SUMMARY

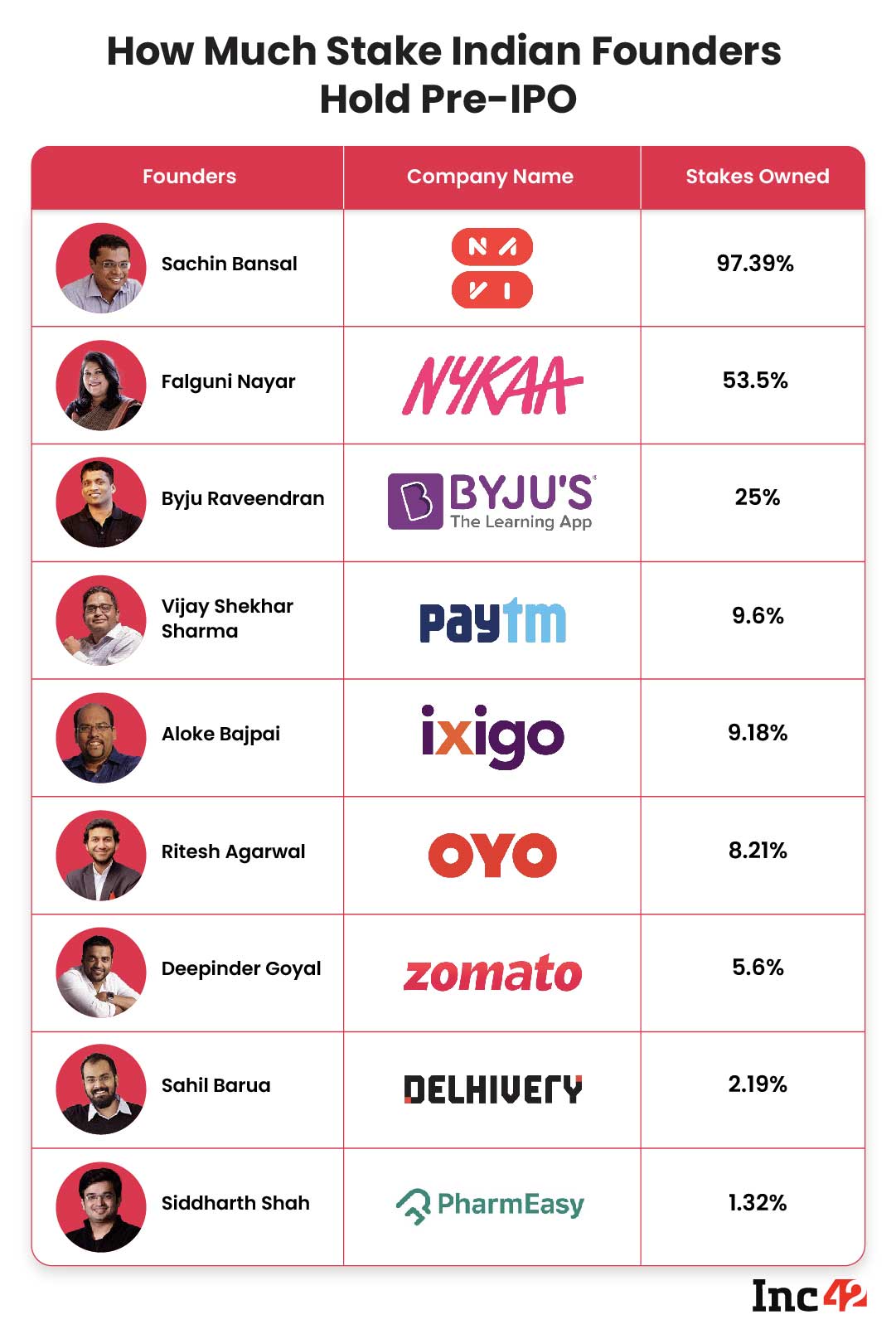

In a majority of the cases, startup founders and cofounders are left with a mere 5%-10% of stakes, which has seen a course reversal with Nykaa’s Falguni Nayar and Navi’s Sachin Bansal

Bansal alone holds a 97.39% stake in Navi

Nayar, along with her husband Sanjay Nayar, their children Anchit Nayar and Adwaita Nayar held 53.5% share before IPO

Today startups are raising funds in billions of dollars and more unicorns are being built every year in the Indian startup ecosystem. At the same time, it’s also raining initial public offerings (IPOs) in India, a trend that took off in 2021. So, it is rather important to know how the founders’ stakeholding is or was distributed in some of the major startup names before they hit the IPO route.

In a majority of the cases, startup founders and cofounders are left with single-digit minority stakes as the firm sizes go big with flooding investment from external investors and Venture Capitalist firms.

Nykaa founder Falguni Nayar gathered immense applause for owning over half the startup’s total stake because startup founders ideally need to keep on diluting their precious shares in order to raise more funds from investors.

Navi Technologies’s Sachin Bansal also holds another such example after Nayar.

Sachin Bansal Owns 97.39% Stake in Navi Technologies

Ex-Amazon employee and Flipkart cofounder Sachin Bansal is an IIT Delhi alumna. Along with his friend Binny Bansal, he founded Flipkart as an online seller of books in 2007. After U.S.-based retail giant Walmart bought a 77% stake in Flipkart for $16 Bn, Sachin Bansal exited the company by selling his minority stake for $1 Bn.

With this wealth and remuneration he earned over a decade in Flipkart, Bansal set up Navi Technologies along with his former Flipkart colleague Ankit Agarwal in 2018. Bansal’s four-year-old fintech startup Navi became the latest startup to file for INR 3,350 Cr draft red herring prospectus (DRHP) with market regulator SEBI.

Bansal alone holds a 97.39% stake in the startup, which is a whopping amount as the picture is quite different in a large number of startups.

Also, since the IPO offer doesn’t include any OFS element, Bansal will continue holding his current stake even after the IPO.

Falguni Nayar Owned 53.5% Stake In Nykaa

A former investment banker, Falguni Nayar founded Nykaa in 2012, and it later managed to emerge as a go-to-ecommerce platform for fashion products. The startup competes against the ecommerce giants such as Amazon, Walmart-owned Flipkart and online grocery platform BigBasket, and others.

The startup went for an IPO late last year and broke several glass ceilings including a woman entrepreneur taking her startup to IPO. Also, unlike most of the Indian startups that have filed DRHP with the market regulator SEBI for an IPO, promoters of FSN E-commerce Ventures Limited, the parent company of fashion ecommerce platform Nykaa, continued to hold over 50% of the share.

Nykaa is another exceptional example where Nayar held a large portion of stake in the company. Nayar, along with her husband Sanjay Nayar, their children Anchit Nayar and Adwaita Nayar held a 53.5% share in the startup prior to the company’s IPO.

Byju Raveendran Owns 25% Stake In BYJU’S

Byju Raveendran and Divya Gokulnath founded BYJU’S in 2011, but Raveendran’s journey in the education segment started years back as a coach for CAT entrance exam. Today, the Bengaluru-based edtech decacorn has expanded to cater to a large student community globally.

Founder and CEO Raveendran is set to take his edtech firm public in Q2 of the current fiscal year. Raveendran currently holds a 25% stake in the startup after leading its latest Pre-IPO funding round of $800 Mn along with Sumeru Ventures, Vitruvian Partners, and BlackRock earlier this month.

Raveendran’s $22 Bn startup is likely to take the Special-Purpose Acquisition Company (SPAC) route to raise $4 Bn via its listing and is in talks with four SPACs to get listed by end of this year.

Vijay Shekhar Sharma Owned 9.6% Stake In Paytm

Paytm founder Vijay Shekhar Sharma is one of today’s most-followed tech entrepreneurs in India. Hailing from a small town of Aligarh, Sharma is a graduate of the Delhi College of Engineering. He founded One97 Communications, Paytm’s parent company in 2000 as a prepaid and mobile recharge platform. Paytm was later launched in 2010.

Paytm is currently one of India’s biggest digital payments companies with its offering spread across digital payments like UPI, credit and debit cards, wealth management through Paytm Money, banking services through Paytm Payments Bank and more. Paytm went for an IPO price of INR 2,150 in January this year.

Sharma held 9.6% when Paytm went for IPO.

Aloke Bajpai Owns 9.18% Stake In ixigo

Aloke Bajpai, at IIT Kanpur graduate, launched travel-tech startup ixigo in 2007 along with cofounder Rajnish Kumar. Though the startup was hit hurt during the pandemic as the entire travel industry felt the heat of the Covid-19 waves, its growth resumed in the post-lockdown phase and became profitable in the last quarter of FY19-FY20.

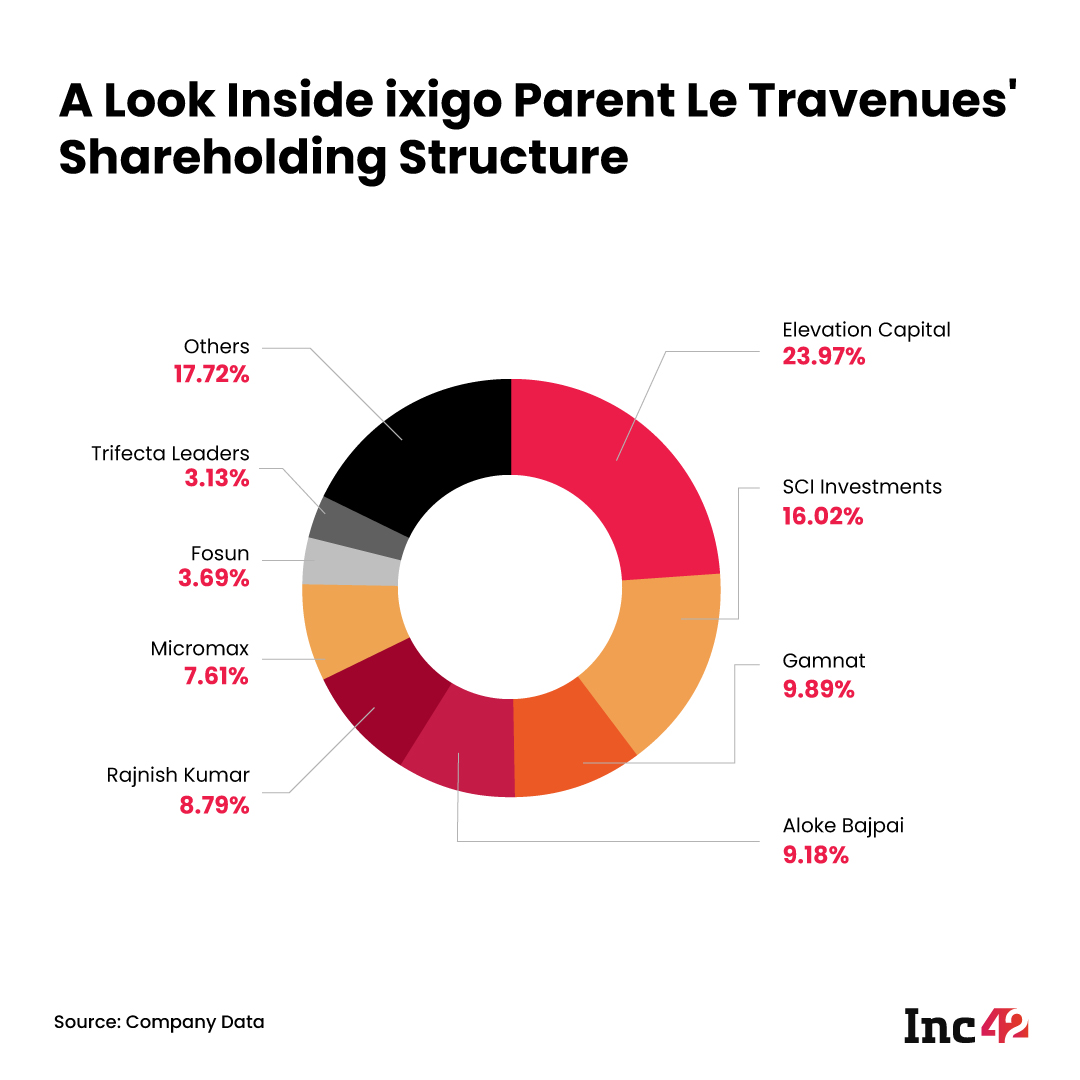

ixigo’s parent company Le Travenues Technology filed its DRHP with market regulator SEBI in 2021, eyeing to raise INR 1,600 Cr through an IPO. ixigo is backed by major investors such as Elevation Capital, Sequoia Capital India, Trifecta Capital, Fosun RZ Capital. In 2011, Elevation Capital and Nasdaq-listed MakeMyTrip invested $18.5 Mn in ixigo.

CEO Bajpai held a 9.18% stake in ixigo when DRPH was filed last year. The cofounders together own a 17.97% stake.

Ritesh Agarwal Owns 8.21% Stake In OYO

Ritesh Agarwal founded OYO in 2013 as a disruptive hospitality business and app. The startup entered the unicorn club in 2018, within five years in business. In 2021 OYO’s parent company Oravel Stays filed for an INR 8,430 Cr ($1.2 Bn) IPO.

Big and renowned investors including Sequoia Capital India Investments IV, Lightspeed Venture Partners IX, Mauritius, Star Virtue Investment Limited and NASDAQ-listed AirBnB have backed Agarwal’s business. Agarwal, also the CEO of the startup, individually holds an 8.21% stake in the company, and as per reports, he won’t sell his stake in the proposed upcoming IPO.

To bulk up his ownership and stake in the startup, Agarwal bought back shares worth $1.5 Bn from early investors Sequoia Capital and Lightspeed Venture Partners in 2019, Inc42 had reported.

RA Hospitality Holdings (Cayman), which is owned by Agarwal, holds a 24.94% stake in the startup.

Deepinder Goyal Owned 5.6% Stake In Zomato

Deepinder Goyal founded Zomato in 2008 along with cofounder Pankaj Chadda, who left Zomato in 2018. CEO Goyal and Chaddah were both IIT graduates and worked as analysts at Bain and Company. The foodtech startup had initially kicked off its service as a food directory website named FoodieBay.

In a matter of just nine months, FoodieBay became the largest restaurant directory in Delhi-NCR. After two successful years, it was rebranded as Zomato. The startup debuted at Dalal Street in mid-2021 at a more than 50% premium to its IPO issue price.

Pre-IPO, Goyal held only 5.6% stake in Zomato.

Sahil Barua Owns 2.19% Stake In Delhivery

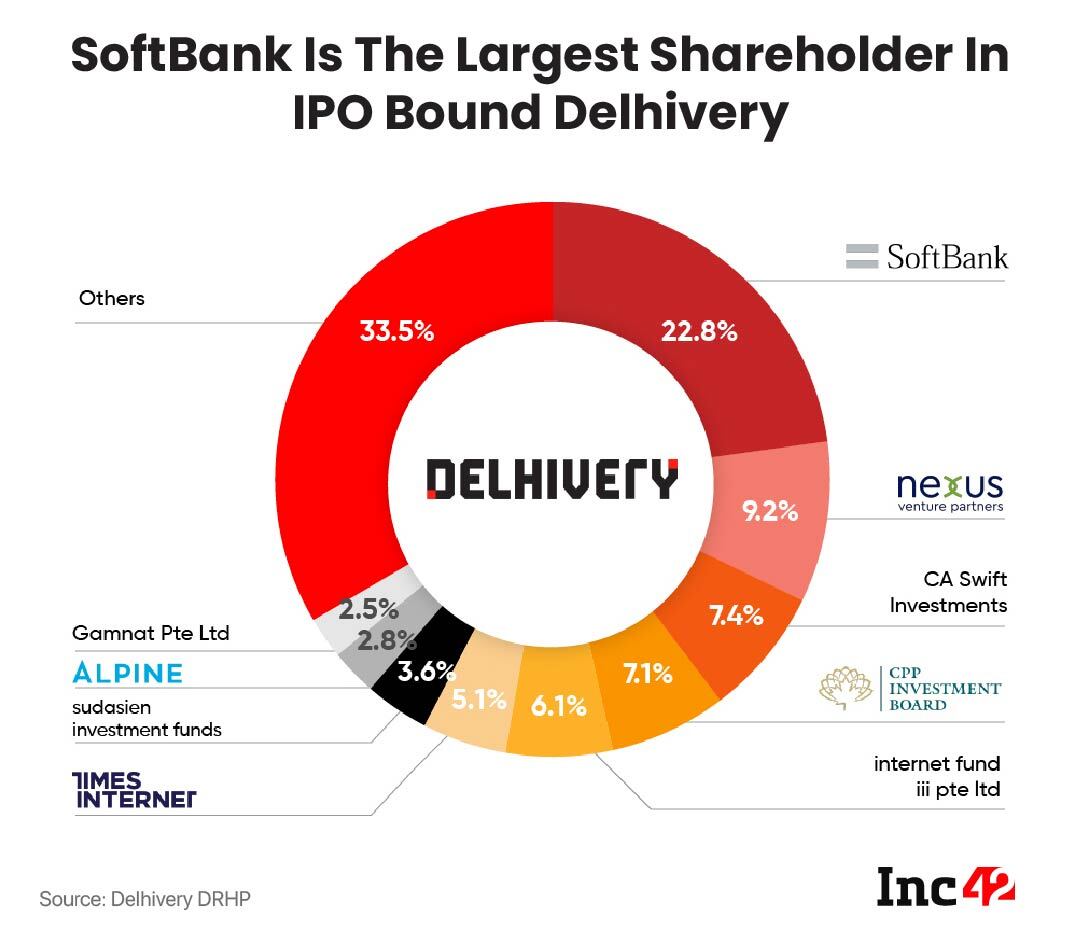

Sahil Barua, Mohit Tandon, Suraj Saharan and Kapil Bharti founded Gurugram-based Delhivery in 2011, which became one of the players in the Indian logistics space.

The logistics services platform is backed by a large number of major inventors such as Times Internet, the digital arm of Times Group, Masayoshi Son-led SoftBank, with Washington-headquartered Carlyle Group also owning a stake in the startup through CA Swift Investments.

In fact, the startup joined the unicorn club in 2019 following SoftBank-led $413 Mn investment. The startup was planning to raise about INR 7,460 Cr through an initial public offering (IPO).

In a crowd of such a large chunk of external investors, the four cofounders of the startup hold a mere 6.97% in total, of which 2.19% stake is owned by Barua, as seen in the DRHP filed by it last year.

Siddharth Shah Holds 1.32% Stake In PharmEasy

Dharmil Sheth and Dr Dhaval Shah founded PharmEasy in 2015, which later merged with its investor entity, Ascent Health, to form API Holdings in 2019. Post the merger, Ascent Health founders Siddharth Shah, Hardik Dedhia, and Harsh Parekh joined PharmEasy as cofounders.

PharmEasy raised a total of $1.6 Bn funds from 43 investors across 14 funding rounds. The Bengaluru-based epharmacy platform’s parent firm API Holdings filed its DRHP for INR 6,250 Cr IPO in November last year.

While a majority of the stake in the startup is held by external investors from large firms such Prosus and Temasek, CEO Siddharth Shah, an IIM-Ahemdabad graduate holds a mere 1.32% stake in the healthtech unicorn.