SUMMARY

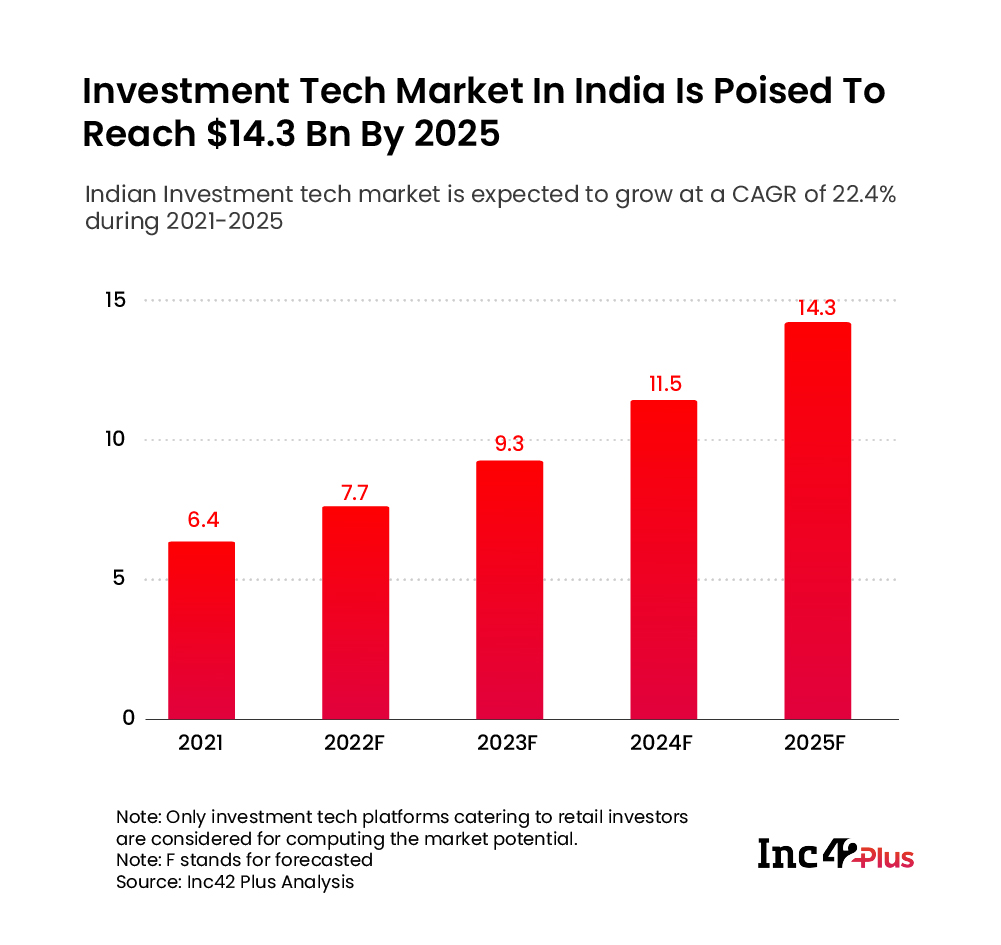

Online trading in India is set to reach $14.3 Bn by 2025, driven by the rise in digital infrastructure, the growing interest of millennials in capital market investments and a compelling push by the new normal due to the Covid-19 pandemic

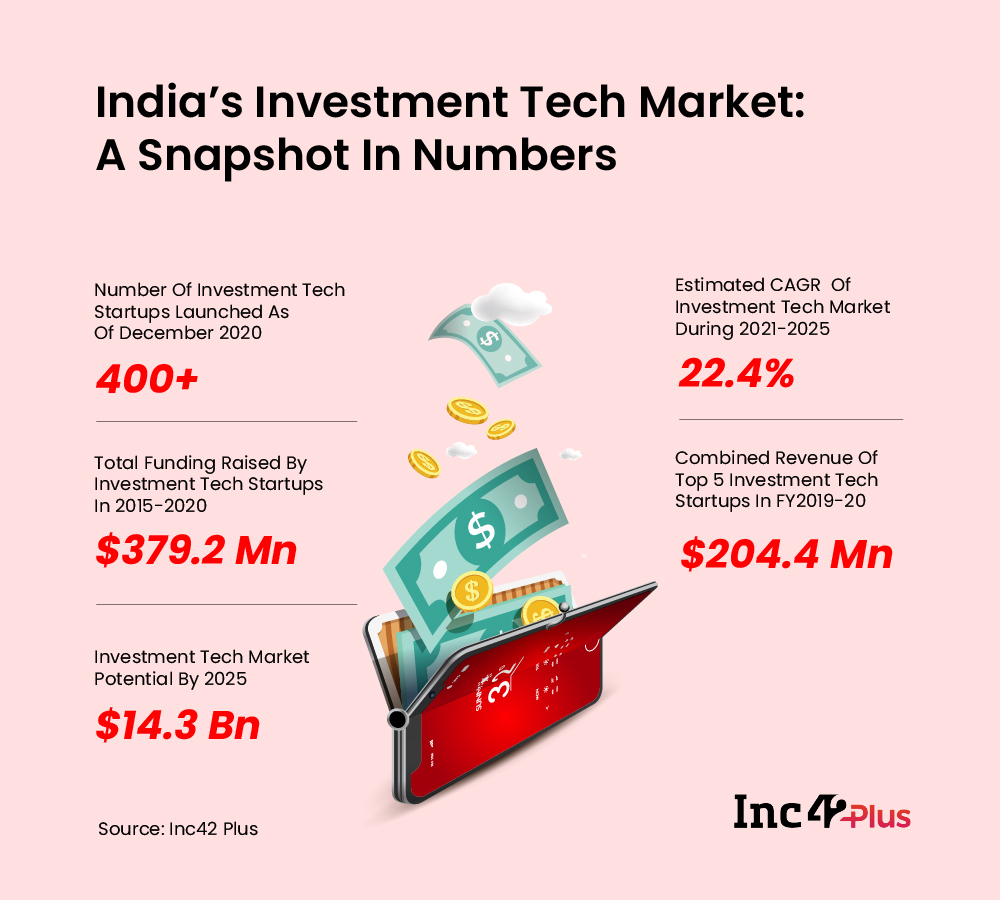

India is home to more than 400 investment tech startups, with companies witnessing a spike in demand due to multiple reasons

Is it the golden moment for investment tech platforms post the Covid-19 era?

The outbreak of the Covid-19 pandemic has disrupted most industries and compelled consumers to adopt digital technologies. It has also prompted people to focus on investments, as many of them have lost their jobs or faced pay cuts. The prolonged lockdowns in 2020 (even now, the second wave of coronavirus has gripped India and lockdowns are happening intermittently in some states) also enabled retail investors to explore investment tech platforms at their convenience, leading to a rise in the number of customers on these platforms and the subsequent growth of the sector.

As per SEBI data, close to 6.3 Mn demat accounts were opened during April-September 2020, a 130% increase year on year. Most of these new accounts were opened by millennials (or the Gen Y, as they are popularly known) aged between 24 and 39, according to data from capital markets regulator SEBI (Securities and Exchange Board of India).

It is entirely understandable. As the pandemic started weighing upon the country’s economic growth and interest rates,, Indian millennials are opting for new channels to grow their incomes. Therefore, online trading platforms and several other digital investment options have seen a recent rush from young and inexperienced investors.

Investment Tech In India: An Overview

The snapshot above clearly underlines how investment tech in India has evolved from floor trading to screen trading and online trading and currently moving towards DIY trading, with the help of robo advisory and algo trading. India is now home to more than 400 investment tech startups and according to the latest release by Inc42 Plus titled India’s Online Trading Market Report 2021, the country’s online trading market is set to reach $14.3 Bn by 2025.

A rise in digital infrastructure, growing awareness regarding retail investments, the growing interest of millennials to invest in capital markets and the enhanced convenience offered by investment tech platforms will trigger this growth. It amply indicates the huge headroom for growth and the massive opportunity that the investment tech sector can leverage.

New Opportunities For Investment Tech Startups

Continued Partnerships

Partnerships are expected to remain the central theme around which incumbent investment managers (especially those with large portfolios) will pursue digital innovations. Investment managers may aim to cultivate a relevant network by forming partnerships with multiple investment tech platforms. Each of these partner platforms will have different digital expertise, thus adding to the investment manager’s overall capabilities.

Deployment Of New Technologies

Several tech platforms will seek to deploy new technologies through partnerships with investment tech companies. These collaborative efforts can bear fruit if incumbent investment managers consider broader and longer-term objectives when engaging with investment tech platforms. Investment managers should encourage innovative thinking and collaboration with non-traditional partners or face the risk of falling behind in this transformational journey.

Emergence Of Hybrid Brokerage Model

The emergence of the discount brokerage model has triggered the growth of the retail brokerage industry. Consequently, full-service brokers are losing out on a huge chunk of new retail clients. To compete with discount brokers and cater to both retail and institutional clients, traditional brokerage businesses such as Axis Securities and Angel Broking have introduced special discount brokerage plans (Trade@20 by Axis Securities and iTrade by Angel Broking) for trading in the equity and derivatives segments. This means traditional brokerage firms are evolving into a hybrid model and providing full-service offerings and discounted plans to meet different customer requirements.

Becoming A One-Stop Financial Solutions Hub

Discount brokers witness high volumes of trade but wafer-thin margins, with limited offerings for institutional clients. This has prompted several of them to expand their portfolios and offer a slew of services, including portfolio management, institutional services and third-party product distribution of insurance, loans, mutual funds and so on. In brief, they have turned into a one-stop hub for all financial needs.

These new opportunities and many more, as presented in the latest release from Inc42 Plus — India’s Online Trading Market Report 2021 — are likely to catalyse the growth of the investment tech sector, especially as the Covid-19 pandemic is triggering the interest of millennials to invest via investment tech platforms and stay in control of their wealth-building plans.