SUMMARY

Fintech leaders from ETMoney, Edelweiss, INDmoney and IndiaGold discussed the challenges of building fintech products for India and Bharat

They discussed issues ranging from planning products to acquiring user and monetisation

Leaders discussed how sachet fintech solutions can be effectively introduced to the product cycle

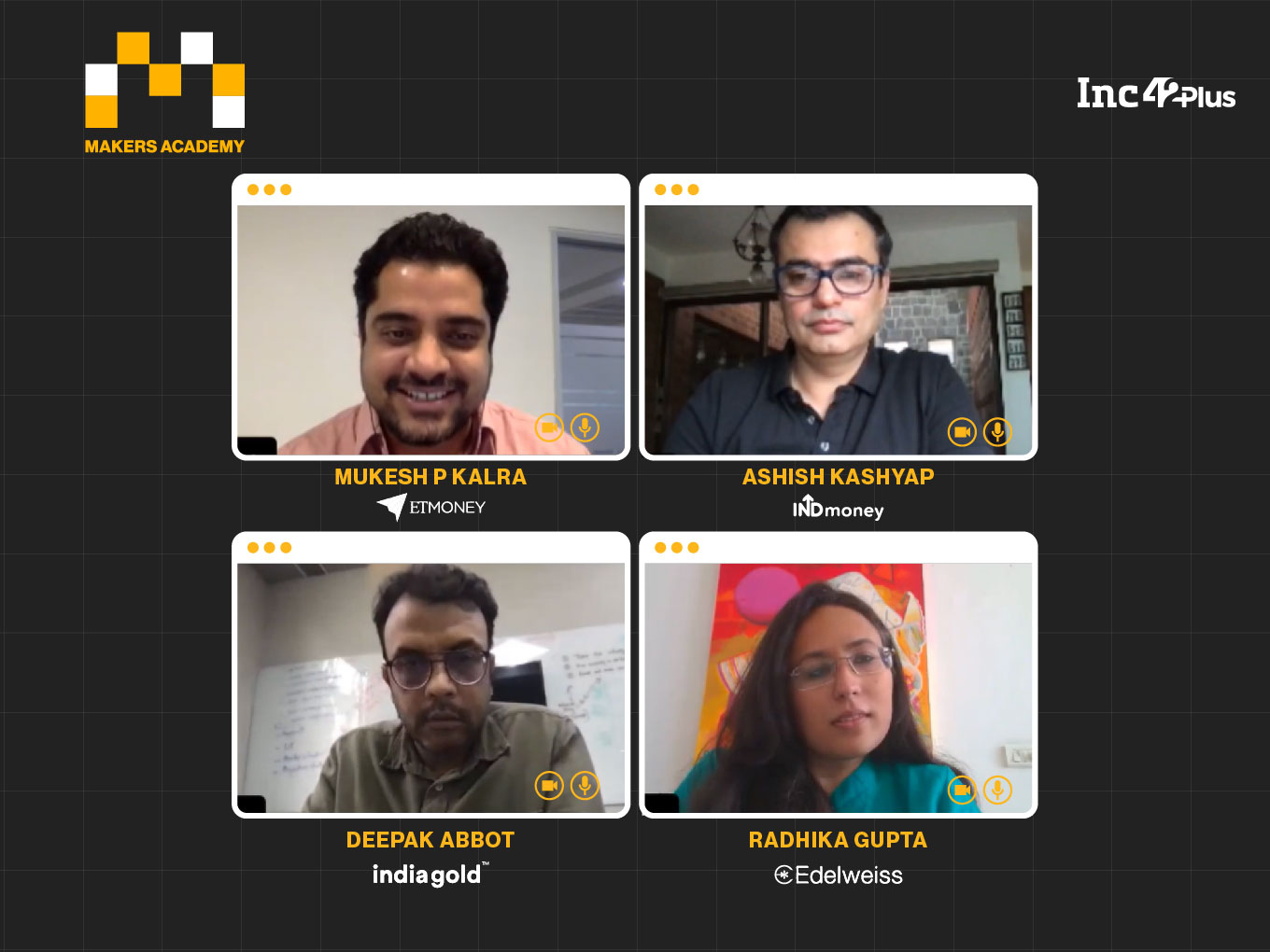

The first day of The Makers Summit witnessed leaders from the fintech industry talk about the challenges of building fintech products in India. The session was moderated by Mukesh Kalra, founder and CEO of ETMoney with participation from Radhika Gupta, MD and CEO of Edelweiss AMC, Ashish Kashyap, founder and CEO of INDmoney, and Deepak Abbot, co-founder of IndiaGold.

These leaders and entrepreneurs discussed a number of different issues including product design for fintech, navigating compliances, user preferences, innovation and sales.

Building Disruptive Fintech Products

The fintech industry is playing a critical role in reducing the touchpoints and risks associated with cash exchange. It is safe to say that Covid-19 has been a huge turning point for fintech adoption in terms of lending, insurance, micro-services and more.

As per Inc42+ estimates, about $11.5 Bn was invested in Indian startups in 2020. Of this, nearly 18.2% of the capital went into fintech firms that raised about $2.1 Bn across 131 deals. Fintech also emerged as the top-funded sector in 2020, followed closely by enterprise tech with $1.7 Bn across 128 deals and consumer services with $1.68 Bn across 95 deals.

So how do fintech startups go about charting their product journey?

Historically in mutual funds, the product role wasn’t taken seriously. In the mutual fund industry people think of sales, asset management or compliance. But we are manufacturers so we have to take products very seriously to drive innovation,” said Gupta.

According to Gupta, good financial products need to solve genuine consumer problems. She said that consumer problems that products intend to solve should be defined clearly. A good example on this front, according to Gupta, is Bharat Bonds, which was meant to address the need for predictable returns.

Cracking The User Acquisition Formula

According to Kashyap of INDmoney, fintech users have different product discovery journeys. To attract the top 30 million odd users who have the capacity and ability to adopt fintech solutions rapidly, one needs to offer products that solve a very specific problem, said Kashyap. “These are people who have fragmented financials and would need solutions to streamline their finances. They need asset management across the board,” Kashyap added.

More than linear marketing activities, this demographic works well through word of mouth referrals and content engagement. An interesting hack, Kashyap mentioned, is to give back users some value for the immense amount of data they share with fintech platforms. This could be in the form of insights or additional recommendations. This helps to keep them engaged with the platform.

Sharing his insights on the subject, Deepak Abbot of IndiaGold suggested that for the low income user group, who are not financially literate or even internet savvy, one needs to go deeper for user discovery. Product makers, according to Abbot, should create simple products with minimum processing charges and easy-to-understand details. “We launched the brand before we launched the product. So, instead of launching our gold loan app we launched the brand first, which gave us a lot of leads before we went live,” revealed Abbot.

Another interesting hack, that Abbot has used in his own gold loan startup was to seek rejected leads from larger competitors who would have to comply with specific eligibility criteria. “That way we turn someone else’s junk into our gold,” he added.

Sustaining The Fintech Products

Once users are in, how do we ensure customers remain engaged to fintech products effectively?

Answering this question, Gupta said that one needs to realise that people don’t understand finance and online buyer behaviour will replicate offline behaviour. Basically, financial literacy is always in a shortfall. “So make the products that are simple. When financial decisions go wrong it affects product perception even if the user chose to make those investments. Use built-in safeguards, monitor performance and communicate so that users are constantly informed about their investments,” added Gupta.

He said that hyper-personalisation is another way to go about it. “We started alerting users when we saw risks way in advance during the Franklin fiasco. This helped us build a lot of trust. The communication should be customised to their specific requirements,” he added.

Fintech applications need to communicate to users why they see negative returns in simple terms and ways that they can reduce their risks.

And what about user retention?

“Make it empathetic,” said Abbot. For products like loans, specifically gold loans, users are most likely in distress when they avail these products. “So help them restructure their loan, extend it and hand-hold them through the journey so that they trust you enough to return when they need it again. Don’t push them into a debt trap,” explained Abbot.

Monetising Fintech Products

Customer acquisition costs can be very high in fintech so building towards scale and monetisation is essential, said the panelists. Some key takeaways here were to ensure that monetisation is built into the solution because in most cases the underwriting is done by partners in the ecosystem and the only way to ensure their participation is by giving them returns.

Is “sachetisation” the answer to everything?

“Sachet products will still have transaction costs. Innovate for packaged solutions that can utilise existing products in new ways, as SIPs have done. This will allow us to sachetise products for Bharat,” said Gupta.

Kashyap suggested keeping a “freemium” model handy so that users can try the service but also see value in paying for it. It works in all industries and should work out well at scale for fintech as well.

Communicate costs to users, gamify it and educate the users about the benefits of paying for solutions.

“While the process of onboarding fintech customers has to get smoother than what it is currently (thanks to compliance burdens), user education is critical for expanding the market. So educate the users constantly when they are discovering and researching the products,” said Kalra.

Measure transactions, user engagement and registrations to evaluate growth and traction of the products. Seek out customer feedback and understand user needs constantly. Finally, it all comes down to building a financially literate ecosystem for users to pay for relevant solutions and everyone (read fintech aspirants) must bear the burden.