SUMMARY

Indian companies that have been heavily backed by Chinese investors are in a grim state right now

The funds would need clearance from the government, which can take up to 12 months

Here, a clear difference will be made by how domestic VCs comes for support

In a circular dated April 17, 2020, the Indian government amended the extant FDI policy for curbing opportunistic takeovers or acquisitions of Indian companies due to the ongoing Covid-19 pandemic. The decision was triggered after China’s Central Bank bought 1% stake in HDFC after the company’s shares suffered in the stock market crash. It was also noted that China-backed funds were seeking to nab companies suffering a valuation slump due to the impact from the pandemic.

The amendment stipulates that any country which shares a land border with India can invest only under the government route. India shares land borders with Afghanistan, Pakistan, China, Bhutan, Nepal, and Bangladesh. Earlier, only an entity established in Bangladesh and Pakistan needed to adopt government routes for consolidation deals in India. Interestingly, except China, no other border country has many investments in India.

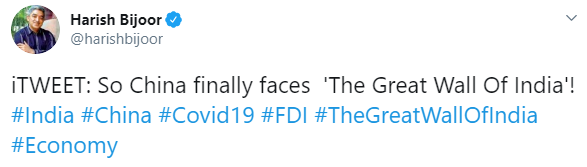

Prominent Twitter users in India welcomed this move by the central government terming the amendments as ‘The Great Wall of India’. But a few also brought up concerns on how China can retaliate in the near future.

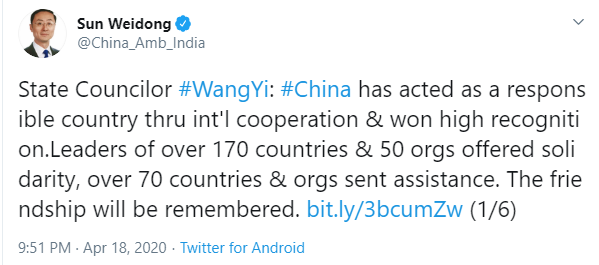

As expected, China shot back as the country’s Ambassador to India Sun Weidong said that at a time like this ‘cooperation’ is needed and not ‘scapegoating’.

Chinese Investor Portfolios In India

In the last 5 years, Chinese tech investors have put an estimated $4 Bn into Indian startups, as suggested by foreign policy think tank ‘Gateway House: Indian Council On Global Relations’. Also, the investments are across all major sectors in the economy.

The Chinese investment funds have played a key role in pushing the Indian startups in an aggravated growth phase. As of now, conglomerates like Alibaba and Tencent hold most investments.

Here’s a look at China’s tech depth in India

- Chinese-funded TikTok, the video app, has 119 Mn subscribers

- Chinese smartphones like Oppo and Xiaomi lead the Indian market with an estimated 66% share

- In electric mobility segment, China’s BYD has become a popular name under electric buses category in India

- As of November 2019, Chinese automakers are expected to pump in $5 Bn in the Indian market

- Key sectors leading Chinese investments: consumer goods, especially electronics, logistics, and retail; smartphones, apps; AI, IoT, Fintech

Overall, 17 Indian unicorns today have Chinese investors on their board. Here’s a table to showcase the lead Chinese investors on board of Indian unicorns.

Is India Ready For China’s Response?

India-China has always been a love-hate relationship. Putting the differences aside, we cannot underestimate the role played by China in the Indian economy. Here are two key areas where India needs to be ready for a significant impact.

Trade Factors

China is the third-largest trade partner for India when it comes to exports with a total trade value over $16.3 Bn in 2018. Compared to 2014, Chinese imports to India had surged 55% whereas India’s export grew only by 22%.

Possible impact of FDI rules amendment: In response to India’s FDI decision, a major impact might be seen on the trade relationship between the two countries. This includes key industries such as raw materials for drugs or APIs, agri-fertilisers, medical and technical equipment, telecom equipment, industrial machines and more.

Readiness shown/ to be shown by India: According to reports, India plans to ramp up production of active pharmaceutical ingredients or APIs and become an alternative supplier for global drugmakers hit by factory shutdowns in China. The minister for chemicals and fertilizers Sadananda Gowda on April 17 said that India has sufficient stock of medicine and fertilizers and citizens need not panic.

Startup Bets

Indian companies that have been heavily backed by Chinese investors are in a grim state right now. Revenues are already bleak. Indian VCs and family houses never had the appetite to pour hundreds of millions in these companies, so foreign VCs were the first option for such companies.

Possible impact of FDI rules amendment: With chances of the lockdown continuing well into next month with certain services excluded from operations, companies could soon be gasping for working capital to continue daily operations. Some have even termed government intervention as a black hole, wherein the funds would need clearance from the government, which can take up to 12 months.

“It will now require a nod from the government and apparently target investments from China. It may restrict Chinese investors to pick Indian companies at all times valuations. The move may end up harming FDI inflows in future,” added Sumit Kochar- Senior Wealth and Transaction Advisor, Findoc Group said.

Readiness shown/ to be shown by India: Here a clear difference will be made by how domestic VCs comes for support and how the other countries look at the Indian startup ecosystem

- Other foreign VC funds active in India: In terms of funding, after China, Japanese VC funds and conglomerates have emerged as the big funding source for the Indian startup ecosystem. According to DataLabs by Inc42, the Japanese investor participation in investment rounds of Indian startups has surged over 2x from 19 in 2015 to 34 by the end of 2018. Japan’s SoftBank alone has invested $10 Bn in the Indian startup ecosystem.

- International startup corridors: In the last five years, India has formed startup corridors with 10 countries including Finland, The UK, Russian, Korea, Portugal, Japan, Sweden, The US, Israel and Singapore. Of these, except the US, the Covid-19 impact seems in a controlled state and these economies can be expected to bounce back much faster. So, in the near future, the Indian startups can certainly turn to these startup ecosystems for further collaborations, if not investments.

- Domestic VC support: According to research by 100X.VC, Covid-19 has pushed investor ecosystem to recalibrate the performance expectations. As Dr Apoorv Ranjan Sharma, 9 Unicorn Ventures indicated, with Indian government nabbing investments from China, the responsibility of domestic venture capital firms increases to extend their support to early-stage startups in India.

“The current situation requires us to come together, and help revive the startup ecosystem by offering to fund, mentoring and networking opportunities,” he added.

Did India Have Alternatives?

China is today facing economic and emotional backlash from countries worldwide for its perceived role in not doing enough to stop the pandemic from spreading. In times where the world struggles to battle and beat coronavirus, several industries in China have restarted their manufacturing units thereby giving them a strategic advantage over countries in addition to the cheap labour and lower material costs.

In the aftermath, to revive the respective economies, governments around the globe are taking extreme measures. According to a MoneyControl report, this notification will have the force of law when necessary amendments are introduced to the relevant FEMA regulations. Other countries such as Canada, Australia, Germany, Italy, Spain, Japan, the USA, and in the European Union are also considering similar provisions.

In another development, an April 14 report on TOI also mentioned that South Korean companies are in talks to pull out their manufacturing units from the country to India. This can put China in a difficult state if other countries look to follow the same route.

KS Legal’s Sonam Chandwani rightly said, the promptness of the government’s decision is indicative of the gravity of the situation and its potential ramifications. Further, this move is likely to have an all-encompassing effect on investments in the form of equity infusions as well.

“Government intervention is, therefore, a necessary move to strengthen India’s domestic capabilities juxtaposed against the Chinese advantage in such turbulent times,” she added.

Correction Note: 15: 40 | June 2, 2020

The table titled “Lead Chinese Investors In Indian Unicorns” erroneously mentioned Fosun as an investor in Dream11. The error has been corrected.

Correction Note: 16:40 | June 8, 2020

The table titled “Lead Chinese Investors In Indian Unicorns” erroneously mentioned the US-based Steadview Capital as Chinese fund. The error has been corrected.

Correction Note: 19:13 | June 9, 2020

The table title “Lead Chinese Investors In Indian Unicorns” has been updated to “Lead Investors From China/ Taiwan/ Hong Kong in Indian Unicorns” for better clarity. The table erroneously mentioned the India-based SAIF Partners as Chinese fund. The error has been corrected.