SUMMARY

While India’s ‘ease of doing business’ or EoDB ranking has improved, on-ground indicators suggest a tough time for many tech companies looking for success in the Indian market

From crypto and NFTs to drones and from foreign ecommerce to digital lending — major growth sectors have been hit by recent regulations or threat of regulations

At the same time, critical and groundbreaking legislation such as the ecommerce policy or the data protection law have been left in the balance despite the urgent need to pass these laws for the stability of India’s digital economy

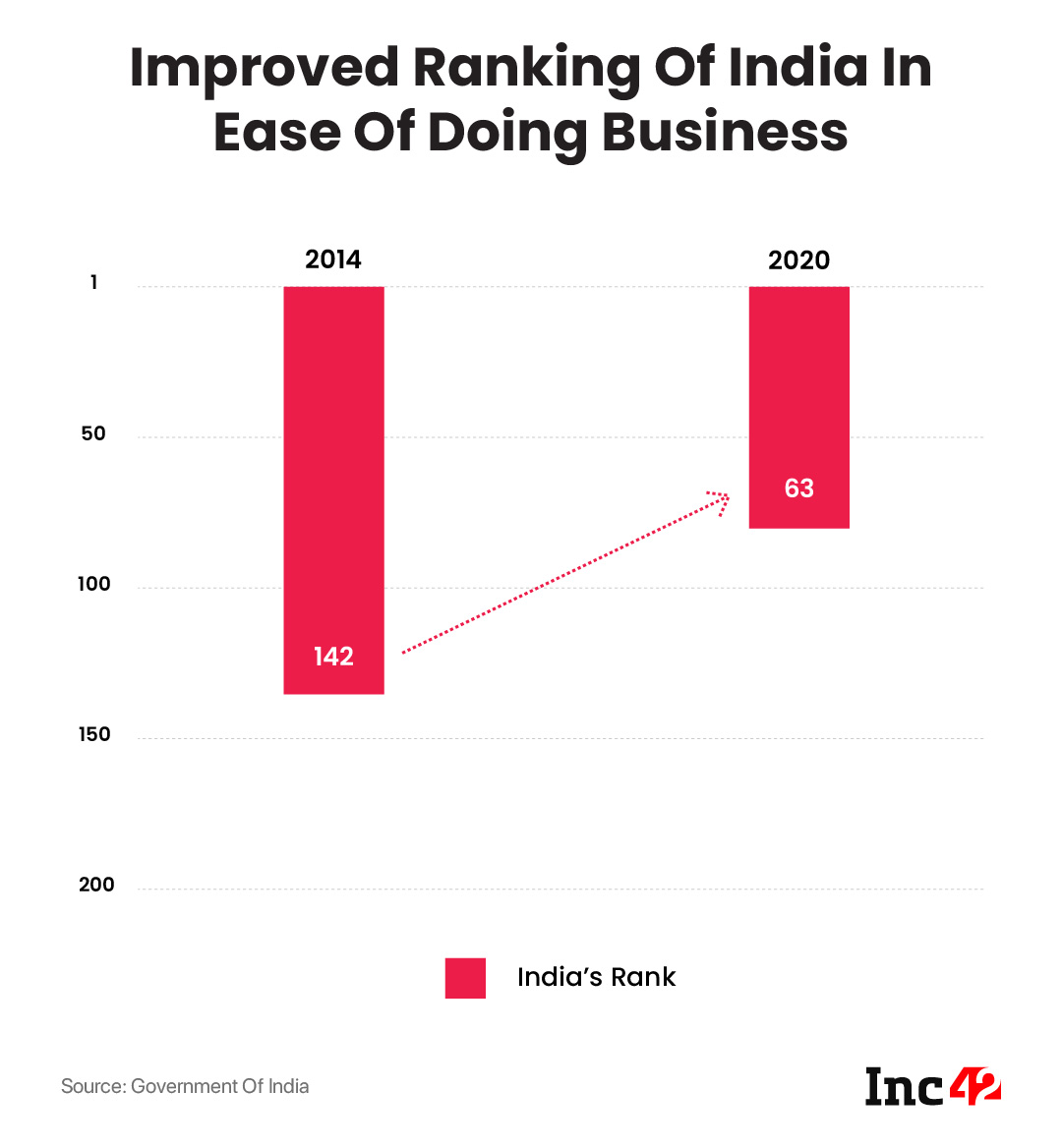

It’s been one of the most touted claims of the current government in India, and one that has time and again been put forward as proof of the progress and development of the Indian economy. We are of course talking about ‘ease of doing business’ or EoDB in India, which is considered a key indicator of how business-friendly a particular market is. While India’s ‘ease of doing business’ or EoDB ranking has improved, on-ground indicators paint a different story for Indian startups and tech giants.

This past week, Union Minister for Industry & Commerce Piyush Goyal made another pitch for EoDB in India, urging Indian startups and companies to register in India and go for public listings in the domestic market, rather than setting up companies abroad for “a few dollars more”, adding that the government is willing to work with entrepreneurs in relation to particular hurdles and resolve them.

And in another instance of a high-level government official talking about the high ceiling and potential of the Indian startup ecosystem, Union Minister of State for Entrepreneurship, Skill Development, Electronics & Technology Rajeev Chandrasekhar said that India is set to see more than 1,000 unicorn startups in the next two to three years. Chandrasekhar added that the government wants the next wave of startup founders to come from India’s tier 2 and 3 cities.

While setting such targets is certainly admirable, are recent government policies, crackdowns and intense scrutiny into operations of certain startups in line with these tall ambitions? As we will see, the government is building up the idea of India as a great destination for global and new-age businesses, some of the recent developments have spooked some observers.

The Economic Survey for 2021-22 released prior to the Union Budget in February, highlighted India’s ease of doing business ranking has improved to 63, up 14 positions from the previous ranking. In the past half-decade and more, we have seen several new policies and platforms creating the infrastructure for startups to flourish. IndiaStack and UPI, for instance, have been the backbone of fintech growth, while the streamlining of the patent and trademarks regime has resulted in the improvement of India’s ranking in the global innovation index from 81 to 46 between 2014 and 2021.

But the ground reality stands in contrast to these rankings. That’s because since 2020, we have seen some rather critical decisions from regulators and the central government that have made doing business more difficult.

After record-breaking funding in 2021, capital inflow into startups is slowing down this year, and these hurdles posed by arbitrary regulatory and government intervention are pinching tech businesses large and small. From foreign companies pulling out of the Indian market due to regulatory pressure to big tech giants caught in antitrust and tax probes, there are some serious counter-indications to the touted EoDB growth.

Where’s The Ease Of Doing Business (EoDB)?

Yes, the number of new startups saw an uptick in 2021, but intense regulatory scrutiny in digital lending, prepaid payments instruments and buy now pay later (BNPL) have raised concerns as well. Similarly, online gaming is also under the microscope of various state legislative houses.

During her Union Budget speech, finance minister Nirmala Sitharaman had announced that a ‘One Nation, One Registration’ regime will be introduced to ease the registration of businesses. This single-window clearance system would definitely relax the compliance burden on startups, but getting various government departments to implement one policy is a massive task.

While it can be claimed that over the past seven to eight years, the Indian government has made registration of new businesses easier, on the other hand, the constant flip flopping on policy and lack of clarity even where policy is present has made life difficult for startups, big tech companies and international giants.

The challenge is two-pronged for startups: regulators intervene at their own behest to tackle problem areas that indirectly affect startups, while at the same time policies by the Indian government have directly complicated operations. Here’s how these two factions have eroded the EoDB gains over the years.

Regulatory Hammer Falls On Growth Sectors

The Indian market is one of the toughest to crack for tech companies due to the array of regulatory bodies that startups and tech giants have to deal with — from the Reserve Bank Of India (RBI) to the Competition Commission of India (CCI) to the Enforcement Directorate (ED) and the Securities and Exchanges Board of India (SEBI).

Together, these agencies and regulators tackle various parts of the market and have been given serious legislative teeth in matters ranging from taxation, financial rules and guidelines to business licensing.

CCI & ED Vs Big Tech

Life is uneasy at the best of times for big tech giants like Google, Amazon, Meta and others even in their home markets, and in India too, these massive tech conglomerates are starting to face some of the very questions that have bogged them down in the west.

Google, for instance, is currently in the midst of multiple investigations by the Competition Commission of India — from its dominance in news distribution to its payment policies for Android apps on the Google Play Store. Interestingly, Apple too is facing similar challenges in India over the payment policies for its App Store.

About the payments issue, the CCI said, “Google’s conduct is also resulting in denial of market access to competing UPI apps since the market for UPI enabled digital payment apps is multi-sided, and the network effects will lead to a situation where Google Pay’s competitors will be completely excluded from the market in the long run.”

Besides this in March, the CCI reportedly launched an investigation against the US tech giant for allegedly abusing its dominant position in the online news publishing business.

Similarly, ecommerce giant Amazon India is said to be under investigation by the Enforcement Directorate. Amazon is alleged to have made misrepresentations, violated foreign exchange laws, and misled the CCI when attempting to seek control in Future Retail in the contentious battle between Amazon and Reliance Industries for the Future Group’s retail assets.

Further, Facebook and WhatsApp parent company Meta has been embroiled in a case at the CCI since January 2021. In January 2021, the CCI started looking into WhatsApp’s privacy policy update after concerns from the general public that it allowed sharing a large amount of data with its parent company and its partners. This case is now slated to be heard in July this year.

In the past, Facebook has argued that its privacy policy does not violate India’s data privacy laws since none exist specifically barring sharing of data after user consent. But the Indian government and other civil rights groups have argued that the extent of the privacy policy and the dominant position for WhatsApp in the messaging space are critical factors and therefore require legal intervention.

RBI’s Eye On BNPL

Like the CCI, the RBI too is looking at some critical issues facing the fintech and banking industry. Talking about a slew of complaints against digital lenders and the BNPL industry, RBI governor Shaktikanta Das said the central bank has its eyes on all manner of complaints that have been made in this regard.

According to an Inc42 report, the addressable market opportunity in the BNPL sector is expected to grow 11X between 2021 and 2025 to reach the $43.3 Bn mark by 2025. But the segment is beset by complaints about ghost loans or loans disbursed by digital lenders even when customers have never sought one, as seen in the case of Dhani Loans, where many high-profile individuals had been affected.

The RBI had constituted a committee last year for digital lending, after reports about predatory lending, aggressive collection practices and even deaths of some borrowers due to alleged harassment by lenders. This led to several loan apps being pulled from the app stores, and a similar fate may befall BNPL lenders too.

UK-based market research firm YouGov’s data suggested that as many as 22% of India’s retail shoppers made purchases via the BNPL scheme in the first three months of 2022, with many more expected to follow suit this year. Major startups in the space include ePayLater, Simpl, ZestMoney, but even players like Paytm, Amazon Pay, Flipkart, Ola, BharatPe and others have entered this space in recent months.

Government Policy Clips Wings Of International Giants

While Startup India has been lauded as a flagship programme by the current government since 2016, the government’s banning of many apps of Chinese origin since 2020 send a different message to the tech industry.

The bans on Chinese apps and scrutiny on Chinese investments came in wake of border clashes in mid-2020, but have been dressed as a push for local businesses. While these bans have been celebrated by many Indian companies, it has also made life uncertain for foreign players in India.

Chinese Investments Under Scanner, Apps Banned

In 2020, following clashes between Indian and Chinese troops on the border, we have seen the Indian government wield its tech ban hammer as a geopolitical tool.

The most recent instance of app bans came in February 2022, when the government banned 54 apps including popular game Free Fire, along with apps such as AppLock, Viva Video Editor, Nice Video Baidu and Astracraft. This, after 200 apps were banned in 2020 and 2021 including the likes of TikTok, ShareIt, UC Browser, PUBG Mobile and others.

Not only has the Indian government banned over 300 apps in the past 18 months on the suspicion of data sharing with the Chinese government, but it has also put curbs on Chinese investment into Indian startups. This has sharply increased protests in the public against Chinese tech platforms and even ones from the wider Southeast Asian market that are seen as having Chinese stakeholders.

Sezzle & Shopee Exit India

This past week, US-based buy-now-pay-later (BNPL) startup Sezzle announced that it would be shutting down its operations in India. Sezzle had entered India with partnerships such as Titan, Noise, Plum, and Kama Ayurveda, but clearly, the Indian market proved to be a tough one to crack for the US major, which was acquired by Australian fintech company Zip in February, and this could have forced the company to reevaluate its position in India.

Incidentally, Zip is an investor in Zestmoney, which is a major BNPL player in India.

While Sezzle’s reasoning for the exit remains unclear, Singapore-based ecommerce player Shopee decided to shut down its India operations due to market uncertainty and wide-ranging protests. The development came five months after it had launched in India and a month after the Indian government banned Free Fire, a mobile multiplayer action game operated by Shopee’s parent company Sea Ltd, which is based in Singapore, but which is claimed to have the majority Chinese ownership.

In the wake of this, Sea Ltd, one of Singapore’s largest tech companies saw as much as 59.71% of its stock value wiped from the peak position that it attained in 2021.

Traders’ body CAIT had launched a movement against Shopee in September 2021, and demanded that the central government take action against it for allegedly violating India’s data sovereignty due to its Chinese ties despite the Singapore registration of Sea Ltd.

30% Tax, GST, TDS Pinch Crypto Growth

One could say the government’s focus has definitely been on ecommerce and online retail, as well as data protection, but even there, the policies are in the draft stage. Both of these are critical for the long-term health of the ecosystem, and at the very least, the data protection bill is long overdue, given that it impacts every business that has a digital or data component.

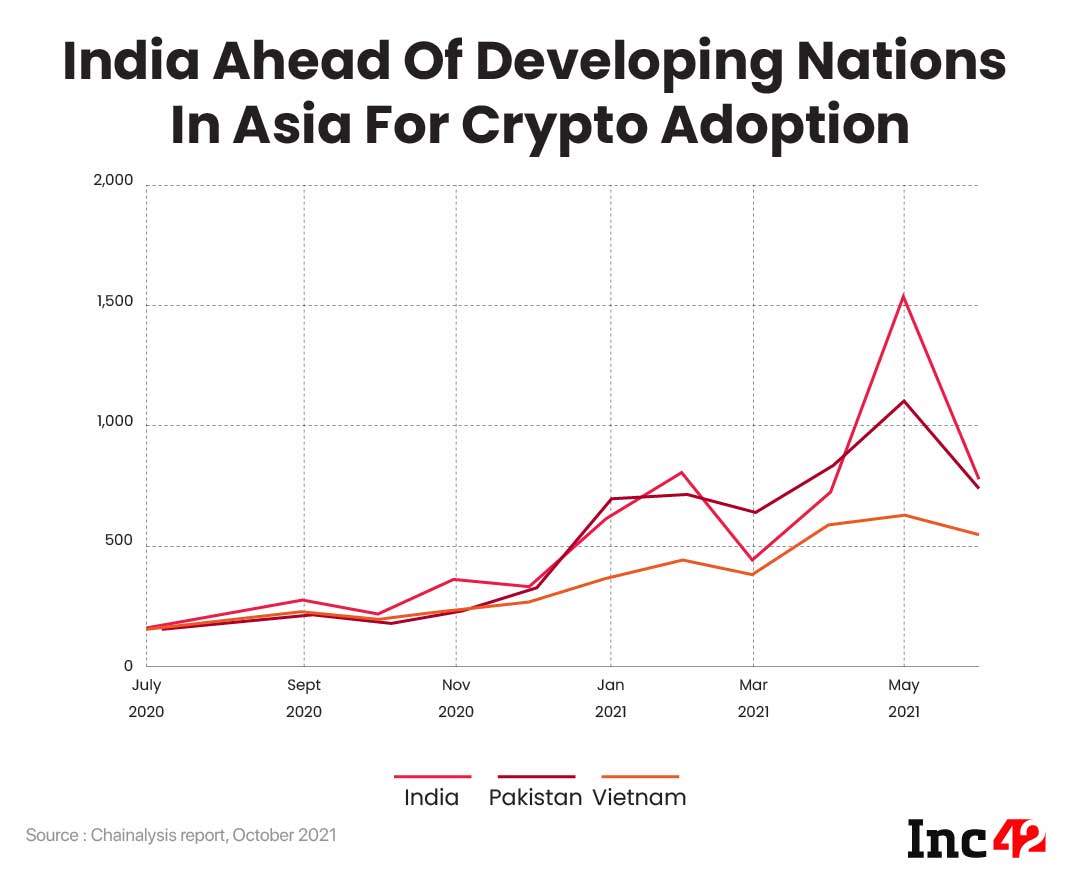

But instead the government has trained its eyes on one of the hottest growth segments – cryptocurrencies and virtual digital assets. A Chainalysis report last October found that India’s crypto market grew 641% from July 2020 to June 2021, turning India into the second-largest cryptocurrency market globally.

There are also signs of maturity as India has a much bigger share of activity taking place on decentralised finance (DeFi) platforms at 59% vs 41% for centralised crypto exchanges.

Given this boom, the eye of the government also fell on this sector. India has applied a 30% tax on income from crypto and 1% TDS on crypto asset transactions. Besides this, while calculating 30% crypto tax, any loss from one crypto asset cannot be offset against income or gain from other assets. Further, the cost incurred for the setting up of infrastructure will not be counted as the cost of acquisition while taxing income from crypto mining.

These rules have spooked many investors as well as startups. Pankaj Gupta, VP of engineering at Coinbase said that while taxation is a great sign, “the numbers are a bit high”. Others such as the former ministry of finance official Subhash Chandra Garg said that the tax rate is quite high and “out of line with the taxation of gains from other financial assets like bonds and equity”.

While crypto trades and transactions are taxed by the government on one hand, on the other, the RBI has independently decided to revoke support for UPI on crypto exchanges and other investment platforms. This issue had plagued transfers of INR from Mobikwik to crypto wallets such as WazirX or CoinDCX.

Even Coinbase had made its grand entry into the Indian market touting UPI support, but on the heels of the Coinbase launch, the National Payments Corporation Of India (under the RBI) released a statement forcing Coinbase to make a U-turn These sudden changes shake the faith of companies in the Indian market.

Millions have been invested in the segment over the years in India — Coinbase’s investment arm has invested more than $150 Mn by itself in Indian crypto and web3 startups, while the likes of Polygon have also raised massive amounts to expand further.

Now, the question is whether the taxation on crypto and other virtual digital assets will derail this momentum. With the crackdown on the industry proceeding steadily, the future looks grim for the booming cryptocurrency market.

Indeed, it’s not just the crypto market that is being threatened with a regulatory disruption — several other key areas in the tech industry such as ecommerce, fintech, online gaming and others face similar challenges. In the past, policy issues such as the so-called angel tax and lack of clarity on regulations for crypto held back startups despite positive changes that encouraged their creation. Several startups that could not succeed due to these issues in the past might well have flourished with forward-thinking policy and action.

Regardless of the EoDB ranking improvements and the metrics in the next update, India needs to clean up its act when it comes to arbitrary regulations and government intervention.