![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%](https://asset.inc42.com/2020/10/Artboard-1-copy-3-100-2.jpg)

SUMMARY

Crediwatch record a 20% growth in its revenue to INR 2.2 Cr but with over 2.6X rise in expenses, its losses also widened in FY2020

The company claims to have surpases its FY2020 revenue by 3x growth in the first half of 2021

The company’s clientele has also grown by 80% to include prominent banks like SBI, KVB and RBL Bank in FY2021

What The Financials

Inc42 unveils and deciphers all the important financial metrics of Indian startups across industries. Find out revenues, unit economics, profit & loss and all the important financial metrics to judge how the startup will perform in the coming years.

Bengaluru-based fintech startup Crediwatch, which helps financial institutions in giving out loans, has noted a 20% hike in its revenues from INR 1.83 Cr to INR 2.2 Cr in the financial year 2020, ending in March. The company’s expenses have also grown by 110% to INR 10.5 Cr from INR 4.8 Cr recorded the previous year.

Subsequently, this has also led to a spike in its losses from INR 3 Cr to INR 7.8 Cr, representing a 160% or 2.6x increase in FY2020. Compared to FY2018, the company’s losses have spiralled by 200% or 3x. Further, Crediwatch’s revenue has grown by 633% or 7.3x and expenses by 243% or 3.5x since FY2018.

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%](https://inc42.com/wp-content/uploads/2020/10/Artboard-1-copy-5-100-1.jpg)

In FY2020, the Bengaluru-based fintech startups earned INR 1.86 Cr through operational revenue, INR 28 Lakh from interest income and INR 5 Lakh from other non-operational sources. The company had earned INR 1.72 Cr through operations and INR 9 Lakhs through interest income in the previous year.

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%](https://inc42.com/wp-content/uploads/2020/10/Artboard-1-copy-100-2.jpg)

Founded in 2016 by Meghna Suryakumar and Sandeep Anandampillai, Crediwatch is an AI-powered insights-as-a-service(IaaS) platform that provides credit intelligence and monitoring to financial institutions, corporates, professional services firms and non-banking financial companies (NBFCs).

It has built an AI and ML tool which is said to minimise credit risk in the financial services industry. The platform collects information from numerous data points that are extracted from several sources, and analyses it to further help lenders assess and monitor borrowers on a more dynamic basis. The company aims to amplify trade velocity by reducing friction in trade and credit.

Crediwatch Eyes Strength, Scalability To Pave A Way To Profitability

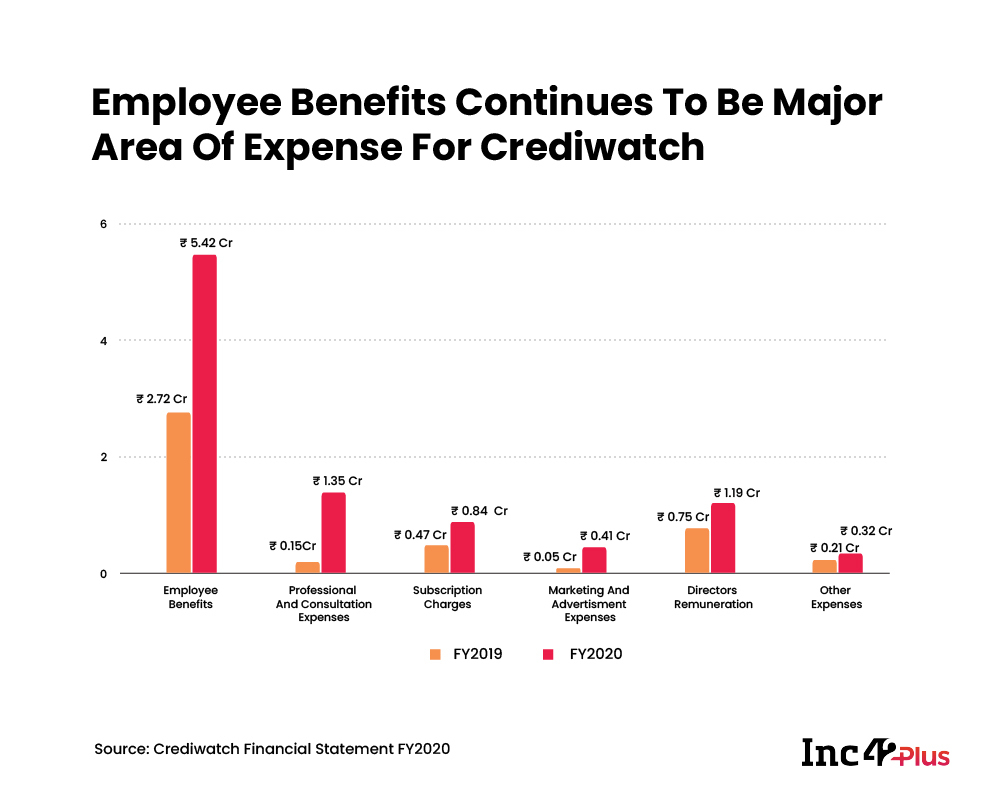

Employee benefits was one of the major areas of expenses for Crediwatch in the last two fiscals, making up nearly 50% of the total spending. It spent INR 3.82 Cr in salary and wages, INR 8 Lakh in staff insurance, INR 10 Lakh in gratuity expenses and INR 34 Lakh in staff welfare expenses in FY2020, totaling to INR 5.42 Cr.

The fintech startup had spent INR 2.72 Cr as employee benefits expenses in FY2019, which included INR 1.64 Cr in salaries and wages, INR 4.76 Lakh in gratuity expenses, INR 11 Lakh in staff welfare expenses. The company’s expenses also included INR 1.03 Cr and INR 89 Lakh spent on employee stock option scheme (ESOP) in FY2020 and FY2019, respectively.

During this time, the company’s advertising expense also increased 8x from INR 5 Lakh to INR 41 Lakh. Professional and consultation fee and directors remuneration was another major area of expense for the company in FY2020, with nearly INR 1.35 Cr and INR 1.19 Cr going into it, respectively. Crediwatch’s directors include founders Anandampillai and Suryakumar, and chief business and strategy executive Ganapathy GR.

In FY2020, the company also spent INR 32 Lakh on other expenses like auditor’s payments, communication expenses, office expenses and miscellaneous expenses. According to the company’s financial statement of 2020, it spent INR 14 Lakh in foreign currency versus INR 6 Lakh in FY2019.

Crediwatch Surpasses FY2020 Numbers In H1 FY2021

Commenting on the financial statement, the company’s cofounder and CEO Suryarkumar, said that in FY2020, it was focusing on building its financial product and getting a product market fit, instead of focusing on the customers. With this, the company managed to register a 3x growth in its revenue in the first half of FY2021 and its client base has also increased by 80%.

“All the effort of staying quiet and building products has paid off this year… We closed our first contract with a total contract value of over $1 Mn with a private commercial bank last quarter,” she added.

Crediwatch has also witnessed a 35% increase in the total number of businesses it is tracking, processing nearly 10K Application Programming interface (API) requests per minute. At this pace, the company is positive about increasing its margins in FY2021. It has more than 20 clients in India, including top banks like SBI, KVB and RBL Bank, and NBFCs such as ABFL and Capital Float. It claims to have provided insights on over 50K businesses and $7 Bn loan portfolio.

“2021 is going to be the best year for us, in terms of our financials and customer traction. Also in terms of team, we have made a lot of high profile hires in the past six months in engineering and data science,” Suryakumar added.

The company will be focusing on building up its team and making key strategic hires in the sales team as well.

Crediwatch has raised nearly $5 Mn till date from investors like Modern India, the family office of Vijay Kumar Jatia, Contrarian Vriddhi Fund, Vaibhav Domkundwar’s Better Capital, angel investor and Udhyam.org’s Mekin Maheshwari, and Blackstone’s former MD Pithambar Gona. The startup had last raised $3.2 Mn in a Series A funding round led by ARTIS Labs with participation from Abstract Ventures in October 2019.

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![[What The Financials] Crediwatch Revenue Grows 20%, But Losses Spike By 160%-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)