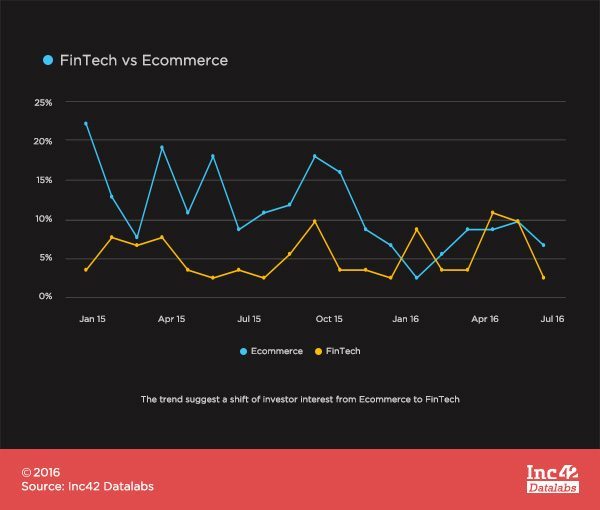

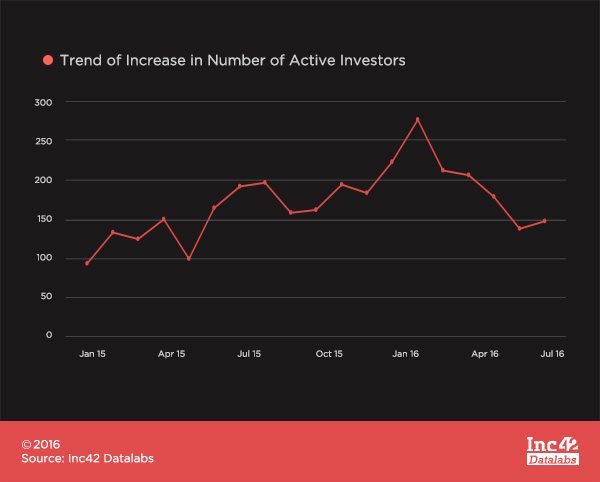

July 2016 marks the beginning of the third quarter of 2016. A lot of speculations still hangs around Q3, given the changes we observed in our Half Yearly Report 2016. We questioned the position of Delhi/NCR as the top startup destination. We inferred the falling trend of ecommerce and the rise of FinTech as the top sector. We observed a steady drop in the number of active investors since January 2016, and hyperlocal businesses emerged as the top sector for M&A.

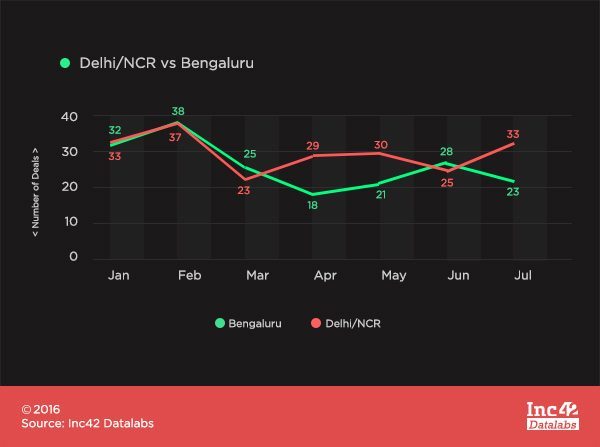

Once again the Indian startup ecosystem has shown robustness in its changing dynamics. Around 96 startups got funded in July 2016, 3% more as compared to last month (June 2016) and 9% more as compared to July 2015. This month, FinTech is the winner with the maximum number of deals, suggesting a steady rise in demand for FinTech solutions and also confirming our trend, as observed in the Half Yearly Report. Delhi/NCR has bagged the title of top startup city, yet again pushing Bengaluru down to second position.

Furthermore, the number of acquisitions has increased by 15.4% as compared to last month and increased by 150% as compared to July 2015. Over 10 acquisitions and five acqui-hires were observed this month. Analytics was the most favoured sector for acquisitions.

At Inc42 DataLabs, we have analysed this data and inferred emerging trends across the various dimensions of the Indian startup ecosystem. The analysis includes 96 startups that have collectively raised $307 Mn (Disclosed) in funding.

Let’s have a closer look!

Rise of FinTech

With the fall of ecommerce as an investor-bullish segment, FinTech has gained top position as the segment to receive maximum deals.

Falling investor trend takes a positive turn

The number of active investors in July were 147, 7% more than June 2016. Finally, we see an upward turn in the falling trend of active investors in the ecosystem.

Delhi back on Top Spot

Delhi/NCR has regained its top position pushing down Bengaluru to second place by 43%.

Key insights

- On an average, more than 3 startups were funded this month per day, with the average deal value of $5 Mn (from 62 Disclosed Deals).

- As compared to June 2015, the number of deals has increased by 9%. But, total deal value was almost the same (8% drop as compared to June 2015, excluding outliers).

- As we concluded in our H1 2016 report, there is a definite rise in bridge funding (52% by the number of deals, 173% by total deal value). Both Series A and Late Stage deals have fallen in number and value.

- FinTech has gained top position as the segment to receive maximum funding.

- Accel Partners was the top VC in July 2016 with 6 investments. Indian Angel Network was one of the top networks with 4 investments.

- Around 15 M&As took place in July 2016 and 5 of these were acqui-hires.

- Acqui-hires have definitely increased. It’s already 25% more than June 2016, with half the year still to go.

- Analytics was the top scorer for M&As last month. This suggests that businesses are becoming more reliant on data-driven decisions to fight tough competition.

Although, this data give us a few interesting observations, trends on the ecosystem could only be conclusive with further analysis of the ecosystem in the coming months.

Stay Tuned!

[Graphics by Satya Yadav]