SUMMARY

Manish Singhal of pi Ventures says “our model is not to spray and pray”

Singhal believes that if one is trying to use AI in a disruptive way, one should be able to add 10x value add to the current state of solutions

He says in future, products will struggle to survive if they don’t use AI and machine learning in a meaningful way

According to Peter Thiel, one of the most famous names in Silicon Valley and the co-founder of PayPal, you need to build proprietary technology that is 10x better than the closest substitute in order to create a monopoly. This, he says, should be the core aim of an entrepreneur.

Thiel writes in his book Zero to One — a book most startup founders have likely been recommended to read at some point — “It’s always a red flag when entrepreneurs’ talk about getting 1% of a $100 Bn market.”

In essence, what Thiel says is go big or go home.

But what happens if the market itself is slated to grow at 10x?

We’re talking about the artificial intelligence (AI) market. According to a report, the AI market in India was estimated to grow from $419.7 Mn in 2014 to $5.05 Bn by 2020, at a CAGR of 53.65%, due to factors such as diversified application areas, improved productivity, and increased customer satisfaction.

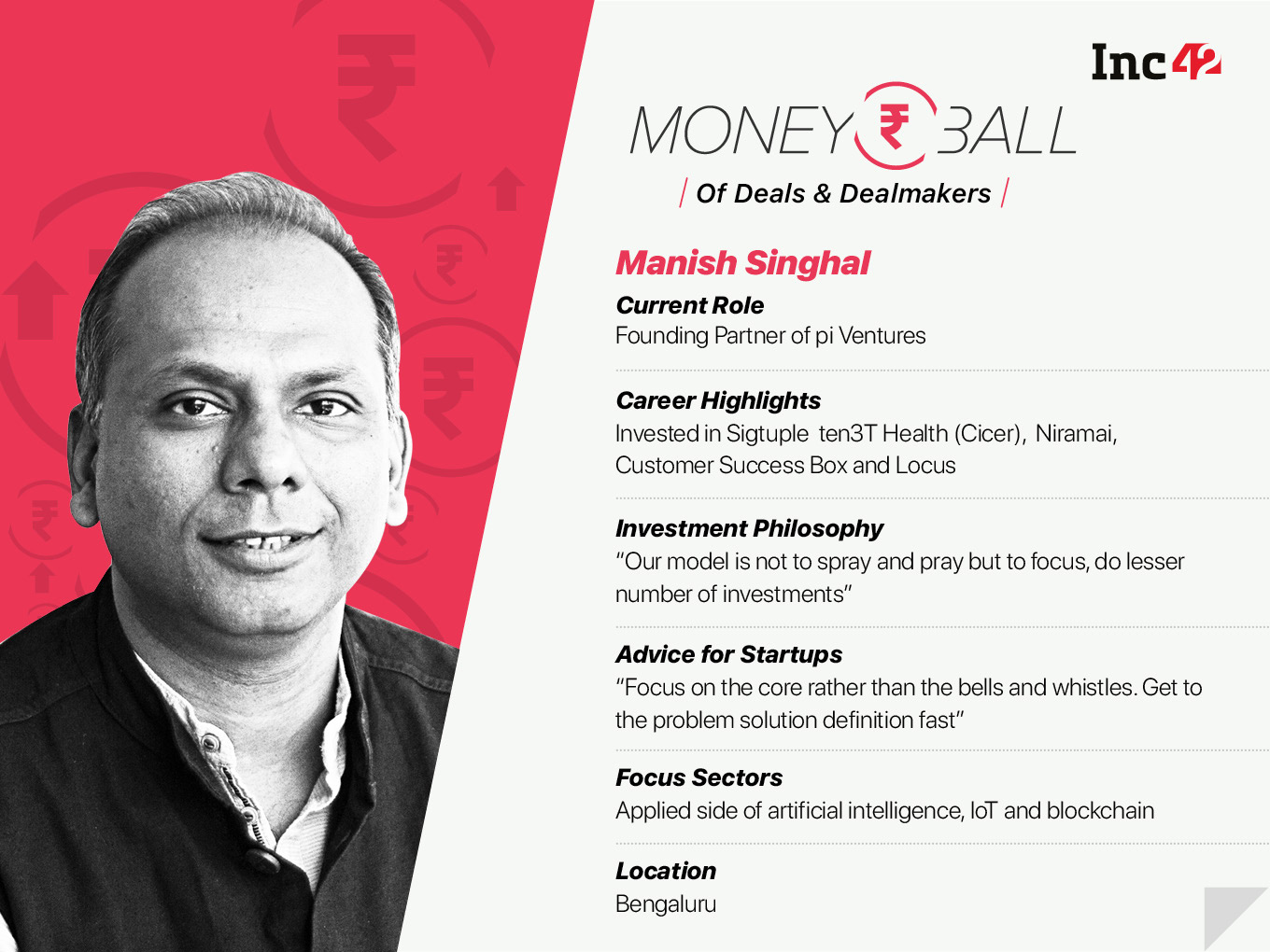

“Data is part of everything we do today,” says Manish Singhal, founding partner at pi Ventures, an early stage venture fund that focuses solely on areas of applied AI, machine learning, and IoT.

Established in 2016, pi Ventures claims to be India’s first such venture fund that is focused on AI. It recently raised $6 Mn from the CDC Group UK, taking its tally for its first fund to $31 Mn — slightly more than its target of $30 Mn — and could see the fund size rise a bit more.

pi Ventures has invested in startups such as Sigtuple, which provides blood diagnostic solutions using deep learning; ten3T Health (Cicer) which does intelligent heart monitoring; Niramai, which helps in prediction of breast cancer; Customer Success Box, which provides real-time health scores to customers; Locus, a startup that uses uses deep learning and proprietary algorithms to provide intelligent route optimisation. The VC firm has already made a exit on its earlier investment in Zenatix, which offers energy efficiency solutions to large commercial consumers of electricity.

Singhal believes that if one is trying to use AI in a disruptive way then one should be able to add 10x value add to the current state of solutions. “If this part is solid, then we are willing to work with the entrepreneurs over the other aspects and we can lead the way to maturity,” says Singhal.

Singhal also does not believe that there is a race for innovation in AI between countries like the US and China and there is no point even talking about where India stands in the pecking order. But this is a debate for another time.

For now, here are excerpts from this week’s Moneyball with Manish Singhal, founding partner of pi Ventures.

Inc42: What is pi Ventures about ?

Manish Singhal: We are a venture fund that looks at pre series A and seed investments in startups. We do up to $1 Mn in the first cheque and tend to be the first institutional cheque in the company.

Our thesis is intelligence from data.

We look at companies that are either on the applied side of artificial intelligence, or IoT or blockchain. We call ourselves a startup because we started out just a couple of years ago.

We have invested so far in six companies, of which three are in healthcare and three in enterprise; we have exited one of them already.

Our model is not to spray and pray but to be be very focussed and do fewer investments. So from the fund, we may do 10-15 investments totally over the next three years.

Inc42: Can you have a business model, innovation, and clarity at the same time?

Manish Singhal: It depends on the maturity and the journey that the startup is at. For example, we had supported a company called Niramai which does breast cancer screening and we came in at a very early stage, when they didn’t even have the product (they only had a basic algorithm working). But at the same time, you can discuss what potential business model the company can attract in the future and, based on that, we do our analysis and try and figure out if a viable business model can be created.

For Locus, we did a pretty mature deal…they were already in the market and had paying customers. Over here, apart from the technology, we also saw validation of the business.

If you are trying to use AI in a disruptive way then you should be able to add 10x value add to the current state of solutions. If this part is solid, then we are willing to work with the entrepreneurs over the other aspects and we can lead the way to maturity.

Inc42: Why did you decide to just focus on these key areas revolving around AI?

Manish Singhal: Data is part of everything we do; similarly, in business, a lot of processes and interactions have become digital.

So, our thesis has been that the companies and products that do well in the future are those that use data intelligently. Google Maps has become prevalent in use cases because it is using AI to show the shortest path.

Data-based intelligence will become a integral part of all products in the future and the best way to derive intelligence from data as of today is AI.

I believe that products will struggle to survive in the market in the next two-three years if they don’t use AI and ML in a meaningful way.

Inc42: What technologies are you excited about going forward?

Manish Singhal: We are truly sector agnostic and we keep meeting entrepreneurs who do interesting work. It doesn’t matter which sector they are in because if we like the whole proposition, we make the investment.

Going forward, there are some very interesting opportunities in healthcare, enterprise solutions, logistics, fintech, and blockchain. These are the areas where we believe we will do investments in the times to come.

What we are looking for is meaningful disruption by use of some intelligent innovation.

Inc42: What do you think of AI race between the US and China and where does India figure?

Manish Singhal: There is no race, it’s happening in our minds and I feel it’s a unnecessary sensationalism of this space. Everybody is trying to the best they can and create for their customers.

I think the right question to ask is if there is worthwhile work happening in AI in India. At present, we are at the initial stage of innovation where people are experimenting.

If you take any sector in India, you find at least 5-10 startups working with AI and if 1,000 startups are trying to create something, at least 10 or 100 will create meaningful solutions.

That’s why, we are optimistic about India. We see a number of worthwhile AI startups and we also have some unique properties and problem statements. For example, logistics in India is very complex and Locus has serviced the Indian market in an optimal way; so, when they go abroad, they’ll be in a better position to service market needs. India has its own strengths.

Inc42: Is there enough being done by the government to promote AI in India?

Manish Singhal: NITI Ayog has published a paper on this and it was a very well researched document. It is my fundamental belief that most startups don’t need any government support to move forward per say. What they need is probably not much interference from the government and so the data laws that they are trying to bring in have to be considerate.

Opening data banks under NITI Ayog is also a good step. It is for us to utilise what’s out there and there is enough money on the table in the ecosystem.

Inc42: What are some of the quick learnings you’ve had over the last couple of years?

Manish Singhal: It’s not about quick learnings but about gradual learning. One of the things that I had to re-adjust to is that when you are a angel investor, your typical value proposition is more gut-feel oriented and, at the end of the day, it’s your money. So, if anything goes wrong, I only have to answer myself.

But when you’re dealing with other people’s money, then the sense of responsibility and stakes are higher. The way we evaluate startups has gone through a bit of a learning curve wherein we factor in market size, competition, and a lot more things compared to when you are a angel investor.

Inc42: Talk us through your exit of Zenatix. Why so early?

Manish Singhal: As we were building that (Zenatix) business, we realised that it had a different type of capital requirement and that sort of requirement was more suited to a family office environment where capital is available and the goal is aligned. Then we found Hero Electronics, which also has a very strong focus in the same area and the founders were very happy to find that mutual fit because Hero has great access to capital for electronics and they have a good reach.

I spoke to the founders recently and they said they are able to build the business in a lot more scalable way than they were able to do with equity financing.

Inc42: Advice for startups looking to pitch?

Manish Singhal: Focus on the core rather than the bells and whistles. This means, get to the problem solution definition fast and how you have solved it uniquely. Follow it up with validation.

Also you need to keep in mind what is your key value proposition and what is the reason for your existence and why people prefer you over the other choices that they have.

I am a big fan of product demos and it is something I look forward to because then I can see how the founder has realised his vision of the product to reality.

Inc42: What advice would you give to CEOs when they are starting/are looking for a quantum leap?

Manish Singhal: Look to build the 10x factor — how is your solution 10x better than the state of the art. However stay grounded while taking a leap.

This article is part of Inc42’s MoneyBall series in which we bring you up close and personal with the pioneers of the investment world. Dive in to find out about what excites them, their views on the latest technology and investment trends, and what the future looks like from their viewpoint! Explore more stories here.