[Note: This article is part of The Junction Series. We will be covering the FinTech sector in detail at The Junction 2017 in Jaipur. Learn more about The Junction here!]

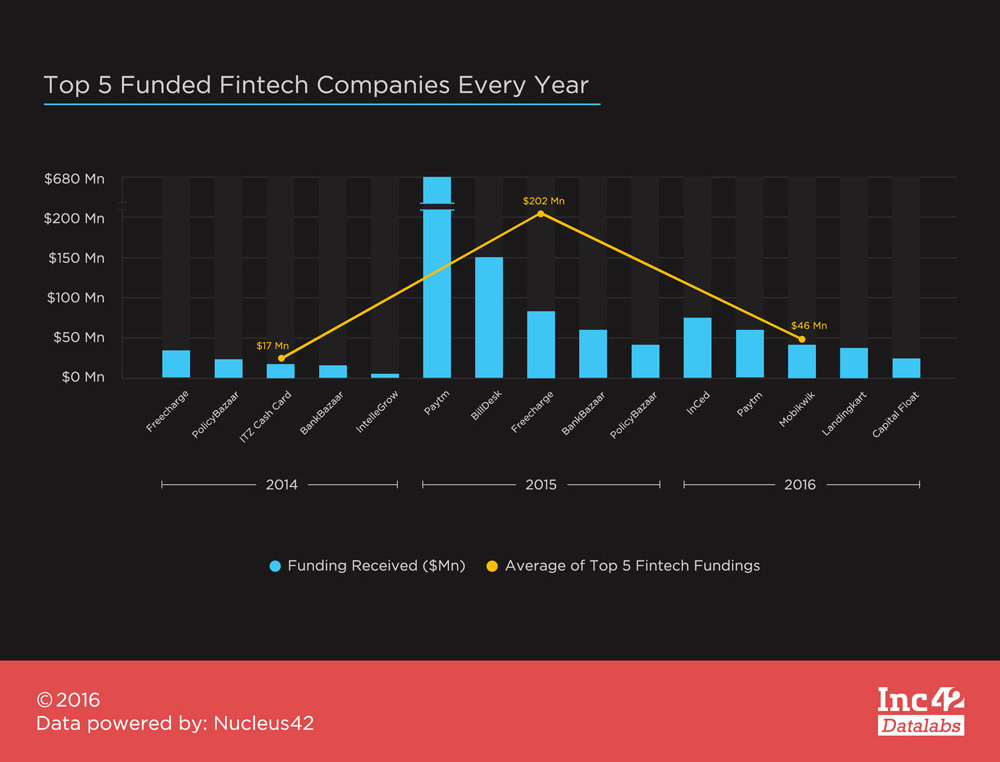

In the past couple of years, the buzz around Indian fintech startups has gained substantial attention worldwide. With an ever increasing number of deals and some astronomically large ticket sizes, one can hardly question this stance. A large ticket size is never the only criteria for a successful venture but can usually point us in the right direction. And looking at some of these funding beneficiaries provides insight into the changing tides in the sector.

This report is the conclusion of our three-part fintech series that began with the Fintech Market Report 2014-2016 and continued with a report on fintech’s chunk of the Indian startup pie.

The Overkill That Was 2015

The trend of averages of the top five fintech fundings in the last three years shows the massive traction the sector generated in 2015. Even excluding Paytm’s massive 2015 funding of $680 Mn, leaves us with an average close to 2x the size of 2016’s mean of $46 Mn. To further elucidate this, we can see that the lowest of the top five fintech fundings from 2015 (Policybazaar, $40 Mn) was still larger than eight of the other 10 mentioned startups from 2014 and 2016.

Inc42’s take on this is that hype-driven fundings polarised in 2015 which led to a dip in 2016. This year has been but a mere correction in the market, and as per the analysis in the first part of our fintech funding series, we can expect larger ticket fundings coming in in the near future.

The Numbers Game

The dominance of finance-centric startups in Mumbai can be seen with five of the 15 deals coming in from the ‘Maximum City’. Delhi too brought in 5 deals, but Bengaluru was the giant that fell short of expectations with just 2 deals.

The chart was dominated with late stage funding entries with the exception from InCred and IntelleGrow Finance. Large fundings in the early stage comes with a burden of expectations, but with over $28 Mn in funding since 2015, Intellegrow’s reputation, at least amongst investors, seems to have not tumbled.

A variation witnessed in the companies on this list is in between companies providing an umbrella bracket of services within their sub-sector and companies sticking to a niche service that has served them well. All the three niche service providers are in the SME Lending space, providing variations in financing ranging from full-fledged business loans and working capital loans to venture loans directed towards startups.

The remaining startups all try providing diversified products targeting expansion in scale, justifying the large ticket sizes received. Scaling across verticals is what these companies have been working towards, and doing so at a brisk pace. However, it must be remembered that Rome wasn’t built in a day. Trying to grow at a lightning pace is an invitation for taking liberties with diminishing standards and we hope these companies don’t fall prey to it.

Trends In Sub Sectors

The sub sectors that made the list include payments, lending, insurance and investments. What is interesting here, is that payments and lending hands down dominated the sector. These are both liability-side sectors which Indian consumers have been gladly accepting because they either help you raise funds which the consumer wants, or help make payments easier which again, the consumer wants – both these subsectors serve the short-term needs of a consumer and are thus being widely accepted.

But to convince a consumer to change his asset investment pattern is a big ask. Especially with the prevalent India myopic tendencies, asset-side businesses that provide long term benefits coming from better allocation and healthy investment practices have not been able to capitalise on what is potentially a huge void waiting to be filled.

This sector has been handed a massive advantage with the demonetisation drive. Payments were the first to prosper in the demonetisation boom, however with more money coming into the formal sector, we can expect investments to rise and the asset-side startups providing simplicity in their product delivery, ought to be able to bite into a large chunk of the market.

All in all, the big dogs in the sector have set the course for fintech advancing towards bigger and better things in the coming years and tracking them will be an adventure in its own right.