Of the $10 Bn+ raised during the year, more than $2.8 Bn (28%) was raised by five startups alone

Overall, the median ticket size reached its lowest level since 2019 to $2.2 Mn from $4 Mn in 2019. Also, funding in women-led startups tanked 80% to $480 Mn from $2.4 Bn in 2022.

Seed stage startups could raise only $681 Mn versus $2.4 Bn raised in 2022, representing a 72% YoY decline

Inc42 Daily Brief

Stay Ahead With Daily News & Analysis on India’s Tech & Startup Economy

The year of extended funding winter has been worse for the world’s third-largest startup ecosystem in almost every sense — layoffs, shutdowns, deal counts and capital infusions.

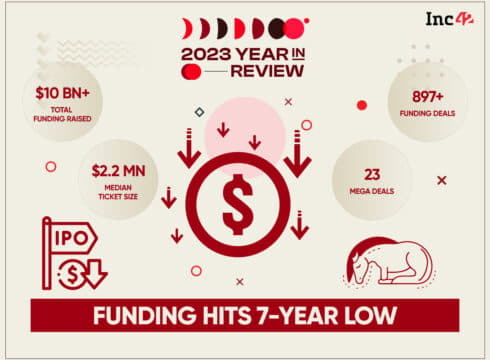

According to Inc42’s annual “Indian Tech Startup Funding Report 2023“, Indian startups secured over $10 Bn in funding until December 25 this year, with just two new unicorns in its kitty.

On a year-on-year basis, this represents a 60% decrease compared to the $25 Bn raised in 2022. Historically, Indian tech startup funding hit a seven-year low, plummeting even below the $12 Bn raised in 2018.

The number of deals, too, witnessed a significant 40.8% YoY decline at 897 deals compared to 1,517+ in 2022.

It must be noted that of the $10 Bn+ raised during the year, more than $2.8 Bn (28%) was raised by five startups alone. While PhonePe raised $850 Mn, Lenskart and Flipkart lapped up $600 Mn each. Further, DMI Finance and Ola Electric received a fund infusion of $400 Mn and $384 Mn, respectively.

Overall, the median ticket size reached its lowest level since 2019 to $2.2 Mn from $4 Mn in 2019. Also, funding in women-led startups tanked 80% to $480 Mn from $2.4 Bn in 2022.

Download The ReportNow, before we delve deeper into understanding which stage startups or sectors got hit the most due to the extended funding dry spell, here are some funding trends of 2023 that we have identified:

- Mega Deals Below 2018 levels: Mega deals during the year under review fell to 23 deals against 28 mega deals in 2018. This also represents a 61.66% decline from the 60 mega deals in 2022.

- Top 3 Startup Hubs Saw A Major Funding Decline: On a year-on-year basis, Mumbai saw the maximum decline in funding at 62%, followed by Bengaluru at 61% and Delhi NCR at 51%

- Chennai Took The Lead Among Other Emerging Hubs: Chennai startups raised $211 Mn across 32 deals, followed by Pune at $211 Mn across 30 deals and Hyderabad at $129 Mn in 27 deals.

- Deeptech Continues To See An Uptick In Funding: Despite the ongoing funding winter, funding in the sector has been continuously rising in the last three years. In 2023, deeptech startups raised $496 Mn compared to $397 Mn raised in 2022.

- Valuation Markdowns: In 2023, investors slashed the valuations of eight unicorns, including BYJU’S, Meesho and PharmEasy.

Interestingly, Padmaja Ruparel, cofounder, Indian Angel Network (IAN), sees this shift as a strategic pivot that is reshaping India’s startup narrative.

“2023 saw a transformation in the Indian startup ecosystem, bringing a sharp focus on the fundamental purpose of business building. This meant that being ‘well-governed and valuable’ rather than ‘valuation’ became a cornerstone for founders and investors,” Ruparel added.

Seed Stage Startup Funding Plunged The Most At 72% YoY

Moving on, seed stage startups could raise only $681 Mn versus $2.4 Bn raised in 2022, representing a 72% YoY decline. The number of deals, too, slipped 36.6% to 467 from 737 in 2022.

Late and growth stage funding figures did not prove to be any consolation either, declining 60% YoY in 2023 to $2.9 Bn and $5.6 Bn, respectively.

Considering the ongoing market correction, with growth and late stage startups being scrutinised more on their ability to show the path towards profitability, the downfall at growth and late stage was quite expected.

The continued government intervention with new policies and regulations, larger corporate governance issues, and pressure to showcase a sustainable future growth path slowed down funding for growth and late stage startups.

Download The ReportHowever, the steep decline at seed stage was surprising, considering 31 early-stage focussed funds worth $1.8 Bn were launched during the year.

But, there is a catch!

Several investors that Inc42 spoke with emphasised that the seed stage funding numbers do not reveal the clear picture as most of the deals have gone unannounced.

Shashak Randev, founder VC & cofounder of 100X.VC claimed to have made 62 investments in 2023, with 70% of their portfolio raising follow-on investments at an median ticket size of $700K to $1 Mn.

Pranav Pai, founding partner and chief investment officer at early-stage VC firm 3one4 Capital even claimed 2023 as one of their most active years in terms of founding teams reaching out to them for an investment.

“Anecdotally, the early stage in India has remained on track and within range despite a challenging year. We have seen most of our peers continue to invest in pre-seed, seed, and post-seed rounds. Most of these rounds have not been announced in the media, and the founders have focussed on building the product and leading controlled launches. We expect the launch and round announcements to resume normalcy in 2024,” Pai added.

Ecommerce & Fintech Sectors Topped The Funding Charts

With $2.6 Bn+ raised across 192+ deals, ecommerce leads in terms of the number of deals in the year of the extended funding winter. As expected, almost 56% or 107 of the ecommerce deals were concentrated at the seed stage.

Meanwhile, fintech took the lead in terms of the funding amount, with startups raising $3 Bn across 129+ deals. Of the total funding, 53.3% or $1.6 Bn was raised by four companies alone – PhonePe, DMI Finance, Perfios and InsuranceDekho.

In 2023, the sector went through a rollercoaster ride as both RBI and SEBI put several regulations, policies and guidelines in place. As a result, fintech funding across all stages was cut to half in 2023, with the seed stage taking the maximum hit. Further, lending tech and banking remained investors’ favourites taking in almost 71% of the total funding.

What’s more exciting is that in the top five sectors, cleantech, including electric vehicle, climate tech, and energy startups, also made it to the top five sectors, along with deeptech and enterprise tech. Between 2021 and 2023, 30+ funds were launched with cleantech as one of their focus areas, thereby leading to continued investment in the sector.

[Edited by Shishir Parasher]

Download The Report{{#name}}{{name}}{{/name}}{{^name}}-{{/name}}

{{#description}}{{description}}...{{/description}}{{^description}}-{{/description}}

Note: We at Inc42 take our ethics very seriously. More information about it can be found here.