SUMMARY

Half of India’s population is below the age of 25 years with a median age of 28 years, which bodes well for the overall talent pool

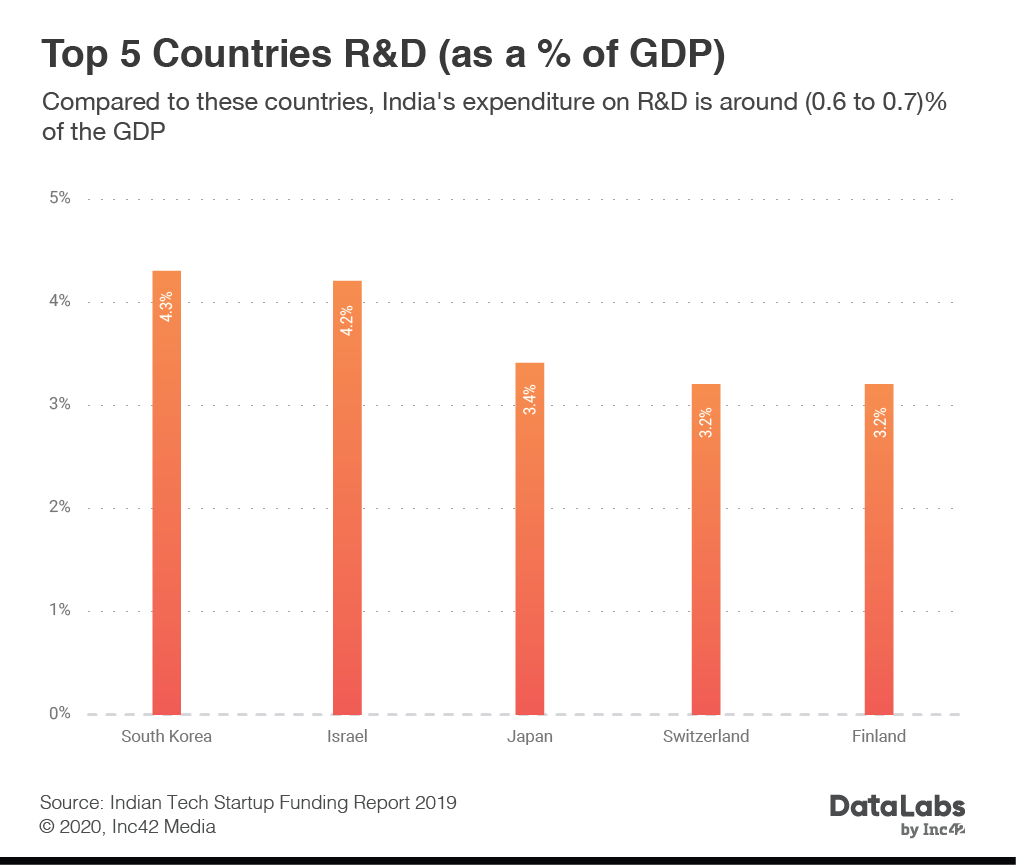

India’s expenditure on R&D continues to be as low as 0.6%-0.7% of the GDP, much lower than South Korea, Israel and Japan

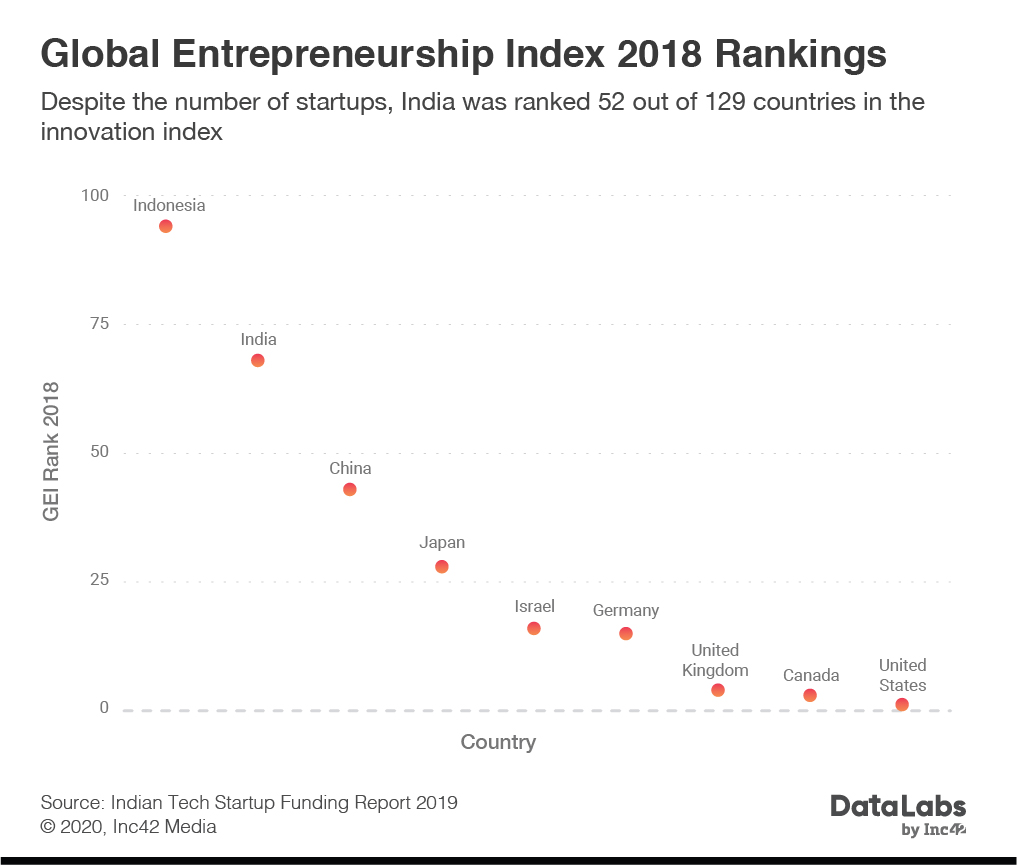

As per the Global Innovation Index 2019, India stood at the 52nd position out of a total of 129 countries

As we launch the DataLabs by Inc42 Annual Indian Tech Startup Funding Report 2019, presented by Dell, here’s a look at the key highlights from the detailed analysis of the investment trends, innovation and R&D landscape, startup policies and macroeconomic factors that influenced the Indian startup ecosystem from 2014-2019. Read all articles in this series

Download Your Free Copy NowWhile 2019 may not have been a watershed year in terms of overall funding or number of deals, India has definitely matured as a startup ecosystem. With 15% growth in funding amount, 2019 represented an evolution rather than a revolution for startups. Where does this put India on the global map and how does India compare with other startup economies when it comes to innovation, research & development (R&D), economic indicators, human resource indicators and more.

As part of this evolutionary journey, the status of India among the world’s leading startup hubs as also grown. While within India, three cities — Bengaluru, Delhi NCR and Mumbai — dominate funding, in the global arena, India is growing to compete with the likes of Israel, USA, China, the UK and Canada, which are some of the leading startup ecosystems in the world.

In 2019, India has 31 unicorns with seven startups joining the club in the year. Amid all this fervour, it is important to take a step back and reflect on the growth factors — market and economic — that are driving or deterring the startup economy in India.

According to DataLabs by Inc42’s Indian Tech Startup Funding Report, 2019, India has grown to become the fifth-most startup-friendly economy in the world based on five parameters — human capital investment, research & development, entrepreneurial infrastructure, technical workforce and policy dynamics. While many of these parameters are in the favour of India’s startup ecosystem, some of these need to be addressed urgently to bring startups on par with global counterparts.

Human Capital Is India’s Biggest Strength

As the Indian economy continues to grow, one of its biggest advantages over other developing nations is that the disposable income and purchasing power are increasing steadily. This rising consumption is driven by the growth of upper-middle-income and high-income segments of the population, both of which are expected to grow from one in four households today to one in two households by 2030. This projection is based on India’s population or human capital advantage.

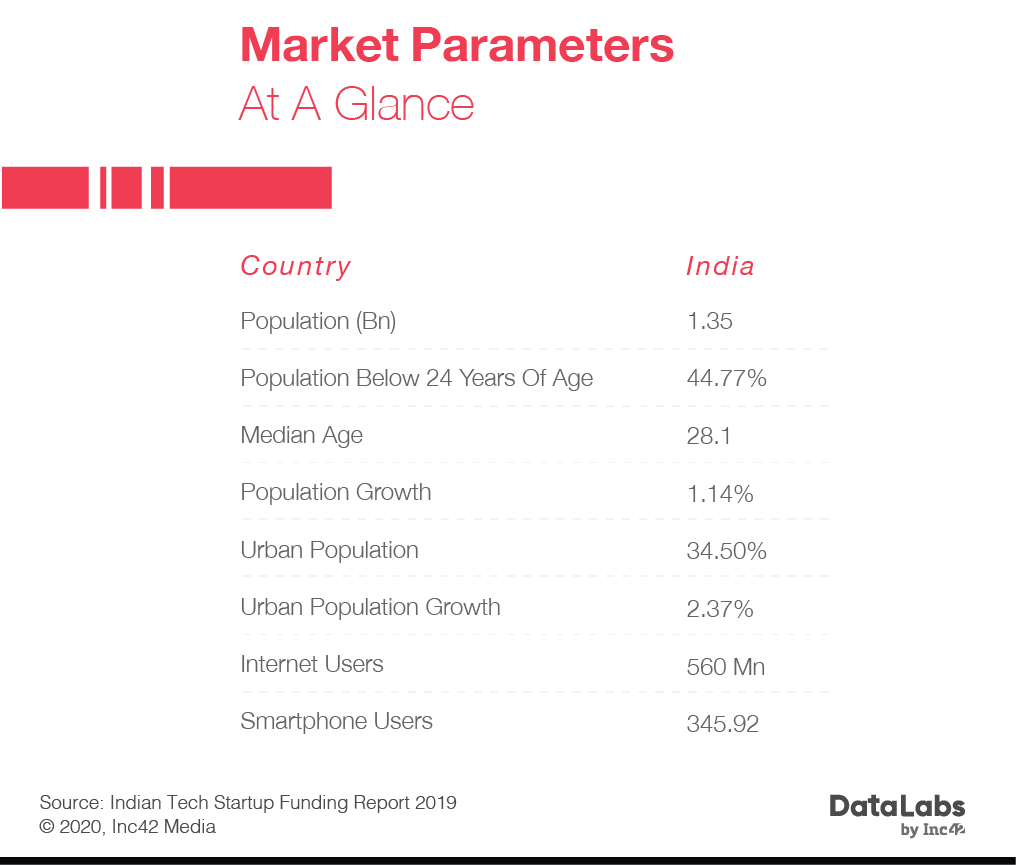

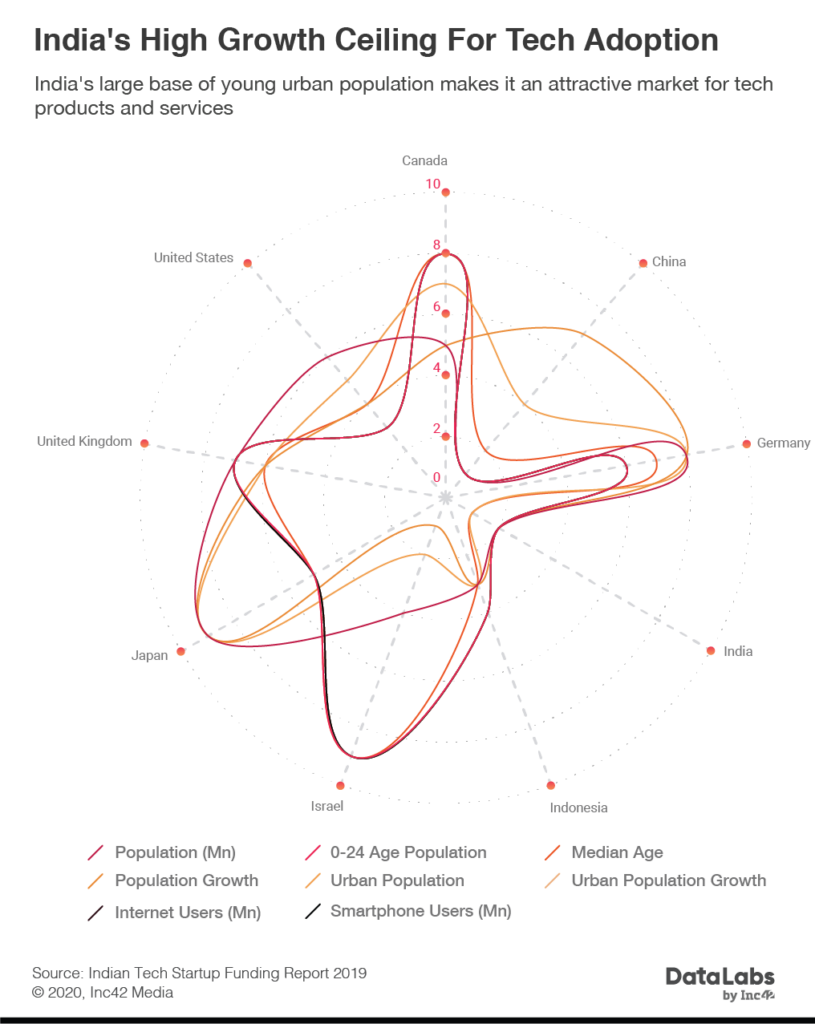

The demographic split of the population is a big boon for the Indian tech startup ecosystem as tech adoption is higher in this audience set. Half of the country’s population is below the age of 25 years with a median age of 28 years. In terms of urban population growth, the internet user base and smartphone user base, India is second in the world among all nations.

Understandably, this has made companies and startups gravitate to India. In fact, India is one of the fastest-growing app economies in the world, contributing the most to app downloads in the past year.

Download Your Free Copy NowLow R&D Spending Hurts Innovation In India

While those stats show that India undoubtedly has the potential, it still trails other major startup economies in terms of key economic indicators such as GDP per capita (PPP), inflation, tariff rates, and corporate tax rate. These indicators are the worst amongst countries India’s economy is being compared to including Canada, China, Germany, India, Indonesia, Israel, Japan, the UK and the US.

While there is a huge need for innovative solutions, particularly those that alleviate poverty and improve the inclusion metrics, India needs to be infrastructure-ready for innovations to flourish. Given the scale of the Indian market and its resource constraints, low-cost, high-impact solutions are the need of the hour. This requires a huge push from the government in making the Indian economy ready for its market to reach full potential.

The Narendra Modi-led government that assumed power in 2014 has put digital transformation at the centre of its plans. The central government has recognised startups as one of the most important engines for economic growth. Moreover, startups are expected to create jobs that will narrow the high unemployment rate in the country.

Yet in 2019, India hit the highest unemployment rate seen in the last 3 years i.e 8.5% (September 19). In 2019, for ease of doing business, India moved to 63rd rank out of 190 countries climbing only 14 points in the ranking compared to 23 points in 2018.

As per the Global Innovation Index 2019, India stood at the 52nd position out of a total of 129 countries for capacity and success in innovation. For a country that is supposedly the fifth most startup-friendly economy globally, this is a poor rank and highlights the slow growth rate of the tech economy despite the ripe consumer market. This lack of innovation is clearly depicted by India’s relatively low expenditure on research and development.

The lack of quality R&D is evidenced by the fact that many Indian unicorn startups such as Paytm, Ola, Flipkart, Zoho as well as soonicorns such as CarDekho, mSwipe, LensKart and others are imitations of successful global ideas fine-tuned to serve local needs.

Successful foreign startups that were established way before their Indian counterparts — years before in some cases — have become blueprints for Indian startups. While one cannot deny that India has become a startup hub with a total of over 49K startups being launched (as of September 2018), however, the reality is that the number of these startups were formed out of ideas that originated elsewhere.

India’s expenditure on R&D continues to be as low as 0.6% – 0.7% of the GDP, much lower than countries like South Korea at 4.3%, Israel at 4.2% and Japan at 3.4%. The worst part is that this low spending in R&D has been stagnant at 0.6%-0.7% for the last two decades.

Digital Penetration Still A Hurdle

The global startup economy has achieved great heights with a total economic value of nearly $3 Tn in 2019, a 20% increase from the prior two periods. This growth is largely driven by high-tech startups in the fields of advanced manufacturing and robotics, blockchain, agritech and new food, and artificial intelligence. However, startups and investment in startups from these sectors are yet to become prominent in India.

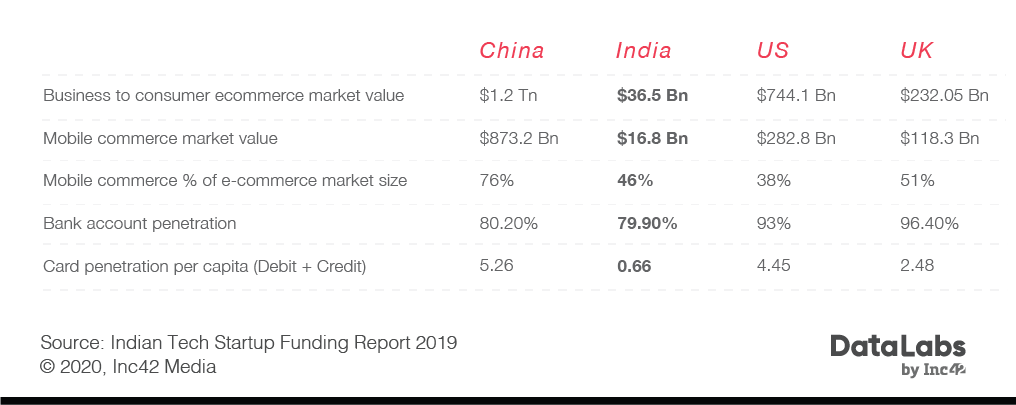

When it comes to digital penetration too, a lot needs to be done. Online shopping or ecommerce — often considered the Indian startup ecosystem’s flag bearer — only represents 2.9% of total Indian retail sales. The average annual per capita spend is also low at $338.24. This is among the lowest spends per capita among countries that India is compared to.

As banking penetration increases, bank transfers are expected to rise quickly. Currently used for one in five ecommerce transactions, this method is expected to increase at a compound annual growth rate of 84% till 2021 to take a 30.2% share of the transaction market. Currently, with just 0.66% card penetration per capita (debit and credit cards) and 0.02% for credit cards, India is still a largely cash-driven economy.

The challenge for the Indian startup ecosystem will be moving past these limitations in infrastructure and the government inaction on the R&D front. As highlighted in DataLabs’ Indian Tech Startup Funding Report 2019, in 2020, we expect sectors such as healthtech and fintech to shine in terms of deal count and funding. The fact that startups operating in fintech and healthtech develop products or services that are so vital to life means that the consumer and business demand for more innovation is always going to be high.

Download Your Free Copy Now