SUMMARY

Boosted by the rise of digital payments, data penetration, and the big push for online commerce during the Covid-19 lockdown, more brands are going the direct-to-consumer (D2C) route, looking to control the whole stack with vertical integration — just like tech companies

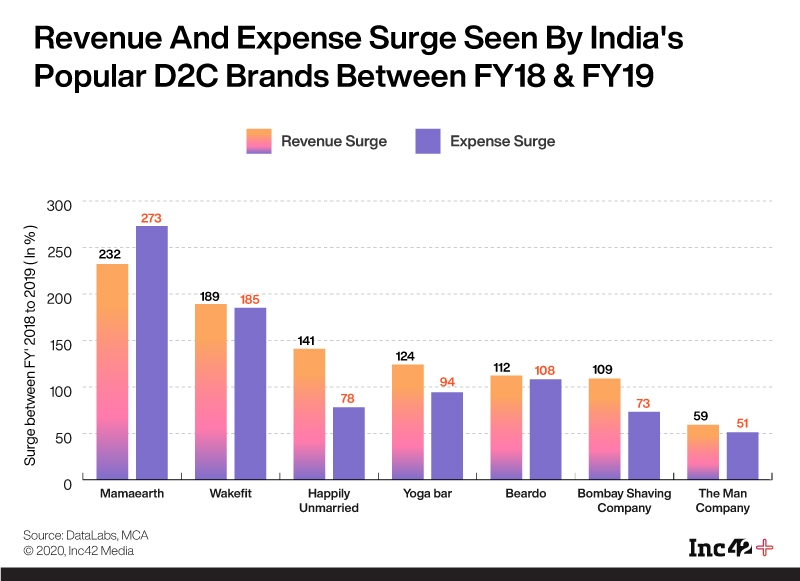

D2C adoption in India also has been quite promising; the average revenue surge between 2018 and 2019 for 11 prominent D2C startups including The Man Company, Yoga Bar, NUA, The Moms Co and others was 213%

Despite the long-term vision of most brands being autonomy in operations and vertical integration, success as a pure-play D2C brand remains elusive given the peculiarities of the Indian market

India's D2C Rush

As more and more consumer brands go digital to reach customers faster and carve a unique identity, India’s direct-to-consumer (D2C) moment is well and truly here. With thousands of brands competing in the D2C space, will this be the future of India’s retail market?

For decades, taking a brand to the end consumer meant multiple rounds of negotiations with suppliers, manufacturers, wholesalers, distributors and retailers — with so many cogs in the machinery, there was bound to be a big breakdown when even one is impacted.

Never before has this been more evident than during the pandemic when everything came to standstill. Many FMCG and consumer goods brands realised that the layers in the middle from manufacturer to consumer are not enablers but hurdles.

Because the sales process was dependent on third-party players, brands also lost out on timely customer feedback. But with ecommerce growing at an unprecedented rate and delivery of essentials through online platforms becoming the norm, the layers are slowly dissipating as brands are taking charge vertically.

Boosted by digital payments, app technology, cheaper data plans and the big push for digital consumers during the Covid-19 lockdown, more brands are going the direct-to-consumer (D2C) route, looking to control the whole stack with vertical integration — just like tech companies.

The internet has helped digitally native brands scale up by leveraging Facebook, Instagram ads and influencer campaigns to gain end-to-end control of its products from factories to the customers and have a better understanding of the target group. And, now many traditional players including Marks & Spencer with Indian Terrain, Pepsico with Snacks have also been opening online stores, hinting at a sea change in how some brands interact with customers. This helps brands to offer a lower price to the customers as well.

Will D2C In India Find Success Like The US?

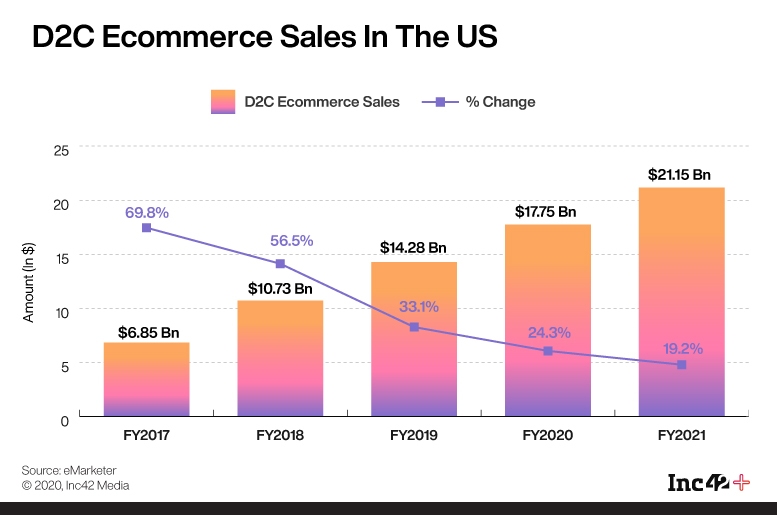

In the US, the market for D2C has been quite promising with the likes of Warby Parker, Everlane, Casper and The Honest Company. From 2016 to 2019, D2C ecommerce grew at three to six times the rate of overall ecommerce sales. In 2019, D2C sales reached $14.28 Bn and in 2020, the sales is predicted to grow by 24.3%, to $17.75 Bn.

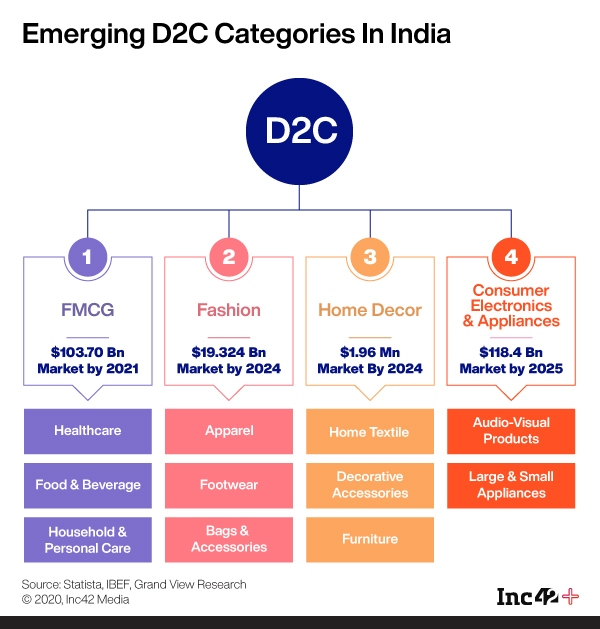

However, D2C adoption in India also has been quite promising since the last few years, which does indicate a bullish future for the segment, especially in FMCG, fashion, home decor and consumer electronics. According to the IBEF report, the FMCG segment in India is expected to grow at a CAGR of 23.15% to reach $103.70 Bn by FY21 from $ 68.38 Bn in FY18. And most D2C startups have tapped into the market by using effective marketing and branding efforts. They have created a niche for themselves within a few years of starting up by identifying areas that don’t have too much competition and carved a niche.

According to DataLabs By Inc42+, the average revenue surge of 11 prominent and funded D2C startups in India including Ustraa, The Man Company, Yoga Bar, NUA, The Moms Co and others between 2018 and 2019 was 213%, whereas the expense surge during the same period was 151%.

Among the several D2C brands and categories, the mattress category, in particular, has been something of a revelation in India. Bengaluru-based Wakefit, a new-age Indian mattress manufacturer, turned profitable within a few years of setting up shop. In the financial year 2019, the gross profit margin for the company stood at 41.2% compared to 38.5% in the previous financial year. Other emerging leaders would be Sunday (mattress), Sleepycat (mattress), Bombay Shirt Company (apparels) and Nykaa (cosmetics).

The growth seen in the fashion industry in ecommerce has led to great expectations on the part of VCs and entrepreneurs in the D2C space as well. The fashion segment is projected to reach $11,404 Mn in 2020 and D2C brands in this segment such as Wrogn, Bombay Shirt Company, Pipa Bella and others have been expanding their presence through significant online presence, marketing spending, leveraging the networks of influencers and celebrities. For instance, Virat Kohli-backed Wrogn has successfully leverage his celebrity status to reach pretty much every male consumer in the market.

Others have achieved success through the engagement of celebrities that may not have a pan-India appeal, but have the right fit for the audience. Bollywood actor Ayushmann Khurrana invested in Gurugram-based The Man Company (TMC) and also became the brand ambassador for the male grooming startup.

India’s D2C Moment: Why Now?

The prominence for online shopping and online grocery purchases in urban areas has made life much easier for D2C brands. A lot of businesses that have been offline-only have been forced to go online in order to survive. This also makes it easier for D2C to be seen as an effective business model and consumers might be quicker on the uptake.

Businesses and consumers are today actually focussing on the supply chain with a sharper eye on the multiple links. Thus the model, which is already popular in developed economies, is also expected to see higher adoption in the near future in India.

“With extended lockdowns and increased traffic in online marketplaces, D2C is becoming more popular because it’s faster and easier to place an order with a brand. The WhatsApp store makes it all the more convenient. A smooth and seamless experience will surely help D2C to catch up quickly,” said Aswani Chaitanya, CEO and cofounder of snacks brand Timios.

Timios is in the early stage of D2C with revenue from its native channel being around 15%-20% of the total income, as against zero last year. The children’s snacks maker also has retail presence, but its online sales account for 70% of the total revenue, which includes the WhatsApp-based stores.

For FableStreet, a fashion retail startup, which ventured into offline retail with its first store at DLF Promenade Mall in February 2020, just before the lockdown was announced, the surge in online demand recently has come in as a blessing.

“It will take some time for offline retail to pick up. However, post-pandemic, the response for our products through online channels has been really good. Customers are realising that they connect at a personal level and reach out to directly, especially if they are made in India,”said founder Ayushi Gudwani.

Significant growth in this segment is expected in the next five years, especially with the pandemic giving it further push. “The online buying experience for D2C brands are much better than that of legacy incumbents; so we feel these brands will benefit the most,” he added.

According to Capgemini April 2020 research of consumer sentiment, most of the Indian consumers’ appetite for online shopping is expected to increase from 46% in the current scenario to 64% over the next six to nine months. And investors too are bracing for the D2C boom. D2C brands that have solved the supply chain hurdle and set up robust manufacturing while also identifying a sustainable rate of scaling-up are best positioned to advance further into the next phase.

“While building a successful ‘want’ product has been more difficult than the ‘need’ product, with forceful pivots happening towards digital because of the pandemic, the growth for D2C across both need and want, seen today may not go away. So even after the virus goes away and people step out, the numbers for D2C startups would be better than before,” believes Ishpreet Singh Gandhi, founder & managing partner at Stride Ventures.

The India Way Of D2C

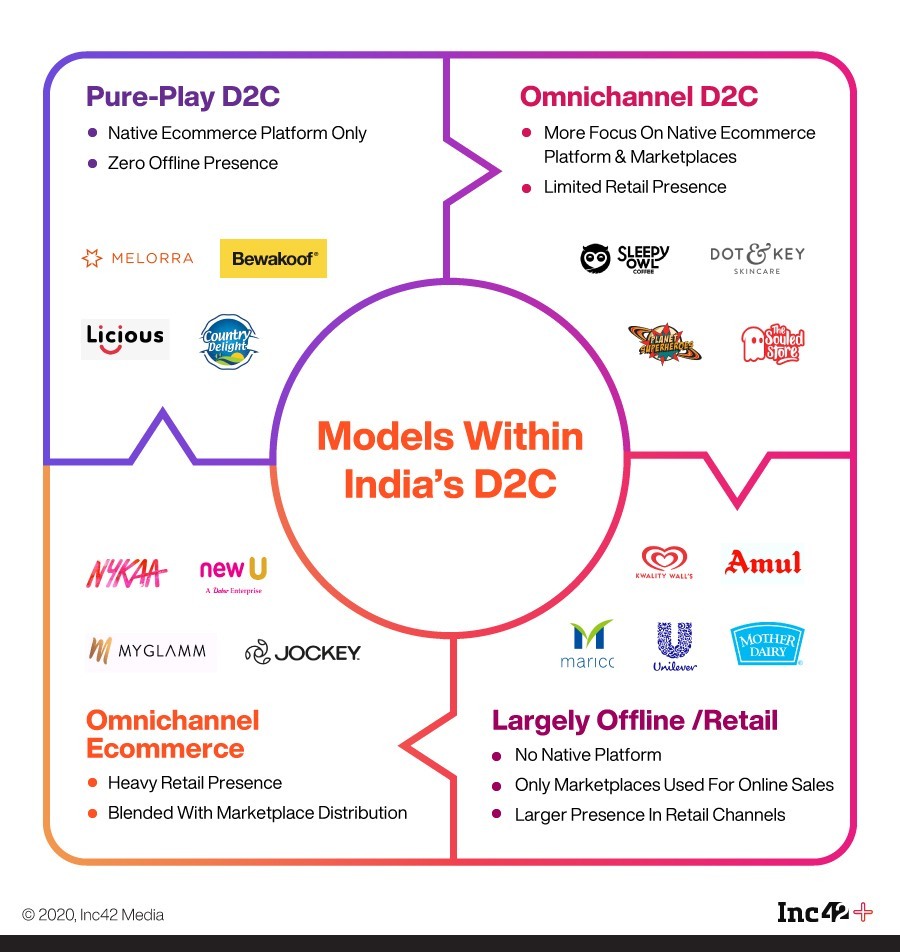

Despite the long-term vision of most D2C brands being autonomy in operations and vertical integration, for the time being, most brands have adopted an omnichannel approach — presence in retail outlets, ecommerce marketplaces, grocery delivery apps and local supermarkets to fulfil hyperlocal delivery demand.

Pure-play D2C as a model is hard to achieve in the Indian context. Besides being a hard-sell to investors, it severely aggravates the cost component, unless brands focus on small and niche audiences and play the long game. Having end-to-end control or vertical integration of the entire value chain is like gold dust in the Indian market.

In pure-play D2C, products go from factories to the consumers with no third-party involvement in the chain. Besides eliminating middlemen or intermediaries, it also means controlling logistics and online reach. In a market like India, that is next to impossible, especially on the first-mile and last-mile logistics front given the complexities involved in that. Battling the reach of competition listed on ecommerce channels is also no mean feat. Which is why D2C brands often put the pure-play vision on the backburner and look to make the best of the situation by creating engagement channels.

The penetration of social media and other online channels to engage with consumers has made it easier for D2C brands as controlling the most important links in the chain. So relying on online marketplaces such as Amazon, Flipkart is key to achieving pan-India scale and then bringing the existing customers to native platforms. Some exceptions would be brands like Country Delight where 98% business comes from the native platform. Similarly, Bewakoof only has a native ecommerce platform with presence anywhere else.

While in developed economies examples such as Casper mattresses, Warby Parker, Glossier, Bonobos, BarkBox have carved out D2C success, in India, D2C has adopted an alternative supply chain model where the journey of a product from the manufacturer to the consumer would be shorter than the traditional supply chain.

“To go totally D2C, you have to be a well-funded startup with deep pockets and you should be betting on building a long term ecommerce D2C business, or it becomes impossible to sustain. You have to ensure customers make a lot of transactions to make unit economics positive. And without scale warehousing is difficult,” said The Man Company founder Hitesh Dhingra.

From the consumer point of view, the comfort level is also high in already established ecommerce. It is a tried and tested place. So brands like The Man Company, that started out as fully native D2C are now multiple ecommerce channels. Even in the US, the likes of Dollar Shave Club, The Honest Company have all leveraged some or the other etailer to increase their reach.

Going full-stack requires heavy infrastructure and is harder and time-consuming to build, which is not everyone’s need either, noted Deepanshu Manchanda, founder and CEO of D2C meat brand Zappfresh. He also added that technology-focused aggregation models are easily scalable in comparison to the full stack D2C model, favouring faster growth and scale.

For Bombay Shaving Company, the native ecommerce platform accounts for only 25% of the overall revenue, but it spends 80% of its marketing budget on driving sales to this platform. This underscores just how difficult it is to go fully native and the costs that a startup might have to incur.

“All our marketing focusses on bringing people to our website. We are D2C from our branding and storytelling not so much with our product. Bringing customers to our website is the core objective,” said Shantanu Deshpande, founder, and CEO at Bombay Shaving Company.

Age-old marketing wisdom says go where your customers are, so brands also feel that going pure-play narrows this significantly. “Our products are essential that one might need anytime. For instance, someone might need sanitary pads, toilet seat sanitizer spray or hand sanitizers while on the move. Thus, products need to be made available at as many locations and with local retailers, organised pharmacy chains, airport stores, supermarket chains etc,” said Pee Safe founder Vikas Bagaria.

The Pipe Dream Of Pure-Play D2C

According to most brands Inc42 spoke with, in the immediate future, we will see a hybrid of own website and online marketplaces (like Amazon, Flipkart) as the only way.

“Physical retail will continue to struggle for a while. In the longer term, some offline presence like pop-ups will come into play but it may not soon go back to the pre-Covid levels as consumer buying behavior will shift,” said Tamiesh Sood, founder, T.A.M. Collective, a startup studio that incubates and grows direct-to-consumer (D2C) brands.

According to VCs watching the space closely, true differentiation for a brand comes only when it owns the marketing/distribution channels. Going through online marketplaces makes it difficult for brands to build relationships with customers and receive customer insights.

While it’s easy to get scale on Myntra, Swiggy or Amazon, it’s hard to build a brand even on these platforms plus after the high commission and ad costs (or discounts) on their platforms, the net margin left for the company is usually only in single-digit percentages with little opportunity to grow without splurging on marketing.

“Ecommerce is the lowest hanging fruit; perfect for commodity products. However, we are weary of D2C brands which start their journey with marketplaces; probably once you have built a very strong brand on your own, you could also use the reach of marketplaces to grow your business,” said Rohit Krishna, General Partner, WEH Ventures.

Krishna also believes that a native ecommerce website and an independent retail presence will enable D2C startups to scale faster and also build strong moats for the business, as well as connections with the customer base.

What Will Decide The Success Of D2C In The New Normal

The predominant target group for most D2C startups are the upwardly-mobile millennial and Generation Z audiences living in smalltown India as well as the migrating families from rural India, who would be exposed to D2C brands through social media campaigns particularly for need-based products.

For smaller brands, product differentiation and exciting features that can replace the touch and feel style of traditional buying, for instance, virtual trials of clothes and makeup, will also play a key role. And, consumer brands in food, farm-to-fork models, health and hygiene products and learning-based categories may be early winners.

With the pandemic, more and more D2C brands are expected to emerge to cater to this audience. Given the niche target groups and product segments, batch size for production is expected to be small for these new brands and players. So effectively and innovatively managing the supply chain and marketing will be the key to ensuring it is not too capital intensive. Being ready for the day the native platform can become the central pillar is just as crucial as keeping the revenue flowing in from third-party partners!