SUMMARY

Following the footsteps of US-based digital media platforms like BuzzFeed, The New York Times and others, several Indian companies like The Better India and MensXP are capitalising on the ecommerce boom and adding a commerce layer to their business models

With the online ad market still undersized and subscription-based revenue model in a nascent stage in India, commerce is acting as an additional revenue stream

Although these platforms have an edge over other D2C brands and online marketplaces in terms of consumer insights and brand recall, surviving in a highly competitive ecommerce space needs dedicated efforts

In 2017, digital media platform BuzzFeed reportedly fell short of its $350 Mn revenue target, laid off 100 people and shut down its podcast team.

A year later, the company focussed on its commerce wing and brought forth an affiliate marketing programme along with the content. Its affiliate links within the content took readers to online marketplaces. If they made a purchase by clicking on those product backlinks, the company earned a cut of the sales. The outcome was phenomenal. By the end of 2018, its commerce wing alone made $50 Mn, accounting for 21% of the company’s total revenue.

BuzzFeed was not alone. Several US-based digital media platforms such as The New York Times, CNN, PCMag and Refinery2 are seamlessly merging commerce and content. They have either launched direct-to-consumer (D2C) channels, online marketplaces or turned to affiliate marketing.

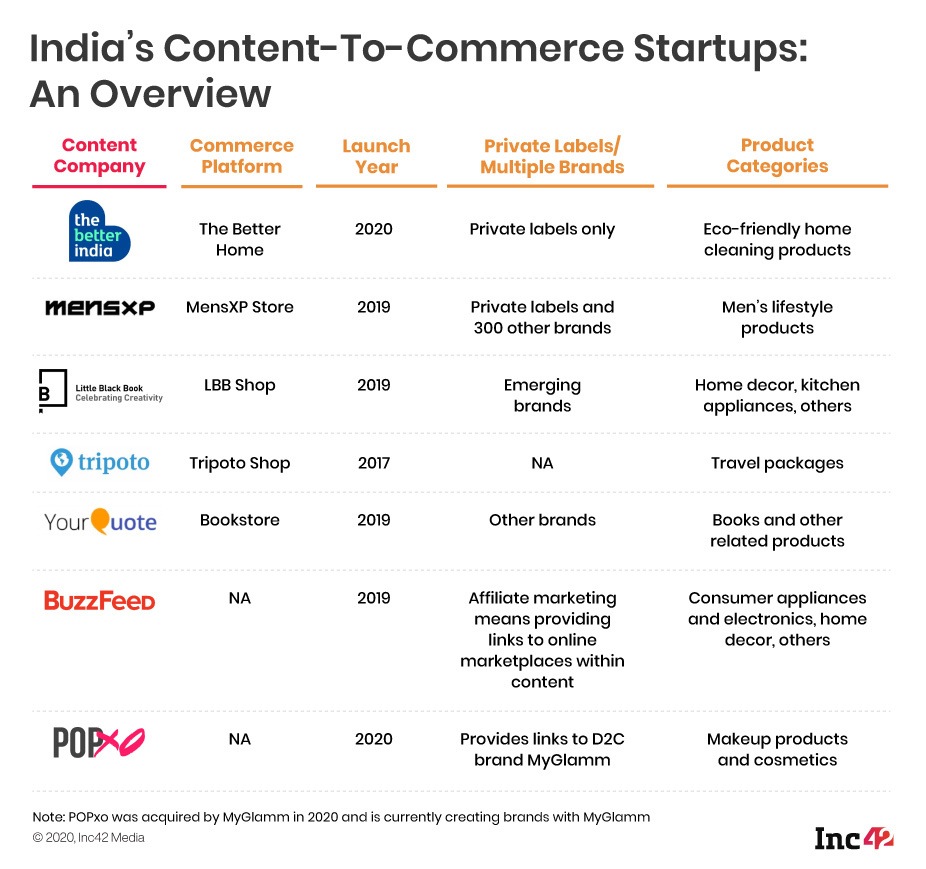

India is not lagging, either. Of late, many homegrown digital media or content companies such as The Better India, MensXP and the Little Black Book, have added an ecommerce/D2C layer to their existing revenue streams such as advertising, subscription and paid content.

The products sold on these content-to-commerce platforms are in sync with the overall narratives featured there. For instance, The Better Home sells eco-friendly home care products, a category that aligns with The Better India’s content on sustainability. Similarly, MensXP writes about men’s lifestyle and the MensXP Shop sells men’s lifestyle products.

This is a prudent move for many reasons. The Indian ecommerce market is expected to grow to $200 Bn by 2026 from $38.5 Bn in 2017, and the D2C business model has also seen an uptick since March 2020. According to an analysis by Inc42+, more than 500 brands are now riding the D2C wave. Traditional companies like Bata India and Saraf Furniture have also jumped on the bandwagon.

Given this boom, the time to launch content-commerce integration seems to be perfect. And The Better India, which covers topics like impact entrepreneurship, socio-economic issues and sustainability, took the plunge and launched an online store called The Better Home in February 2020. Within six months, it saw phenomenal growth and hit a monthly revenue of INR 1 Cr+. MensXP currently connects with more than 65 Mn users a month across its platforms and the MensXP Shop clocks 2.5 Mn+ shoppers every month.

“Generally a good portion (but not all) of digital media companies build commerce platforms when their communities are at scale. It is more to do with engaging better with one’s users and monetising them beyond advertising and paid subscriptions,” says Karan Mohla, partner at Chiratae Ventures.

The venture capital firm has invested in content-to-commerce platforms such as POPxo (acquired by MyGlamm), Little Black Book, Tripoto and YourQuote.

Overcoming Challenges Of Scale In Digital Media Through Commerce

Scaling digital media in India is not an easy task. The digital ad market is relatively small in the country and so are other sources of revenue such as subscription, says Deepak Gupta, founding partner of WEH Ventures. The market size of digital advertising in India stood at $1.93 Bn by the end of 2019 and is projected to touch $3.98 Bn in 2022. Currently, social media grabs the highest share of total advertising spend at 28%.

“Even in the US with a $120 Bn online ad market, scaling media properties on advertising has not panned out as was once expected. That is why some other avenue needs to be found to ensure scale. Also, there is an emergence of brands looking for distribution. So these stores may find an audience,” adds Gupta.

According to these content platforms, commerce revenues have contributed meaningfully to their businesses. MensXP claims that its revenue across commerce offerings has grown significantly in the past few months and is now bigger than its advertising sales. The Better India also claims that its D2C revenue has surpassed the revenue from its digital content. The platform has more than 100 Mn readers in India, and its D2C channel has shipped 200K+ units to more than 400 cities and towns.

In a country like India where the digital ad market is still small (in spite of being the fastest-growing segment of overall media), it makes sense to monetise through commerce as long as it is adjacent to the digital platform’s primary use case for consumers, notes Mohla of Chiratae Ventures.

Unlocking Customer Spend As An Extension Of Content

Be it through brand marketing, celebrity ambassadors/influencers or online communities, establishing trust is critical for online transactions. Associating commerce with a digital media platform works out when trust is established through communities and a continuous, meaningful engagement with users.

However, Dhimant Parekh, The Better India and The Better Home founder, feels subsidising one business with another is a wrong approach, one that does not scale. “We ensured that our digital media business was already profitable before building our ecommerce business. That way, both have strong growth paths,” he says.

The idea was to build a thriving, loyal community as a foundation and then build something valuable on top of it, something that the community needs and will appreciate, he adds. As of now, 85% of The Better Home’s revenue comes from its D2C website and the rest from online marketplaces.

At MensXP, its content’s natural affinity for commerce led to the launch of the D2C channel.

“Here, culture and commerce come together towards a single unified brand and product objective, which is to build India’s biggest men’s lifestyle destination,” says Angad Bhatia, founder of MensXP and CEO of Indiatimes Lifestyle Network.

Capitalising On Insights And Higher Brand Recall From Content Offering

Affiliations with communities and the consumer insights gathered help these platforms target commerce more precisely than others. For instance, MensXP gauges user interests and affinities through what they consume on the site over multiple visits. Say, users are reading through a number of hair growth articles and spending a significant amount of time on the same. It establishes their need for a curated product range for hair growth.

These platforms derive two types of insights from the content consumption patterns of users. One is market data that explains the trend or shift happening in the market, and the other is discovery data that helps personalise user experience so that users can discover the right set of products.

“After lockdowns, we saw a huge rise in demand for staycations and weekend getaways and the content around them. So, we immediately partnered with properties and agents which were offering those packages and listed them on the platform,” says Anirudh Gupta, cofounder and CEO, Tripoto, a travel content platform that has introduced commerce to sell holiday packages.

Better still, these platforms have the advantage of acquiring customers at a lower cost. Content provides a low cost-funnel for D2C because consumers trust the platform’s content, advice and expertise.

They also hold the upper hand in terms of continuous feedback and inputs. In 2018, when The Better India saw over 60% spike in reader engagement regarding its content on sustainable living, the company spoke to them to dig deeper and realised a surge in demand for eco-friendly products. This eventually led to the launch of The Better Home.

“Our customers are essentially building the brand with us, sharing regular, actionable feedback via our communication channels such as WhatsApp groups, email and calls. All these have shaped our journey, saving us the time, effort and risk of conducting extensive research. This will continue to shape our journey as we add new SKUs and categories,” says Parekh of The Better India.

A buyers’ journey in ecommerce starts with the discovery phase, and content plays a significant role there apart from ensuring better retention and brand recall. “Commerce-only companies have to develop paid marketing channels to create a top-of-the-mind recall. In contrast, our content and community-based approach give us the legroom to keep in touch with users instead of just showing up for selling products,” says Bhatia of MensXP.

Dealing With Trust Issues And Other Hurdles In Diversification

Although commerce or D2C may seem like a natural extension, it is a different ballgame. Despite the advantages of ecommerce-building software and third-party logistics providers available today, such an initiative requires a dedicated team, time and efforts. The Better India has a team of 20 and MensXP a team of 100+.

Additionally, scaling the D2C business can be tough for newcomers. Priyanka Gill, founder and CEO at POPxo and cofounder and president at MyGlamm, explains. “Content and ecommerce platforms have very different DNAs. As a content platform, as POPxo, we were able to grow and flourish. When we ventured into ecommerce in 2018, we were on a learning curve as we were one of the first content startups to launch and sell lifestyle, fashion and skincare products under our own brand name at the time.”

Last year, POPxo was acquired by the D2C brand MyGlamm, and the former no longer sells products under its private label as operated single-brand retail laws do not permit the same. It is currently creating beauty brands with MyGlamm, and these are marketed via POPxo.

“To successfully navigate this, you need patience, capital as well as the ability to adapt to a whole new industry. If any of this is not optimised, it gets challenging. Luckily, we began discussions with an expert partner, MyGlamm, that has a perfect ecommerce DNA. Today as POPxo + MyGlamm, I have actively been a part of and witnessed how a content platform at scale and a D2C ecommerce platform at scale can partner together to deliver outstanding results.”

The chances of losing trust are also high for digital media, and conscious efforts need to be taken to mitigate the same. Tammana Gupta, the founder of Umanshi Marketing and Branding, a digital marketing firm, explains it. “When sales come in, it can be followed by business goals such as bottom line, product diversity and more. Hence, there can be a vested interest in creating content to push these products, and it may dilute customer equity,” she says.

Unless the commerce business has an intuitive and natural flow into the content and community platforms, users may resist transactions simply because they are featured there. “The workflow should happen organically and requires the right balance of product or service curation, with a feedback loop involving the community to help promote (or demote) certain categories. Everything must have a user-first approach,” adds Mohla of Chiratae Ventures.

To mitigate these challenges, The Better India spends 20% of its net revenue on product innovation. The company has an in-house and dedicated R&D and new product development team that focusses on building premium products while another team co-ordinates with warehouse, logistics and last-mile delivery partners to ensure effective supply chain management.

To have a competitive edge over the new-age D2C brands, these platforms have to keep upping their game and invest in building a talent pool, product innovation and supply chain management. If done right, adding a D2C layer to digital content (which has also seen a surge in users) may help with an additional revenue stream and bring an uptick in advertising.