SUMMARY

The Indian Media & Entertainment industry to touch $34.8 Bn by 2021

The online gaming industry in India is expected to grow at a CAGR of 22% by FY23

How are startups in India gearing up to capture the market in 2020?

Startup Watchlist

The Inc42’s annual series, Startup Watchlist brings together the list of top growth stage startups to watch out for in 2020 across industries including — agritech, deeptech, logistics, healthtech, edtech and more.

This article is part of Inc42’s Startup Watchlist, an annual series in which we list India’s most promising startups for 2020 from startup sectors such as media and entertainment, agritech, logistics, healthtech, edtech and more. Explore all the stories from our Startup Watchlist 2020 series here.

The idiot box is no longer without smarts. Not only has it evolved into the smartest version but it has also cloned itself onto every possible screening device, thanks to the birth of OTT and digital entertainment. These screens are the avenue for the bulk of the millennial and Generation Z population for gaming, movies, and TV.

The rise and projected growth of the over-the-top platforms is a certainty given the penchant for data consumption in India. Considering the increasing number of entrants in this segment and a wide user base, India’s national investment promotion and facilitation agency, Invest India projects the Indian media & entertainment industry to touch $34.8 Bn by 2021. It further states that the industry is projected to grow at a CAGR of 14% over the period 2016-2021, outshining the global average of 4.2% Compounded Annual Growth Rate (CAGR), with advertising revenue expected to increase at a CAGR of 15.3% during the same period.

The Indian advertising industry is projected to be the second-fastest-growing advertising market in Asia after China. At present, advertising revenue accounts for around 0.38% of India’s gross domestic product.

According to DataLabs by Inc42, the media and entertainment sector recorded a total funding of at $561.27 Mn in 2019, a decline of about 23% in the amount of funding in the sector from the previous year. This could be a temporary fall given that the market for media & entertainment startups is only growing with the wave of new Internet users and the rise of the regional language ecosystem.

The online gaming industry in India is expected to generate a revenue of INR 11,900 Cr by the financial year 2023, growing at 22% CAGR, according to a report by consulting major KPMG and the Indian Federation of Sports Gaming. The addressable base is also increasing and is expected to touch nearly 600 Mn users in India by the end of this year. As a result, the Indian media and entertainment startup sector is also booming.

To highlight the growth of this space, Inc42 has curated a list of some media and entertainment startups that are expected to make it big this year and have the potential to outlast the competition in 2020.

Editor’s Note: The below list is in alphabetical order and is not meant to be a ranking of any kind.

Editorji

News has changed in the 21st century with the advent of digital media and entertainment and the rise of video as a format for consuming news in India. Founded by veteran journalist and former NDTV CEO, Vikram Chandra, Editorji uses artificial intelligence (AI) and machine learning (ML) to learn user tastes and preferences, and suggest a playlist of news videos tailored to their interests.

Founded in 2018 and headquartered in New Delhi, Editorji offers a free-of-charge and ad-free version at present but plans to roll out a paid version this year. It generates revenue through paid content partnerships and events.

The application has close to 2 Mn downloads across iOS and Android other than users that flock-in via partnered distribution platforms such as Airtel Thanks & Xstream, Panasonic Arbo Hub, Firestick, Alexa, Glance among others.

Biswajit Borkataky, head of operations and platform relationships for Editorji, told Inc42 that the biggest challenge that the media faces currently is that most established TV companies do not have their digital strategy in place, most often it’s TV content rehashed for the web & mobile. “This does not work and secondly quality independent content publishers do not find distribution. Editorji sees this as an opportunity to give quality independent publishers the platform and also getting the traditional TV companies to use the platform to experiment with short video content,” he added.

For 2020, Editorji is looking at integrating with more distribution partners, including smart TV apps and expanding the offering to 6 additional languages along with rolling out an adtech service for the platform.

Hippo Video

Video is the next frontier for brands and businesses. Hippo Video is a SaaS platform capitalising on the need for businesses to create engaging video content, offering personalised video distribution and enabling businesses to leverage a single video to create multiple experiences for each customer at scale.

The platform generates revenue through subscriptions for its video creation and distribution engine. Leveraging AI and ML applications, Hippo Video is looking to grab on to the social media opportunity for branded videos. The startup told Inc42, “With the success of platforms like Facebook Live, Instagram, and TikTok, we know that video is the most engaging media that brands should create. But when a single content is designed for the masses, it fails to connect with them genuinely. Hippo Video is perceiving AI and ML as the torch bearers of the future and is already using it to create personalized videos, exclusively for businesses.”

With close to 500 customers worldwide, Hippo Video is looking to expand its customer base in 2020 and reach different verticals with its video distribution service.

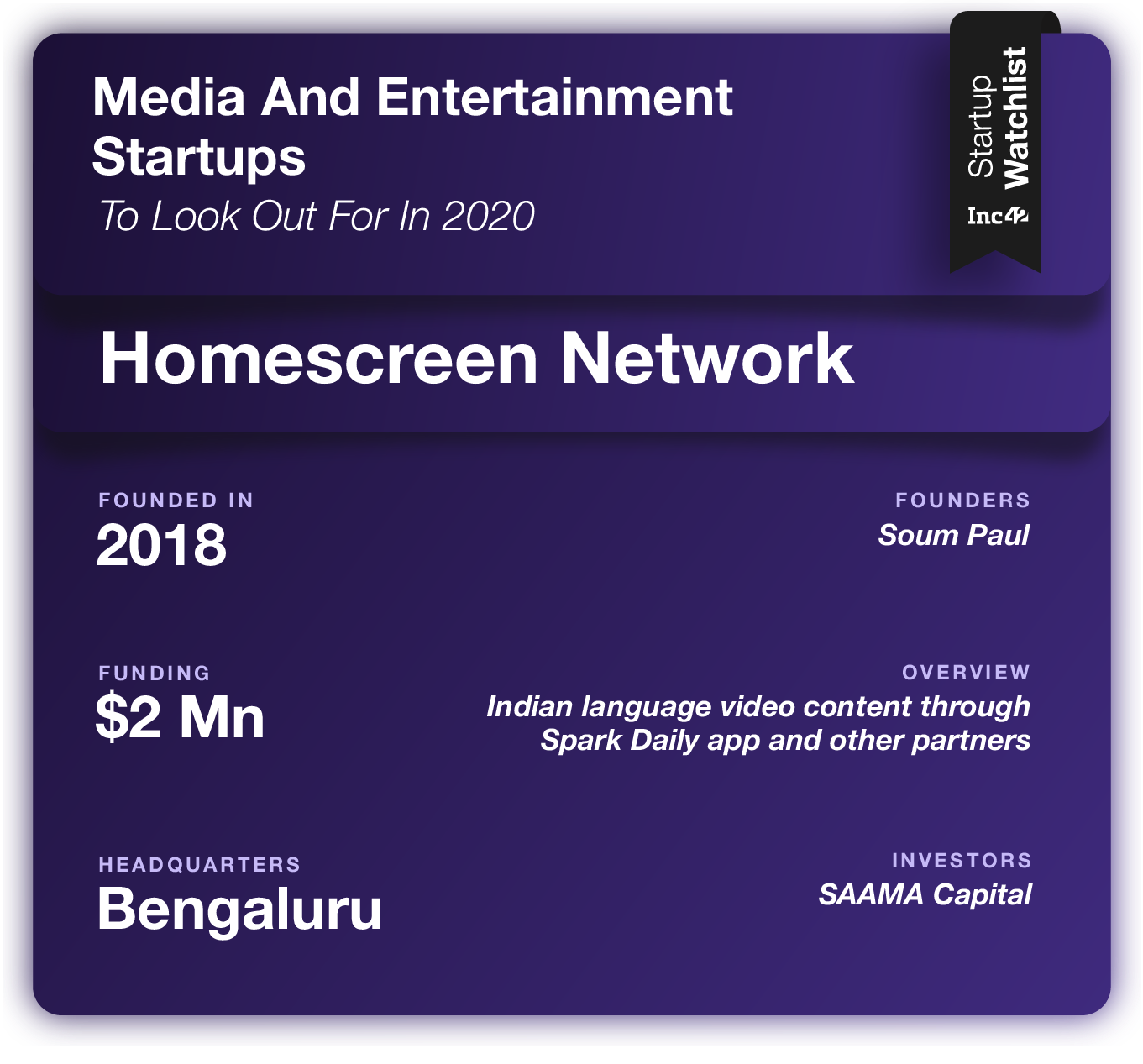

Homescreen Network

Interactive and multilingual content is the need of the hour to cater to the millions of users coming online for the first time and using Indian regional languages for digital communication and consumption. Homescreen Network is a content-community-commerce platform for India’s regional language users. While the model is similar to Hippo Video, HSN focusses on lifestyle brands, products and services with content in vernacular languages.

Founded in 2018 by Soum Paul and headquartered in Bengaluru, Homescreen Network claims to have worked with hyperlocal businesses, experts and merchants from Chennai, Bangalore, Kolkata, Pune, Mumbai, Mysore, Coimbatore, Indore, and other Tier 2 cities.

While touting penetration of mobile phones into India’s hinterlands and regional language internet as catalysts, Paul told Inc42, “We are also in the early phases of a highly interactive video and live-stream era, where audiovisual experiences will transcend and transform numerous domains like lifestyle, commerce, education, healthcare, fashion, and living.”

In 2020, Homescreen Network plans to add support for at least four more Indian languages and do a wider public launch of the platform features to work deeply with a wider set of brands and merchants.

Kuku FM

Kuku FM is a platform where Indian storytellers share their stories in their mother tongue to the world through podcasts. Cofounder Lal Chand Bisu told Inc42, “We help them in content creation, distribution, and it’s monetisation and we are going to make money in every aspect of this process.” Adding that the subscription model and micropayment will be the startup’s primary business model in times ahead.

Founded in 2018 by Bisu, Vinod Kumar Meena and Vikas Goyal, the Mumbai-based startup is backed by India Quotient, 3one4 Capital and Shunwei Capital.

Bisu further added, “We are being downloaded over 15 lac times and have been rated 4.9 stars on play store by more than 20,000 users. The average daily listening time per user is 50 min. We work with over 3000 skilled content creators across all content types and genres including brands like Dainik Bhaskar and Film Companion and HT Media.”

For 2020 the startup aims to bring monetisation into play and grow its community of creators 10x with support for three new vernacular languages.

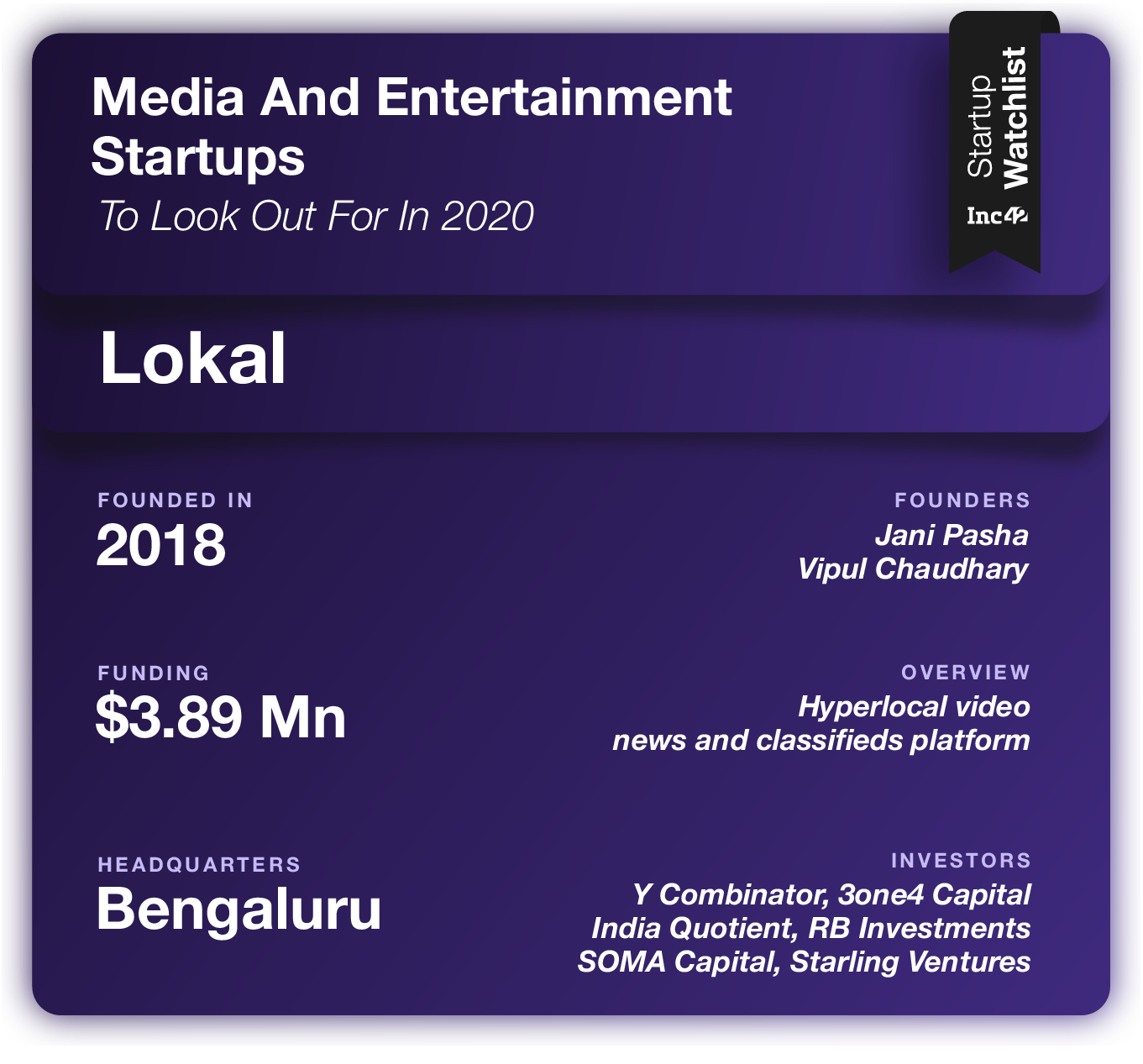

Lokal

Regional language content is booming in India. Many Indian startups have looked to address this burgeoning opportunity, and Lokal is one of the first to bring a vernacular classifieds and videos platform for India’s regional language internet users. Cofounder Jani Pasha told Inc42 that out of India’s 1.3 Bn population, regional language users don’t get access to good internet products for jobs, classifieds, e-commerce, education, like the English speaking set.

“There is a total lack of quality internet products for non-English speaking users for anything other than entertainment. We are building Lokal to solve this. Lokal is changing this by building a world-class product for 900 Mn non-English speaking Indian users providing them local news, classifieds + more meaningful use-cases evolving every day,” Pasha said.

The Bengaluru hyperlocal news and classifieds platform was founded by Pasha and Vipul Chaudhary in 2018. Pasha told us that local content platform that will win the Indian market will be the one that is able to monetise regions in a better manner by having a business model around classifieds and not just impression-based advertising.

While at present Lokal has more than 4 Mn downloads and is operating in 27 districts across Andhra Pradesh, Telangana, and Uttar Pradesh, it plans to launch in three more states in 2020.

Mobile Premier League

Mobile gaming reached new heights in 2019 with the ascension of Dream 11 into the unicorn club. Mobile Premier League is gunning to become a unicorn soon with its platform approach and multiple games. Targetting casual and esports players and game developers, MPL helps games monetise their skills through real rewards in games such as chess, pool, carrom among others. Users participate in skill game tournaments or challenges by paying a registration fee on the MPL app, with the winner taking a major chunk of the pooled amount.

Founded in 2018 by Sai Srinivas Kiran and Shubham Malhotra, MPL has 32 Mn registered users across India. The company also has operations in Indonesia and Singapore. It partners with over 20 gaming studios and organisations including names such as Psypher interactive, Dumadu Games, Juego Studios, Paytm, NDTV, AWS, Cornerstone, and Clevertap.

“We feel that the biggest challenge for the media and entertainment sector is to understand and appreciate that different kind of people like/consume different kinds of content, and as an industry, we need to be receptive to those needs,” an MPL spokesperson told Inc42.

In the year ahead, MPL aims to become the world’s largest esports and content monetisation platform by adding more titles, games, foray into more kinds of content and expand.

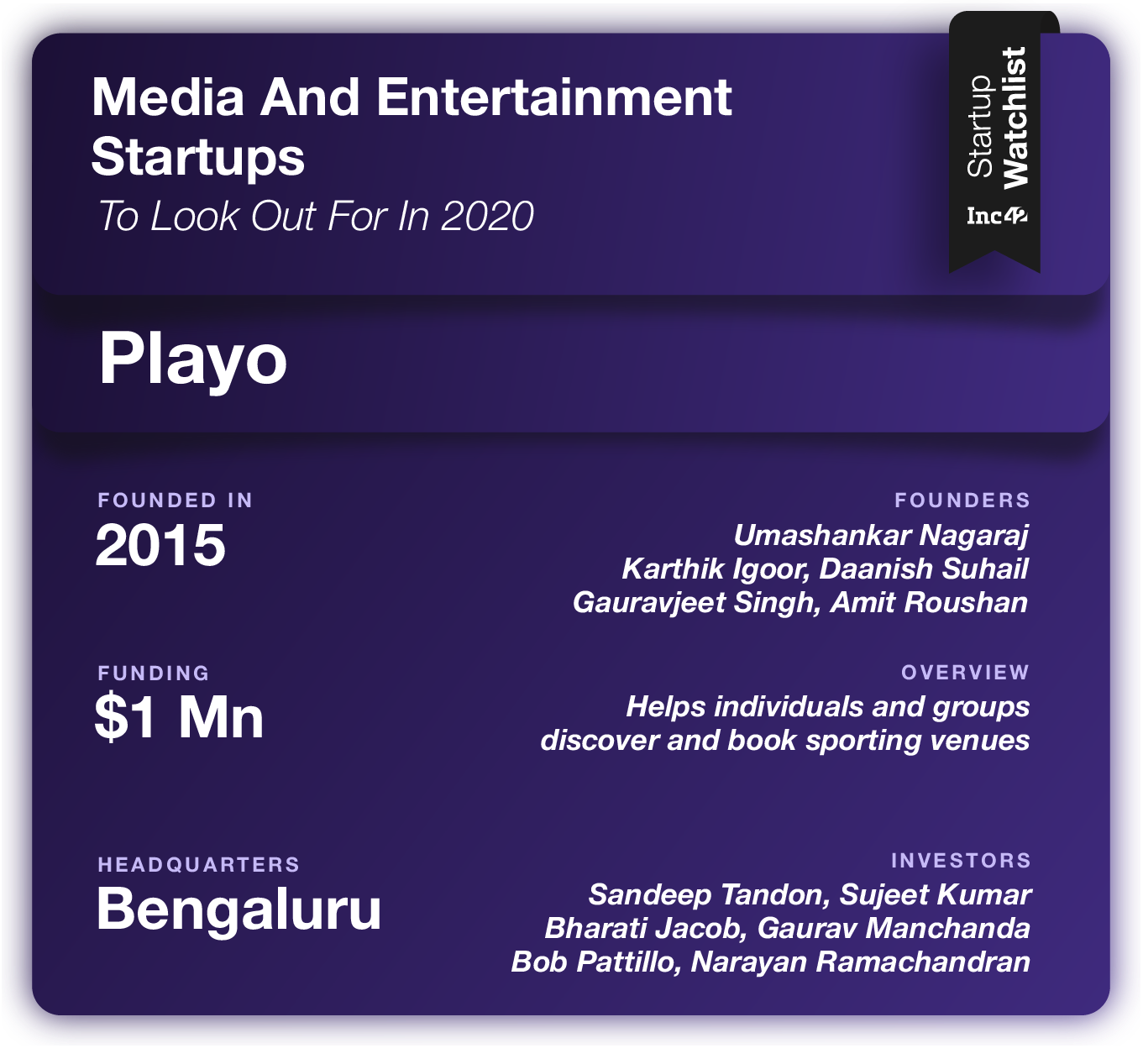

Playo

Despite the huge landmass, India is not a very friendly place for sports enthusiasts with spaces and venues available only at a premium. Playo is looking to change that with a community and commerce platform catering to amateur sports enthusiasts and groups. The platform helps users engage with other enthusiasts while also accessing activities, venues, events and other sports-related services. The startup generates revenue through a commission from merchants on venue bookings, event registrations, products or service sales and for advertising.

Founded in 2015 by Gauravjeet Singh, Amit Roushan, Karthik Igoor, Daanish Suhail and Umashankar Nagaraj, Playo is headquartered in Bengaluru. The Playo app has more than 1.2 Mn downloads and is present in seven cities in India and UAE. The startup claims to have partnered with more than 1000 sports venues and organisers, enabling over 150K activities per month.

Gauravjeet Singh, cofounder and CEO of Playo, told Inc42, “The lack of established market means that we have to continually work on advocacy to catalyse the market growth. Further, the lack of an established existing player means there is not a tried and tested playbook for the business model. Sports has been akin to medal conquests and positioning it as a recreational opportunity means changing the status quo.”

For 2020, the startup aims to expand geographically to more Indian cities and enter Europe and Southeast Asia markets.

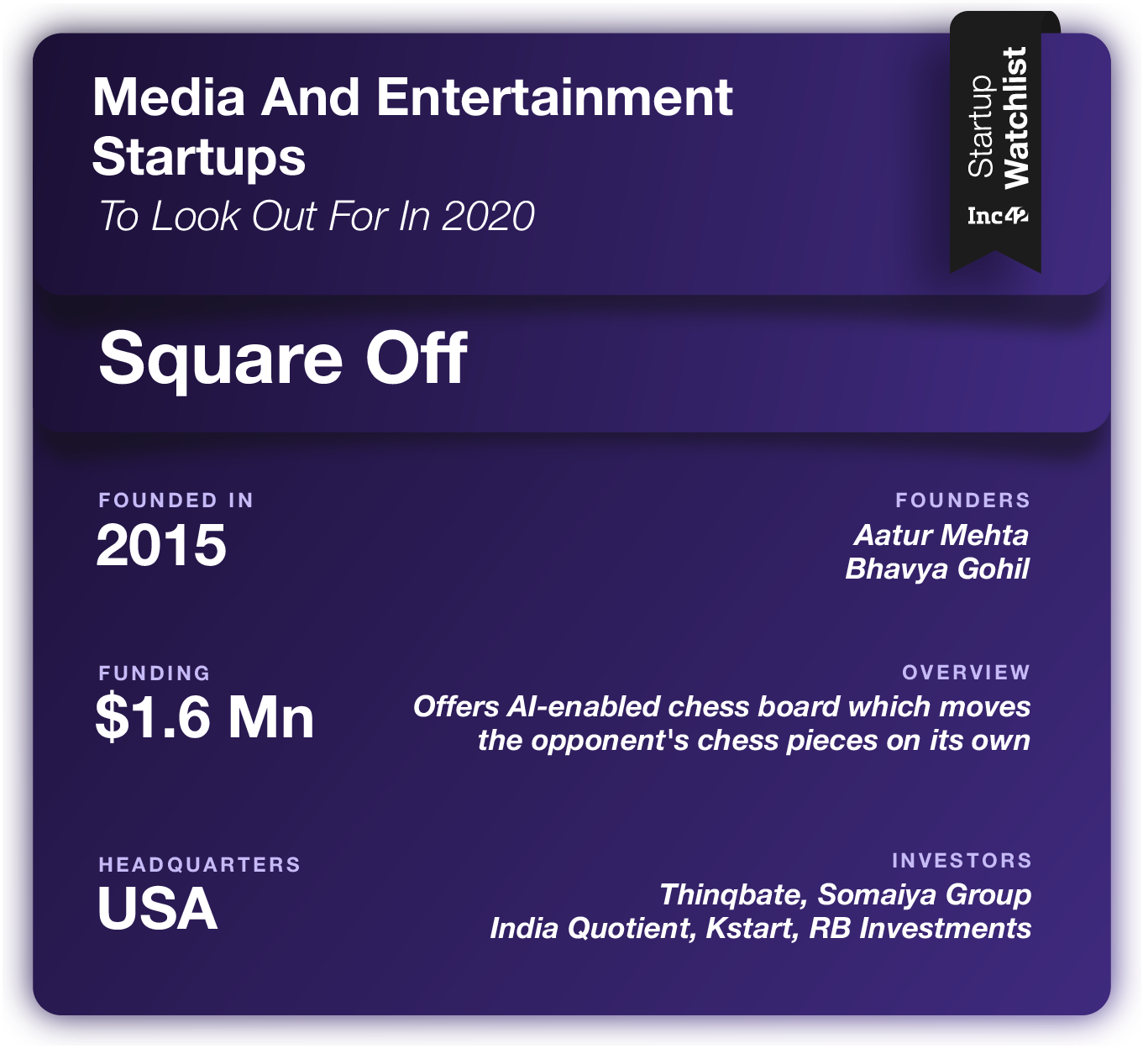

Square Off

Can AI, robotics and IoT change traditional board games? Square Off is looking to do just that with its high-tech board games starting with the ancient game of chess.

Square Off was founded by Bhavya Gohil and Aatur Mehta in 2015 and is headquartered in Delaware, USA. Its smart chess boards make moves automatically when controlled through a smartphone app. The startup generates revenue through sales of its game and app which has paid features and online chess coaching. It currently claims to have over 20K customers for its board and 30K users on the Square Off mobile app.

Square Off has a partnership with Chess.com which has 30 Mn+ registered chess players and it also works with retail majors like Amazon, Touch of Modern, Hammacher Schlemmer, B8ta stores, D & H Distribution, Chess USA, Chess Baron and House of Staunton.

Cofounder Gohil told Inc42, “We are trying to give a modernised experience of a traditional board game backed by technology, hence, our boards come with minimum tech aesthetics, however, we are strongly backed by AI and robotics in the backend. We feel with our new offerings at a relatively lower price, we will revolutionize the way board games are played.”

For 2020, Square Off plans to introduce two new chess-centric products and revamp its app with new features.

Vokal

While Quora is now moving to add support for Indian languages, Vokal is going with a native approach to address the regional language opportunity in India.

Founded in 2017 by Aprameya Radhakrishna and Mayank Bidawatka and headquartered in Bengaluru, Vokal is an Indic language question answer app using voice and video as the mode to provide answers to the user’s questions. For 2020, Vokal says it wants to reach 30 Mn monthly app users which would make us one of the top content communities and platforms in India.

Cofounder Aprameya Radhakrishna told Inc42, “While smartphones and data getting cheaper are increasing the number of people getting onto the internet, the amount of content and number of products available to use the internet is falling significantly short. Pushing for more community-based products that will enrich the Indic internet is the way forward.”

WinZO

Gaming has taken India by storm and the rise of PUBG is the biggest example of this phenomenon. Looking to capitalise on the craze for casual games, WinZO aggregates third-party games and offers them in various vernacular languages. It currently offers personalised content in 10 languages and pushes the most relevant content to the user based on past gaming history and other data, making content discovery easier. Just like MPL, WinZO has taken a multi-game approach with tournaments for games such as quizzes, carrom, cricket, chess and more.

Founded in 2018 by Paavan Nanda and Saumya Singh Rathore, WinZO is headquartered in New Delhi and backed by Kalaari, KStart, and Hike. At present WinZO has more than 15 Mn registered users, spending 55 minutes on the application per day on average. The company claims that 90% of its user base belongs to Tier 2-Tier 5 cities across India.

“We foresee far more opportunities than challenges in the mobile gaming industry in India today. Indian gaming space is one of the fastest-growing sectors, globally. In 2018, six billion games were installed only in India. We see this as at least a $10 Bn opportunity. India is steadily moving towards value-driven consumption, with an increased focus on local development,” a spokesperson told Inc42.

For the new year, WinZO plans to add over 300 games in over 15 languages to target an expanded user base of up to 100 Mn players.

The media and entertainment startups are selected for the Watchlist based on editorial criteria as well as the recent funding, stage, growth or scale achieved in the preceding year and how it has differentiated itself or its model in a competitive market.