Signalling the arrival of blockchain technology in the Indian banking sector, last week ICICI Bank, announced that it has successfully executed transactions in international trade finance and remittance using blockchain technology in partnership with Emirates NBD (banking group in the Middle East)

This made ICICI the first bank in the country and among the first few globally to exchange and authenticate remittance transaction messages as well as original international trade documents related to purchase order, invoice, shipping & insurance, among others, electronically on blockchain in real-time.

So what is blockchain and how does it do that?

Simply speaking, blockchain allows one to change the age-old process of maintaining a ledger that can be accessed only by one party. Blockchain puts in place a distributed ledger that allows a participatory model.

Since blockchain is a decentralised ledger, it means all system members can access stored information. Verification by an intermediary is not needed.

For instance, in the pilot transaction executed by ICICI to showcase confirmation of import of shredded steel melting scrap by a Mumbai-based export-import firm from a Dubai-based supplier, the blockchain application co-created by the bank replicated the paper-intensive international trade finance process as an electronic decentralised ledger.

That gave all the participating entities including banks the ability to access a single source of information. This enabled all the parties to view the data in real-time, transfer of title and transmission of original trade documents through a secure network while preserving client and commercial confidentiality.

Breaking news: ICICI Bank executes India’s first banking transactions on blockchain in partnership with Emirates NBD. (1/5)

— ICICI Bank (@ICICIBank) October 13, 2016

It also enabled them to track documentation and authenticate ownership of assets digitally, as an unalterable ledger in real-time. This facilitated the stakeholders to execute a trade finance transaction through a series of encrypted and secure digital contracts. The pilot transaction eliminates the need for financial messaging between banks and heralds the convenience of instant cross-border remittances for retail customers. Currently, international remittances take a few hours to up to two days.

ICICI Bank executed these pilot transactions via its blockchain network with Emirates NBD on a custom-made blockchain application, co-created with EdgeVerve Systems, a wholly-owned subsidiary of Infosys.

Though the transactions itself are a significant milestone, what’s more significant is that the banks are now beginning to believe that blockchain technology will change the way transactions will be done. And banks are warming up to them.

Though the transactions itself are a significant milestone, what’s more significant is that the banks are now beginning to believe that blockchain technology will change the way transactions will be done. And banks are warming up to them.

Chanda Kochhar, MD & CEO, ICICI Bank stated, “I envision that the emerging technology of blockchain will play a significant role in banking in the coming years by making complex bilateral and multi-lateral banking transactions seamless, quick and more secure.”

And they have a reason to do so.

Besides the reduced cost of remittance for customers as well as banks and eliminating the need for moving paper across countries, the usage of blockchain technology simplifies the process and makes it almost instant—to only a few minutes.

Typically, this process takes a few days. Unlike regular trade transactions where documents are authorised and physically transferred, in a blockchain transaction, all parties can view the authorisation live — akin to viewing a shared Google document.

No wonder, the banks are gung-ho. Added Kochhar, “Going forward, we also intend to work on expanding the blockchain ecosystem and create common working standards to contribute to the commercial adoption of this initiative.”

Email For Money

Blockchain, also known as a distributed ledger technology, was originally created as a tracking database for Bitcoin transactions in 2009. Australian entrepreneur and self-declared cyber security expert Craig Steven Wright made an unverified claim to be the inventor of Bitcoin and blockchain technology – who goes by the moniker of Satoshi Nakomoto, currently. It was developed to enable individuals and organisations to process transactions without the need for a central bank or other intermediary, using complex algorithms and consensus to verify transactions.

Fast forward seven years, and now, a host of startups and technology, banking and finance players are betting on blockchain to provide a reliable alternative to systems that depend on intermediaries and third-party validation of transactions. The idea is to leverage blockchain’s distributed ledger approach to creating a system that decentralises trust, brings down the cost of transaction fees, and reduces processing times.

In a whitepaper titled “Blockchain-in-Banking-A-Measured-Approach,” IT firm Cognizant states that:

“The disruptive potential of blockchain is widely claimed to equal that of the early commercial Internet. A crucial difference, however, is that while the Internet enables the exchange of data, blockchain could enable the exchange of value; that is, it could enable users to carry out trade and commerce across the globe without the need for payment processors, custodians and settlement, and reconciliation entities.”

Vidit Baxi , Director – Technology, of cyber security firm Lucideus further explains, “In simple words, blockchain is a secure transaction ledger technology shared by all parties in a distributed network. It records and stores every transaction that occurs in the network by creating an auditable and irrevocable transaction history.”

, Director – Technology, of cyber security firm Lucideus further explains, “In simple words, blockchain is a secure transaction ledger technology shared by all parties in a distributed network. It records and stores every transaction that occurs in the network by creating an auditable and irrevocable transaction history.”

“It has the potential to reduce duplicative record-keeping, eliminate reconciliation, minimise error rates and facilitate faster settlement. Bitcoin blockchain, one of the most prevalent blockchain applications in the financial industry, is anonymous and permission-less, which means, it does not reveal identity or offer privacy. For a financial institution in India, blockchain technology can become a source to introduce new services/offerings which would not just increase their profits, it would provide them with the necessary infrastructure to enter into the market of cryptocurrency.”

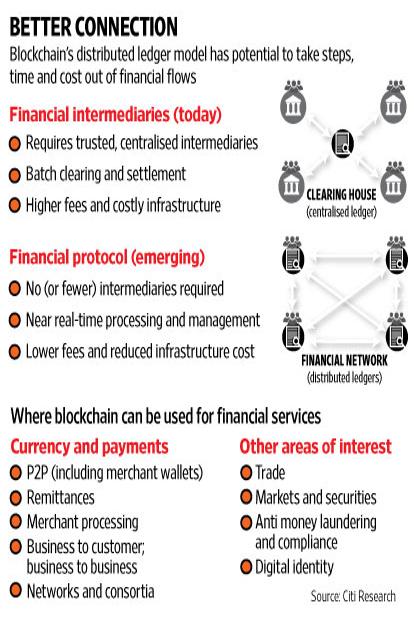

The following is a diagrammatic representation of how blockchain works:

As can be seen, instead of a trusted third-party or a central bank, blockchain relies on consensus among a peer-to-peer network of computers based on complex algorithms. Instead of being stored in a single database, blocks of time-stamped transactions are stored on all systems across a value chain. This elimination of middlemen makes processes such as cross-border payments, trading and settlement faster, more reliable and less costly.

Banking On Blockchain

If the market hype is any indication, blockchain has the potential to reduce many challenges faced by the banking industry and make transactions faster, secure and more transparent. Thus banks are experimenting with the distributed ledger approach to creating efficiencies, automate processes, reduce data storage costs, minimise data duplication and enhance data security.

Tighter regulation, competition from technology companies and low central bank interest rates, have forced the banking sector to look seriously at reducing costs in all possible ways.

Globally, banks such as UBS Bank, ABN Amro, and Deutsche Bank are trying to find ways to use blockchain. In June this year, Santander UK announced its introduction of blockchain technology for international payments through a new app that is currently being rolled out as a staff pilot, thus making it the first bank in the UK to use blockchain for international payments. Besides ICICI, other Indian banks such as Axis Bank Ltd are also aggressively looking at blockchain technology.

Key benefits would include:

- Significant reduction of settlement time to mere seconds by removing intermediaries

- Replacement of trusted third parties with access by all participants in the value chain

- Significant security enhancement in areas such as payments and credit card fraud through a decentralised public transaction record that stores details of every transaction

- Risk reduction through data integrity ensured by the technology that reduces compliance burden and cuts regulatory costs in areas such as know your customer (KYC) initiatives

- Material cost reduction through the elimination of expensive infrastructure

- Elimination of error handling through real-time transaction tracking

- Full automation of processes, from payment through settlement

- Removal of documentation bottlenecks caused by duplication

Rajashekara V. Maiya, Associate Vice President & Head of Product Strategy at Finacle – Infosys’s core banking product and part of EdgeVerve Systems Limited, states that the blockchain technology, underlying cryptocurrency Bitcoin today, is the most secure technology that also brings trust, transparency, and immutability to the entire network.

Rajashekara V. Maiya, Associate Vice President & Head of Product Strategy at Finacle – Infosys’s core banking product and part of EdgeVerve Systems Limited, states that the blockchain technology, underlying cryptocurrency Bitcoin today, is the most secure technology that also brings trust, transparency, and immutability to the entire network.

Underlining the importance of blockchain for the financial sector, he says,

“The financial sector is the biggest beneficiary of blockchain technology. Basically, banks can use blockchain technology for offering frictionless banking.’

He enlists the benefits of blockchain technology as:

- Reduce the friction of physical documentation moving from one location to another. It enables banks to digitise transactions.

- Banks can process transactions faster. Also the network banks assures of the transactions.

- Banks do not have to pay for the transactions.

He concludes that blockchain has revolutionised the traditional banking operations, thus helping banks to enhance efficiency and lower costs of operations.

Similarly, Anup Purohit, Chief Information Officer, YES Bank concurs that the future of blockchain technology looks to be quite promising in India, especially in the Financial Sector. He explains, “This is because even the regulator is embracing this technology and Reserve Bank of India acknowledged that blockchain has potential to create transformation in India’s Financial Markets especially because of its strength to combat ‘counterfeiting’.”

Similarly, Anup Purohit, Chief Information Officer, YES Bank concurs that the future of blockchain technology looks to be quite promising in India, especially in the Financial Sector. He explains, “This is because even the regulator is embracing this technology and Reserve Bank of India acknowledged that blockchain has potential to create transformation in India’s Financial Markets especially because of its strength to combat ‘counterfeiting’.”

Some of the areas where as a bank it sees tremendous potential include Supply Chain Financing, Trade Finance and Cash Management Services and Remittance solutions. As per Anup, blockchain has potential to be useful in areas of E-KYC as well as AML (Anti-Money Laundering) checks because it helps create a more transparent trail of records for every transaction undertaken.

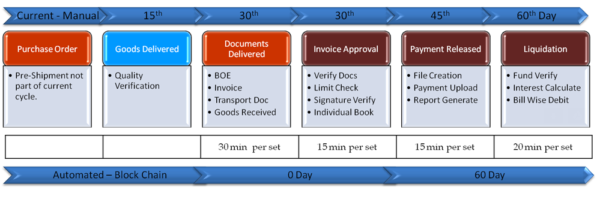

Yes Bank itself is working with one of India’s leading companies in the engineering and manufacturing sector to implement blockchain for Supply Chain financing. The aim being to reduce the turn-around-time for an invoice to payment cycle from the current 60 days to near instantaneous real-time processing. This will help realise enhanced efficiencies and save 400 man days just for this one implementation.

The Vendor Finance solution is realised by giving BlockChain access to Customer(Anchor) and their Suppliers(vendors), and YES Bank. Integration with both upstream and downstream systems will be achieved by YES BANK’s API Banking. The transactions are governed by a specifically designed Smart Contract. Similarly, like ICICI bank, YES BANK is also conceptually focussing on cross border remittance as India is one of the biggest corridors for inward remittance.

The Chain Reaction

Amid the rising fervour for technology, there is also the realisation that the same technology will have to overcome serious hurdles to prove itself to be robust and secure.

Vidit Baxi, Director – Technology, of cyber security firm Lucideus explains, “Blockchain is relatively different architecture as compared to the traditional financial system model, even attackers might take some time in adopting this technology to further craft attacks. Bitcoin lovers vouch for the encryption mechanisms used in blockchain technology (which are far more unique as compared to the generic cryptographic algorithms), which might convince us to believe that it’s secure though the recent attack on the DAO and Bitfinex increases the probability of security flaws present in the code. The security status depends on a lot on the implementation architecture and the frameworks used.”

Meanwhile, Infosys’ Rajashekara feels that blockchain helps prevent fraudulent transactions through its unique consensus mechanism and also gives guarantee of asset ownership to the owners in the transaction cycle.

He says, “Blockchain has emerged from cryptocurrency and it supports the process of mining and pricing cryptocurrencies. Such transactions are not reversible, also anonymous, and supports two-factor authentication, thereby making it safe. The transaction provides comprehensive transparency and security which is essential in today’s financial world. Only the banks or the members of the blockchain network are privy to the transactions performed, under blockchain technology, hence making it even more secure. This assures that the transactions are exposed to lesser audience, which further prevents frauds and scams. Blockchain technology once implemented boosts security, privacy, and autonomy of data transferred.”

Similarly, Anup from Yes Bank believes that blockchain technology ensures maximum transparency because of its structure, which does not allow deletion of data, and works in append-only mode (records can only be added). He adds,

“YES Bank’s implementation of the permissioned ledger blockchain network requires each node to prove it’s identity as a member of the network. This permissioned ledger keeps out unauthorized users while simultaneously allowing anonymity to the members so that the transactor’s identity is hidden but their transactions are still readily auditable by YES BANK. This helps banks in maintaining transactional anonymity and un-linkability on the shared ledger while retaining the confidentiality of the contract between business users.”

While security might not be an issue yet, the technology also needs to win backing from the regulators. In this regard, RBI has set up a committee to understand the possibility of using blockchain technology.

Then there’s the question that a shared system for executing transactions could allow rival banks to spy on each other’s activities. Also, the transparency of transactions might not go down the privacy needs of secretive bankers. Hence, it leads to the question whether decentralisation will get global acceptance given that financial institutions like to have centralised control on money management.

There are also questions of scalability: If data is replicated across all the banks using a shared settlement system, it could potentially become too cumbersome. In fact, detractors have argued that rather than being an innovation, “blockchain is just another database with the right amount of “cool” to persuade cost-conscious bankers to work together, more an advance in marketing rather than technology.”

Meanwhile, globally, different sectors are trying to use blockchain (besides bitcoin players such as Unocoin and GreenCoinX) sectors such as the property market, car leasing, the real estate market, for maintaining public records such as land titles, building permits, accounting records, voting records, healthcare record management, crowdfunding of equity financing, peer to peer lending, in trading platforms, in IoT, in storage and delivery of digital content, in gaming and many more.

And now with ICICI bank leading the foray in India and others joining in globally, it is clear that Indian banks and startups too can no longer ignore it. More so, banks will need to get started by creating plans to enable blockchain technology to co-exist with their legacy systems.

In the long run, blockchain can only be successful if banks formulate a common protocol that enables interoperability. That point might be still a long way to go, especially in a country like India but one thing is certain – banks will probably have to start learning how to bank with blockchain.