SUMMARY

As the super app heats up, the big question for Tata is how well it integrates its various acquisitions

It’s been less than a year since we first heard about the Tata super app, but while those plans seemed like a sandcastle at that time, they have turned into something a lot more concrete now. Unveiled in August last year, the super app represents the summit of Tata’s digital ambitions, and the salt-to-steel conglomerate’s way of joining 21st century businesses.

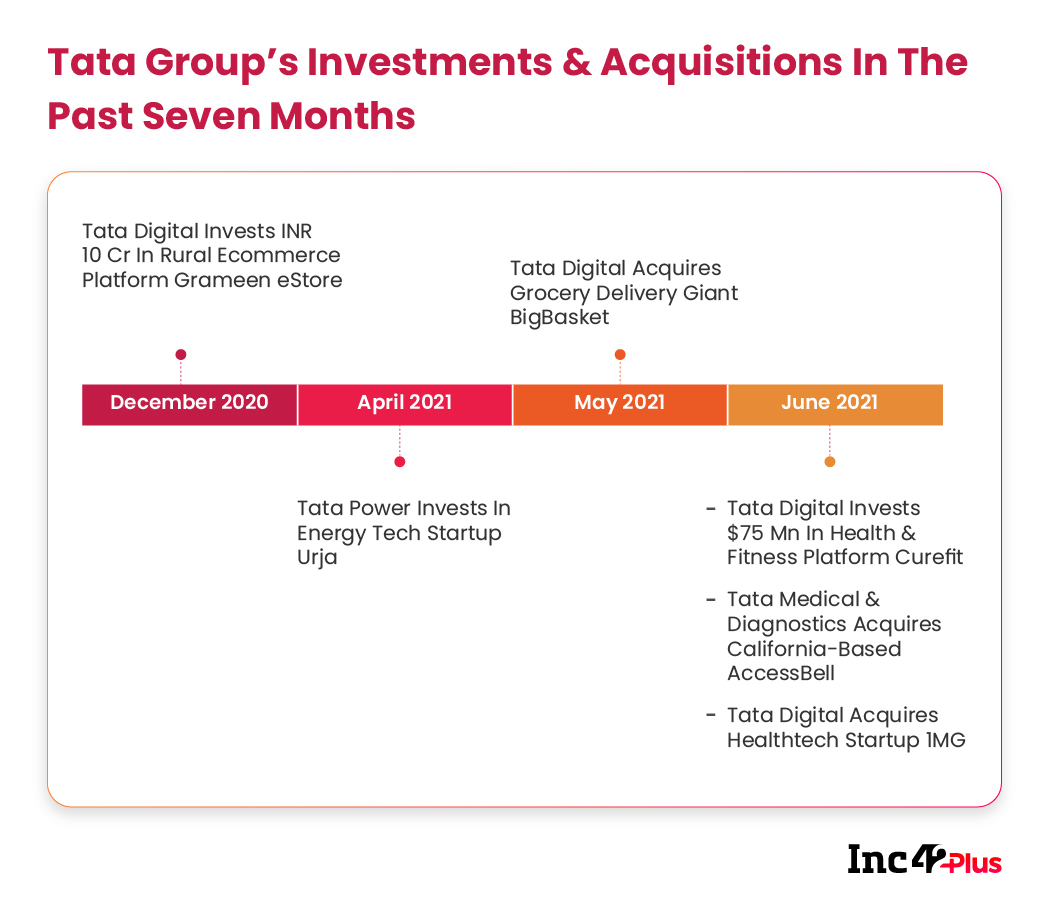

And to get there, Tata has acquired companies, invested millions of dollars and made changes to its leadership that are shaping up to be pivotal. Now, slowly but surely, the pieces of the Tata super app are finally becoming clearer and the questions have changed from whether Tata can pull it off or not to whether the company’s inorganic approach is working.

To start with Tata acquired a majority stake in grocery unicorn BigBasket in May this year. Come June, and Tata is again in news for back-to-back deals — a $75 Mn investment in Curefit and the majority stake acquisition in healthtech startup 1MG. The Curefit deal brought over its cofounder Mukesh Bansal to Tata Digital as its president, even while Bansal continues to lead the health and fitness company.

Speculation is rife about Tatas eyeing similar majority stakes in Dunzo and Justdial, even as the company waits to launch its ‘new umbrella entity’ and builds the digital bridge that brings its various consumer business groups to the super app table. The question is why now and whether these big bets will pay off given the state of the Indian economy.

For one, super apps will be the foundation for the future of two of India’s largest companies. Tata, Jio and a slew of ecommerce companies are gung-ho about super apps because of India’s growing appetite for online transactions, shopping and services. The pandemic has caused an even swifter transition to ecommerce and online services. In that sense, some analysts believe that the Indian market is ready to embrace a super app, finally.

But even if the market is ready, cracking the super app formula calls for more than just a few acquisitions. It requires vision, engagement fuel and the right balance of supply and demand, and people — and sometimes even that may not be enough.

Fitting In The Pieces

One of the biggest challenges for Tata will be to integrate these startups into the Tata Group, while also allowing them the leeway and the flexibility that startups want. The key question here is whether Tata can recreate the environment that helped these startups flourish within its larger corporate universe and its various disparate parts.

But digital is new for Tata Sons, even though it runs one of the biggest IT services companies in the world — Tata Consultancy Services (TCS). Tata Sons is over a century old but Tata Digital was incorporated only in March 2019. So Tata Digital, which is the company that has acquired these startups, is carrying only a little bit of that Tata legacy baggage. Even for its leadership, it has looked outside the Tata circle with Mukesh Bansal, who has the experience of running businesses in different sectors and also in integrating acquired startups.

Having founded Myntra and sold it to Flipkart in 2014 for $280 Mn and helping integrate Myntra into Flipkart, Bansal founded Curefit in 2016 and made it a nationwide fitness chain with the Cult.fit brand. The startup has raised close to $480 Mn over multiple funding rounds and has over 33 investors backing it. In FY20, the company’s revenues grew to INR 496 Cr from INR 181 Cr in FY19. With the pandemic, Curefit had to scale back Cult.fit’s offline presence, laying off more than 1,600 employees.

The current focus of the startup is on virtual fitness and while it has hived off its food business Eat.fit to lower costs, the revenue would have taken a huge hit in FY21, for which Curefit is yet to release its financials. As such, the Tata investment is being seen as a bridge funding round to enable Curefit to tide over the FY21 crisis and grow the business in FY22.

But the pandemic blip aside, Bansal has a reputation of being able to attract funds and manage multiple acquisitions, according to those who have worked with him in the past. In that sense, he seems to be tailor-made to bring together the various acquisitions under Tata Digital. At Curefit, he oversaw the acquisitions and integration of various startups. For instance, Curefit acquired fitness platform Cult in August 2016 for $3 Mn, followed by Tribe Fitness, Seraniti, Kristys Kitchen, and a1000yoga to form the basis for its health food and yoga services. Recently, it acquired US-based Onyx, fitness aggregator Fitternity and smart bike maker TREAD.

And another noteworthy point about how Tata might approach the integration of its various acquisitions is that Bansal and BigBasket cofounder Hari Menon will be part of 1MG’s board of directors along with 1MG founders, according to the most recent filings seen by Inc42. This shows that Tata wants founders to work with each other. So perhaps Tata is going for a startup approach at Tata Digital after all when it comes to allowing founders to express themselves in the right manner.

But does it even have the right ingredients for a super app?

The Engagement Gap In Tata’s Super App Plan

According To Sreedhar Prasad, an independent advisor for internet companies and consumer businesses and former partner at Curefit investor Kalaari Capital, the super app formula only works if the app in question has a strong engagement component along with a sizable user base to start off with. The former is key for retention and the latter is critical to unlock the value of the super app elements. This is why most super apps have failed in India.

“Super apps have rarely worked outside of particular geographical contexts. There’s no global super app because of the tight hyperlocal integration needed in a super app. That is hard to achieve in India,” he said. In that sense, only Chinese platforms like WeChat or AliPay or Singapore’s Grab, which has various degrees of penetration in different markets or Indonesia’s Gojek can be called super apps.

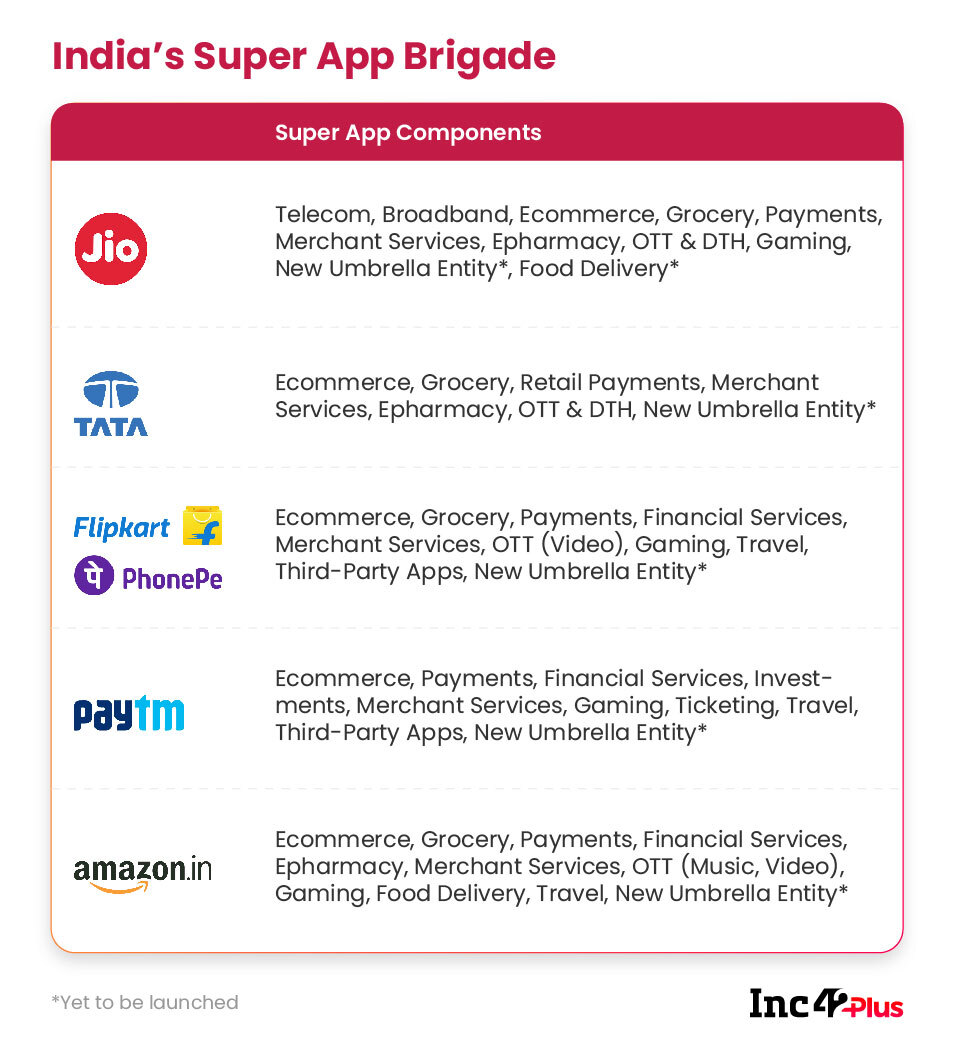

In India, the super app formula has been attempted by Hike, Paytm, Justdial and others, but these did not exactly see stickiness across all services, which led to them unbundling or discarding parts that didn’t bring in the users. But the super app debate is once again back on the table with the likes of Tata and Jio throwing their hats in the ring, while digital-first companies are also slowly inching towards this objective.

But for Prasad and others who are watching the ecommerce space, there are still pieces missing from the super app puzzle. When it comes to Tata, it’s not clear how its super app will fulfil the engagement quotient. Analysts reckon Tata has gone for the two biggest targets with 1MG and BigBasket. This fills a massive gap for grocery delivery fulfilment and epharmacies within Tata. Now the focus will come to areas which are not traditionally Tata’s strengths — gaming, content, video and other aspects around engagement. This will be the trickiest thing to achieve for the company, according to the people Inc42 spoke to.

This is also why Paytm is not being seen as a strong super app contender. The fintech giant is emphasising its super app chops in recent weeks ahead of a $3 Bn IPO by talking up its cohesive platform that caters to financial services and ecommerce needs across verticals. But the gaming component or entertainment is not a strong aspect of Paytm and it’s not the primary use-case for Paytm.

Tata is looking at a major neobanking play to match Paytm and has reportedly set up a neobank and is trying to rope in industry veterans and scouting for strategic tie-ups with licensed banks and insurers. It is targeting services such as credit card applications, insurance distribution, micro loans and even merchant management.

Beyond this, Flipkart has made a stronger statement towards adding travel (by acquiring Cleartrip) to its burgeoning bouquet of ecommerce offerings, as well as PhonePe’s support in terms of digital payments. In fact, Flipkart added videos to its bucket in 2019, but that has been a damp squib so far. Prasad believes that Flipkart will have to look at videos more closely in the near future. Flipkart also acquired MechMocha to add a gaming component to its app.

On the other side, Reliance Jio does have major plans when it comes to gaming, OTT and DTH for home entertainment, but these are yet to be seen from a super app context. These are all standalone efforts for now with varying degrees of traction. On the ecommerce front, JioMart has seen good early traction for Reliance while the acquisition of Netmeds has allowed it to expand to hyperlocal medicine delivery. It too needs to bring engagement front and centre to bridge its super app components.

Tata Vs Jio: Who’s Got The Right Idea?

Both Tata and Reliance plays are being seen as the new avatar for India’s ageing conglomerates. After all, these companies have only embraced the digital services industry in the past few years. That does put them at a slight disadvantage when it comes to tech, but their large distribution, massively deep pockets and investor network allows them to have the buying power to acquire startups and hit the ground running.

T Vaitheeswaran, the founder of India’s first ecommerce platform India Plaza, told Inc42 that the likes of Flipkart and Amazon India have not even managed to earn a profit from their massive ecommerce scale. Replicating that scale or coming close to it would take some doing. “Even if Tata or Jio acquire ecommerce platforms, there is a lot more work to be done to fill gaps within the super app vision, enable customer acquisition at scale without cash burn and unlocking the value for the partners,” he said.

Launched in December 2019, JioMart started off as a grocery delivery platform and gradually expanded into other verticals to become a full-fledged ecommerce platform with operations in 200 cities. It has also started testing subscription-based daily morning deliveries of milk, eggs and bread in select pin codes of Bengaluru and Chennai. The company claims to have served 1 Mn customers as of January 26, 2021, across stores and JioMart. However, it is yet to integrate fashion or electronics within JioMart, which continue to be sold through Ajio or Reliance Digital.

Plus, a super app does not really offer any real benefits for the sellers that work with marketplaces. Vaitheeswaran, who is now the founder of D2C brand Again Drinks, feels that the Indian audience makes ecommerce purchase decisions based on pricing, it’s not about being able to buy everything at one place.

There’s a big difference in the companies that Tata has gone for in contrast to the acquisitions by the likes of Reliance to line up its own super app pieces. One of the main reasons is the go-to-market strategy. While Reliance may reposition MyJio, its primary customer-facing app for Jio’s telecom services, or JioMart into its super app store front, Tata’s super app strategy is unclear.

MyJio has an install base of more than 100 Mn users only on Android, which is 10x the install base of the now Tata-owned BigBasket. Tata is planning to add other threads to its super app fabric in the form of Dunzo and possibly Justdial, which will give it a massive push in terms of the user base, though these will still be in independent silos.

This also explains to a certain extent why Reliance has gone for startups that may not necessarily have the largest base, but bring the domain knowledge — Netmeds and Urban Ladder were in fact distress sales — whereas Tata is acquiring platforms on the ascendancy, because it needs to reach close to the 100 Mn install base. This is the threshold for super apps to build their base on, according to Ankur Bisen, senior VP of the retail and consumer products division at management consultancy Technopak.

Without the 100 Mn users to start off with, no app can actually claim to be a super app, since super indicates it’s essential for users and this needs to be validated from the get go.

Given that Tata will end up managing multiple acquisitions by the time it realises its super app vision, one does wonder whether it will get the high reach from any one app. It may end up creating an ecosystem or an umbrella where it manages multiple recognised brands rather than lose out on the high brand recall of the likes of BigBasket, 1MG and Curefit.

It would seem that just like Reliance Retail and Reliance Jio, Tata would need a significant cash infusion in the near future to bring on board these high-value brands. That’s because at the moment, Tata Sons — promoters of the country’s largest business group — is heavily reliant on TCS for income, with Tata Steel being the second largest contributor. TCS accounted for 92% of Tata Sons’ earnings in FY21, from among 14 listed companies. The success of the vast Tata empire hinges on the performance of TCS and perhaps Tata Digital is being seen as the second bulwark for the decades ahead.

Tata Digital, which is still a public limited company, would need to raise massive funding to facilitate the transactions for future acquisitions, according to equities traders, who spoke to us on the condition of anonymity as they look at Tata group stocks. The onboarding of Curefit’s Bansal will be a critical step in this direction.

Till next time,

Nikhil Subramaniam

Featured image & graphics: Aprajita Ashk

![[The Outline By Inc42 Plus] The Dawn Of Tata's Super App](https://inc42.com/wp-content/uploads/2021/06/tata-super-app-featured.jpg)

![[The Outline By Inc42 Plus] New Breed Of Big Tech In India](https://inc42.com/wp-content/uploads/2021/12/Outline-97-_Featured-490x367.jpg)

![[The Outline By Inc42 Plus] Funding Boom Before The Bubble?](https://inc42.com/wp-content/uploads/2021/12/Outline-96-Featured-490x367.jpg)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] The Dawn Of Tata’s Super App-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)