SUMMARY

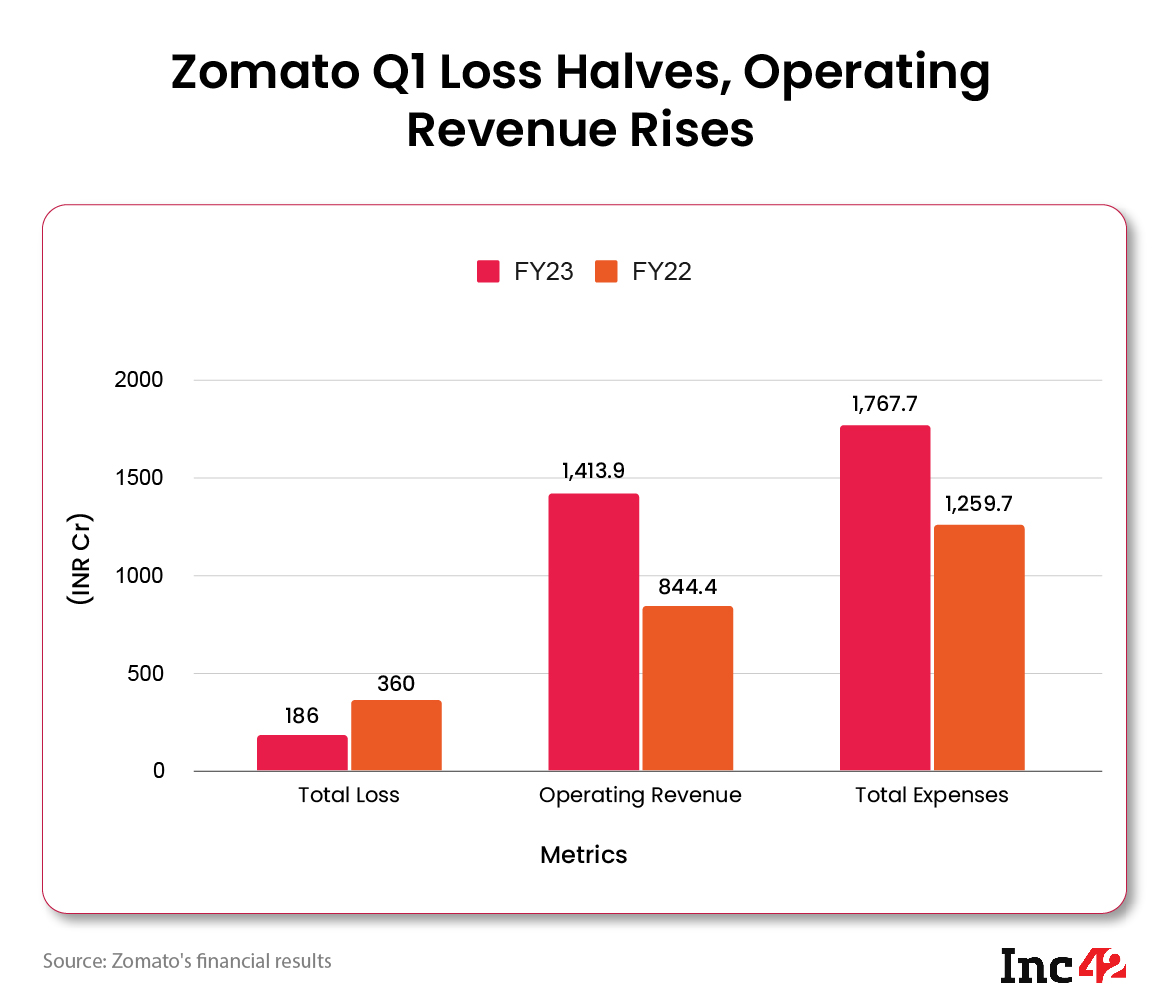

The foodtech startup reported a net loss of INR 360 Cr in June quarter last year and INR 359.4 Cr in Q4 FY22

Zomato’s operating revenue grew to INR 1,414 Cr, driven by a strong growth in gross order value

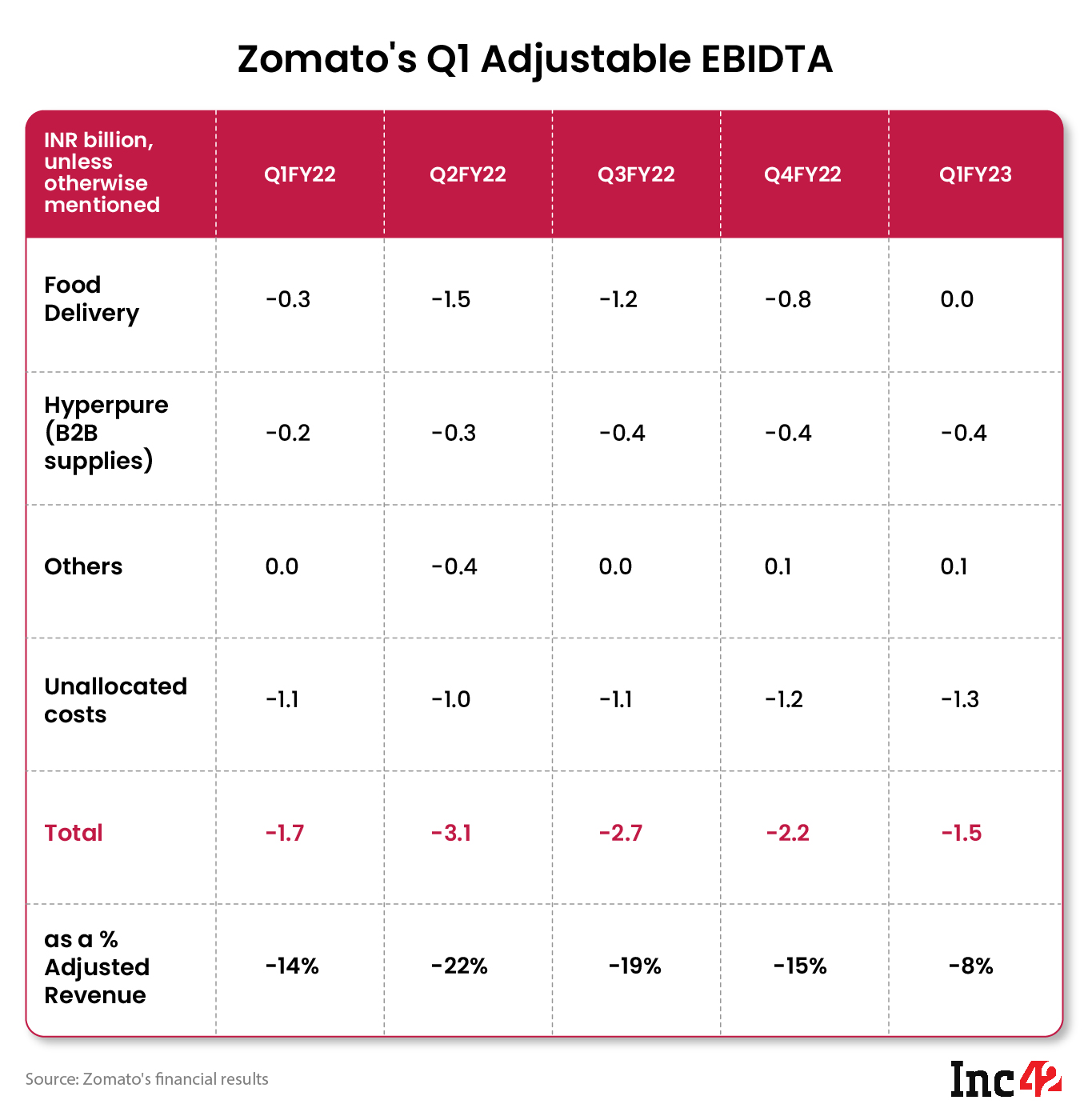

Zomato said its food delivery business achieved break-even at adjusted EBITDA level in Q1 FY23

Foodtech startup Zomato on Monday (August 1) reported narrowing of its consolidated loss to INR 186 Cr in the June quarter of financial year 2022-23 (FY23) from INR 360 Cr in the corresponding quarter last year, helped by increasing order volumes.

On a quarter-on-quarter (QoQ) basis, the loss declined 48.2% from INR 359.4 Cr reported in the March quarter of FY22.

Zomato’s operating revenue also jumped over 67% year-on-year (YoY) to INR 1,413.9 Cr from INR 844.4 Cr in the June quarter last year.

The startup said that its overall revenue growth was driven by a strong growth in gross order value (GOV) to INR 6,430 Cr in Q1FY23. Its GOV stood at INR 4,540 Cr in Q1 FY22.

The GOV growth was driven by robust growth in order volumes and mild growth in average order values (AOV) as compared to the previous quarter, Zomato said. However, it didn’t disclose the AOV for June quarter. The AOV for its food delivery business stood at INR 398 in FY22.

On the profitability front, Zomato said that its food delivery business achieved break-even at adjusted EBITDA level in Q1 FY23.

“Our focus on profitability has sharpened over the past few months with the change in market context, without compromising our focus on growth,” Zomato founder and CEO Deepinder Goyal said. “We are doing that by assessing everything with a critical lens and allocating resources by taking a long-term view to sustainable growth, as well as profit.”

Zomato’s total expenses surged 40.3% YoY in Q1 FY23 to INR 1,767.7 Cr. In the corresponding quarter last year, the startup had reported total expenses of INR 1,259.7 Cr.

In the June quarter of this fiscal year, delivery and related charges had the biggest shares in total expenses, contributing over 32%. Zomato’s expenses in the segment increased to INR 572.4 Cr from INR 296.7 Cr reported in the year-ago quarter.

Employee benefit expenses, at INR 348.9 Cr, were the second largest contributor to Zomato’s total expenses. However, on a QoQ basis, the startup’s expenses under the head declined over 14% from INR 406.8 Cr reported in Q4 FY22. Besides, it also declined 10.7% YoY from INR 390.7 Cr in the June quarter of FY22.

Zomato’s advertising and promotional expenses also saw about an 8% YoY decline to INR 277.6 Cr from INR 301.5 Cr reported in Q1 FY22.

Zomato said that its margins are getting negatively impacted due to higher fuel costs and wage inflation.

“…there is definitely a negative impact on the demand side but it is hard to quantify that in our business at this point given multiple moving parts. Similarly, on the cost side, the margins are getting negatively impacted due to higher fuel costs and wage inflation. Having said that, the overall efficiency gains have helped us make good progress on improving contribution margins,” Zomato CFO Akshant Goyal said.

Shares of Zomato have been on a downward spiral over the last one month or so since the startup announced the acquisition of quick commerce platform Blinkit in June. The addition of another loss-making company to its portfolio added to investors’ worry.

However, Zomato reassured its stakeholders that Blinkit’s losses are coming down every month.

“Quick commerce cuts across a wide range of essential spends including grocery, fruits and vegetables, beauty and personal care, OTC medicines, stationery items, among others. Therefore, we expect the overall customer base, average order value as well as monthly order frequency to be higher than food delivery,” said Akshant.

While Zomato didn’t provide a clear outlook for the next quarter, it reiterated its goal towards revenue growth and reducing losses.