violated. Google, on the other hand, says that an arbitrary pick-pay-and-publish system will hurt the quality of the content it displays.

But first things first. How does big tech hurt news publishers, you ask? For years, publishers have cried foul about tech giants like Google and Facebook controlling a bulk of the digital advertising supply chain. As of 2020, 90% of all online searches took place on Google and its subsidiaries like YouTube and Google Maps. Together with Facebook, the duo earns more than 60% revenue from the global digital marketing supply chain as they design go-to-market solutions for brands, create and supply ad-space and offer analytics-driven solutions.

Imagine, out of every dollar spent on advertising, more than 60 cents go to adtech platforms, and fewer than 40 cents are left to meet the cost of content — the actual USP of the media publications that drives people to those platforms.

A look at the Indian market tells us a similar story. In 2018, Google and Facebook held a combined market share of 68% across the online advertising space in India, according to a report.

Google’s dispute with the Australian government comes at a time when the search engine giant just complied with a similar requirement in France and agreed to pay the publishers for using their content. But unlike Australia’s demand for a standardised payment format for all, Google will strike a deal with individual publishers in France, depending on how much content is used (and at what frequency), the cost of production and the reader base. These deals will be part of the Google News Showcase initiative, announced by the search giant in October 2020.

Google News Showcase has already started negotiations with publishers and announced agreements worth $1 Bn with 200 entities in six countries — Brazil, Argentina, Germany, the UK, Canada and Australia (rolled back since the dispute started).

Why hasn’t Indian media raised the same concerns against big tech as their global counterparts, yet?

The India Conundrum

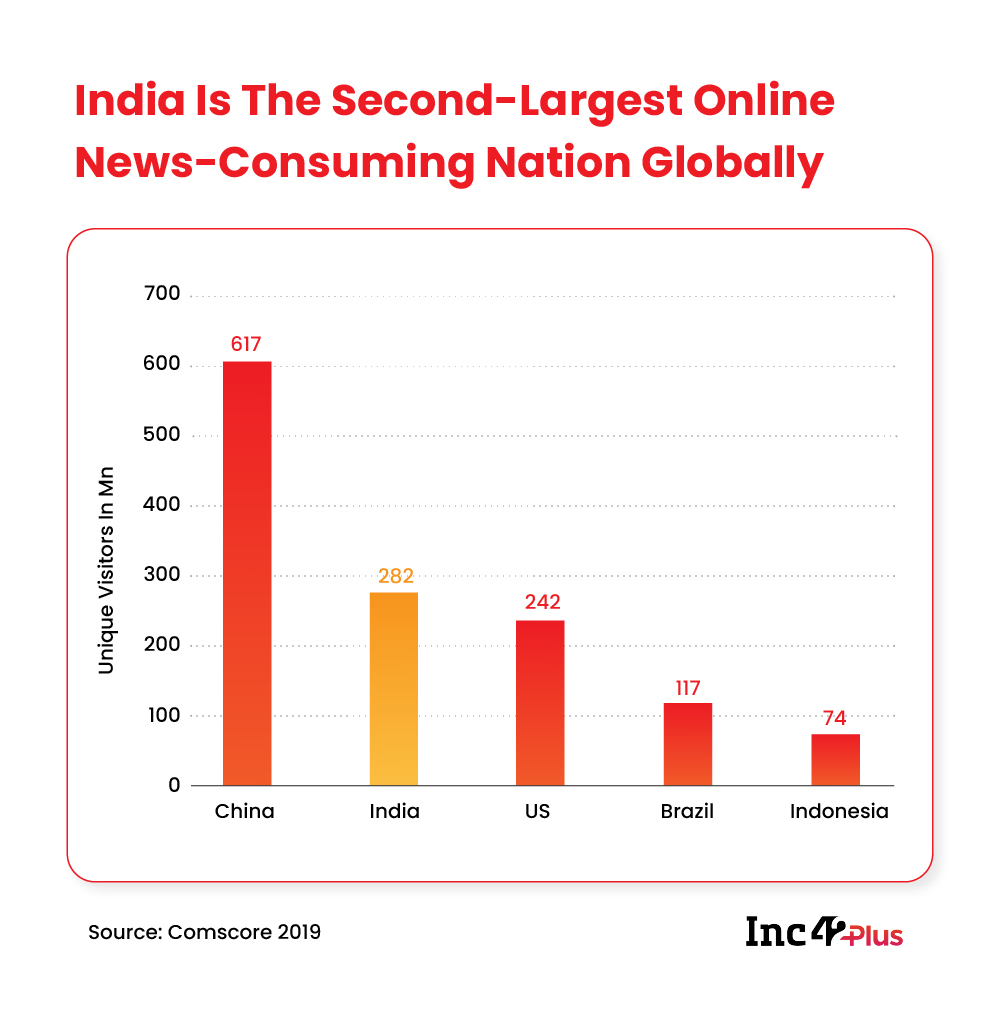

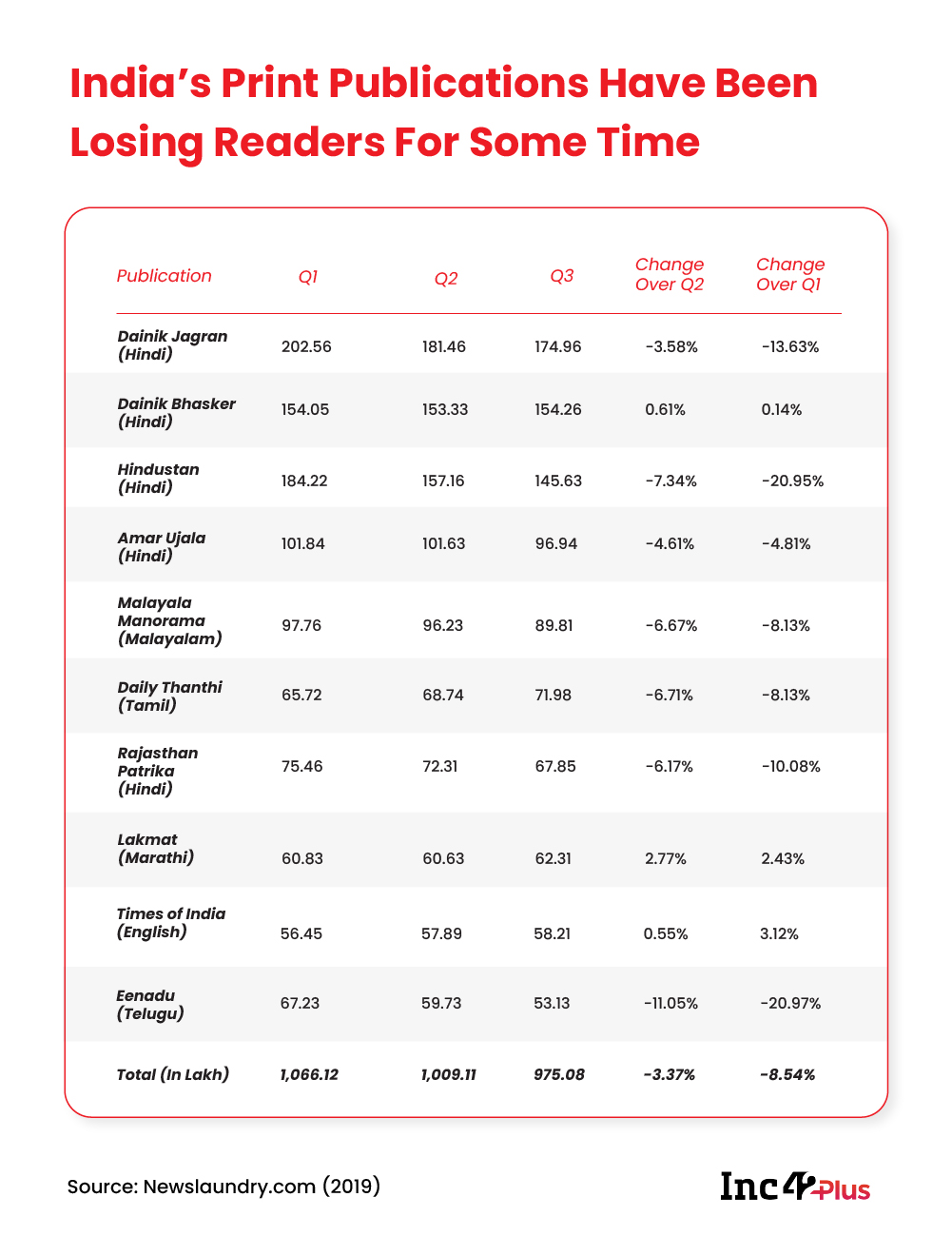

Mainstream print publications in India have been struggling for the past few years as readers are increasingly embracing digital media. Things took a turn for the worse in 2020 when pandemic-induced lockdowns halted print production and sales for nearly two months. The print media is yet to recover, but there is something more alarming. According to 2019 data from the Indian Readership Survey, the rot had already set in, and readership had steadily declined even before Covid-19 hit the world.

During Q2 and Q3 of FY20, the average readership of Dainik Jagran, India’s largest circulated Hindi daily, dropped by 13.6% and 3.6%, respectively, clocking 1.81 Cr average readership in Q2 and 1.75 Cr in Q3. During this period, other widely-read vernacular newspapers like Malayala Manorama, Hindustan, Amar Ujala, Rajasthan Patrika and Eenadu also reported a double-digit decline in average readership.

By the 2020 festive season, vernacular newspapers’ ad revenue touched 90% of the pre-Covid numbers compared to a 36% drop in ad revenue for English newspapers, according to TAM AdEx data. One reason for that: English publications have a better online presence; hence, readers became accustomed to accessing the content online. In contrast, vernacular newspapers, with not-so-wide digital footprints, recovered their traditional readership and ad rates faster after lockdowns.

However, despite a massive rise in screen time and internet usage in 2020, digital ad rates collapsed. In India, digital media buyers have witnessed a minimum of 15-25% drop in ad rates of biddable digital inventory; in some cases, it has fallen by more than 30%. Biddable media refers to all inventory purchased through auction platforms. Nearly 85% of digital advertising spends are allocated to biddable media.

In brief, digital media houses did not start reporting massive ad revenues in spite of their newfound popularity.

Guess who did continue to report big profits? Google’s global ad revenues jumped 8% in Q2 FY21 (April-June) to $30 Mn and 10% in Q3 FY21 (July-September) to $37 Mn. In 2018 alone, Google News generated $4.7 Bn in revenue. David Chavern, president of News Media Alliance, a US-based news media trade organisation, summed up the ground reality when he told The New York Times, “The journalists who create that content deserve a cut of that $4.7 Bn. There needs to be a better outcome for news publishers.”

Interestingly, Google’s stand on publishers’ content did not see any ripple effect in India. Yes, Indian media houses extensively reported the developments in France and Australia, but the matter ended there.

A chat with Jayadevan PK, who had earlier set up the digital media startup FactorDaily, throws light on the same. According to him, digital marketers can target people across different platforms, not necessarily via news platforms, and hence, have the upper hand. The cost of content creation on (non-news) platforms is usually zero because it is user-generated or has a long shelf life as in case of music.

“Even with such poor economics (low revenue from ads), online media companies (and digital versions of mainstream media) rely heavily on Google traffic to get by. So, unless all publications, including the traditional ones, put their content behind paywalls and figure out other revenue streams, they have no leverage,” says Jayadevan.

Traditional media like print and television enjoy a far better fate in this respect. According to industry veterans, their market position allows them to offer their digital content without incurring additional expenses for newsgathering. At the same time, they can negotiate slightly better ad rates for their digital publications.

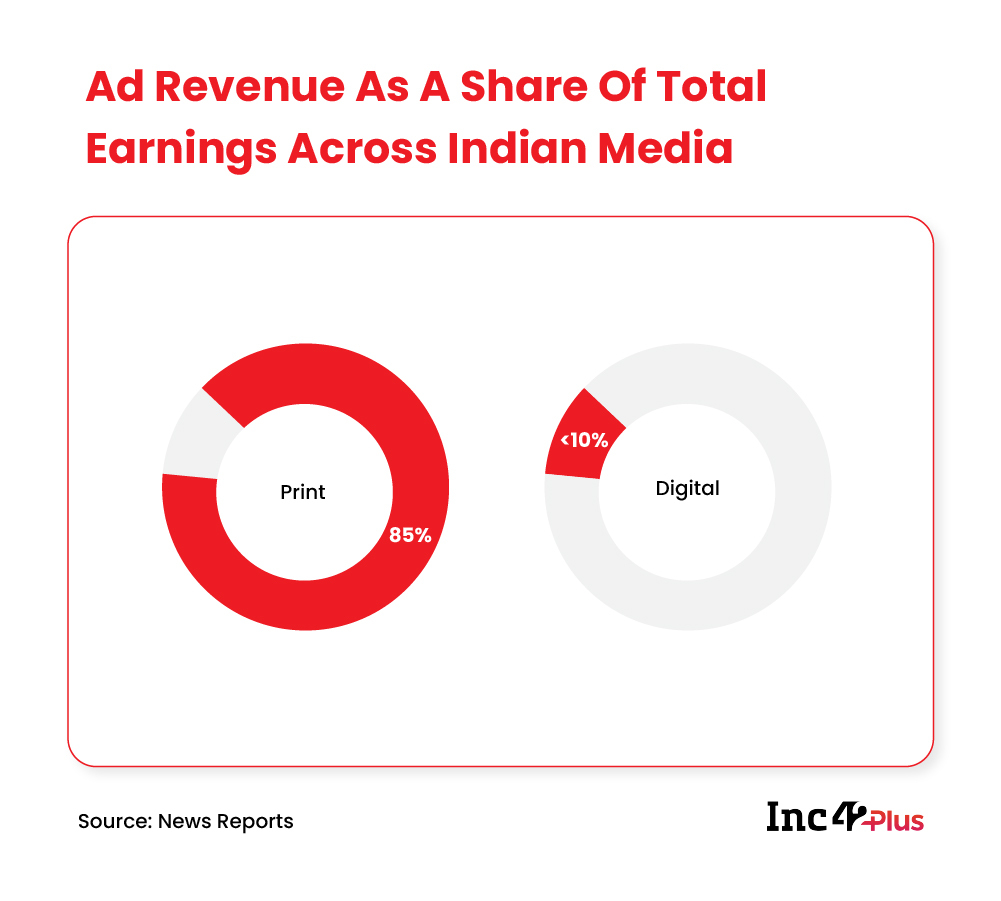

Unlike print media where more than 80-85% of the revenue may come from advertising, digital news outlets earn less than 10% of their revenue from the same. This clearly impacts digital-only entities, a key reason why independent publishers of digital news tend to opt for a subscription-based model. Simply put, when ad rates are as low as $0.10-0.25 for 1,000 page views, it is much more feasible for news publications to seek loyal subscribers for fresh content instead of competing for eyeballs in a space where a cat video can get more traction than serious content.

According to media consultant Bala Murali Krishna, when Indian news publishers initiate discussions with big tech aggregators, there are two problems. First, digital-only outlets are not creating enough original content. And second, most legacy media houses have not yet figured out how to build an effective digital presence apart from the media outlets which have a subscription model in place. Google has started negotiating curated content deals with a few publishers (in India as well). But how this initiative pans out will depend on the quality of journalism.

“News publishers cannot directly compete with tech giants by building equally sophisticated adtech platforms. But when they offer content that caters to a loyal audience, there is scope for negotiations. We see print publications have started doing it thanks to their existing reader base. In the next phase, we may see some of the stronger, digital-only Indian publishers negotiate similar deals,” says Murali Krishna.

He, however, argues that these content deals with big tech platforms will serve the print media better than the new media publishers as the latter is already focussing on several digital-first revenue models. In contrast, the print media is still figuring out their digital play but can leverage its deeper news network and large user base.

Fragmented Media In Search Of Consensus

In spite of their massive reach, digital news publishers in India lack the bargaining power when they lock horns with the likes of Google and Facebook, which act as gateways to end users, say experts. This, undoubtedly, puts Indian publishers in a tricky position while negotiating.

“Initiating a meaningful commercial or policy conversation requires a fragmented content publishing industry to collectivise and build consensus. In the meantime, low-hanging fruits like developing standard operating procedures for taking down pirated content are ripe for the picking,” says Vivan Sharan, advocacy partner at the Koan Advisory Group, a public policy research firm.

Nikhil Pahwa, a digital rights activist and founder of the media platform Medianama, believes that the Indian media ecosystem is now getting vocal about these issues and lobbying for better terms through industry bodies like the Indian Digital Media Association (IDMA). However, much like the restrictions on foreign funding of digital media, charging big tech companies for access to news snippets is likely to benefit traditional media outlets alone, he says. “We have not heard of digital-only publishers making such demands because there is not much to benefit from it compared to the subscription model,” he says.

One major difference, underlined by industry experts who spoke to Inc42, is that governments are backing the news publishing industry in the negotiation process in France and Australia. There are several reasons for this. The European Union is already at war with big tech companies, and any action against them has popular support, especially after the implementation of the General Data Protection Regulation (GDPR) for better awareness about digital rights.

Ashok Kumar Bhattacharya, Editorial Director of the financial daily Business Standard, thinks Google plays an important role in the media industry for distributing and popularising content. The problem arises because Google is a dominant player in the search market. Small publishers can be at a disadvantage if they do not play along.

“The regulatory environment does not exist here for the Indian government to step in and lay down rules. Ideally, some regulation should ensure that search engines’ dominance does not lead to misuse or distortions. However, the government should avoid stepping in as this can impinge on media freedom,” says Bhattacharya.

Collectively, the Indian media can negotiate with search engines like Google, he adds. The media can make a simple argument. If Google can share its revenue with individual content creators, why can’t the company share it with publications instead of treating them as business rivals?

New-Age Startups Disrupting Media And Entertainment

Speaking of massive user growth in the digital space in 2020, let us not overlook how Indian startups witnessed exponential growth in the media and entertainment space. The pandemic and the following lockdowns led to new business opportunities and companies catered content, music and gaming across demographics. The ban on Chinese apps further raised user interest and traction.

According to industry estimates, the digital media and entertainment sector in India is expected to grow at a compound annual growth rate of 3.24%, fuelled by digital adoption across geographies. The sector is likely to reach a market size of $25.5 Bn by 2022. Revenue models will be led by subscriptions and advertising, and the latter is likely to benefit from a reassessment of the existing digital advertising model for different content streams.

In the fifth edition of our annual Startup Watchlist series, we have featured companies such as Kuku FM, NewsBytes, Trell and The Better India which are taking the industry to the next level. Digital adoption across the country has also touched startups operating in fintech, agritech, healthtech, D2C and edtech space. Take a look at the companies disrupting these sectors!

WhatsApp’s Peek-A-Boo With Authorities

How can we talk about digital reach and smartphones without mentioning one indispensable app that keeps Indians connected? Yes, it is WhatsApp. The Facebook subsidiary cannot get enough of headlines, albeit not for the right reasons. After entering 2021 with a strongly worded privacy policy update, the messaging app continued its run-ins with the government throughout this week.

According to media reports, the ministry of electronics and information technology wrote to WhatsApp CEO Will Cathcart, asking the company to withdraw the proposed changes and reconsider its approach to data privacy, freedom of choice and data security. But given the global scrutiny of big tech’s data usage, it may take a long time before an amicable solution can be reached.

But what is clear from l’affaire WhatsApp is that big tech companies are not easy to tame, and it takes a lot to stand up to their my-way-or-the-highway style of conducting business. Can Indian media unite to fight this game of survival?

Until next time,

Romita

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] Will Indian Media Stand Up To Big Tech To Claim Its Due?-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)