SUMMARY

The pandemic pushed startups to focus on ESOP liquidity - is it enough to fix the image of ESOPs?

In an ecosystem, where big exits are scarce and billion-dollar companies struggle to make profits — it’s a big ask from employees to accept ESOPs instead of cash bonuses. Making things worse are the cautionary tales around ESOP.

Here’s a famous one that involved a serial entrepreneur and a celebrated name from the startup ecosystem.

Alok Goel, who recently quit venture capital firm SAIF Partners (now Elevation Capital) to start his own venture, was promised a lucrative ESOP deal in return for a drop in pay when joining redBus in 2012 from Google. The promised deal would allow employees to vest 20% of their ESOPs in two years, 30% after three years, and 40% after four years of working with the company. But, something unexpected happened — less than a year later in 2013, redBus cofounder Phanindra Sama decided to sell the company to travel giant Ibibo, which meant Goel lost out on the promised ESOP benefits.

Obviously, people were not happy and till date, the story of redBus is quoted by employees whenever employers ask them to compromise on the in-hand salary in lieu of ESOPs. Those who deride ESOPs feel it’s nothing more than a promise that rarely materialises. After all, one can’t pay the rent or expenses using company stocks — the common argument goes. So it’s not enough for employers to simply offer ESOPs without also showing the potential liquidity options in the future. Along with this, the nature of ESOPs itself is changing as the startup ecosystem has matured.

Take, for instance, how startups have turned to ESOPs to offset the salary cuts and drop in bonus payouts during the pandemic. Interestingly, this time, ESOPs have not been just limited to the top-level senior management, but for employees in middle management and even entry-level in some cases.

Given the cash crunch, it was becoming difficult for startups to retain and acquire skilled talent as the pandemic had diminished the trust factor between employers and employees. ESOPs are now a retention tool for growth-stage startups.

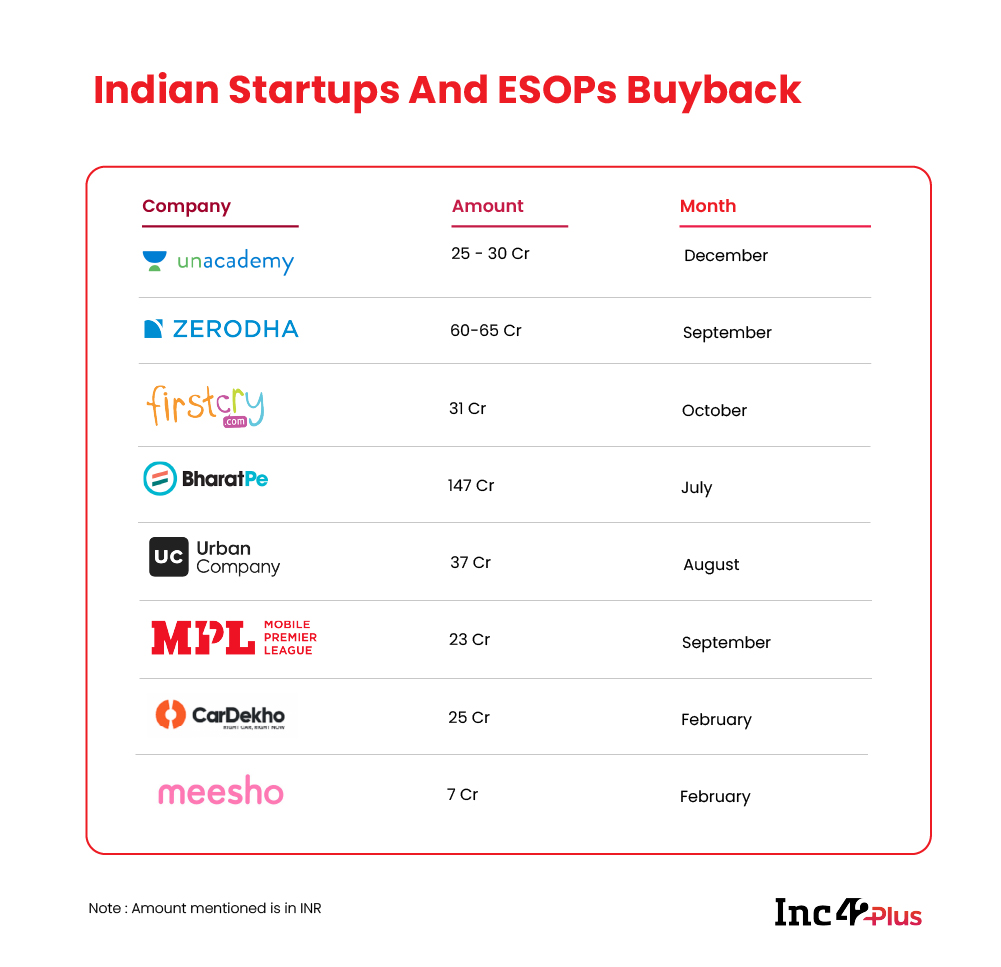

That’s why ESOP liquidity in the form of buybacks and secondary sales has come into the picture after six months of tightening purse strings. Some of India’s most valued startups like Unacademy, Zerodha, Firstcry, BharatPe, Urban Company, MPL, CarDekho, and Meesho have orchestrated ESOP buybacks for their employees this year alone.

Siddarth Pai, founding partner of 3one4 Capital, believes that the market has changed in the post-Covid era since March.

“ESOP buybacks have been taking place for the past 2-3 years in India, but it’s been concentrated usually within larger unicorns. The pandemic has pushed the need for generating employee liquidity to younger companies as well,” Pai said.

Perhaps noting that many startups are lining up to launch ESOPs, angel network AngelList launched equity management software EquityList in June this year. AngelList told us that its customer base — essentially companies looking to launch ESOP buyback programs — has grown but most are either profitable or already large unicorns.

Sumukh Sridhara, who is the CEO of EquityList, noted that late-stage companies with regular capital inflow or good cash generation are best poised to buy back ESOPs. “The common pattern is that the buybacks are the expected way for liquidity versus employees exercising their options for shares. For these companies, it has turned into either a recurring event (every year or alternate year) or will be tied to future financing rounds,” Sridhara added.

Given that external funding is clearly a big factor in companies going for ESOPs, the list of startups that have enabled liquidity is not lengthy by any means — not many have the cash reserves to offer employees liquidity through an ESOP buyback.

“Companies who have offered ESOP buybacks, have been able to do it because they can spare cash and they want to motivate their employees. Also, because they do not see foreseeable liquidity events in the near future. It’s a great thing to do, but the number of companies who can afford this is just a handful,” said Avendus Capital managing partner Ritesh Chandra.

Further, angel network LetsVenture director Ganesh Nayak, and Sanjay Jha head of the fund’s equity management platform MyStartupEquity, noted in a conversation with Inc42 that by offering ESOP buybacks, companies are nullifying the whole purpose of ESOPs, which is to use the company’s share price to drive value. “If a company does ESOP buybacks, the company needs to use cash from its balance sheet, which nullifies the benefit of using its stock to compensate employees.” Nayak said.

He added that while some companies have offered ESOP buybacks in the initial phases, a lot of them will eventually move towards letting employees own company shares and sell to an existing investor or a buyer who can come in later — that’s how the whole cycle gets validated.

On the other hand, speaking in the favour of ESOP buybacks, 3one4’s Pai said it is actually more tax-friendly with regard to the employees because a secondary transaction would include payment of tax at the applicable rates and IPOs are not very common in the Indian startup ecosystem yet.

An important caveat to note about ESOP buyback is that the employees do not pay any tax in this liquidity event, the company picks up the tab here and it pays a buyback tax which is about 20% of the entire value. To put things into perspective, in the case of a secondary sale of ESOPs, employees are mandated by the Indian law to pay a hefty tax which has time and again been seen as a deterrent against ESOPs by employees.

There are also other reasons why ESOPs have not seen wider traction among startups. “Employees in India are still largely unaware of such plans and are often unconvinced by their benefits. The terms of the agreements can vary from company to company, as there are no set norms,” said Hersh Shah, CEO, India Affiliate of Institute of Risk Management (UK).

ESOPs are ordinary shares and typically have a lower price than the preferential shares held by investors and founders or promoters. Plus, during layoffs, employees may find their ESOPs voided without recourse. So it’s best to understand that there are definitely risks involved even for startups in the growth stage.

BharatPe cofounder Ashneer Grover believes that Indian founders have been guilty of keeping an eye on the ESOP pool as an option to eventually claw back their diluted equity. This is the single most reason why so many startups typically underutilise the ESOP pool which has been set aside by the board, he added.

How The World Does ESOPs

However, experts and investors have a positive outlook around ESOPs becoming a mainstream trend in India. Avendus Capital’s Chandra noted that as the underlying company valuations keep on increasing thereby increasing the value of the ESOP pool. The ESOP market itself will become fairly large and active and thus liquid. Employees may not have to necessarily depend on the next company financing round to seek liquidity and institutional platforms will be available for the same.

Though investment experts say institutional investors have shown some interest in buying ESOPs, it is still a rare sight. This eventually means that employees do not have an option to liquidate their stocks in the absence of an institutional round of investment, which also does not guarantee that a sale of ESOPs will take place.

ESOPs typically make up the bulk of a startup employee’s net worth — it can be 20-30% of net worth for someone who joined the company in the later stages, but it can be as high as 40%-50% for early-stage employees. This essentially means a big part of their income is inaccessible to them for a long period of time.

ESOPs typically make up the bulk of a startup employee’s net worth — it can be 20-30% of net worth for someone who joined the company in the later stages, but it can be as high as 40%-50% for early-stage employees. This essentially means a big part of their income is inaccessible to them for a long period of time.

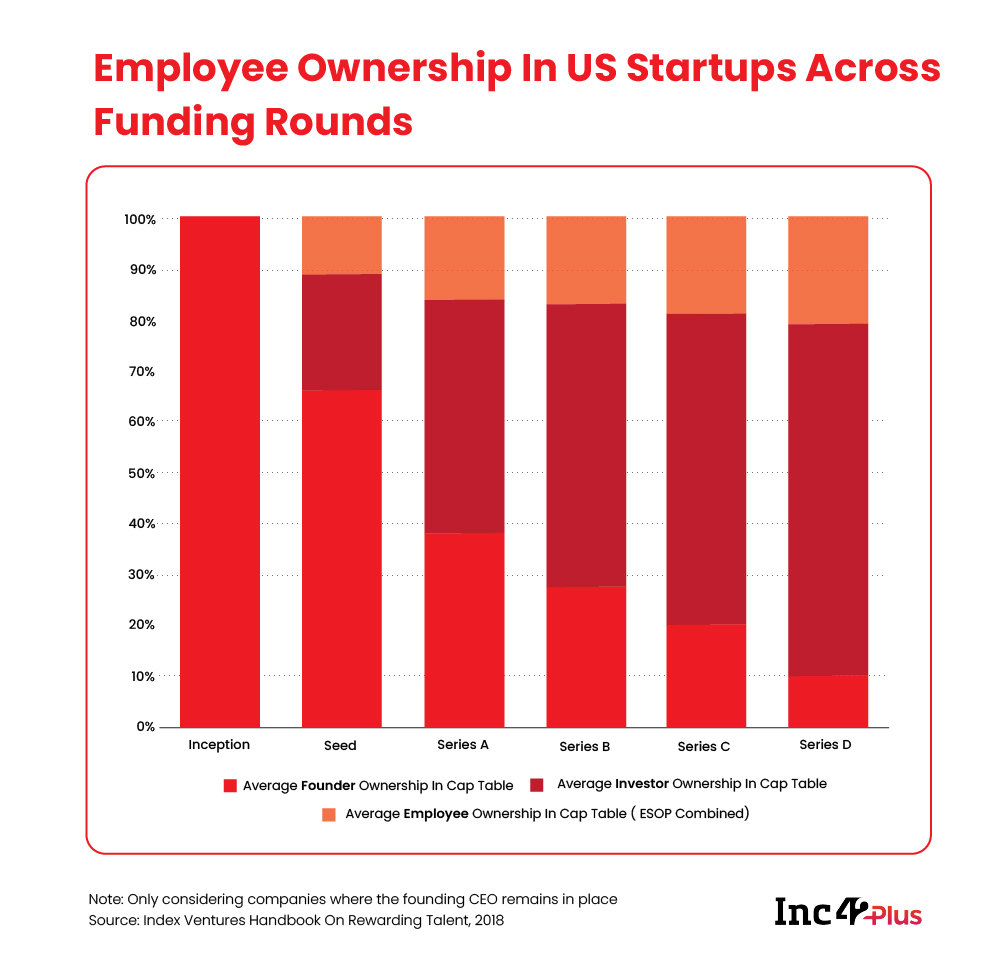

Comparing this to growth-stage funding rounds in Silicon Valley, MyStartupEquity’s Nayak said that in the US-based startup such rounds are always a combination of primary and secondary sale. Another best practice getting popular in the US is that companies offer liquidity options to employees at least once a year.

“The employees may not pick it but they know there is an option. It could even be a small fund like 5%-15% of the invested ESOP but it helps employees in their financial planning. I think the frequency and predictability of liquidity events are more important than the company stage at which they are offered. I think such practices would help employees to really appreciate the value of ESOPs,” Nayak added.

Keeping Up With Billionaires

As Indian startups rise up to address employee compensation challenges, the fate of 50K Future Group employees hangs in balance. Ecommerce and retail heavyweights Reliance and Amazon are pitted against each other in a fight for the ownership of the Kishore Biyani-led entity.

Earlier this week, the Singapore International Arbitration Centre (SIAC) put the INR 24,713 Cr Reliance-Future deal on hold, following Amazon’s claims that Future Group violated a deal between the two companies when it entered into an agreement with Reliance. But Mukesh Ambani’s Reliance has emphasised that the deal is valid under Indian law and would move forward without any delay.

Legally speaking, Reliance Retail may not have a leg to stand on. Legal experts told Inc42 that both Reliance Retail and Future Group would have to comply with the interim order since there is a precedent of Indian courts upholding decisions taken by the SIAC. Media reports have now indicated that Amazon is considering filing a case with an Indian high court if Future Group declines to bypass the order and proceed with the stake sale to Reliance Retail.

Amazon has also urged Indian market regulator Securities and Exchange Board of India (SEBI), Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) to take into consideration the Singapore arbitrator’s interim judgment against Reliance and the Future Group.

Keeping Up With Lending Tech

In the case of consumer tech companies like Xiaomi India, Amazon, Flipkart, and Zomato; retention is of course not about employees but about customers. Consumer tech giants see retention from a totally different lens and with an aim to bolster their digital ecosystems, they have jumped into digital lending with both feet.

Put simply, users on loan books (even if most of the companies above are only loan originators), are more likely to feel a sense of loyalty because the company has seemingly taken a risk on the customer’s behalf. It’s an age-old and useful tactic that has been revived by tech startups, whether to retain users or service partners.

However, Paisabazaar’s business head Gaurav Aggarwal asserted that one must not forget that the goal of consumer companies is always to boost consumption of their platforms. This is because of the sheer nature of these consumption loans, these loans are typically for smaller amounts and for shorter periods. Even if consumer companies are lending, the nature and goal of these loans are not the same as of a lending company, added Aggarwal.

Given the fact that there is no match between supply and demand, as far as lending is concerned, the role of consumer companies has only helped meet the unmet demands, creating a wave of partnerships and products for lending startups.

Most developments in the business world are usually a ripple effect of what happened in the past — the market always changes with time and new opportunities emerge.

In 2018, Flipkart gave India’s startup employees the first taste of ESOPs and the kind of value that startups can bring to the table. Over time, these employees have ended up launching their own ventures and startups — fondly known as the Flipkart Mafia. They are now paying forward the faith to the rest of the startup ecosystem with similar employee-first thinking. Yes, it’s as much about culture a company can create as it is about its financial clout and in that regard, many founders are poised to write the next chapter in the ESOP story of Indian startups.

Until Next Time,

Yatti Soni

Correction Note | 9:44, November 3, 2020

- Sanjay Jha is the founder and head of MyStartupEquity, the same was updated in the article

- Some sections of this article have been edited post-publishing to fix typographical errors and improve clarity of language

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs](https://asset.inc42.com/2020/10/image-5-100-1.jpg)

![[The Outline By Inc42 Plus] New Breed Of Big Tech In India](https://asset.inc42.com/2021/12/Outline-97-_Featured-490x367.jpg)

![[The Outline By Inc42 Plus] Funding Boom Before The Bubble?](https://asset.inc42.com/2021/12/Outline-96-Featured-490x367.jpg)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![[The Outline By Inc42 Plus] Keeping Up With Startup ESOPs-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)