SUMMARY

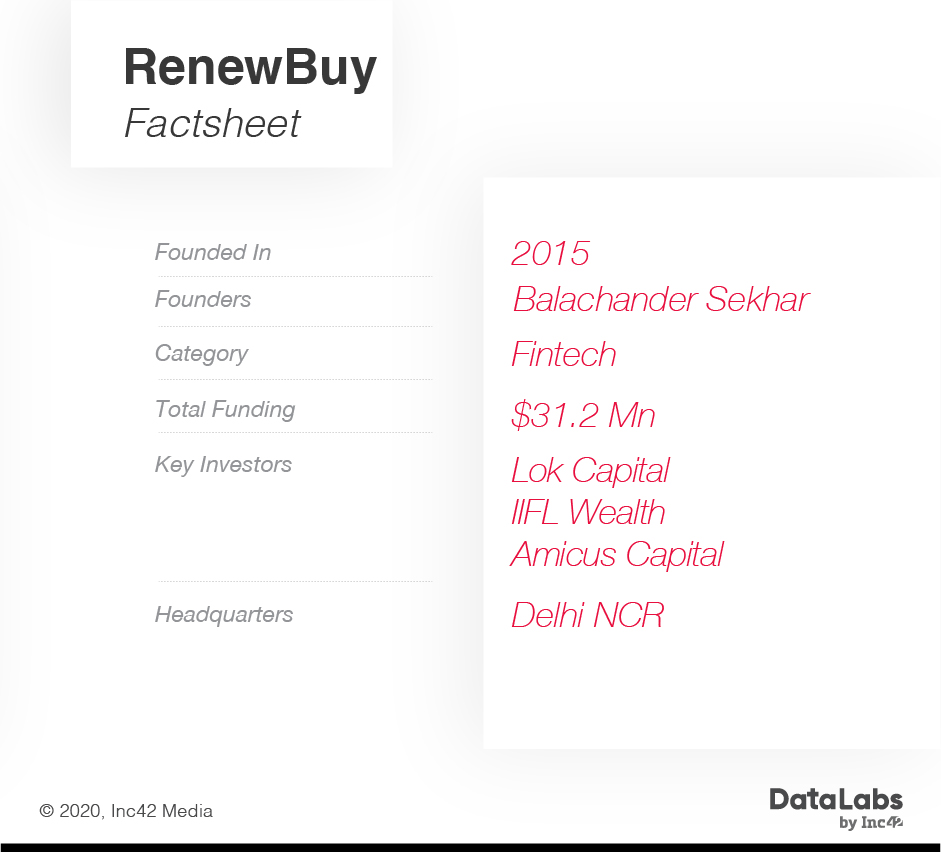

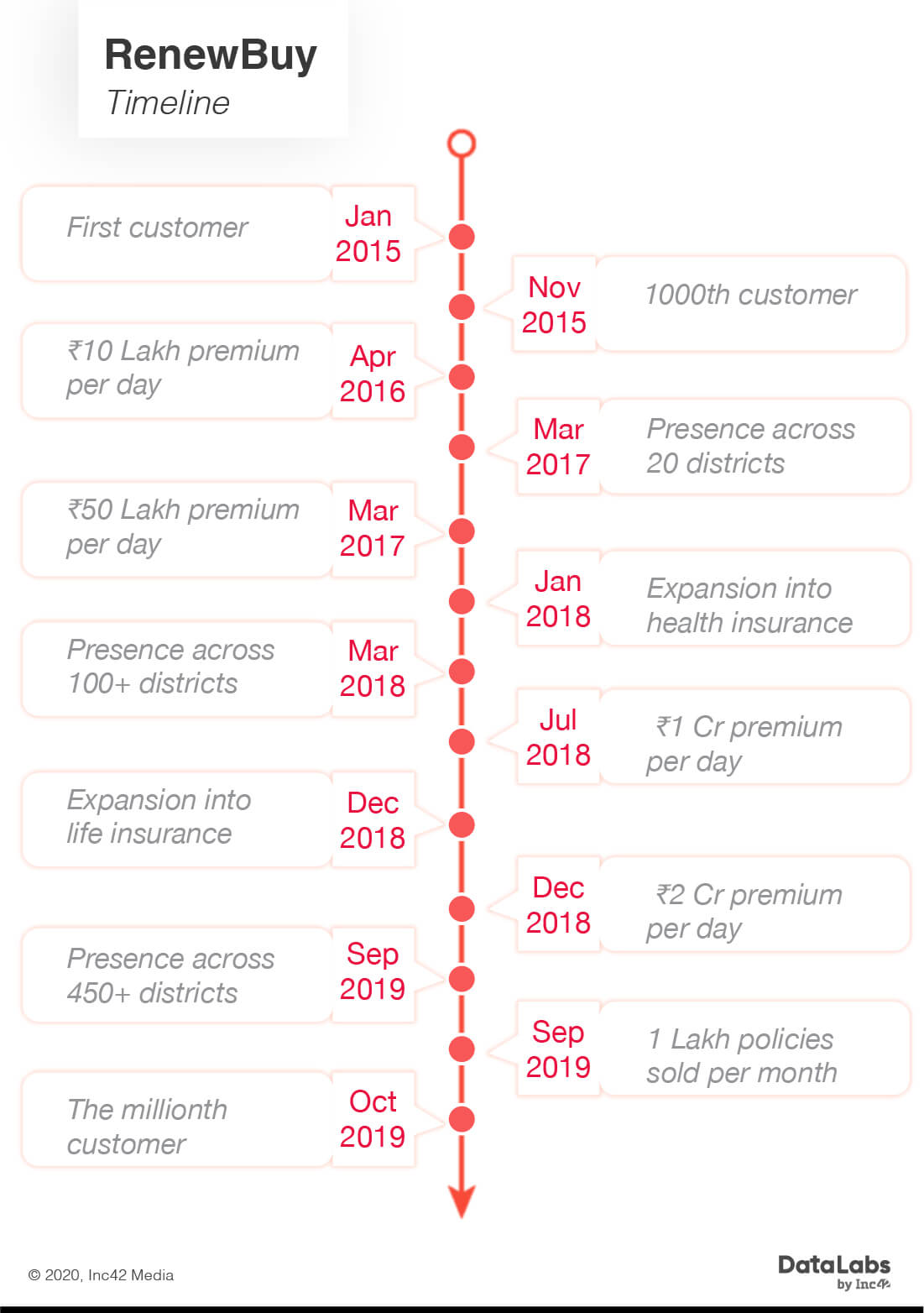

Launched in 2015, RenewBuy aims to digitise the insurance industry in India

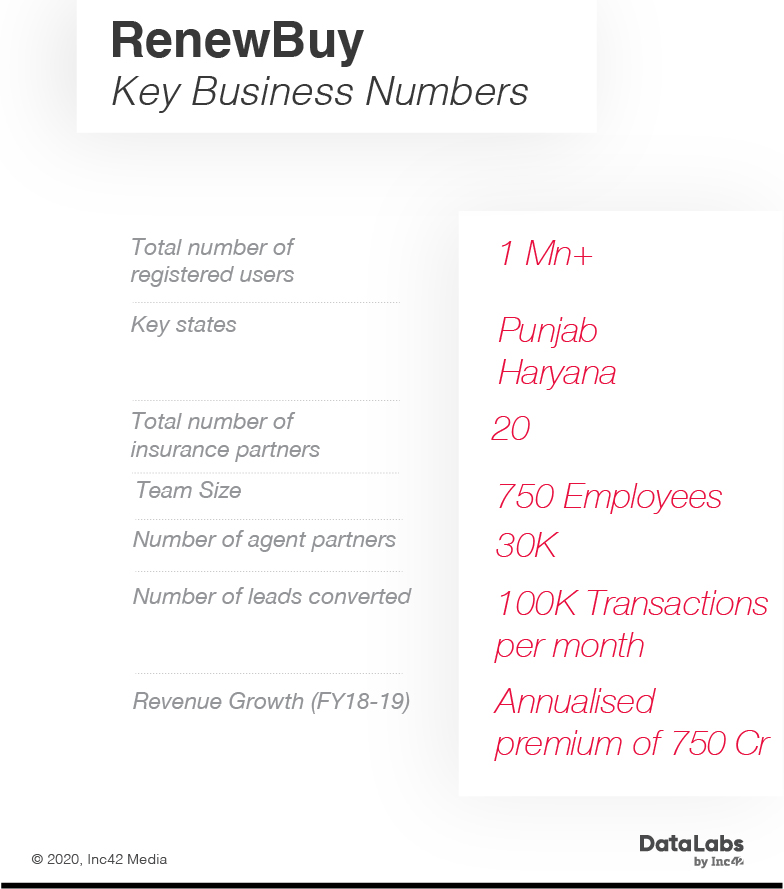

Working with its digital agent model, it’s already present in 500 towns and has 30K agent partners

It looks to increase the footprint to 1000 cities and 10 Mn customers by 2022.

To celebrate India’s rising startups, Inc42 is profiling a new soonicorn every Friday in the Inc42 UpNext: Unicorns Of Tomorrow series. For the next few months, we will be speaking to founders and cofounders at these potential unicorns and shining light on their journeys and growth stories. We begin the series with a look at insurance tech startup RenewBuy.

“Our differentiated approach has enabled us to be efficient and productive in a short span and we are confident of being profitable by 2021. We want to be present in every nook and corner of the country.”

This is the vision that Balachander Sekhar, CEO and founder of RenewBuy, is trying to bring to life. The app-enabled, end-to-end digital insurance platform is on track to become a unicorn soon and with its digital agent model, it’s able to reach the nooks and crannies that most traditional players cannot.

Launched five years ago, RenewBuy has already secured a branchless presence in more than 500 towns along with more than 30K certified POS agent partners.

With over 12 years of experience in the insurance sector, Sekhar understood the factors that are plaguing this industry deeply. As he told Inc42, despite being privatised since 2001, India continues to have the lowest insurance penetration amongst equivalent countries in the globe. With digitisation, although the processes have become less cumbersome, the need for knowledgeable and active insurance agents is a pressing issue in the segment.

“For instance, India has over 17 Cr two-wheelers of which more than 13 Cr are uninsured. While most two-wheelers owners want insurance, the process of insurance is cumbersome for them, and provides hardly any remuneration for insurance agents, for the kind of effort put in,” he added.

This led to the foundation of RenewBuy, a proprietary technology platform through which an agent can offer a choice of motor, health, life and travel insurance products to the customer, transparently and instantly, and at a comparatively lower premium.

RenewBuy’s aim is to solve for under-penetration in the insurance sector and reach 500 Mn Indians in Tier 2/3 and beyond, which it claims can afford insurance but does not have an insurance provider or a platform that can service their needs due to the lack of supply across most geographies and segments. Insurance companies simply don’t want to look at this segment as building a presence would require considerable capital expenditure.

Digital Agent Model: How It Works?

To become an insurance point of sale (PoS) advisor, the minimum educational qualification criteria is 12th pass. A candidate needs to undergo online training of 15 hours, which consists of 5 modules, and on each module, one must spend a minimum of 1 hour to move to the next module.

Once qualified, an advisor or digital agent with RenewBuy can sell policies of all the categories offered by insurance companies such as Bajaj-Allianz General Insurance, Bharti AXA General Insurance, Digit Insurance, HDFC Ergo General Insurance, ICICI Lombard General Insurance, IFFCO TOKIO General Insurance, New India Assurance, Reliance General Insurance, Religare General Insurance and TATA AIG General Insurance.

Here, RenewBuy acts as a registered broker with IRDAI, and receives commission income for policies that it sells from these insurance providers. It spends money to acquire advisors and the balance is the earning. The team also claims to have been unit positive from day one.

“Our business model is about assisting our customers in buying the right product for their insurance needs and also the timely renewal of their policies. Hence the name RenewBuy. Also, local agents or advisors are the most preferred agent for insurance business since they bring in that personal human touch to the whole process,” added Sekhar.

Tracing The Path Travelled: Challenges Faced And Milestones Gained

Businesses in the scale-up phase face a range of challenges. As a business grows, different problems and opportunities demand different solutions. Like any startup, RenewBuy also passed through all these phases.

The biggest challenge was the consumers’ discomfort in transacting online. “Today, almost 98% of motor insurance is sold offline and is dominated by large brick & mortar conglomerates and financial services powerhouses,” said Sekhar.

Another challenge was to get agents on to a tech platform. “Education and training of these agent partners initially was a challenge but once on our platform they realised the benefits,” he added.

Once the RenewBuy team overcame the initial challenges, the milestones kept on rolling by.

The Key Success Pillars On The Road To Unicorn Club

To succeed in the era of digital insurance, insurers are focusing on a range of value drivers. These include customer experience, engagement and ownership, business innovation, technological leadership and more. Sekhar has also identified three core areas where RenewBuy will continue to scale the platform.

Balancing Capital Infusion And Spending

RenewBuy has raised just three rounds of funding amounting to $31.2 Mn in total funds raised. This is quite low when compared to other soonicorns in the same segment such as Paytm Money, Bankbazaar, Mswipe, LendingKart, Capital Float, MobiKwik and other fintech startups. While the angel funds raised in 2015-16 were used to rapidly grow in NCR and Punjab, the next fund infusion came only in 2017.

“We started growing so fast that many advisors sought to join us. When we realised that RenewBuy can become very big, we decided to grow even faster,” said Sekhar. He also believes that the most recent $20 Mn funding is adequate for them to become a large and profitable business.

Building USPs Against The Competition

While many players rely heavily on intrusive telemarketing processes to reach out to consumers, RenewBuy with its ‘No Tele-calling’ mantra focusses on simplifying and digitising consumers’ buying experience. Moreover, it also offers one-click insurance buying process, which requires no paperwork, and instant policy delivery. Additionally, there is a digital locker for key documents like registration, insurance policy, license, road tax certificate, pollution certificate and more.

AI At The Core

Artificial intelligence tools help RenewBuy in data collection, figuring out the permutations and combinations for insurance premiums, and use of data analytics helps it create smart underwriting rules. It also allows to co-create products with insurance companies backed by rich data and analytics.

The entire process of policy issuance and renewals is automated. RenewBuy also uses AI for partner and customer servicing like endorsements and quote generation, co-creation of products, pre-sales, post-sales and customer service using bots.

The self-inspection tool within its app integrates with insurers’ underwriting logic engine and uses AI to approve or reject the case in real-time. For post-sales, non-financial implications underwriting is automated, which provides immediate solutions to customers with regards to policy servicing and claims processing.

Tapping The $165.02 Bn Insurance Opportunity

Sekhar said RenewBuy will now focus on enhancing its infrastructure and back office to ensure the next two years of unabated growth. This expansion will happen in two ways. First, it plans to go deeper into the 500 towns where it is already present and increase the footprint to 1000 cities and 10 Mn customers by 2022.

“This will happen by increasing our agent network. For this we are investing in marketing and field sales who will identify the right agent, train him, certify him and bring him on board,” said Sekhar

Overall, the Indian digital insurance platform market is expected to reach $165.02 Bn by 2024 at a CAGR of over 13% during 2019-2024, according to a report by TechSciResearch. While technologies like AI, IoT, and data analytics are considered crucial factors for this growth, Sekhar has a differentiated opinion here.

According to him, the Indian insurance ecosystem is largely struggling to adapt to the technology-driven pace of change due to reasons such as traditional mindset, legacy practices and inadequate skills. This sluggishness could lead to a scenario where faster technology-adopting incumbents swallow the slower ones.

“In long run, incumbents need to regularly assess market dynamics, customer feedback and opportunities to collaborate and connect with the larger insurtech ecosystem. Although it’s still early days in India, insurtech has already disrupted the traditional value chain to improve digital distribution and customer experience,” Sekhar added.